Bearish sentiment lingers in the oil market despite bullish fundamentals

Bearish sentiment lingers in the oil market

- Despite strong expectations for crude oil prices to rise in recent weeks, a very different scenario has unfolded in the energy commodities landscape.

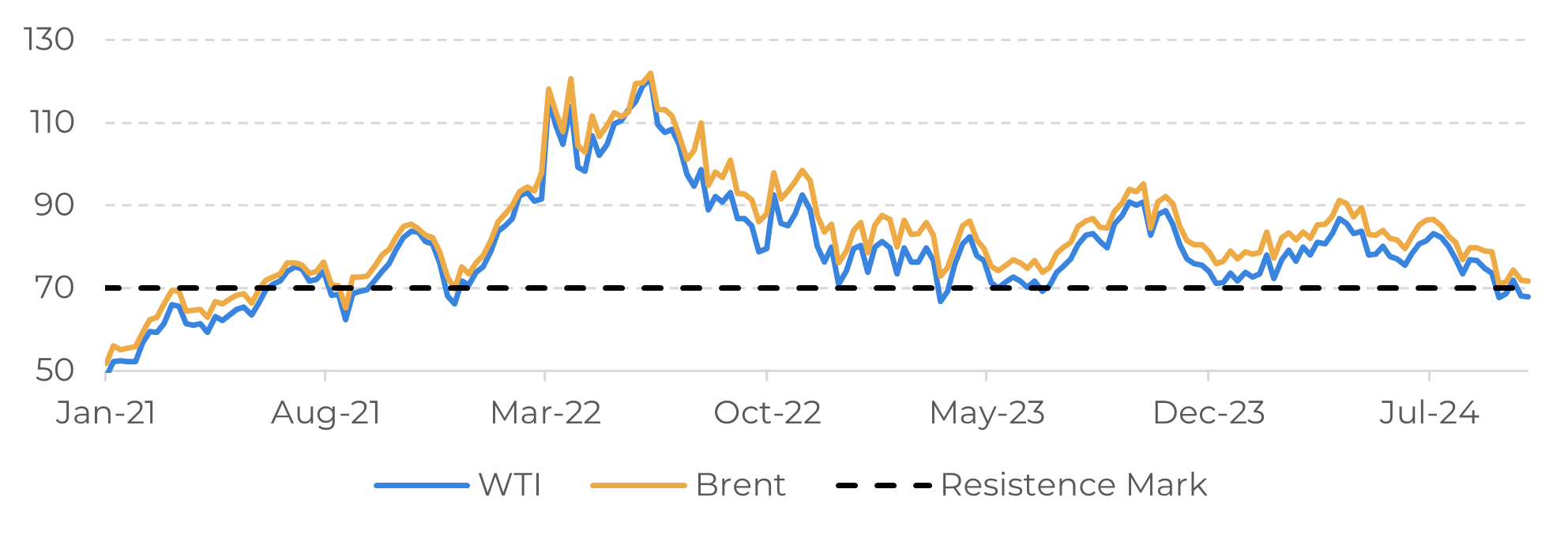

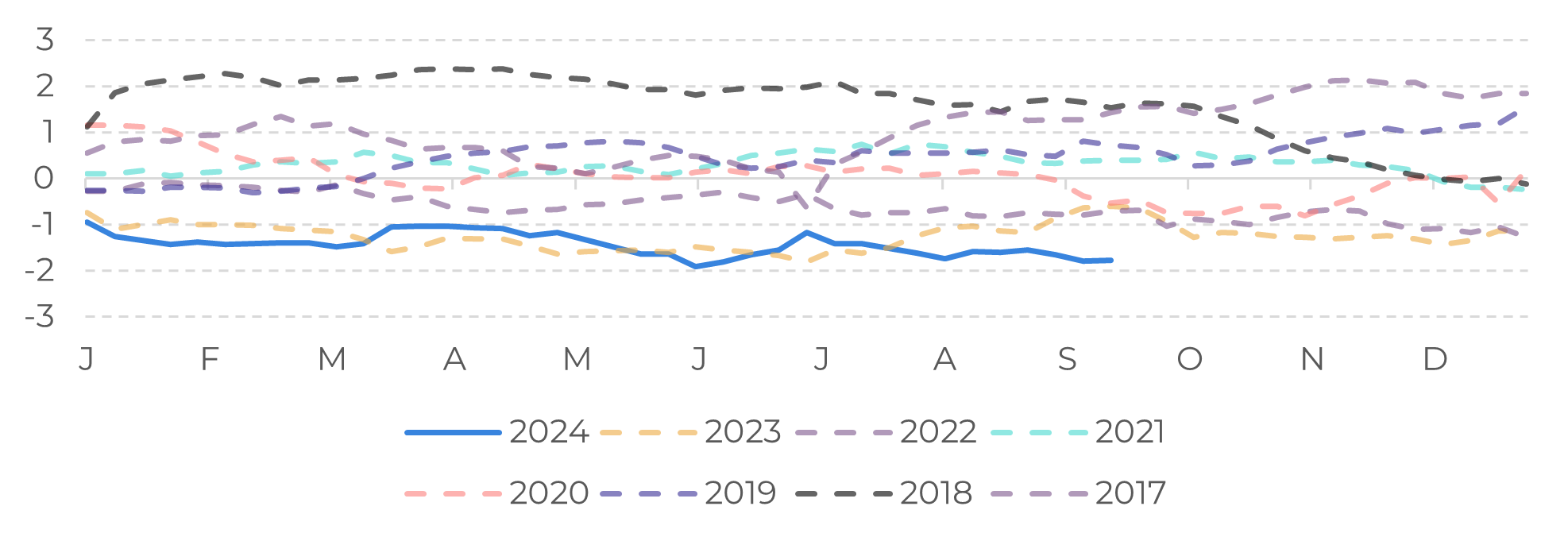

- Amid numerous bullish risks for oil, the average front-month WTI price in September fell below $70 per barrel, a level not seen since 2021. As a result, long positions in oil on the CFTC and ICE have decreased in recent weeks.

- At the moment, the main driver pushing oil prices is the geopolitical risks emerging in different regions, with the largest coming from the Middle East as the confrontation between Israel and Lebanon takes on more shape.

Introduction

Despite strong bullish fundamentals in recent weeks, crude oil prices have frustrated any hopes of a rally. Key factors such as the Fed's rate cut, delayed OPEC+ production cuts, and geopolitical tensions in the Middle East have failed to ignite a significant price rally.

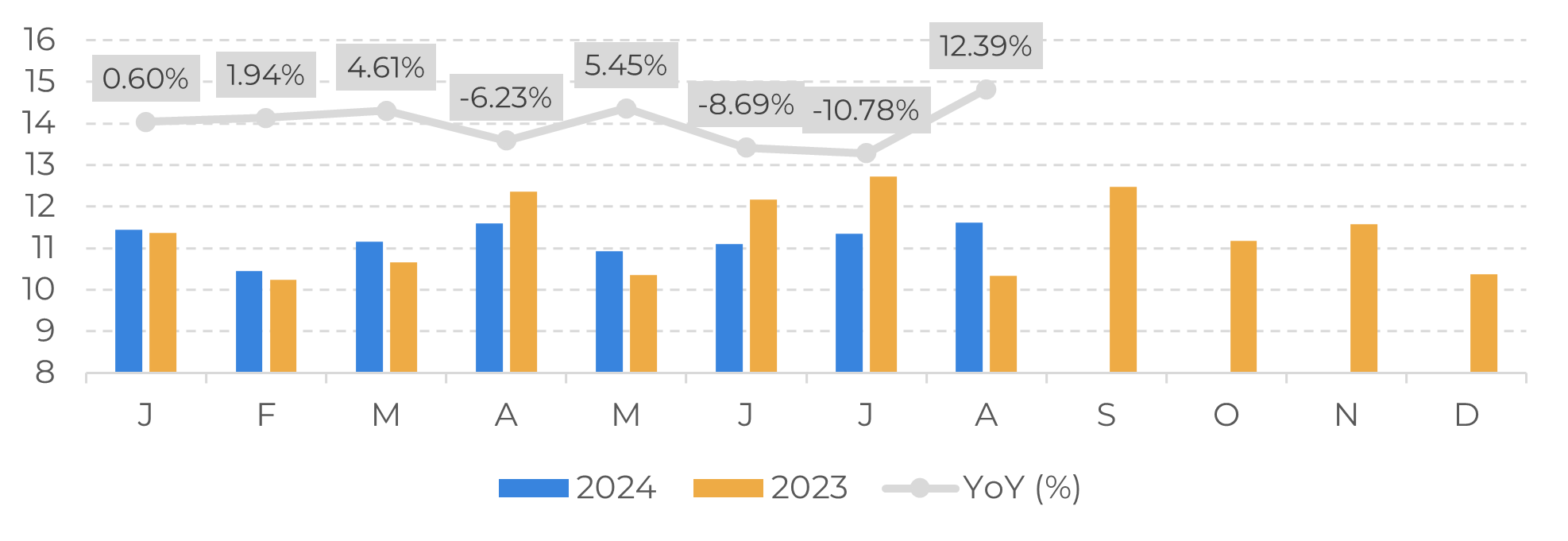

Conversely, bearish sentiment has been gaining traction amid economic uncertainties in the U.S. and China, along with speculation that Saudi Arabia could boost its production before the end of the year to regain lost market share in the crude oil market.

In this report, let’s examine the current market fundamentals and explore potential scenarios for the upcoming months.

Image 1: Crude Oil Benchmarks (US$/bbl)

Source: Refinitiv

Image 2: Crude Oil Net Position Z-Score (10-Year Deviation from Average)

Source: CFTC, ICE, Refinitiv

Obs: Crude Oil Non-commercial Net Position (1,000 Contracts)

Bearish sentiment dominates the oil market

In September, the Fed surprised some market analysts by cutting interest rates by 50 basis points, resulting in a strong weakening dollar, which could increase demand for oil since the commodity is traded in dollars and is now cheaper for holders of other currencies. Additionally, the ongoing conflict in the Middle East appears to be escalating, with Israel increasing its attacks against groups aligned with Iran, a major oil producer in the region. As if that weren’t enough to support a bullish outlook for oil, China decided to expand its monetary stimulus last week, generating a rally in metals markets, which generally show some positive correlation with crude oil prices. Despite this, bearish sentiment remains strong in the oil market.

What is happening is that many bearish fundamentals are becoming increasingly relevant in the market. Stimulus measures in China could result in higher domestic demand, but they may not necessarily raise fuel consumption. The strategy to curb production by OPEC+ members has become increasingly costly for Saudi Arabia, which has lost ground to both non-OPEC and OPEC countries over the last few months, leading to speculation that they will soon boost production, potentially resulting in a market share war.

Image 3: China – Crude Oil Imports (Million b/d)

Source: Refinitiv

Inventories in the US are at historically low levels

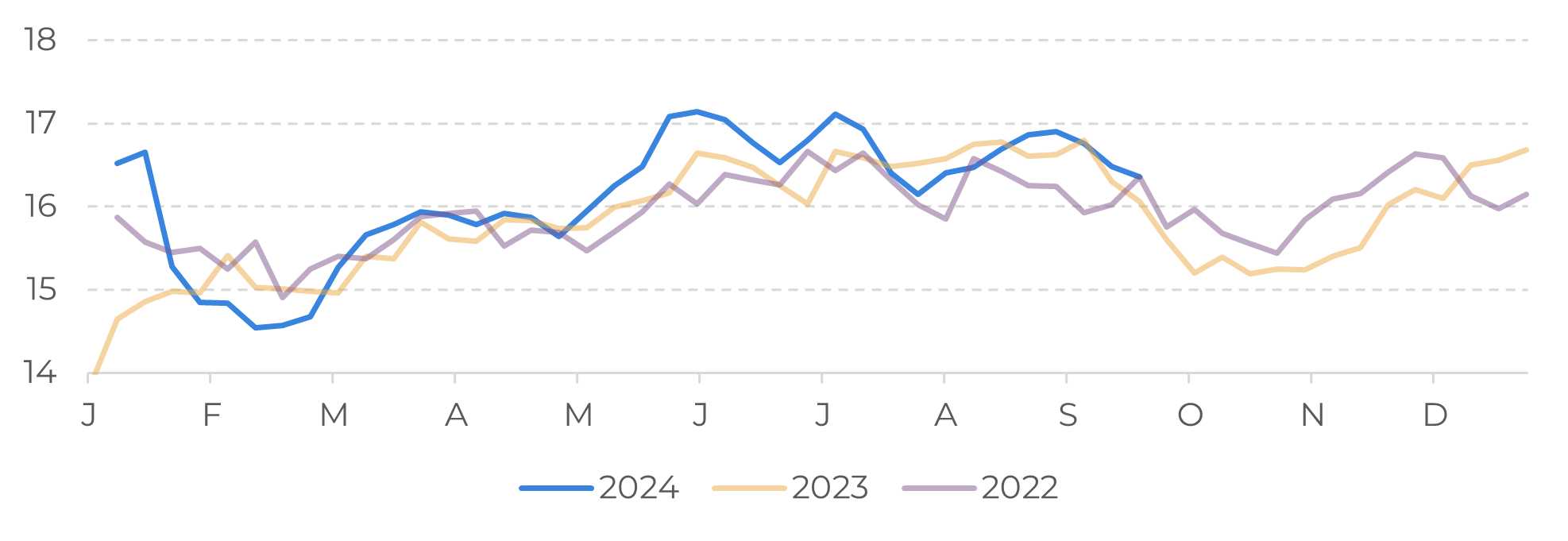

Not even the historically low inventories in the U.S., with commercial reserves reaching 413 million barrels (-0,78% YoY) and strategic reserves at 381 million barrels (+8,81% YoY) this week, have provided support for the market. U.S. refineries are entering a maintenance period, resulting in lower oil consumption by these facilities and an increased availability to build inventories in the weeks ahead.

In this context, the main bullish factor for the market in the coming weeks is the perception of increased risk in the Middle East, driven by the escalation of the conflict between Israel and Lebanon. The intensification of hostilities in this region could led to a rise in global risk aversion, which, in turn, would result in higher prices for oil. In South America, although the likelihood is lower, a potential open conflict between Venezuela and Guyana over the Esequibo region could generate instability in the area and also impact oil prices.

Image 4: US – Refinery Oil Input (Million b/d)

Source: Bloomberg, Refinitiv

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.