Growth in oil consumption faces obstacles until the end of 2024

Growth in oil consumption faces obstacles until the end of 2024

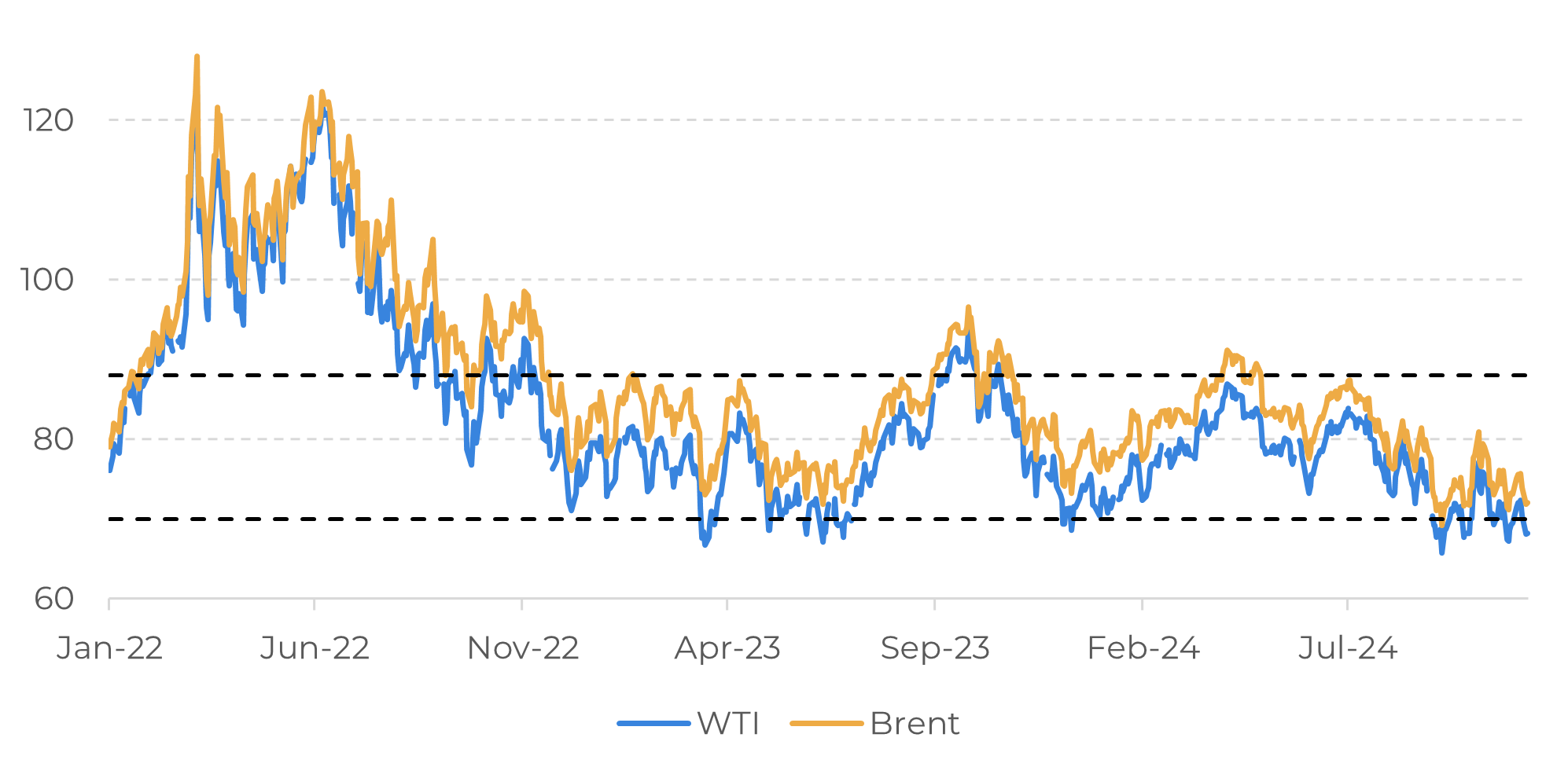

The oil market has found little support in recent weeks as strategies to restrict supply by producers have shown signs of running out of steam. In addition, the lower volumes of fuel imports in Asia also signal a weakening in demand. In this sense, organizations are beginning to adjust their projections, such as OPEC, which now forecasts global growth of 1.82 million barrels per day (bpd), 107,000 barrels lower than last month's estimate.

Some fundamentals in the energy complex have hampered demand this year, but the main one is the lower volume of oil imported by China, which has seen a drop of around 3% (-351k b/d) in the accumulated 2024 compared to 2023. In its estimates, OPEC predicts growth of 450,000 bpd in the Asian giant, a figure well below the 580,000 bpd forecast in its previous month's projections. Although Beijing is presenting a stimulus plan capable of strengthening the economy, which has been marked by a severe crisis in the real estate sector, this will not necessarily translate into higher fuel consumption, which may have a limited effect on market expectations in relation to the main oil benchmarks, which are down by more than 10% year-on-year.

Image 1: Main Oil Benchmarks (US$/bbl)

Source: Refinitiv

There are some bullish fundamentals in the market, such as the tightening of sanctions against Venezuela and Iran, which could result in some short-term support for energy commodities. However, new incentives for oil production in the US, as well as a possible increase in production by OPEC+ member countries from December, make it even more challenging to achieve a substantial increase in the prices of the main commodity benchmarks, especially considering the bearish revisions for energy demand in 2024 and 2025.

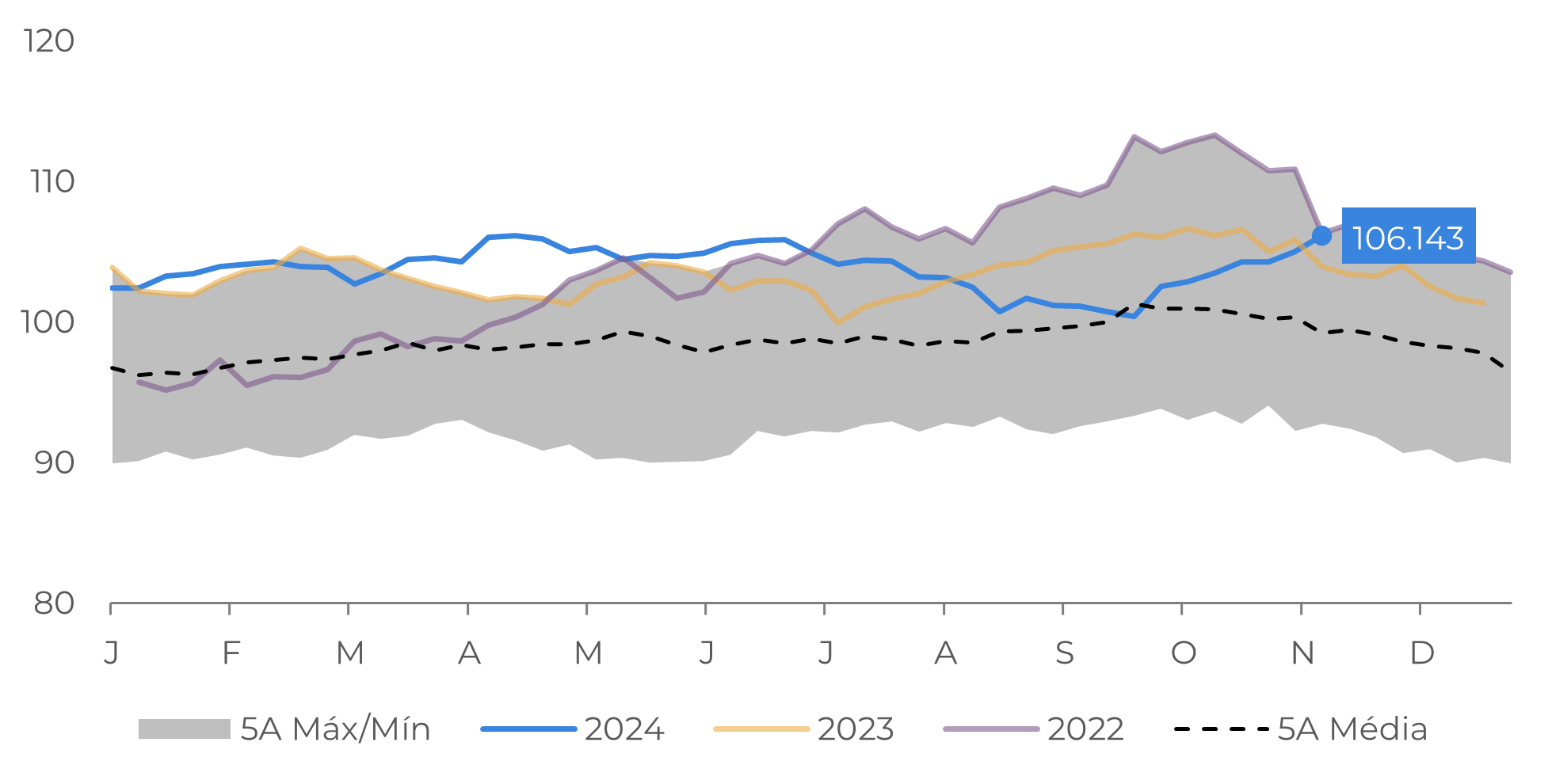

The macroeconomic environment is also not contributing to an improvement in risk aversion, with uncertainties about the new direction of American policies bringing strength to the dollar and making energy commodities more expensive for holders of other currencies. Possible tax cuts in the US could result in a deepening fiscal deficit, forcing the US Treasury to pay higher yields to attract investors to its bonds, which supports the dollar. In the month of November, the DXY shows a rise of 2,213 points towards 2023, very close to the levels seen in 2022 when the Fed began its restrictive monetary cycle.

Image 2: Dollar Index (DXY)

Source: EIA

Despite the reduction in its estimates, OPEC's figures are still much more optimistic than those of other energy sector organizations, such as the EIA and the IEA, which respectively project global growth of 940,000 barrels per day and 860,000 barrels per day. In the final months of the year, fuel consumption tends to decrease in the northern hemisphere due to the approach of winter, which reduces the chances of upward revisions for oil consumption. Therefore, the outlook for energy commodities remains cautious, with seasonal factors and divergences in the forecasts of the main organizations influencing future expectations.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.