Oct 9

/

Pedro Schicchi

Grains, Oilseeds and Livestock Weekly Report - 2023 10 09

Back to main blog page

"Brazil's soybean planting season is underway, and while the prospect of a record bean production year is promising, there are complexities to consider.

The country's soybean industry faces a dual challenge: a slower growth rate in domestic demand for soybean meal over the last few years, and a resurgence in biodiesel mandates, leading to increased soybean oil consumption.

The industry is advocating for a return to the B15 biodiesel mandate from the current B12, but the timing and exact details remain uncertain. This presents a dilemma as soybean oil production is intrinsically tied to soybean meal production.

In 2023, Brazil was able to export surplus meal due to a shortage in Argentine meal production. However, with Argentina expected to recover in 2024, the market may not have the same appetite for Brazilian meal."

The scenario for crush next year in Brazil

With the soybean planting starting in Brazil, let us explore the scenario for the crush in the country next year. Certainly, if we expect a record bean production, the industry should have a great year, right? Maybe, but that’s not the whole story. Ample supplies are just one part of the picture. The other is the demand for meal and oil.

In 2023, Brazil was able to export its excess because of the lack of Argentine meal. However, with an active El Niño, we expect the country to recover. As such, the market may not be as eager for Brazilian meal in 2024.

Since the African Swine Fever’s (ASF) shock in the global meat market passed, domestic demand for meal has been growing at much slower rates in Brazil. Meanwhile, biodiesel mandates are back on the rise, meaning soy oil consumption is rising.

The industry is asking for the “return” to the B15 from the current B12 for March next year. The 15% biodiesel mandate, despite never having been reached, was supposed to be in place by early 2023 according to a government-set plan back in 2018. The issue is, one can’t have soybean oil, without also obtaining meal. However, if the latter’s consumption is sluggish, what to do with the excess meal produced?

In 2023, Brazil was able to export its excess because of the lack of Argentine meal. However, with an active El Niño, we expect the country to recover. As such, the market may not be as eager for Brazilian meal in 2024.

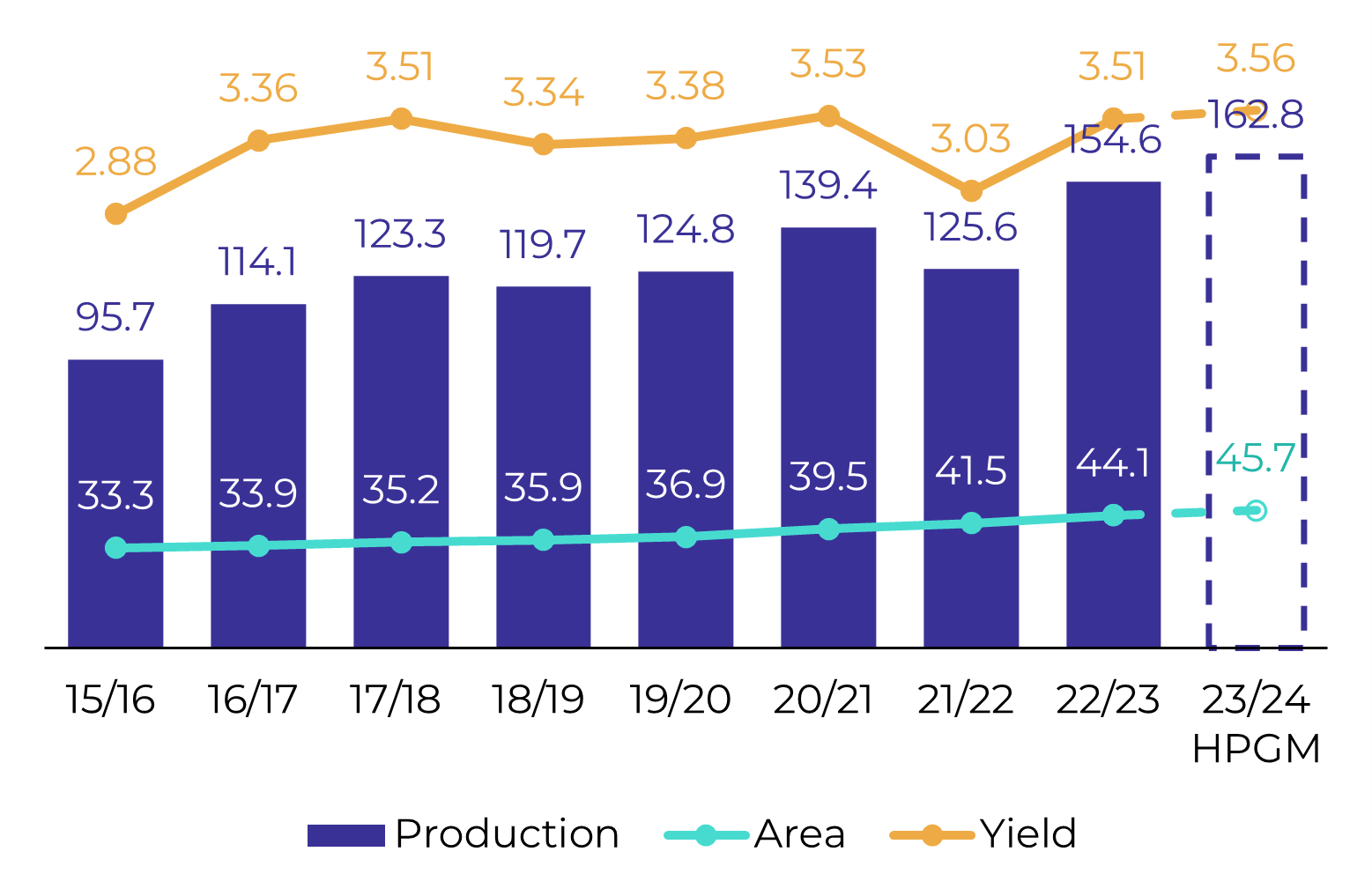

Figure 1: Soybeans Brazil - Area, Yield and Production (M ha, ton/ha, M ton)

Source: Conab, hEDGEpoint

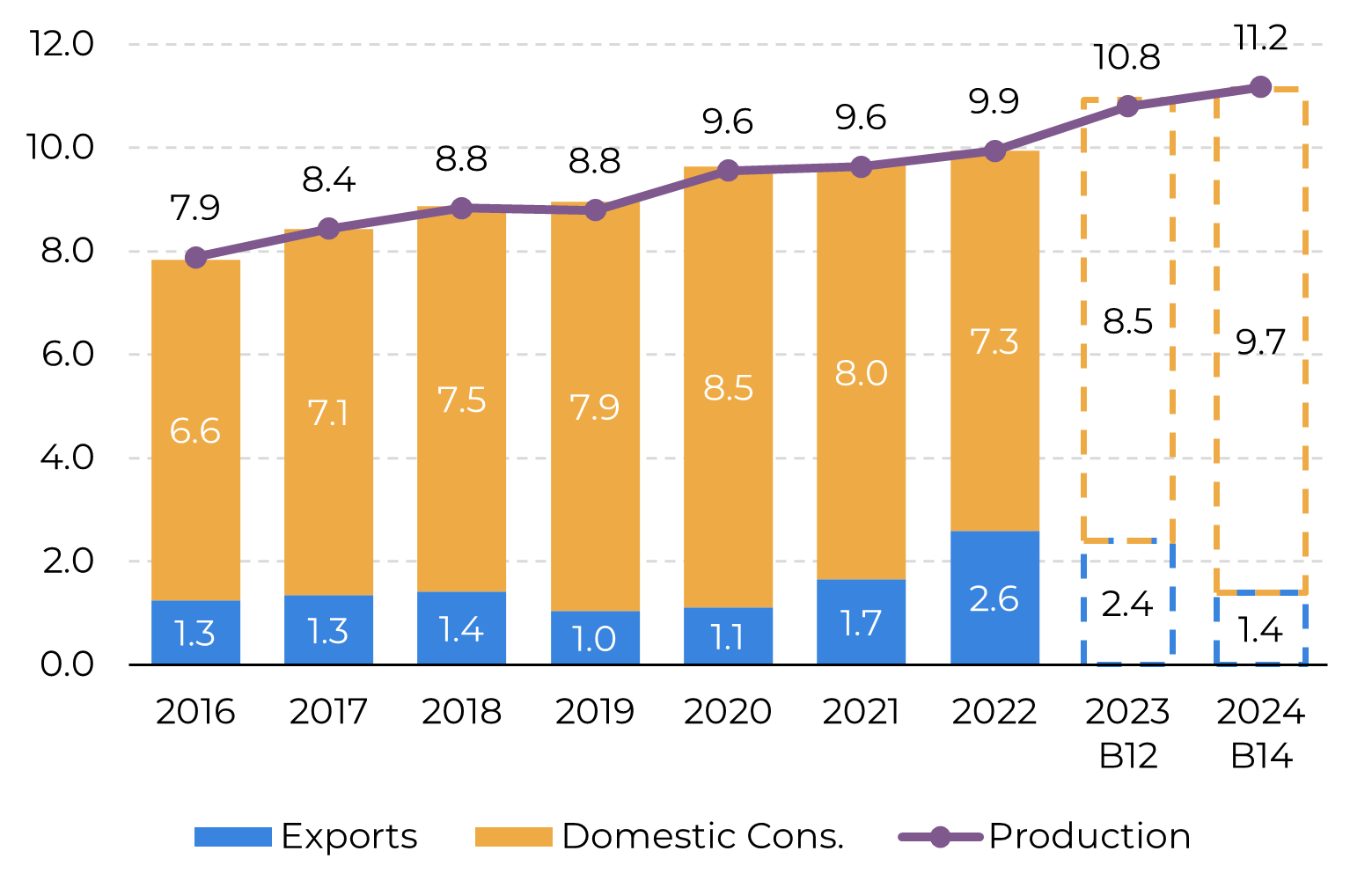

Figure 2: Brazil Soybean Oil Balance (M ton)

Source: ABIOVE, hEDGEpoint

What can we expect for next year?

The first thing to watch out for is how the mandates are going to progress. As mentioned, the industry is asking for B15. Although government representatives have reinforced the commitment to boosting biodiesel consumption, they have avoided giving precise dates and figures so far. We believe an increase in mandates should come, but perhaps not as high as the segment is asking for.

With 56M ton of soybeans crushed in the year (vs 53.5M estimated in 2023), 11.2M ton of oil and 43M ton of meal would be generated. If we assume B14 throughout the year, we get a relatively tight soy oil balance, which should lead to lower exports.

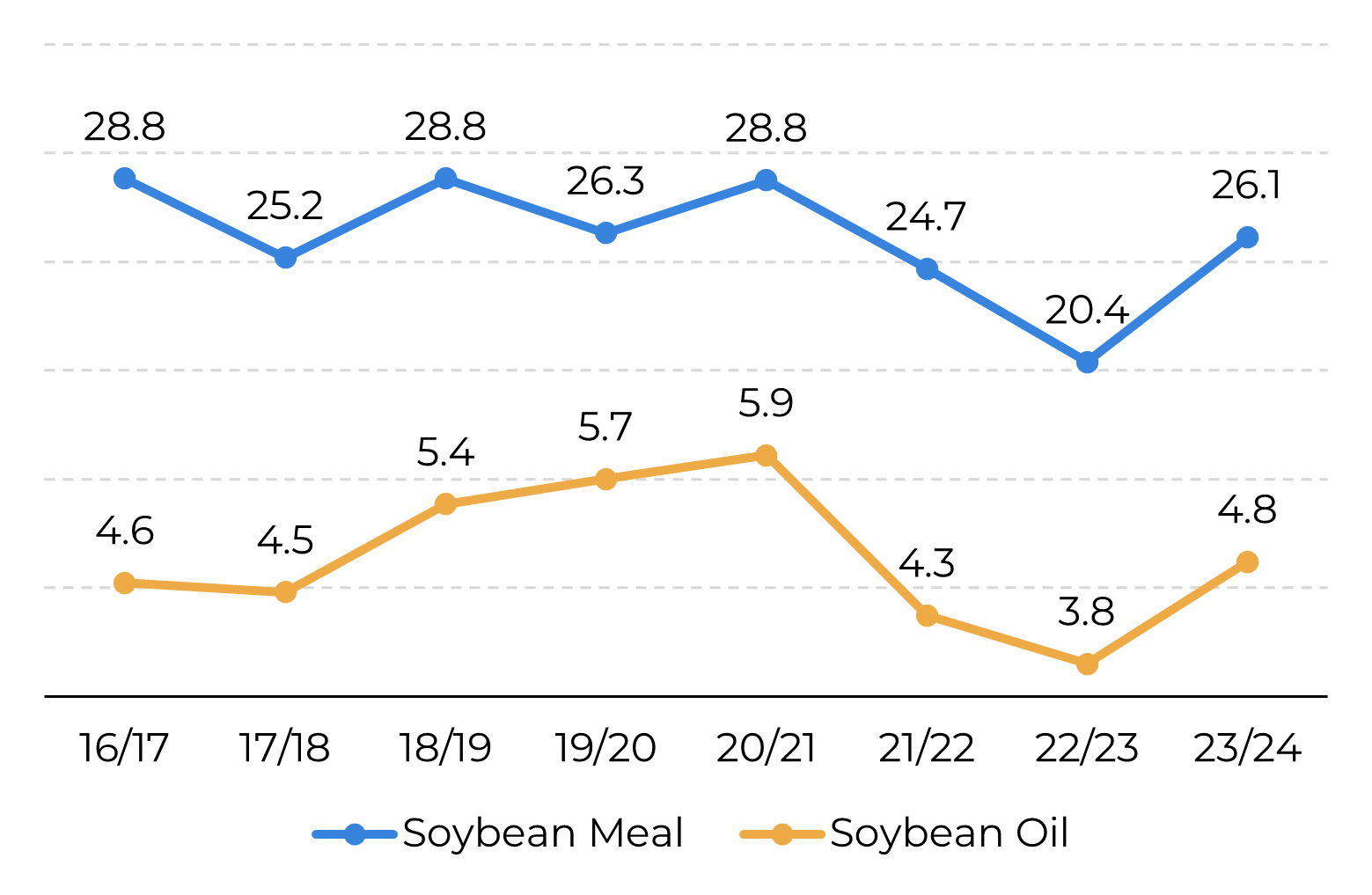

Taking the USDA’s data into consideration, Argentina’s exportable surplus of soybean oil should grow by around ~1M ton from 2023 to 2024. According to our projections, if we have an increase to B14 in Brazil, exports should decrease by the same amount. In other words, despite a better crop from Argentina, the two countries may have around the same amount of oil to export in total. Granted, USDA’s numbers are conservative, but still, an interesting point to be noted.

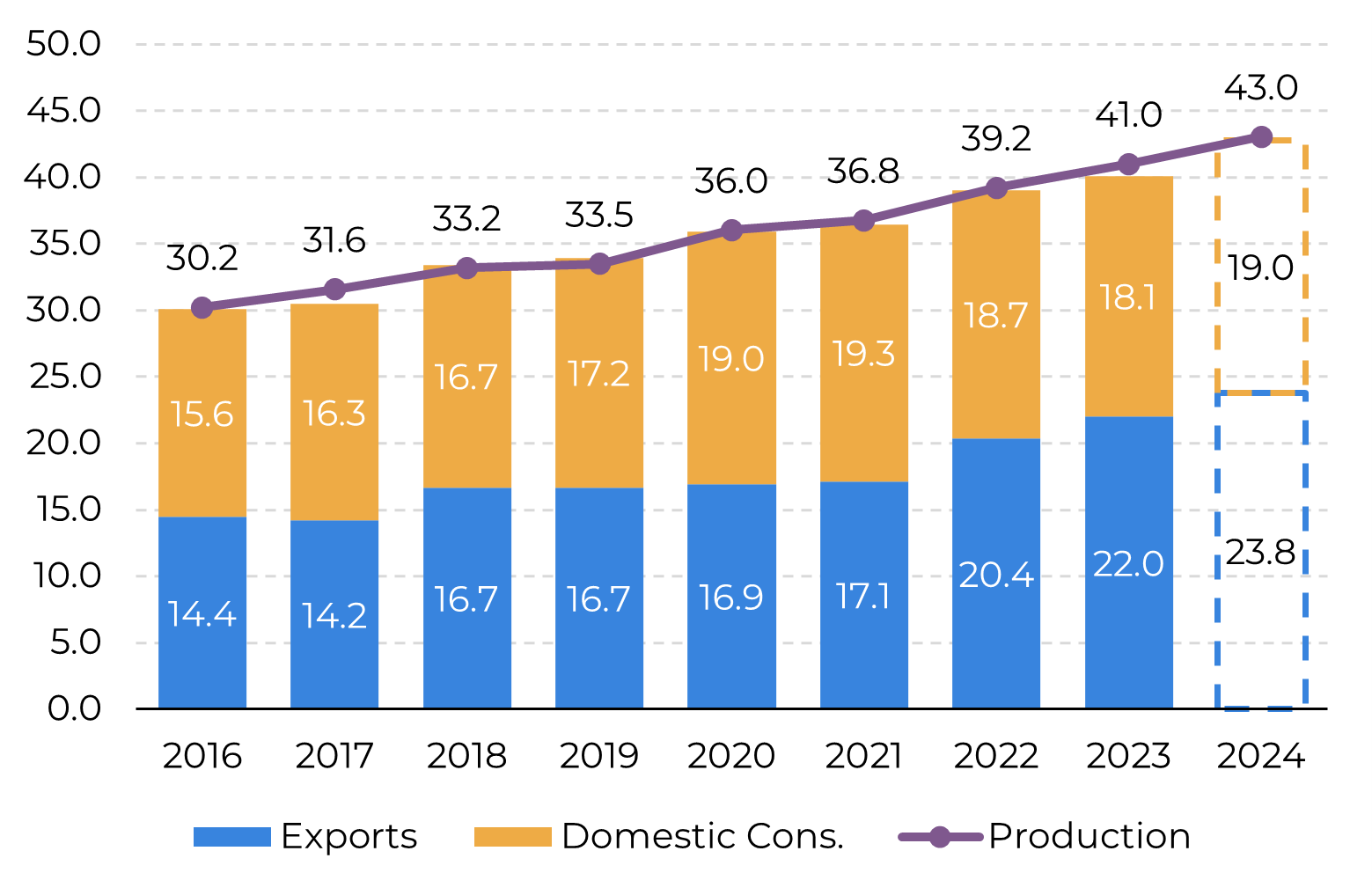

Brazilian meal exports also thrived with two poor crops out of Argentina in a row. However, it is hard to expect the same in 2024 with much better soybean production in the latter. The difference with soy oil is that the domestic consumption is not growing much. So, even projecting some growth, there would be a lot more exportable surplus in Brazil adding to Argentina’s greater availability and applying downward pressure in the market. Thus, we believe either the oil does a lot of the work to maintain crush margins attractive in Brazil in 2024, or the meal scenario will keep crushers’ appetite in check.

Figure 3: Brazil Soybean Meal Balance Scenarios (M ton)

Source: ABIOVE, hEDGEpoint

Figure 4: Argentina Soybean Meal and Oil Exportable Surplus* (M ton)

Source: USDA, *Exportable Surplus = Production-Consumption

Weekly Report — Grains and Oilseeds

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.