Oct 16

/

Pedro Schicchi

Grains, Oilseeds and Livestock Weekly Report - 2023 10 16

Back to main blog page

"A conflict typically triggers risk aversion, resulting in capital flight from volatile assets to the dollar and US treasury bonds. In turn, this could impact commodities futures in the short term.

The region's importance in the oil market and its proximity to the Suez Canal may elevate oil prices and risk premiums in maritime freights.

While Israel plays a limited role in the import of agricultural commodities, the broader Middle East, a major importer of various agricultural goods, holds substantial weight in the global market.

The impact of the conflict on the grains market depends on its scale and the responses of neighboring countries. If contained within the current areas, effects on grains may be limited. However, the scenario changes if it takes greater proportions within the region."

What could the Israel-Palestine conflict mean for the grains market?

Introduction

In analyzing the impacts of the escalation of the conflict, one needs to look somewhat coldly at the situation. Therefore, before starting, we would like to acknowledge the terrible losses and damage to human lives and the feeling of sadness with which we see our world enter yet another war in less than two years.

Before we begin the analysis, we need to consider the context. The ways through which the escalation of the conflict may affect the grains market are many and can vary depending on the developments of the next few weeks. To break them down into a few segments we have: impacts on the financial market in general, the potential impacts on oil and freight prices, and, finally, the grains fundamentals and trade flow.

Financial markets

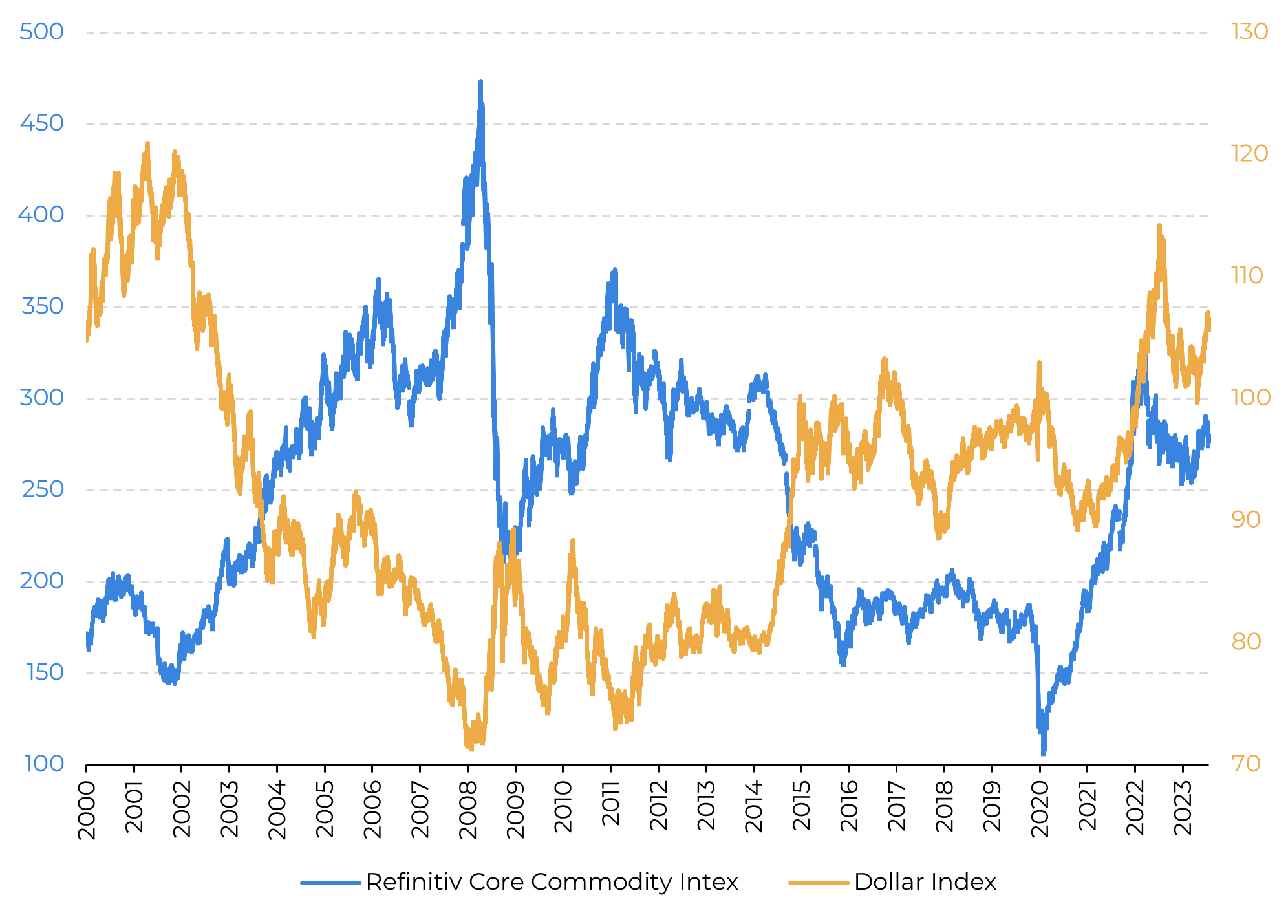

Starting with the broad financial markets, the escalation of a conflict always leads to some risk aversion worldwide and, therefore, a flight of capital from risky assets toward safer ones, the dollar and US treasury bonds in particular. This is especially true this time as the US interest rates were already attractive before last week’s events.

The flight of capital is usually bearish for commodities futures as investors sell their positions in volatile assets. However, it also tends to be a short-term factor, as fundamentals prevail in the long run.

A strong dollar is also usually bearish for commodities prices. That’s because it makes US exports more expensive, and a lot of the main ag exchanges are based in the country. This is especially true in the case of soybeans, which is a more export-oriented market in the US, competing with another export-oriented country, Brazil.

Oil and freights

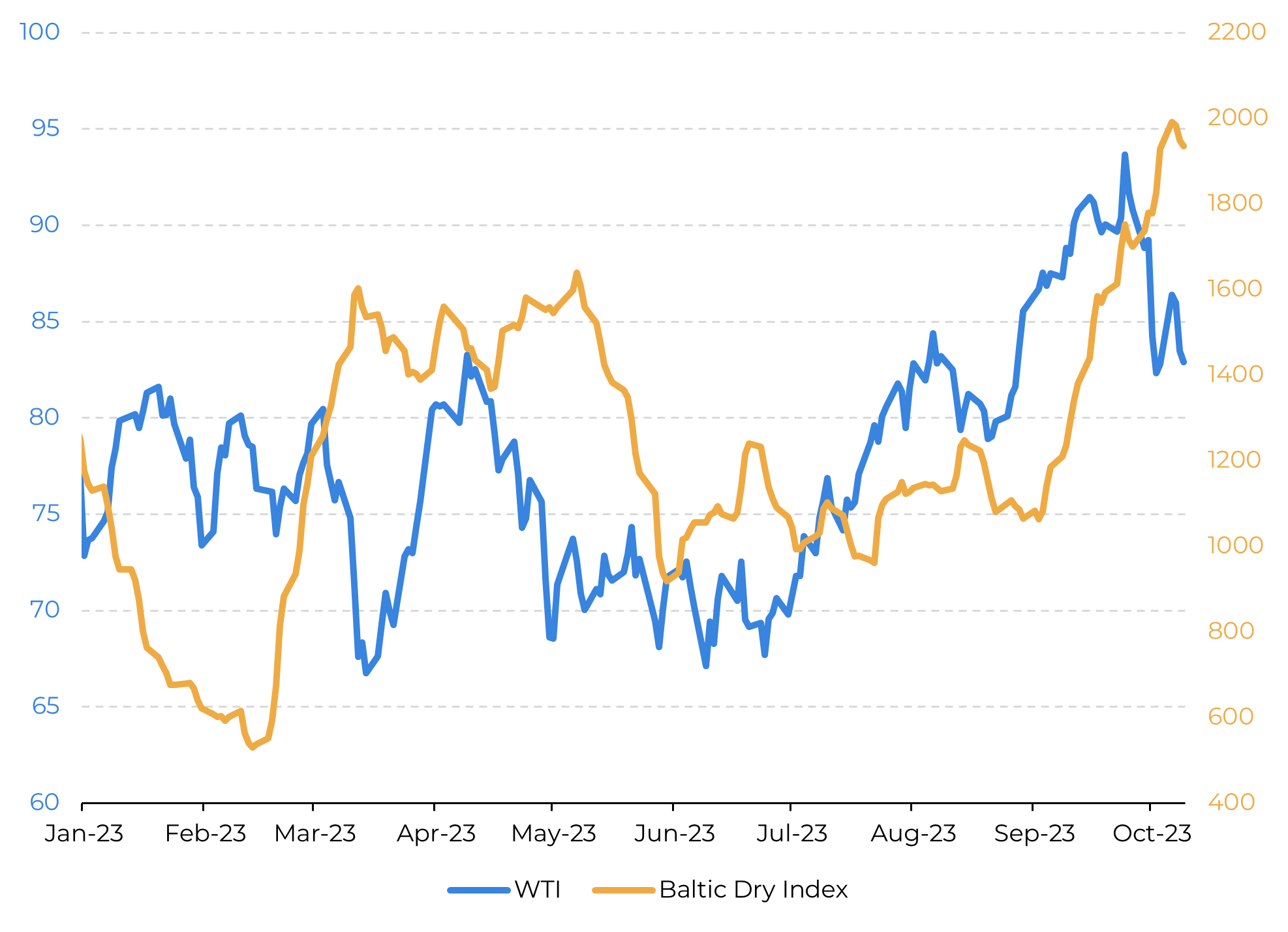

The region is filled with important players in the oil market that have tense relations with Israel. At the same time, it is close to one of the main channels through which goods flow around the world, the Suez Canal. On top of all of that, this will be the second ongoing conflict in the same corner of the world, which may increase the risk premium built into freight prices in the area.

The bottom line is that it will all depend greatly on if and how neighboring countries respond to the conflict and its consequences.

The number of possibilities of how this could unfold is too many to count, and all speculative. Without getting too much into these other markets (see our energy report for that) and geopolitics, we tend to see mostly support for these two variables - oil and freight prices. The first could be bullish for ag commodities prices, while the second may pressure prices at the origins. It must be said, however, that routes from the Americas to Asia are not likely to see too much change unless the conflict scales much worse levels.

The bottom line is that it will all depend greatly on if and how neighboring countries respond to the conflict and its consequences.

The (usually) inverse correlation between commodities and the dollar

Source: hEDGEpoint, Refinitiv

Recent WTI Oil Prices (USD/bbl) and Baltic Dry Freight Index (USD/NU)

Source: hEDGEpoint, Refinitiv

Fundamentals

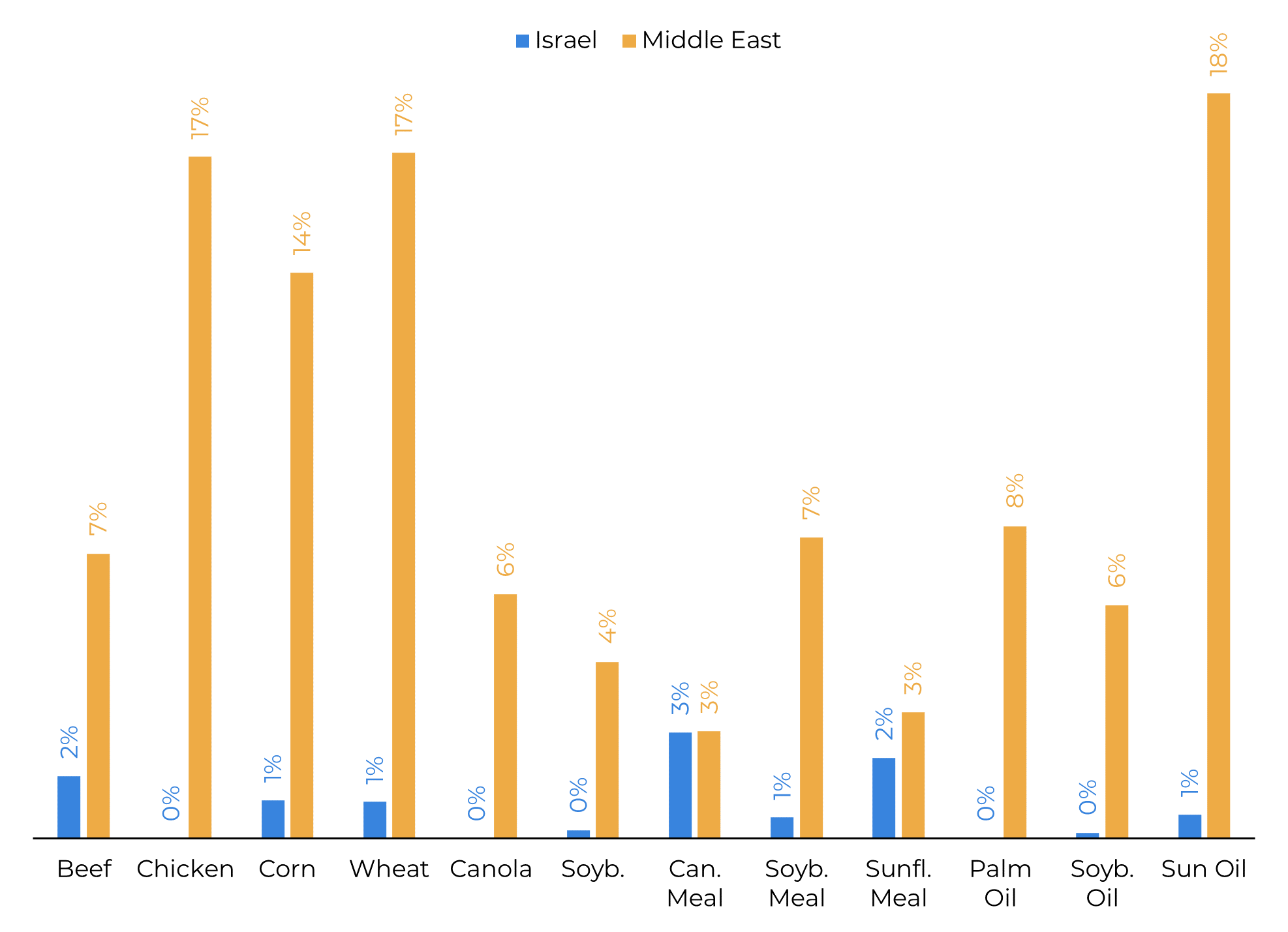

Looking at the commodities covered by the USDA, Israel only figures among the top 10 importers of canola meal, canola oil, and sunflower meal. Even then, with less than 3% of world imports in each. A small role, though not unexpected given the country’s area and population. However, looking merely from this point of view is ignoring the bigger picture.

First, the Middle East as a bloc of countries – as varying as this definition can be - is a major importer of agricultural goods, especially grains and meats. The group represents 14% of the world’s imports of corn, 17% of wheat, 7% of beef, 16% of chicken, and 18% of sunoil. Of these, Egypt, Iran, Iraq, Saudi Arabia, and the UAE hold most of the share.

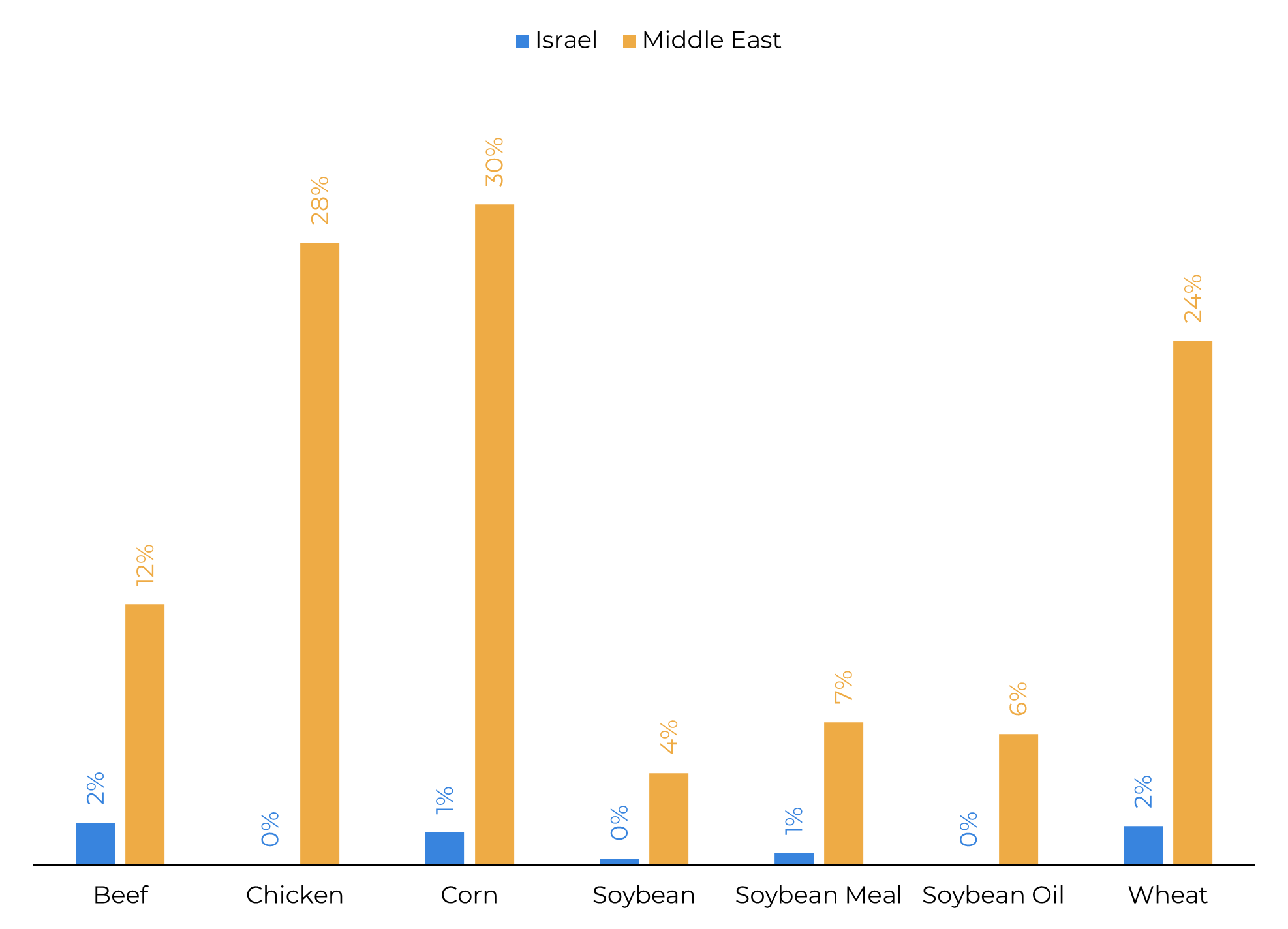

On this matter, we see two possibilities. First, when risk is high, countries tend to stockpile essential goods, food being a common target - Egypt, in particular, may play a key role. Its grain tenders are already market movers and, adding to that, it is the only country other than Israel to share a border with the Gaza Strip. Thus, if it comes to it, Egypt will probably be the channel through which aid (food, medications, and so on...) may enter the area. The increased demand in the short term may lead to higher prices.

The second major fundamental factor to watch is how ag exporters will navigate this geopolitical environment. The US already has a clear alignment with Israel. Others, however, may face a tough diplomatic challenge, in particular Brazil. Almost all of the aforementioned countries figure among the top 10 buyers of Brazilian corn, chicken, and beef. An emblematic case is Iran importing corn almost exclusively from Brazil for many years now.

Finally, Israel is an important supplier of phosphatic fertilizers to the world and has a few relevant production sites. The risks in this case are related to lasting damages to production capacity.

Middle East’s high share of world imports (% of the total)

Source: hEDGEpoint, USDA

Relevance of the Middle East in Brazilian Exports (% of total)

Source: hEDGEpoint, Brazilian Customs

Conclusions

In the end, everything will depend on how much the conflict escalates and, especially, how neighboring countries will respond to it. If it remains restricted to the current areas, it is not likely to have a big effect on the grains market directly, though the impact on the broad financial market and fertilizers may have indirect consequences.

If the conflict takes greater proportions within the region, then the risks are much bigger. There are several important grain and meat buyers in the Middle East, as well as oil producers. Trade flows will definitely see some adjustments, either because of diplomatic issues or because of the direct impacts of the conflict.

Weekly Report — Grains and Oilseeds

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.