Refining margins in the US have seen an improvement, though this uptick might be temporary

Refining margins in the US have seen an improvement, though this uptick might be temporary

- In the week ending October 4, gasoline stocks in the US sharply declined by 6.3 million barrels. Hurricane Milton forced millions to seek shelter, leading to increased fuel consumption.

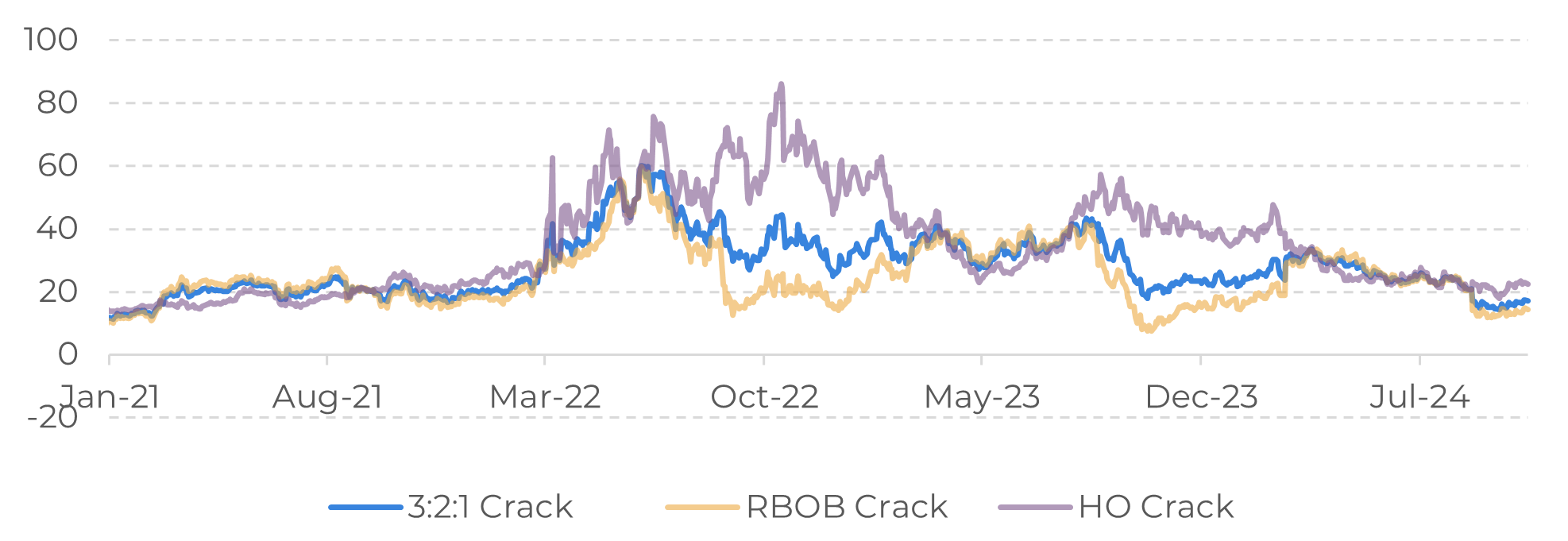

- The gasoline crack spread, a key margin indicator for refineries, has risen in recent days. This growth may continue over the next few days as many people return home.

- However, the coming months could be challenging for refinery margins as the hurricane season approaches its end and low temperatures reduce mobility in the northern hemisphere.

Introduction

The consumption of oil derivatives is a key indicator of global energy demand. Increases in the consumption of gasoline, diesel and other refined products boost the demand for crude oil, typically leading to higher prices.

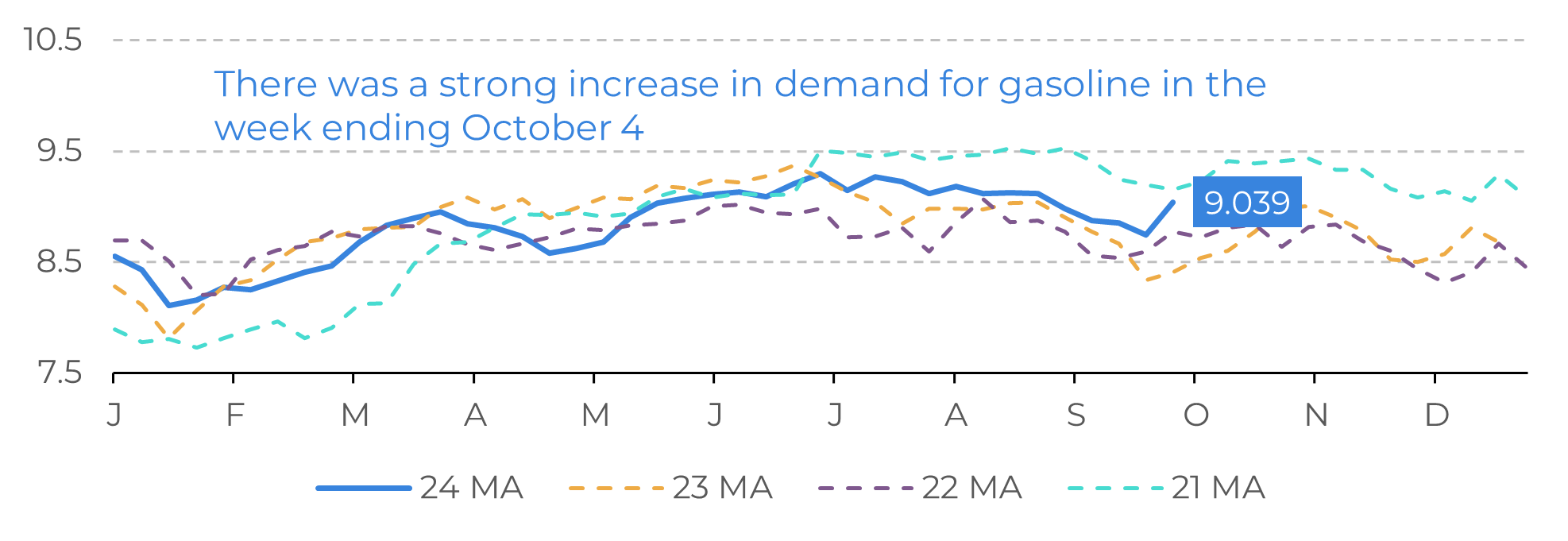

Last week, fuel consumption in the US, particularly gasoline, surged due to Hurricane Milton, which forced many people to evacuate the Gulf Coast regions. Consequently, the gasoline crack spread increased, supporting refinery margins.

However, significant bearish fundamentals could emerge in the coming months, impacting oil product futures. This report will discuss the factors that have influenced refinery margins and potential developments in the months ahead.

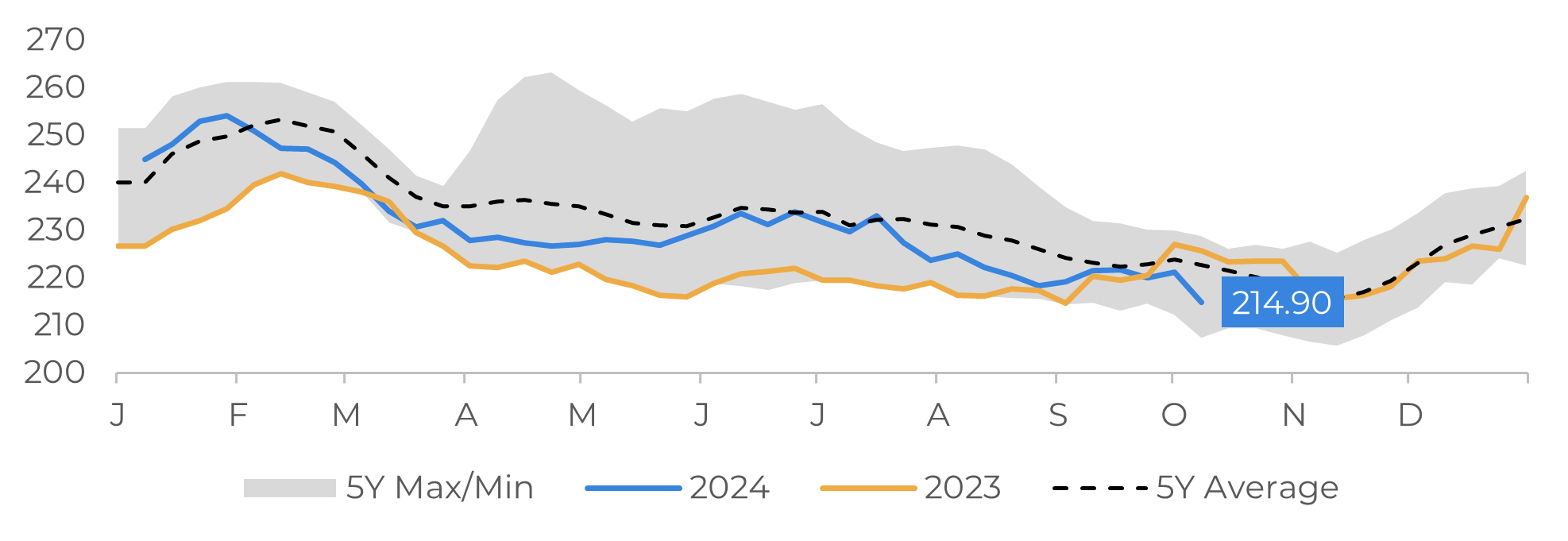

Image 1: USA - Gasoline Stocks (in Millions of Barrels)

Source: EIA

Image 2: USA - Implied Demand for Gasoline (Million Barrels per Day)

Source: EIA

Hurricane Milton raises refinery margins

Although gasoline demand in the US performed well in 2024, averaging 8.856 million barrels per day (+0.27% compared to 2023), the continuous rise in inventories from March to July prevented a substantial increase in gasoline prices and limited possible gains in RBOB futures. It's unusual to see such a significant inventory build-up during the driving season, when many Americans typically travel, but that's exactly what happened this year.

However, in the week ending October 4, there was a sharp drop in the country's gasoline stocks (-6.3 million barrels). Hurricane Milton forced millions of people on the Gulf Coast, especially in Florida, to relocate, boosting fuel demand at a time when refinery production usually declines due to maintenance.

Crack spreads - profit margins obtained by converting a barrel of oil into consumable products - have increased over the last two weeks, with the gasoline crack spread growing by nearly $7 compared to the same period last year. This trend may continue for a few more days, as many people return to their homes, maintaining support for refiners.

Image 3: USA - Refined Products Margin (US$ per Barrel)

Source: EIA

The gains from monetary easing will be gradual

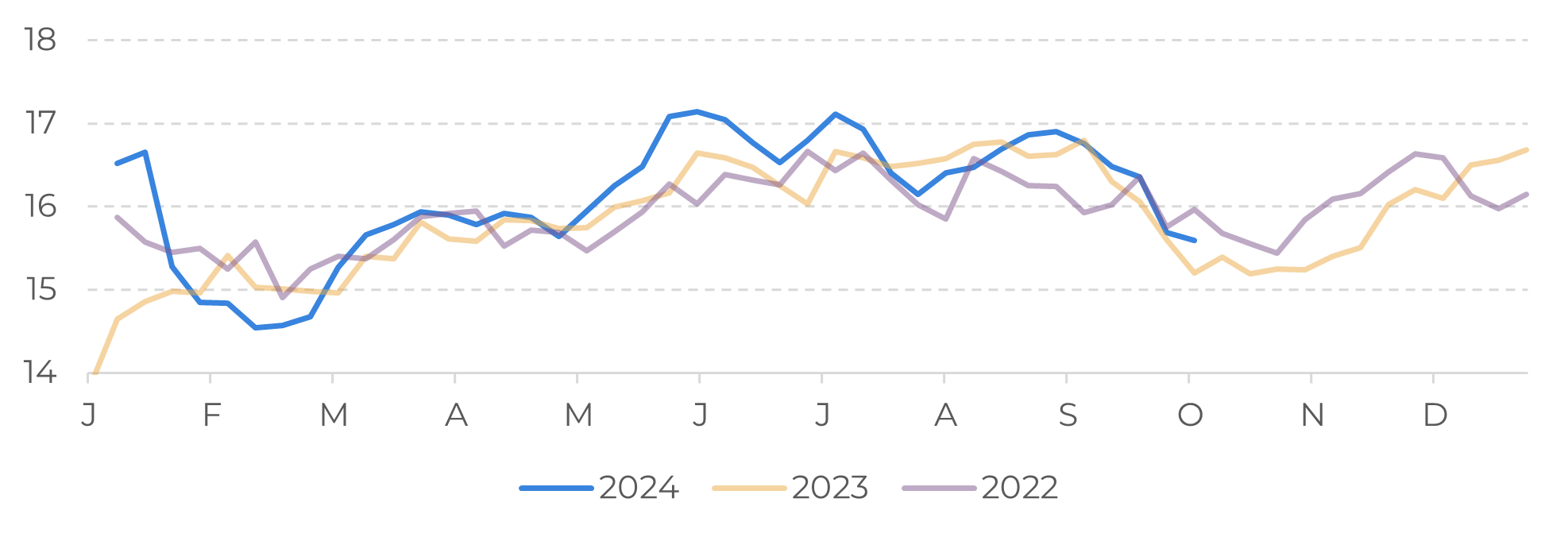

As we approach the end of the hurricane season and cooler temperatures begin to reduce mobility in the country, refining margins will increasingly depend on the performance of middle distillates (heating oil). While, there is a recovery in demand, with an average consumption of 3.662 million barrels in 2024, it remains about 2.78% below the same period in 2023.

However, bearish fundamentals in the market could affect oil refinery margins in the coming months. Biofuels have been gaining relative ground in total diesel consumption, especially in California, where public policies have promoted the use of biodiesel and renewable diesel. Additionally, restrictive interest rates have reduced activity in the industrial sector, which is heavily reliant diesel.

Significant changes are underway, such as the loosening of US monetary policy, which tends to make the dollar cheaper and favor domestic economic activity. However, the benefits of the new monetary scenario in the US will take time to materalize and will occur gradually.

Image 4: USA - Oil Consumption in Refineries (Million Barrels per Day)

Source: EIA

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.