US gasoline stocks send out a warning signal

US gasoline stocks send out a warning signal

- Last week, the US recorded an increase of 2.1 million barrels in gasoline stocks. The level is one of the lowest in the last five years.

- Between November and March, American refineries usually direct part of their production to commercial stocks, to guarantee sufficient supplies to meet the high demand of the Driving Season.

- Although refineries still have time to prepare supplies for next year, low inventories in the country could continue to support gasoline futures.

- This risk is amplified by possible adverse weather conditions, which, as of the beginning of 2024, have compromised oil extraction and forced refineries to close temporarily.

Introduction

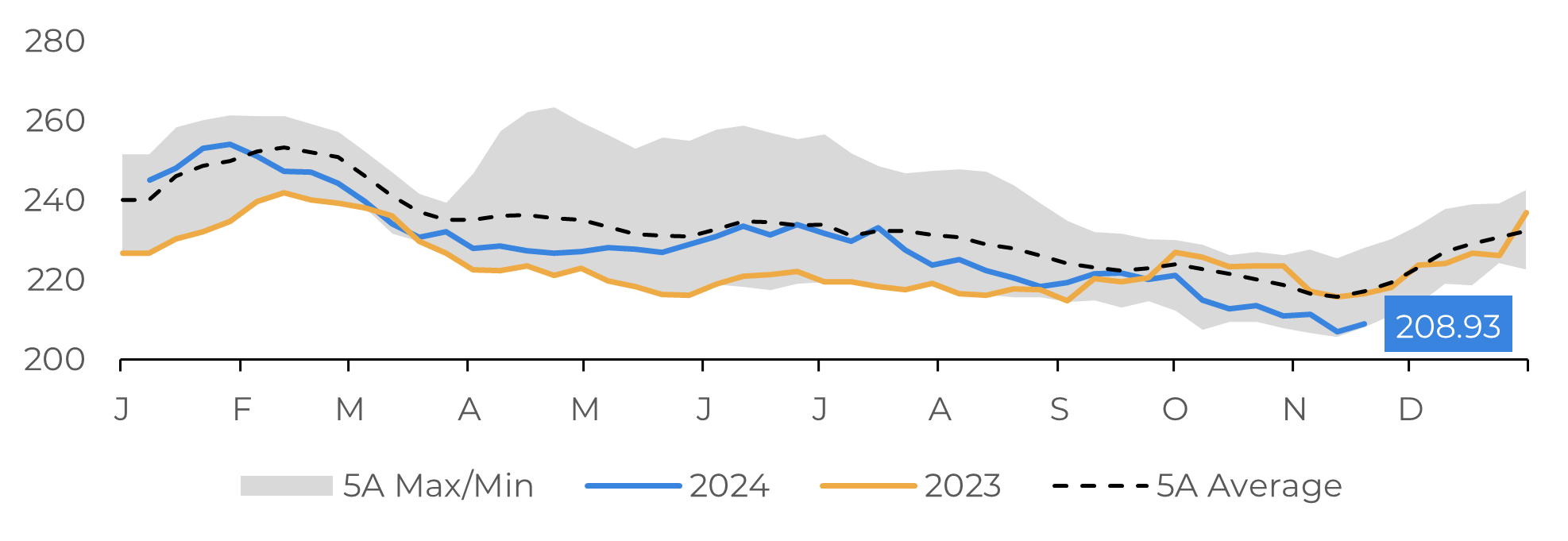

After weeks of a downward trend, US gasoline inventories recorded growth, according to data released by the EIA last week. With an increase of 2.1 million barrels, stocks reached 208.93 million in the week ending November 15.

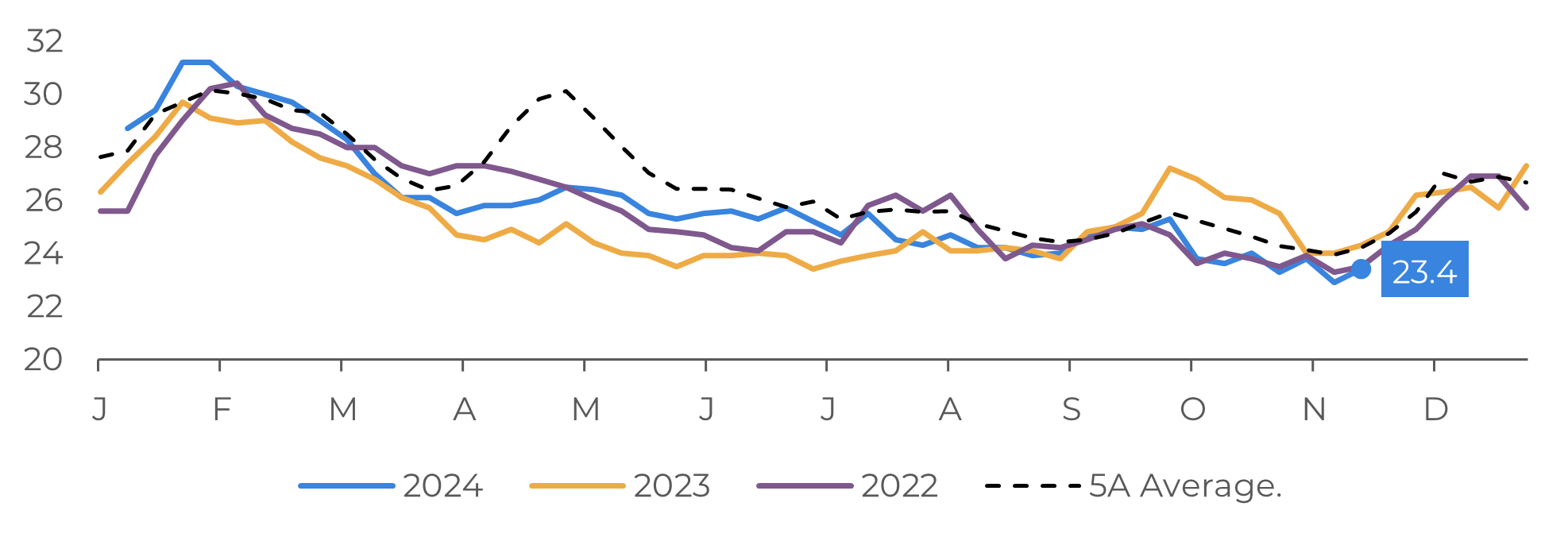

However, a warning signal has been triggered and could persist in the coming months. In addition to low stocks, their formation is slower in 2024, due to still resilient demand. Gasoline supply days, which relate stocks to demand, are currently at 23.4. This is about one day less than the same period in 2023 and nearly the same level as in 2022, when Russia's invasion of Ukraine significantly pressured American stocks.

Therefore, today's report will discuss upside risks for gasoline that could emerge in the future, impacting benchmarks for the commodity on global markets.

Image 1: US - Gasoline Stocks (Millions of Barrels)

Source: EIA

Image 2: Gasoline Supply Days in the US

Source: EIA

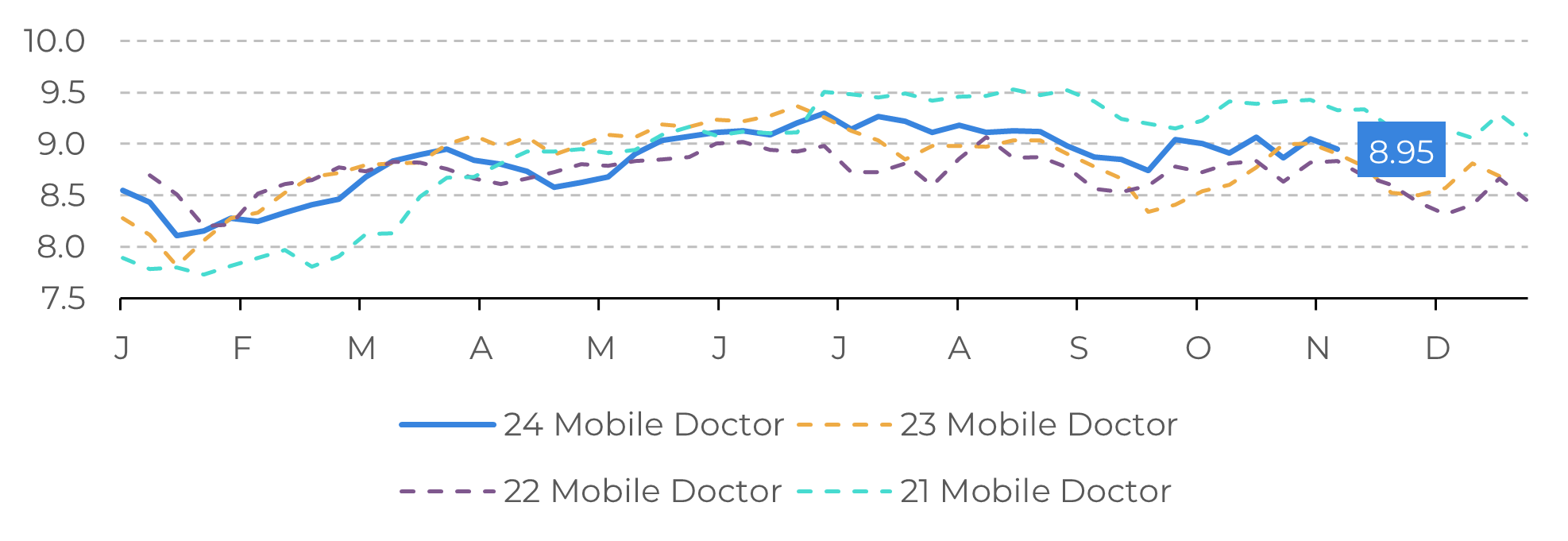

Demand for gasoline remains high in the US

Currently, gasoline stocks in the US are 3.74% below the average of the last five years, around 8 million barrels in absolute terms. The approach of winter in the northern hemisphere, a period traditionally marked by lower vehicle mobility, could limit the market's bullish fundamentals. However, this scenario also raises alarm bells for next year. This is because, generally, between the months of November and March, American refineries direct part of their production to commercial stocks, with the aim of guaranteeing sufficient supplies to meet the high demand of the Driving Season, which begins on Memorial Day (May) and ends on American Labor Day (September).

However, the start of gasoline stockpiling, usually observed in November, is slower in 2024. This scenario can be partly attributed to the high demand recorded in recent months, driven by events such as Hurricane Milton, which forced millions of people to relocate in Florida in October. In addition, the economic climate is also different this year: with inflation more under control, retail prices at gas stations are around 6% below 2023 levels, according to the EIA, which has contributed to stimulating demand in the United States.

Image 3: US - Implied Demand for Gasoline (4-Week Average, M b/d)

Source: EIA

Rising RBOB represents an additional risk for fuel importers

While refiners still have time to prepare supplies for next year, low stocks in the country could continue to support gasoline futures. This risk is amplified by possible adverse weather conditions, which, like earlier this year, have compromised oil extraction and forced refinery closures.

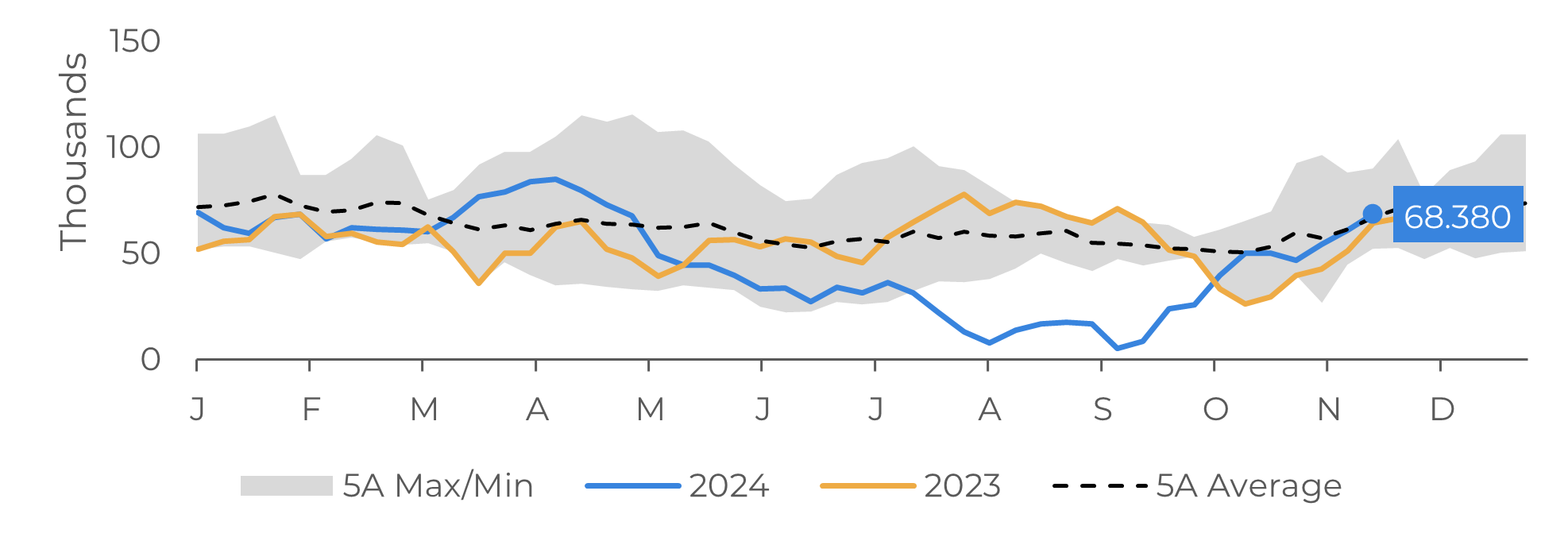

These fundamentals seem to be catching the market's attention, with hedge funds and money managers extending their net long positions to around 68 million barrels at RBOB, an increase of 21.794 million barrels in November compared to the end of October. A sign of a more bullish perception forming for gasoline in the US.

In this context, Brazilian fuel importers may face an additional challenge in the coming months. The rise in gasoline prices could impact the import parity price, already pressured by the strong devaluation of the real, making it even more difficult to obtain profit margins on fuel imports.

Image 4: Fund Managers' Net Long Positions in RBOB

Source: Bloomberg

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.