What lies behind OPEC+'s decision to delay the oil output increase?

What lies behind OPEC+'s decision to delay the oil output increase?

- In recent years, OPEC+ has been a significant bullish force in the energy market by curbing oil production, which has helped support prices. In addition, since October 2023, the ongoing conflict in the Middle East has added a risk premium and increased volatility in the energy market, reinforcing a bullish sentiment for much of 2024.

- Currently, the group is maintaining voluntary cuts of 2.2 million barrels per day. It had planned to return 180,000 barrels per day to the market in December, but the alliance decided to postpone the increase production due to the ongoing bearish trend in oil prices.

- However, weak energy demand from Asia, coupled with the risks of an economic slowdown, is impacting overall market sentiment, bringing the Brent benchmark close to the $70 mark in recent weeks.

Introduction

The last quarter of the year will be the most challenging for oil, as increasing bearish risks in the market could severely impact the main benchmarks for the product. On one hand, in recent years, OPEC+ has managed to defend prices, even benefiting from the geopolitical premium coming from the Middle East; on the other hand, weak demand data from Asia increasingly weighs on market sentiment.

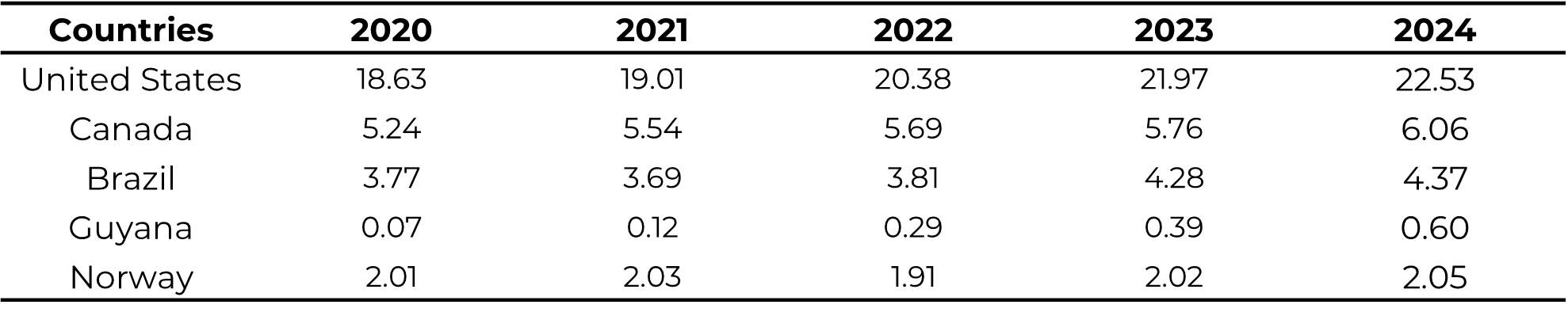

Amid the growing bearish sentiment taking shape, the alliance has decided to postpone its plans to increase production by 180,000 barrels per day. Currently, there are voluntary cuts of 2.2 million barrels. While this is helping to stabilize the fall in oil prices, it is also costing the group dearly in terms of market share, as countries such as the United States, Brazil, Canada, Guyana and Norway are increasingly its share in oil market.

Consequently, we will analyze what lies behind this decision and its impact on the market by the end of 2024.

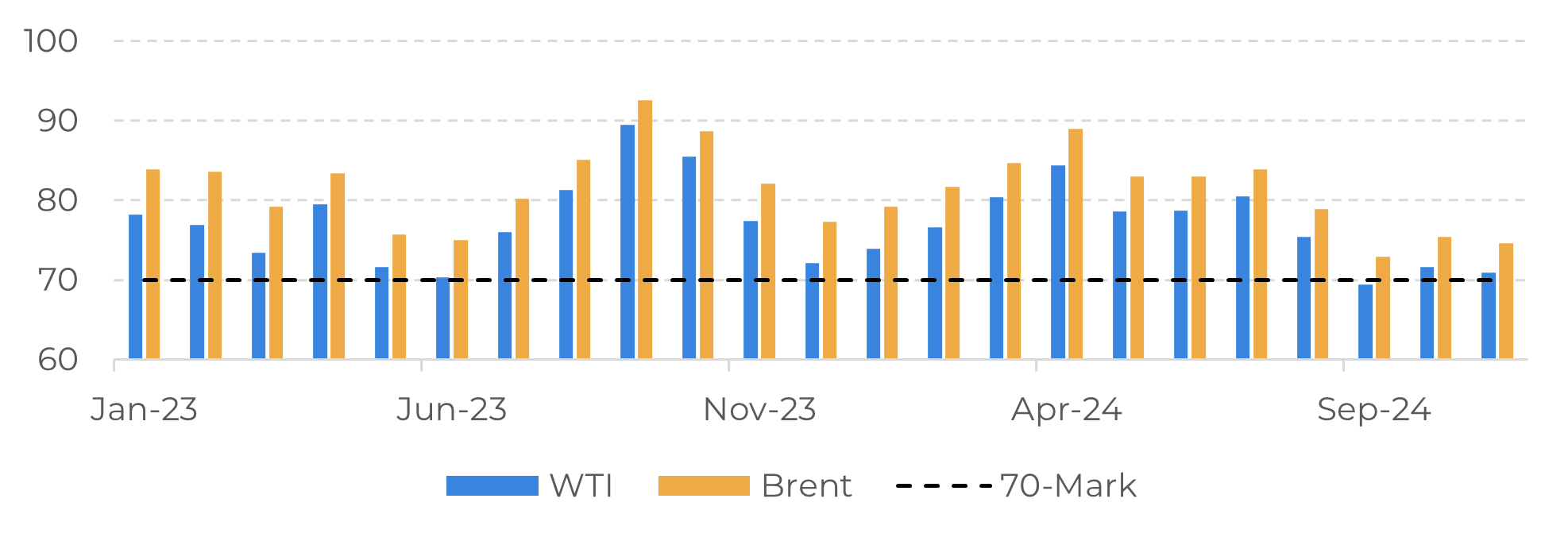

Image 1: Crude Oil Benchmarks (US$/bbl)

Source: Refinitiv

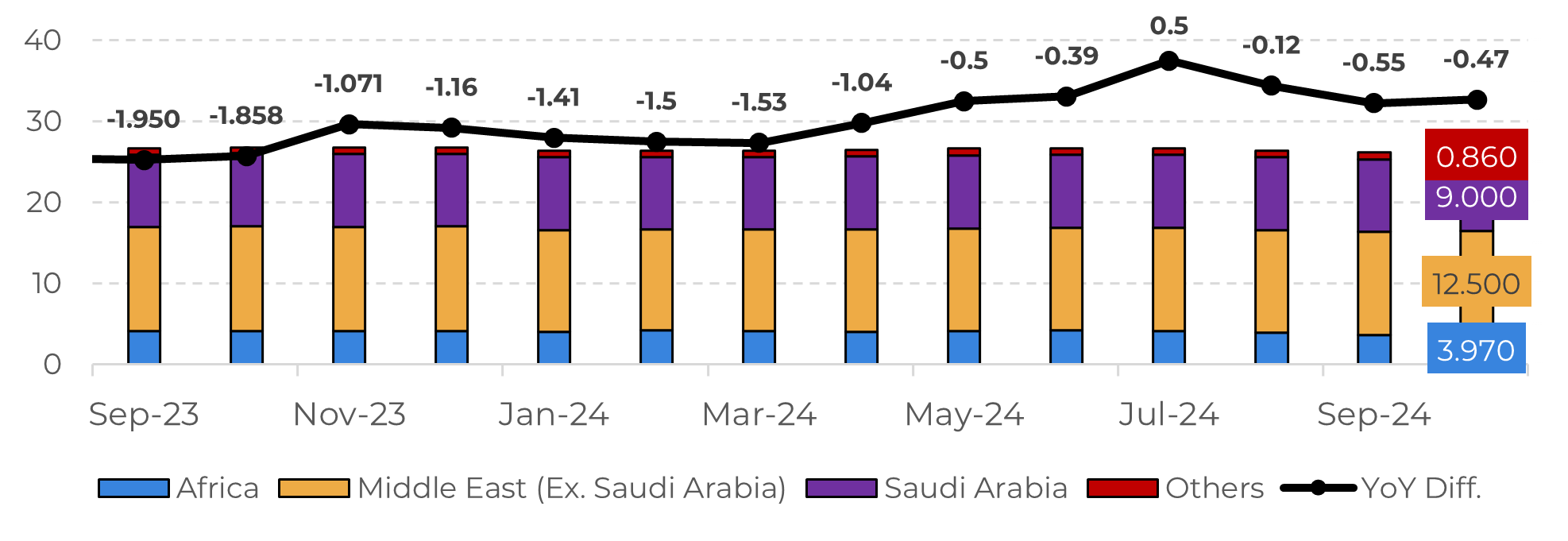

Image 2: OPEC – Crude Oil Production (M b/d)

Source: Refinitiv

Brent has approached the $70 mark over the past few weeks

There’s no doubt that, over the past few years, OPEC+ has been a major bullish force in the energy complex, with its curbs on oil production helping to support the market. Other fundamentals have also supported the main oil benchmarks, such as the ongoing conflict in the Middle East, which has added a risk premium to oil and increased market volatility. Nevertheless, in recent months, concerns about global oil demand have increased significantly, leading to a decline in prices that has, at times, brought Brent close to the $70 mark—a key support level.

Due to the decline in crude oil prices, OPEC+ has once again decided to postpone its plans to increase production by 180,000 b/d from December to another month. In fact, increasing the supply of oil at this time does not seem appropriate for budgets that heavily rely on revenues from oil and gas exploration, especially with the upcoming results of the US elections, which could bring changes to global energy landscape.

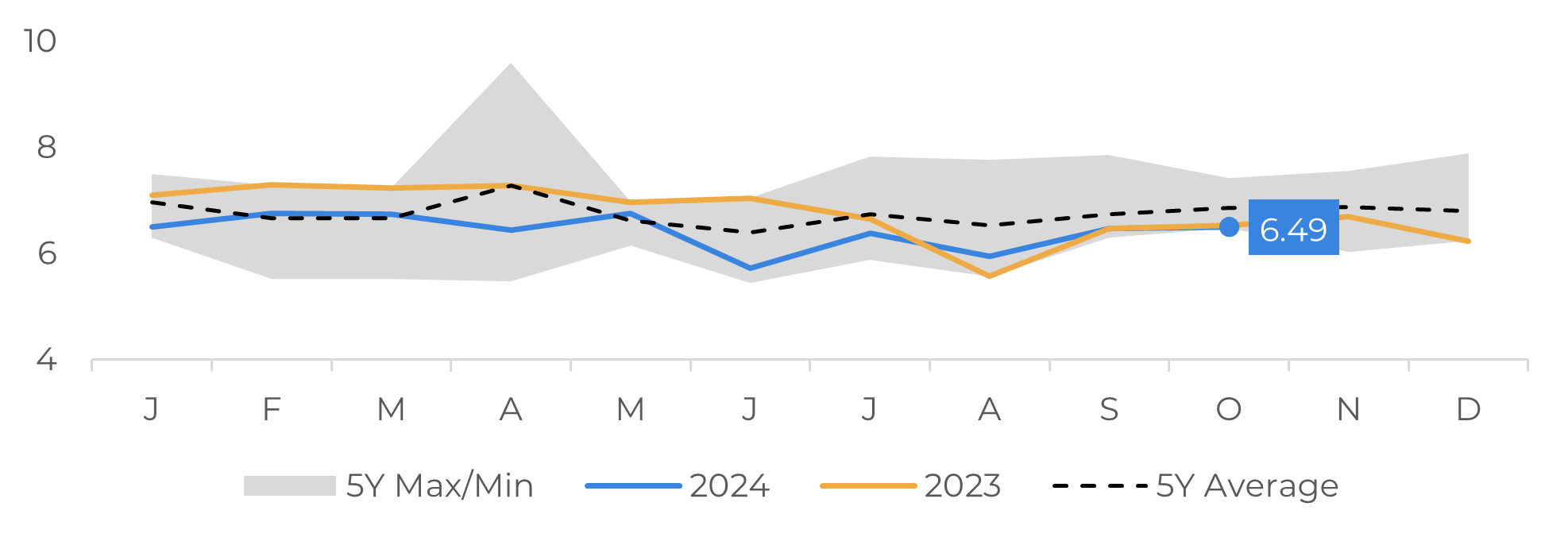

However, defending oil prices will become increasingly difficult and costly for OPEC+, particularly for Saudi Arabia, which has lost market share to non-OPEC countries over the past year and is holding 3 million barrels per day of spare capacity.

Image 3: Saudi Arabia – Crude Oil Exports (M b/d)

Source: Refinitiv

OPEC+’s difficult cooperation represents a major downside risk

Although OPEC+ remains an important player in oil production, its dominance has diminished in recent years due to the rise of non-member countries such as the U.S., Canada, Brazil, Norway, and Guyana, which are achieving record levels of production of oil and other liquid fuels. To worsen this trend, both the EIA and IEA have revised their projections for oil growth this year, now estimating an increase of less than 1 million barrels—less than half of OPEC's projection of 1.93 million barrels per day (bpd).

In addition, OPEC+ members have collaborated to create a more challenging environment for sustaining crude oil prices, with countries such as Iraq, Russia, and Kazakhstan producing oil above their quotas for most of 2024. The difficulties in cooperation among members led to Angola's exit from the group, reducing the number of OPEC members to 12. Such issues represent significant downside risks for oil benchmarks.

There are bullish fundamentals underway, such as the US interest rate cut and China's stimulus measures; however, this will need time to translate into improvement of economic activity, which could lead to greater demand for oil in the future. In this context, the OPEC+ decision was important, some extension was needed to give the alliance time to increase its production in a less bearish scenario than the current one.

Image 4: Non-OPEC Petroleum and Other Liquid Fuels Production (M b/d)

Source: EIA

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.