Biofuels in the United States: how the new EPA proposal could impact the entire soybean complex

New biofuel proposal in the US already affects the soybean complex

Over the last few days, the soybean complex markets have been impacted by the new proposal for mandatory biofuel blending in the United States announced on June 13, with the US Environmental Protection Agency (EPA) proposing a large increase in the volumes of biodiesel and renewable diesel to be blended into fossil fuels in 2026 and 2027.

Although the proposal is still in the early stages of the approval process, the market has already begun to speculate about possible impacts on the supply and demand frameworks for the US soybean complex (soybeans, soybean meal and soybean oil), which has resulted in important movements in futures contracts in Chicago, which tend to continue at least until August when a new stage of the process will come into play.

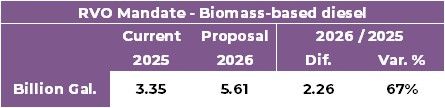

The EPA's proposal points to an increase in the mandatory volume of biodiesel and renewable diesel blended into fossil fuels from the current 3.35 billion gallons in 2025 to 5.61 billion gallons in 2026, which represents a significant increase of 2.26 billion gallons (+67%). If confirmed, it will be the largest increase ever recorded in mandatory blending in the US, marking a new era in the use of alternative fuels in the North American market.

US "RVO" Mandate - in billions of gallons and %

Source: EPA, Hedgepoint

For 2027, the proposal calls for an even higher blend (5.86 billion gallons), but in this report we will only use the forecast for 2026 to build the scenarios.

As mentioned, the proposal is still at an early stage, and a virtual public hearing is scheduled for July 8 for discussions on the topic. In addition, the EPA will receive opinions and comments on the subject until August 8. After this period, we should have news regarding the progress of the proposal.

US soybean crushing capacity

US soybean crushing capacity

Soybean crushing capacity currently stands at 69.4 million tons (2550 million bushels) per year in the US, according to April data from the American Soybean Association (ASA).

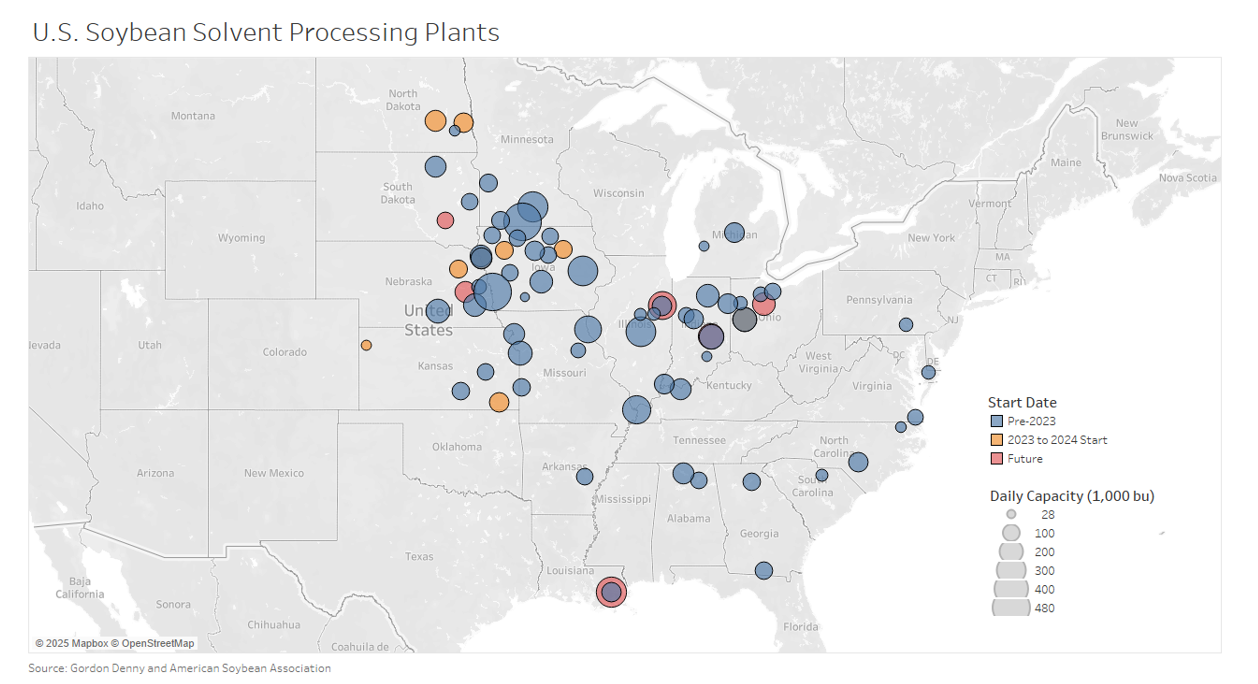

Map - Soybean Crushing Plants in the USA

Source: ASA, Gordon Denny

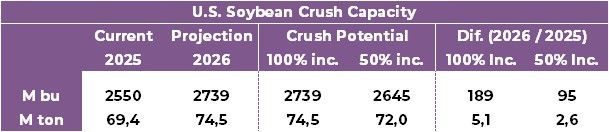

The projects, if completed by 2026, should increase US crushing capacity by 5.1 million tons (189 million bushels) per year, from the current 69.4 to 74.5 million tons (2550 to 2739 million bushels) in 2026. In the table below, we summarize the data and also estimate the crushing capacity if only 50% of the expansion is achieved by next year.

US soybean crushing capacity - in million bushels and millions tons

Source: ASA, Hedgepoint

We would like to point out that although current capacity stands at 69.4 million tons (2550 million tons), the USDA's June estimate points to 67.8 million tons (2490 million bushels) of soybeans being crushed in the 2025/26 US season, representing 97.7% capacity utilization. Thus, there is also room for an increase in crushing using the capacity already available.

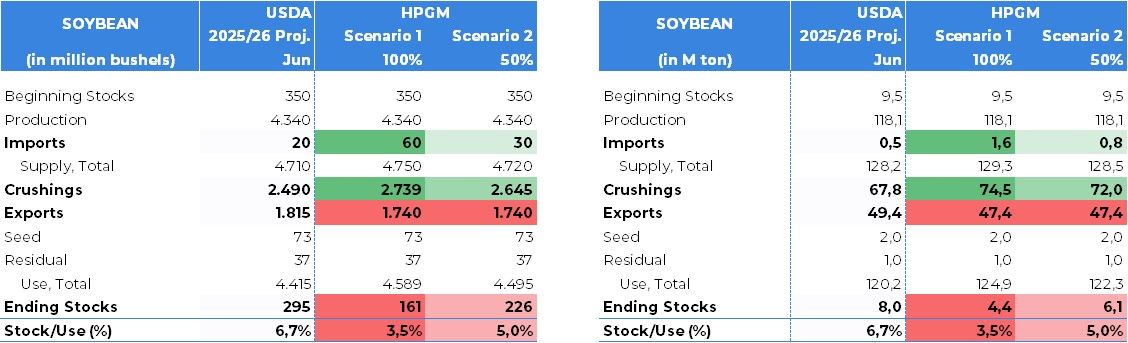

Scenarios: Soybean

In Soybean Scenario 1, we assume that 100% of the potential growth in soybean crushing capacity will be achieved (+5.1 million tons or 189 million bushels regarding 2025 capacity), which would lead to a potential crush of 74.5 million tons (2739 million bushels) of soybeans in the 2025/26 season, if all capacity is used. This increase in domestic use of soybean for crushing would lead to the need for an increase in soybean imports to maintain stocks. In addition, the greater domestic need, coupled with issues involving the trade war, should lead to a reduction in exports (47.4 million tons or 1740 million bushels), which should fall due to lower availability, less competitive prices and a drop in Chinese demand.

We believe that, although possible, Scenario 1 is less likely to occur, since we believe it will be difficult for the US to reach 100% of its potential growth in crushing capacity and use it in the first half of 2026.

Scenarios - Soybean Supply and Demand - in million bushels and millions of tons

Source: USDA, Hedgepoint

In Scenario 2, we assume that 50% of the potential growth in crushing capacity will be reached (+2.6 million tons or 95 million bushels regarding 2025), which would lead to a potential crushing of 72 million tons (2645 million bushels), if all capacity is also used.

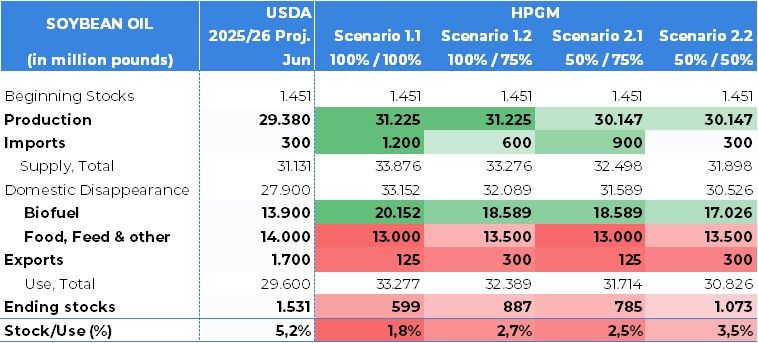

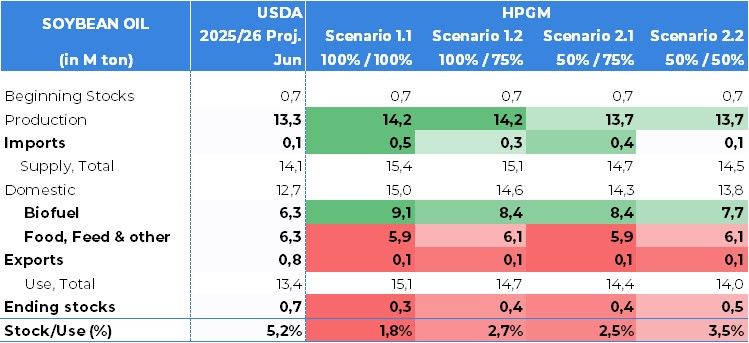

Scenarios: Soybean Oil

Deriving from the soybean crushing scenarios, we designed four scenarios for the soybean oil supply and demand picture, mainly considering the availability and potential use of the soybean derivative for making biodiesel and renewable diesel in the proposed higher blend environment.

Scenarios - Supply and Demand for Soybean Oil - in million pounds

Source: USDA, Hedgepoint

Scenarios - Supply and Demand for Soybean Oil - in million tons

Source: USDA, Hedgepoint

In Scenario 1.2, we also consider the crushing forecast in Scenario 1 for soybean, but we take as a basis the loss of 1/4 of the share of soybean oil in the manufacture of biofuels due to possible higher prices, which is represented by the second percentage of the header (/ 75%).

Finally, in Scenario 2.2, we considered the crushing forecast in Scenario 2 for soybean but based it on a loss of half (1/2) of the share of soybean oil in biofuel production, which is represented by the second percentage of the heading (/ 50%).

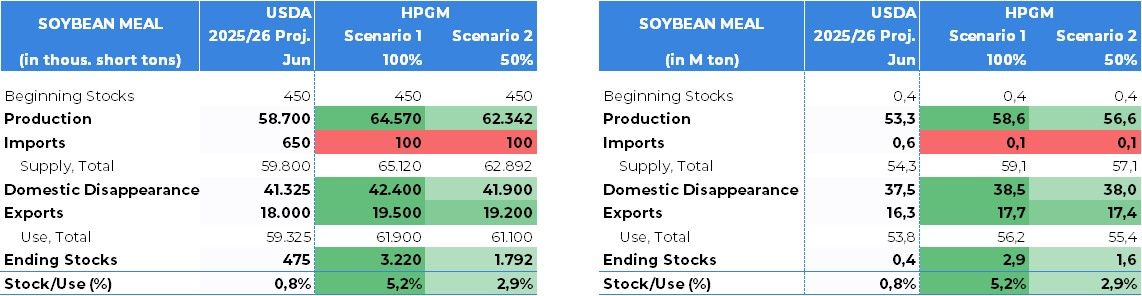

Scenarios: Soybean meal

Regarding soybean meal, the strong expansion expected for North American crushing due to the increase in biofuel mandates tends to result in a significant increase in the production and supply of meal in the 2025/26 season. This situation should lead to a strong expansion in US ending stocks, since the increase in supply should not be accompanied by an increase in demand in the same proportion, regarding both domestic consumption and exports. In view of this, we have drawn up two scenarios.

Scenarios - Supply and Demand for Soybean Meal - in thousand short tons and million tons

Source: USDA, Hedgepoint

In Scenario 2, where the crushing derived from soybean Scenario 2 is taken as a basis, corn meal production is estimated at 56.6 million tons (62.342 thousand short tons), still representing a significant increase regarding the USDA's current estimate. This increase in supply should reduce the need for imports to minimal levels (0.1 million tons or 100 thousand short tons), as in the previous scenario.

Conclusions

In view of the above scenarios, we conclude that the proposal to increase mandatory biofuel blending in the US has the potential to bring major changes to the US soybean complex, with a significant impact on the formation of prices for soybeans, soybean meal and soybean oil.

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com