Nov 6

/

Pedro Schicchi

Grains, Oilseeds and Livestock Weekly Report - 2023 11 06

Back to main blog page

"RIN prices have been declining over the course of the year, a movement that became more pronounced from July onwards.

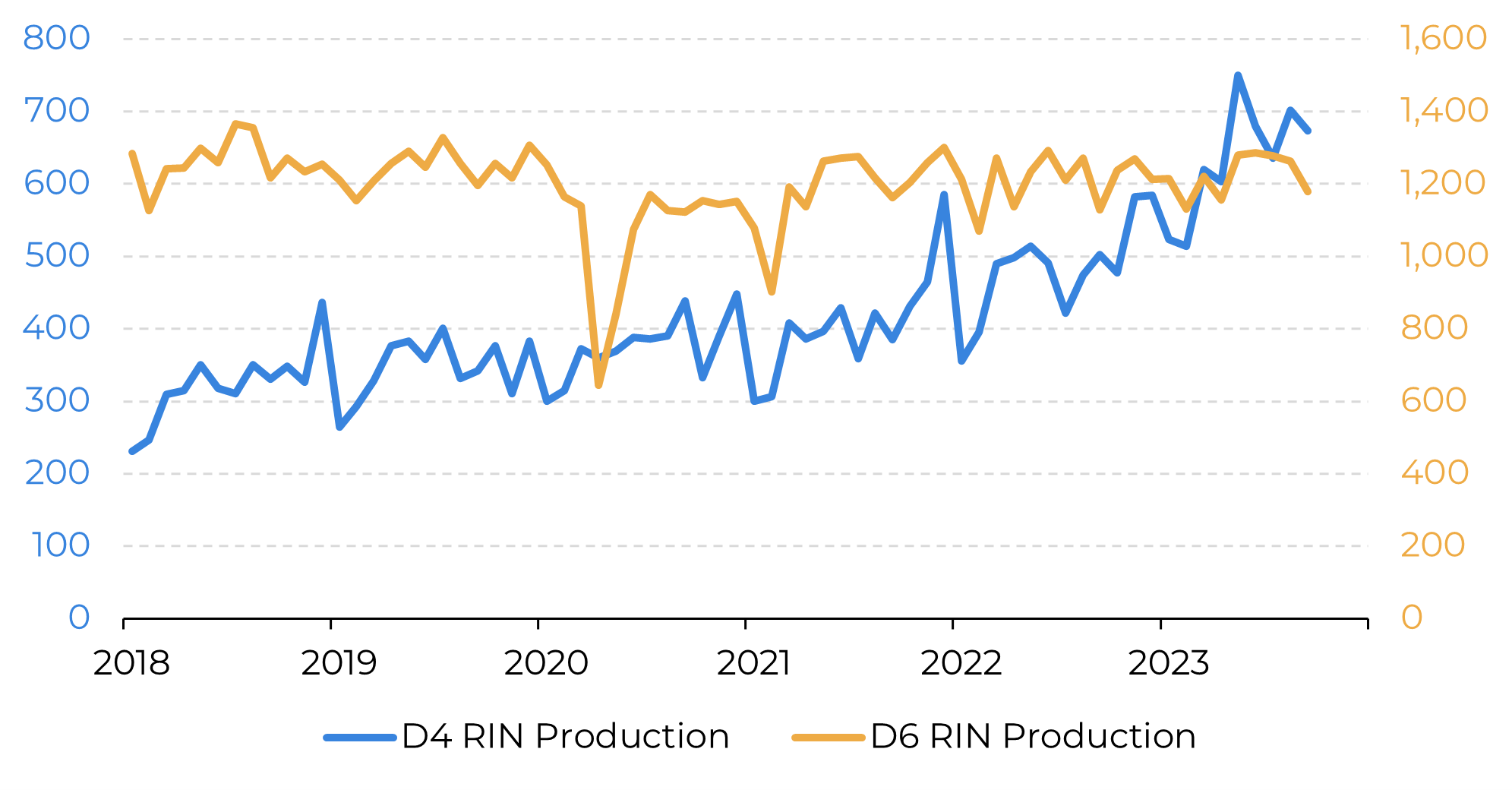

One major reason for this decline is the significant increase in the supply of D4 RINs. A contributing factor is that renewable diesel, included in the D4 category, generates more RINs per gallon, adding to the supply surge.

Improved profit margins for blenders can increase purchases in the short term, but their influence may be limited, as the total demand is bounded by finished fuel consumption in the country.

Additionally, the D4 RIN surplus can potentially diminish demand for ethanol (D6) since RFS allows them to be used interchangeably."

Unpacking the Decline: Factors Influencing RIN Prices and Production

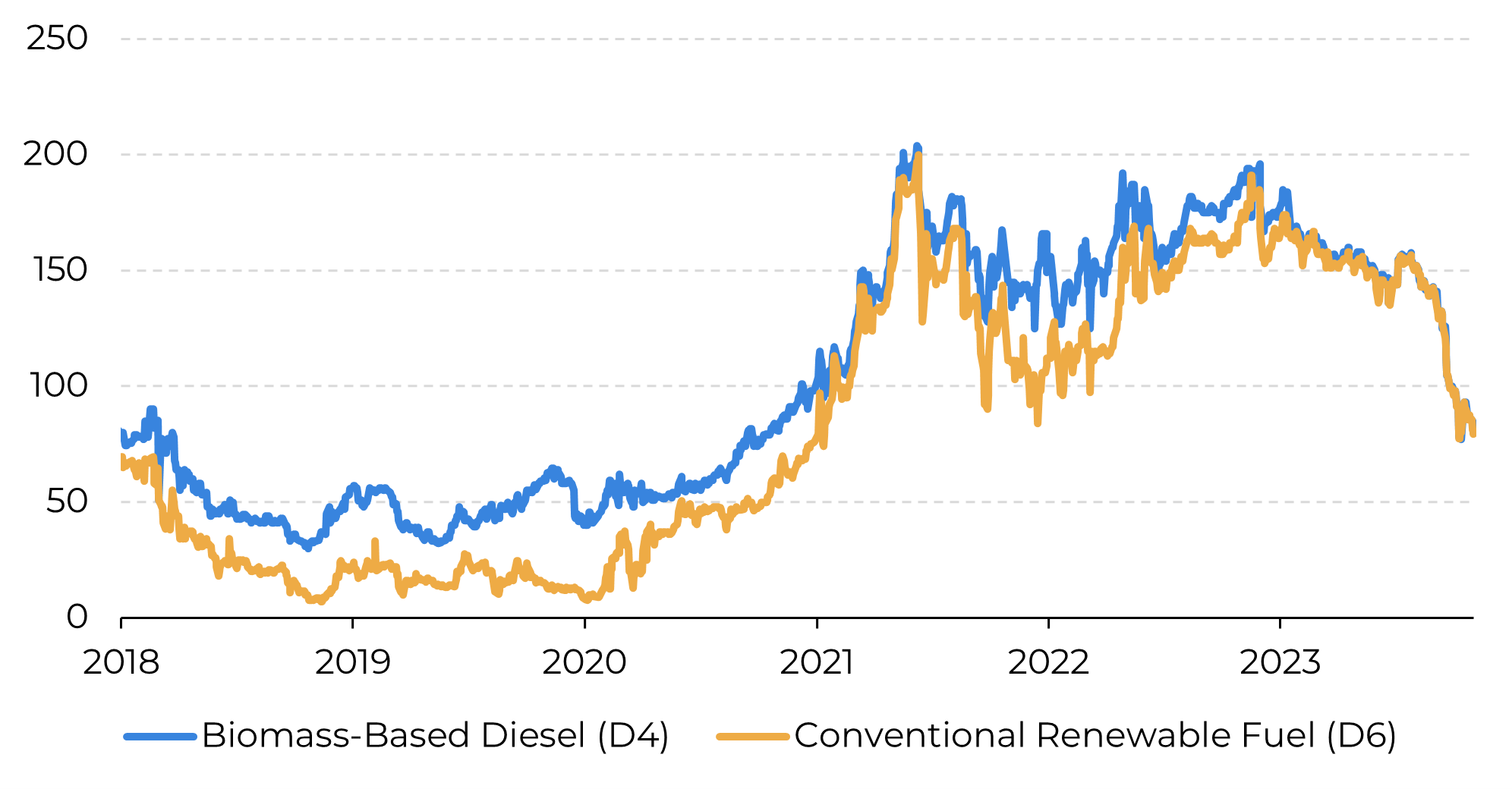

RIN (Renewable Identification Number) prices, although still relatively expensive when compared to the four-year historical average, have been on a decline since the beginning of the year, particularly accelerating after July.

What's driving this shift?

In addition to the outright drop in prices, another noteworthy factor is the narrowing gap between biomass-based diesel (D4) and conventional (D6) RINs. One of the reasons behind both of these developments is the surge in the supply of D4 RINs. This category encompasses both biodiesel and the rapidly expanding renewable diesel, both of which rely on soybean oil as their primary feedstock in the United States.

As more renewable diesel plants come online, there's a greater incentive to keep them running to justify the recently invested capital. Moreover, renewable diesel, owing to its higher carbon reduction compared to other biofuels, generates more RINs per gallon of biofuel. These factors, taken together, have led to a substantial increase in D4 supplies.

US RIN Prices fall on increased supplies (USD/RIN)

Source: Bloomberg, EPA

US D4 RIN production surges due to the renewable diesel (Millions of RINs)

Source: Bloomberg, EPA

Now, let's delve into the feedstock situation: soybean oil

US soybean oil was relatively expensive compared to other vegetable oils worldwide, primarily due to the tight balance in the US soybean market and some uncertainty surrounding crop numbers. The costly US soybean oil opened up an import opportunity, resulting in increased net purchase of biofuels by the country, further increasing RIN supplies.

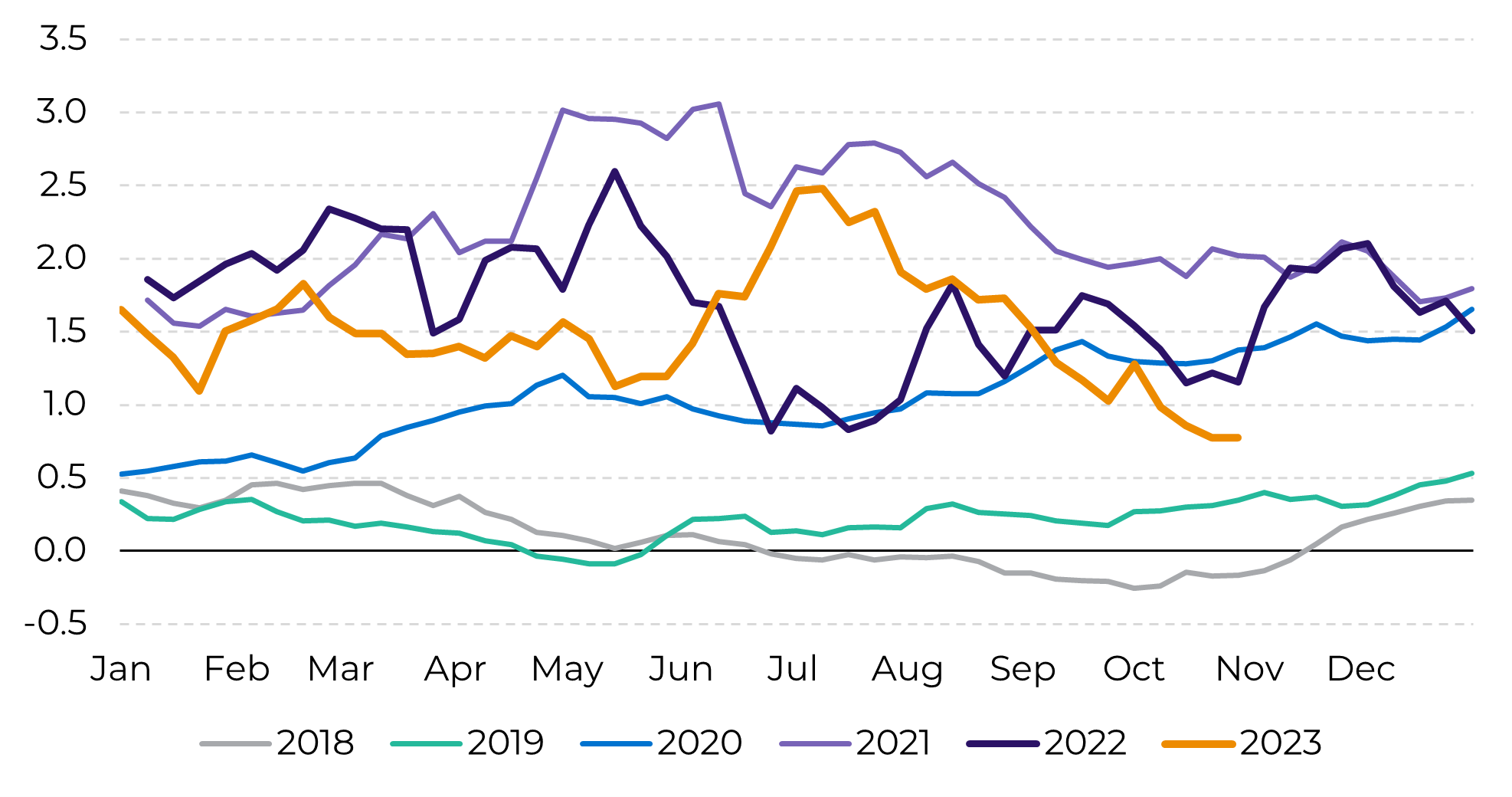

However, as the harvest progressed and some of the risk premium diminished, the price differential with other feedstocks started to narrow. Simultaneously, bullish oil fundamentals lent support to heating oil. The result was a more attractive margin for blenders, as shown by the lower bean oil-heating oil (BO-HO) spread, incentivizing short-term biofuel demand.

Nevertheless, it's important to note that the US soybean OIL market remains tight, and the commodity will likely maintain a premium over other oils, such as palm, given the more comfortable supply situation for the latter.

Nevertheless, it's important to note that the US soybean OIL market remains tight, and the commodity will likely maintain a premium over other oils, such as palm, given the more comfortable supply situation for the latter.

What lies ahead?

The issue is that, even though blenders are enjoying improved profit margins, their overall impact on demand may be limited. The consumption of biofuels in the US is bounded by the demand for finished fuels, namely diesel (in the case of D4) and motor gasoline (in the case of D6).

As a result, unless the actual consumption of these products changes, any increase in biofuel/RIN purchases by blenders due to better margins only means they will have less appetite later, as a greater portion of their annual target will already be fulfilled. Since some RINs can be carried over from one year to the next, a potential surplus of RINs produced in 2023 could also “eat” into the demand for 2024.

As a result, unless the actual consumption of these products changes, any increase in biofuel/RIN purchases by blenders due to better margins only means they will have less appetite later, as a greater portion of their annual target will already be fulfilled. Since some RINs can be carried over from one year to the next, a potential surplus of RINs produced in 2023 could also “eat” into the demand for 2024.

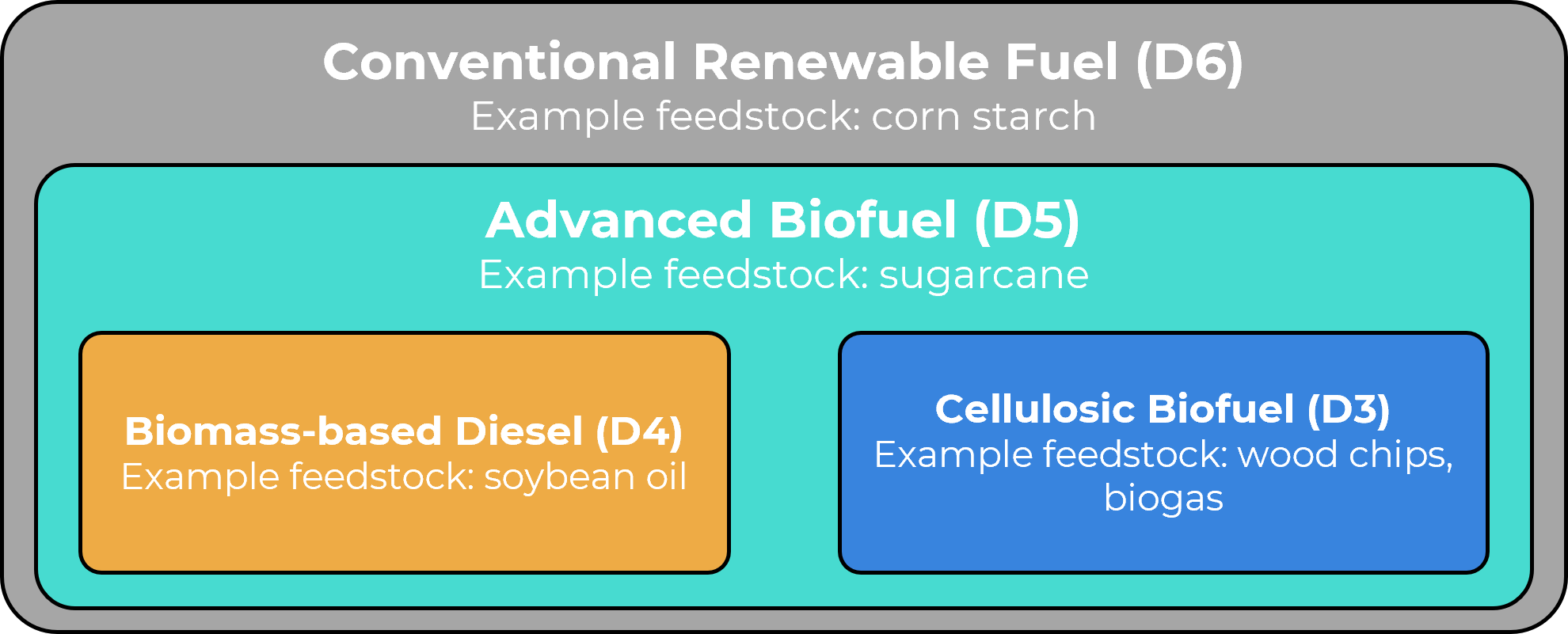

For ethanol (D6), there’s another issue. Since D4 RINs have a higher carbon-reducing score, the Renewable Fuel Standard (RFS) allows them to be used to meet a company’s D6 obligation. With the spread between these two categories nearly non-existent, the surplus of D4 RINs may also diminish some of the demand for ethanol.

In summary, the current oversupply of D4 RINs is already putting downward pressure on prices and may discourage sustained high production rates in the sector in the mid-run.

BO-HO Spread is reducing, improving margins for blenders (USD/gal)

Source: CME, NYMEX

In the RFS nesting scheme D4 can be used to meet D6 volume obligation

Source: EPA

Weekly Report — Grains and Oilseeds

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.