Nov 22

/

Pedro Schicchi

Grains, Oilseeds and Livestock Weekly Report - 2023 11 22

Back to main blog page

"Unfavorable weather conditions in Brazil, including scarce rainfall and high temperatures, are affecting the soybean crop, prompting concerns about production.

Chicago soybean prices are unusually responsive to the Brazilian crop situation, with export premiums typically shouldering this role. The reason is a tight soybean balance in the US, coupled with potential lower Brazilian production.

Brazilian farmers, already hesitant to sell, are doubling down on their stance due to increased concerns and the possibility of higher prices. Slow sales are being reported, leading to a strong local cash market and a simultaneous rise in both futures and premiums.

Despite some improvements in short-term weather forecasts, challenges persist, with the El Niño pattern expected to endure until early 2024."

Navigating the (lack of) Storm: Impacts of Brazilian Weather

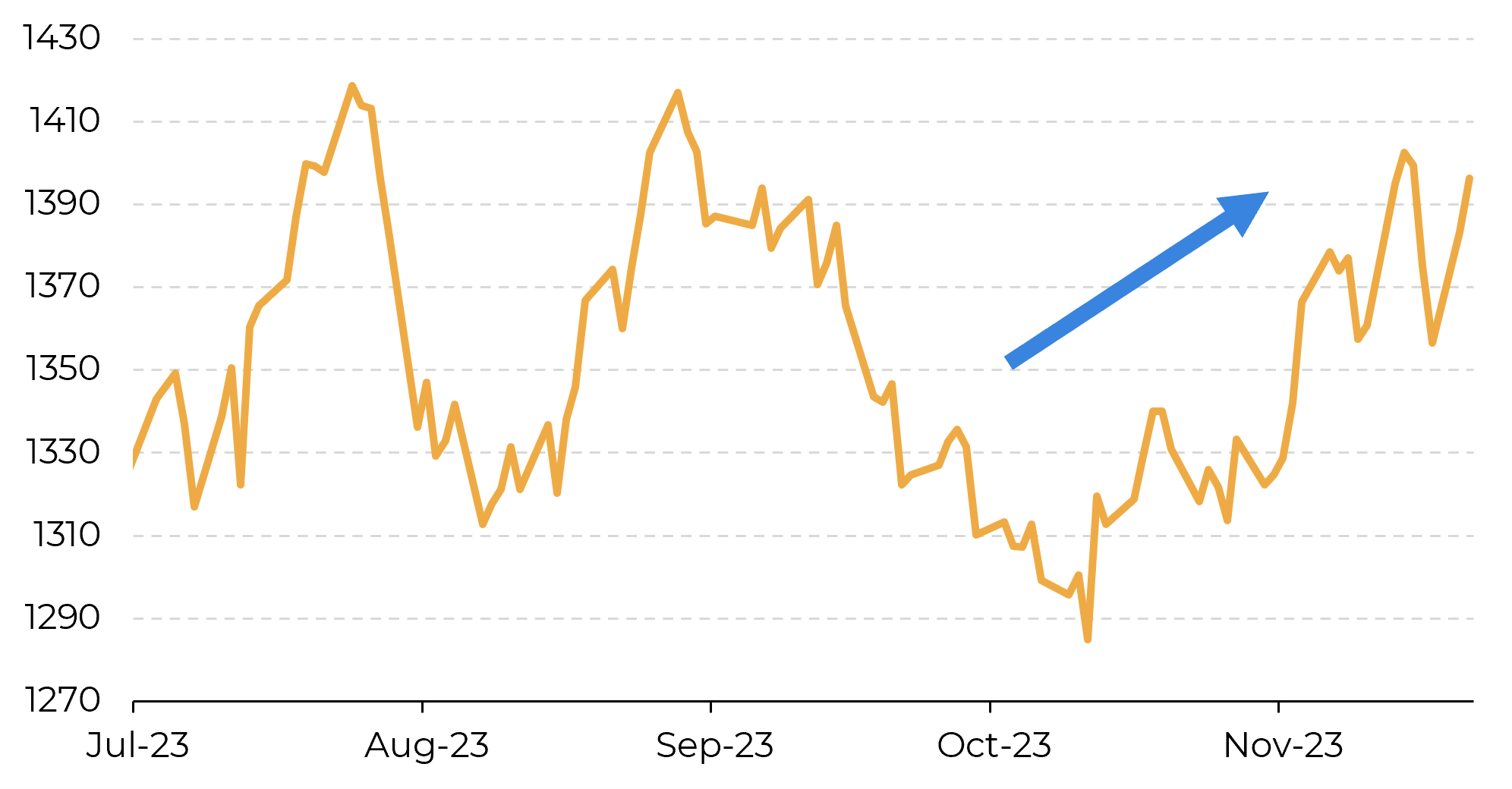

Chicago soybean prices have gained support due to concerns over the crop in Brazil

Although the troubling weather pattern is not a recent development – we've been discussing it for the past couple of months (refer to the reports on Sep 22 and Oct 24) – it only became a focal point after mid-October. This shift in attention happened when the debate over US production started to settle, prompting the market to turn its focus to the Brazilian crop.

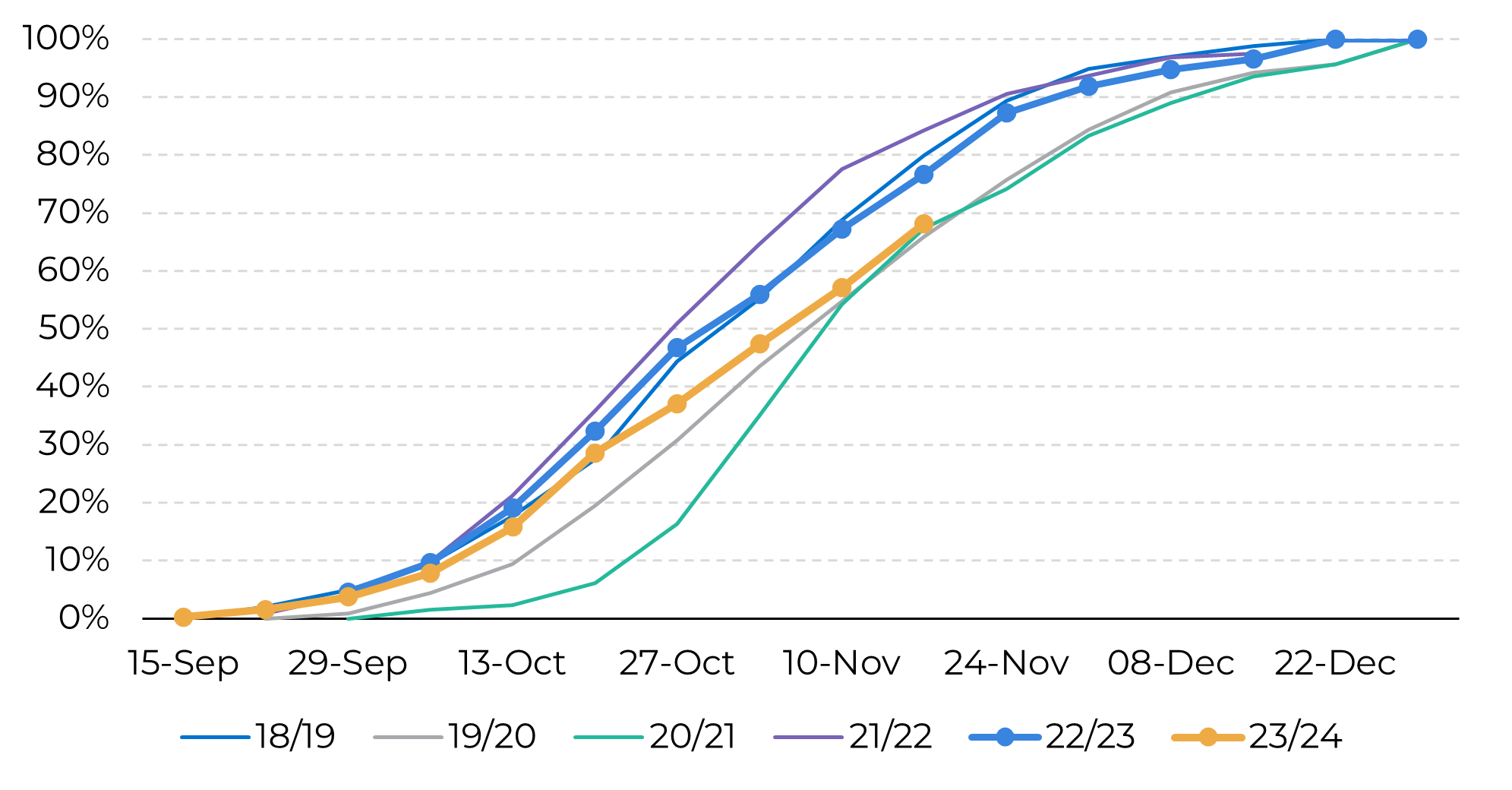

The planting season, which began on a promising note, has slowed down significantly since then due to the observed weather conditions. While precipitation tends to grab the spotlight in discussions about weather and crops, it's crucial to note that temperature also plays a significant role.

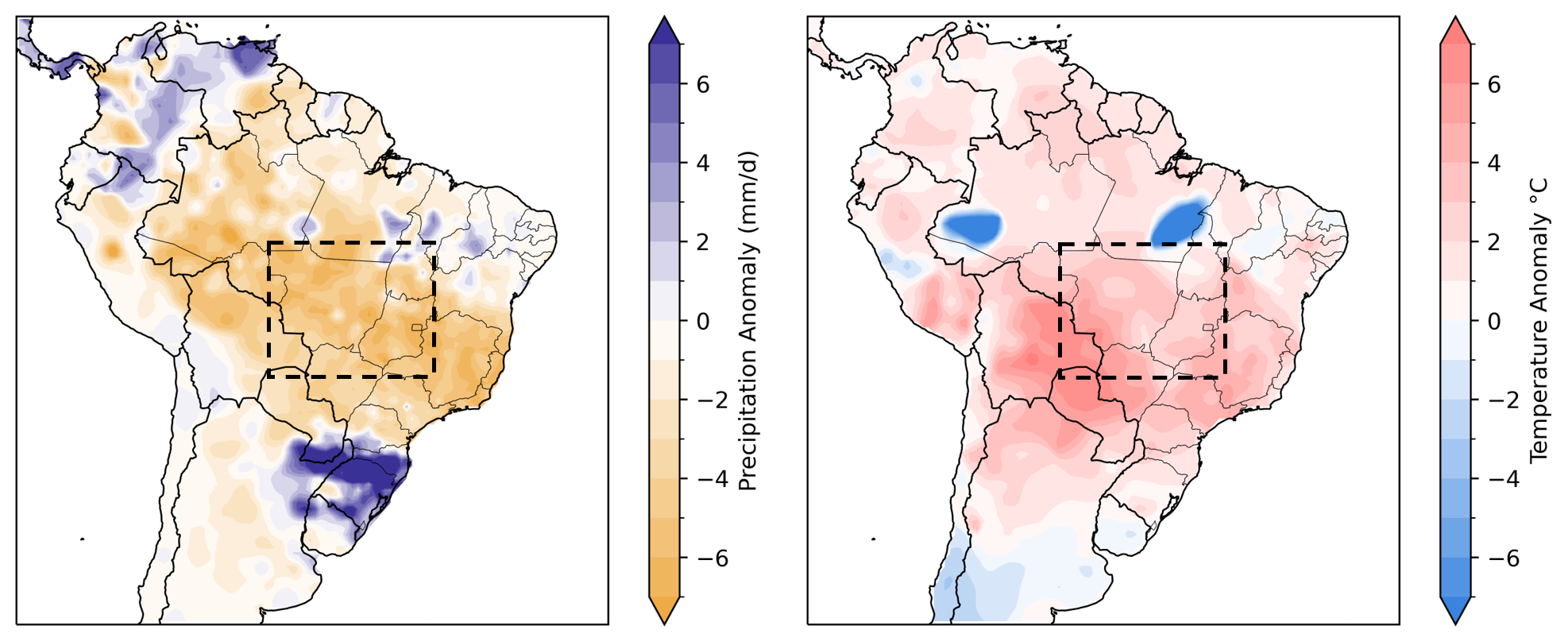

This season not only has rainfall been scarce, but temperatures have also been unusually high, exacerbating the issue.

CBOT Soybean March-24 Delivery (USDc/bu)

Source: CME

Brazil Soybean Planting (%)

Source: Safras

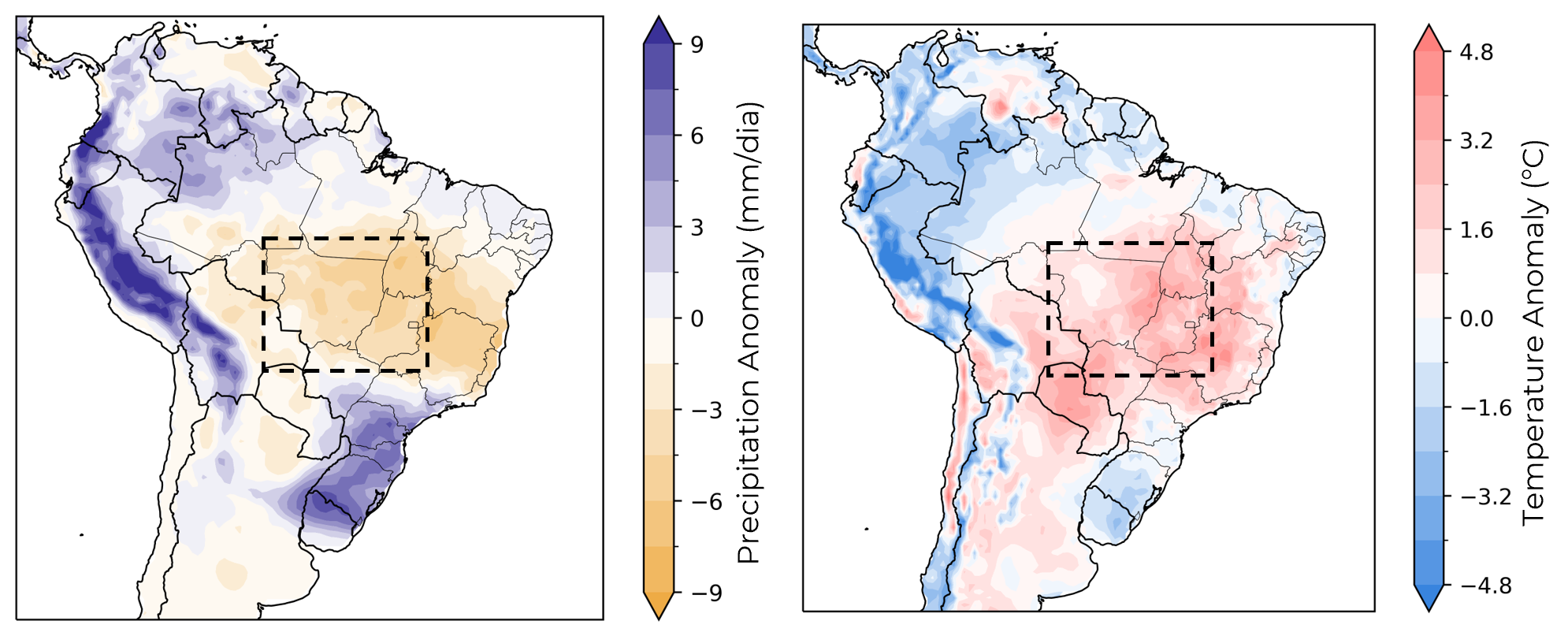

In the short term, forecasts are not encouraging, but they are slightly better than before

The divide between dry and wet areas has shifted northward, from the middle of Paraná in last week's reports to the middle of Mato Grosso do Sul in the latest ones. This is good news, especially considering that there are approximately 32 million tons of production between these two states.

However, it's crucial to temper our expectations. The situation in Mato Grosso and Goiás still involves below-normal precipitation and above-average temperatures, although to a lesser extent than in previous model runs. These two states together are expected to produce more than 60 million tons.

The optimistic viewpoint is that there's still time. Just as "beans are made in August" in the US, Brazil's soybean crop is defined between December and January.

So, there's still an opportunity for recovery, even though some damage is likely already permanent. The challenge is that the current weather maps indicate an El Niño pattern expected to persist until early 2024, which doesn't inspire much hope.

Precipitation and Temperature Anomaly – Last 30 days (mm/d and °C from normal)

Source: CME, NYMEX

Precipitation and Temperature Anomaly – Next 14 days (mm/d and °C from normal)

Source: EPA

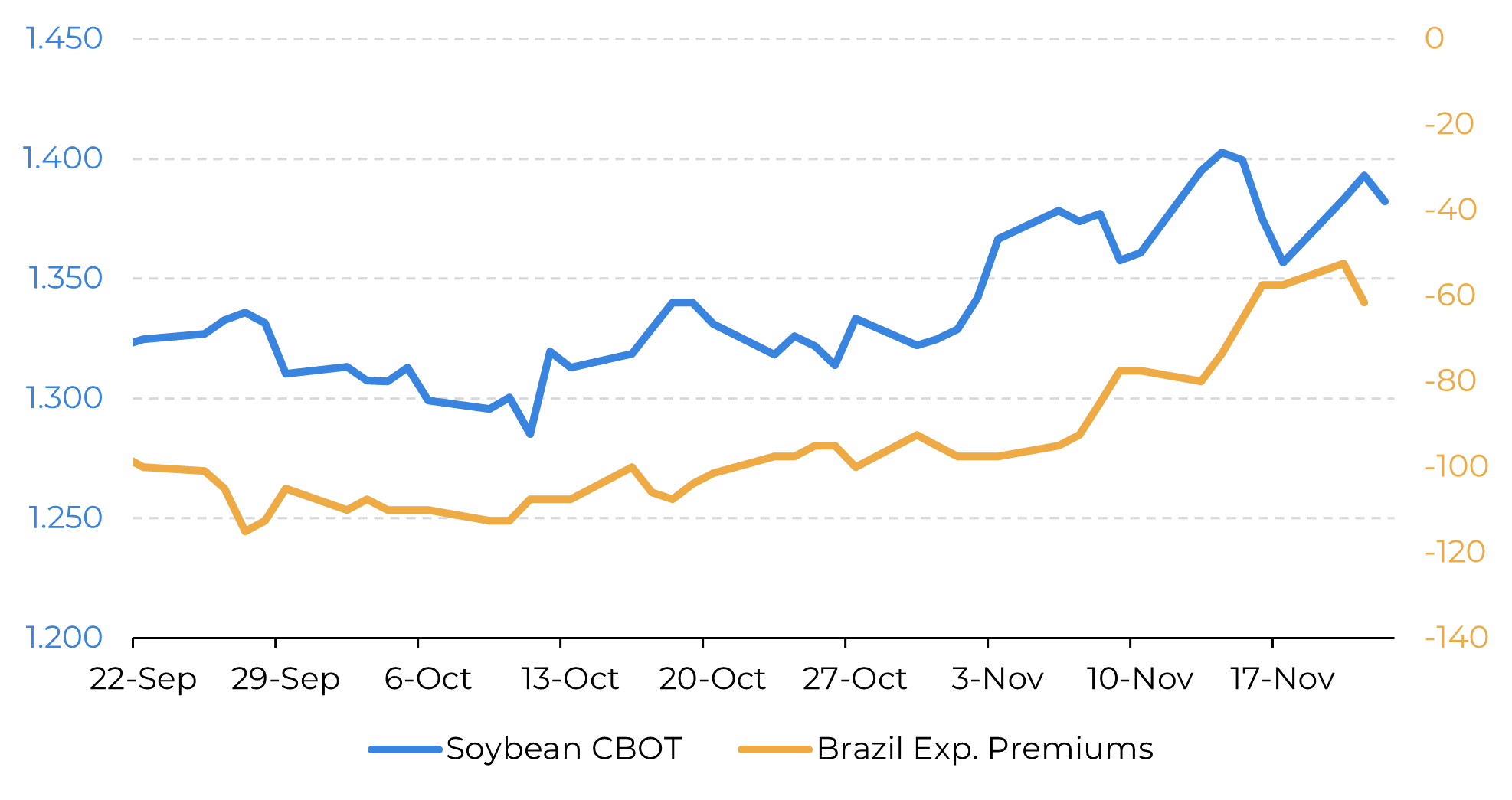

Interestingly, Chicago is responding more strongly to concerns in Brazil than it typically would...

... – usually, export premiums handle this role. However, with a tight soybean balance in the US, the prospect of lower production in Brazil suggests increased foreign demand for the American market, competing with the strong domestic market.

As a result, futures at CBOT have been more sensitive to the weather maps for Brazil, even showing some weakness as better forecasts emerged last week. Nevertheless, for now, the cash market in Brazil doesn't seem convinced that the amount and consistency of these rains are enough to bring significant change.

Reports suggest that farmers in Brazil were already hesitant to sell, and with heightened concerns and the possibility of higher prices, they are likely to stand firm on this stance. With slow sales, we anticipate a strong local cash market. This has led to an unusual scenario where futures and premiums are rising simultaneously.

Reports suggest that farmers in Brazil were already hesitant to sell, and with heightened concerns and the possibility of higher prices, they are likely to stand firm on this stance. With slow sales, we anticipate a strong local cash market. This has led to an unusual scenario where futures and premiums are rising simultaneously.

Even though support for premiums is generally expected, it's even more likely when CBOT quickly responds to improved weather forecasts, while the local market remains skeptical, as observed in the previous week.

One final aspect to monitor regarding the premium is that, despite relatively high production cuts, there's still a big chance that output in Brazil will still be substantial.

With low farmer selling and storage capacity deficits, premiums will likely be under pressure at harvest time – perhaps not as much as last year, but still notable.

What to make of all this?

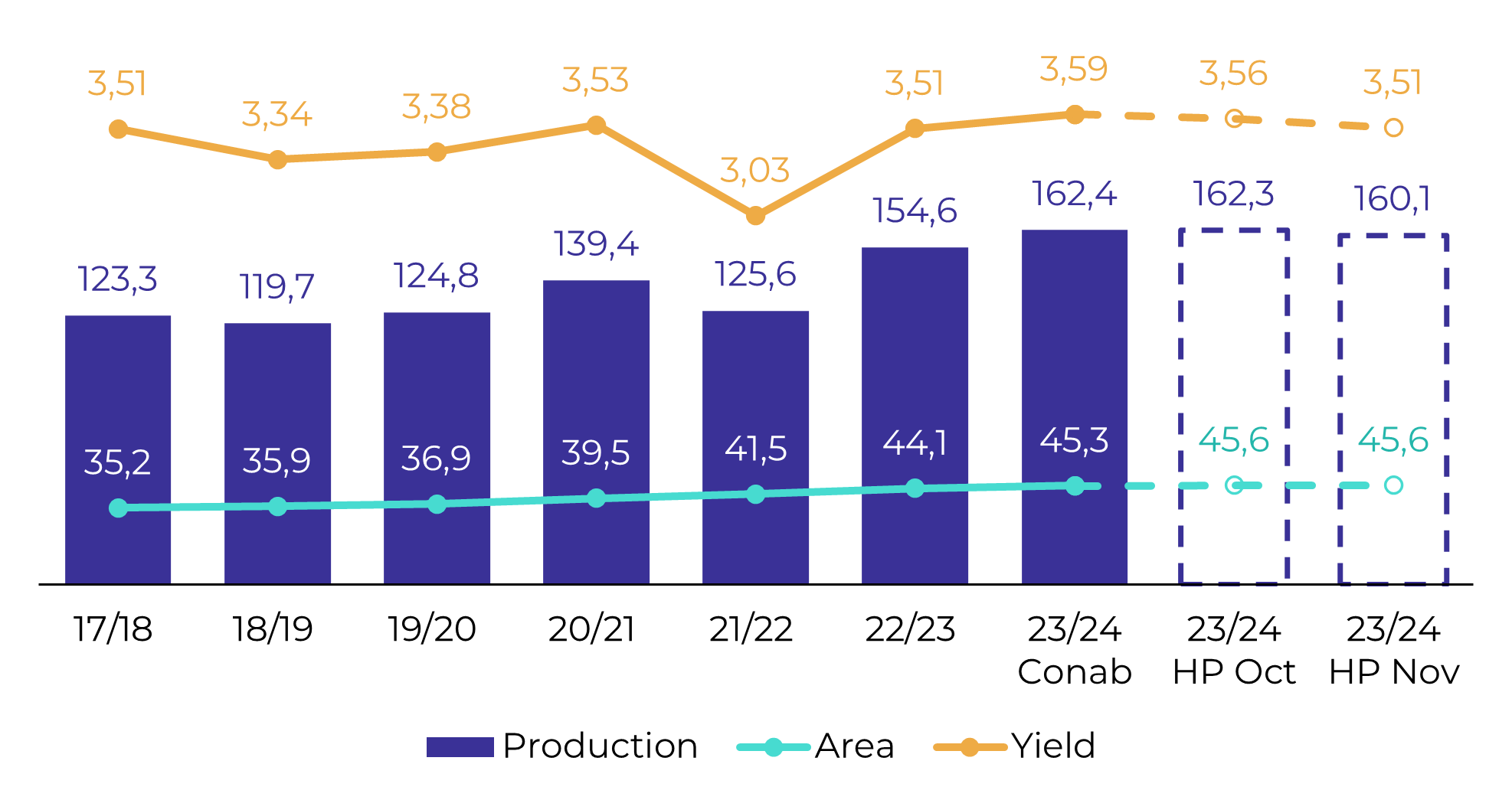

In summary, considering these factors, we estimate Brazilian production at 160 million tons, a slight decrease from the previous estimate of 162 million tons. While there's potential for further cuts if poor weather conditions persist, there's still much uncertainty, and it's challenging to make definitive claims before the crop's reproductive stages in December and January.

Despite improved rainfall forecasts, the local cash market does not appear to be buying it. CBOT prices are more volatile and respond faster to new model runs, premiums, however, may continue to find support on low sales.

Soybean Prices for Mar-24 – CBOT and Brazil export Premiums (USDc/bu)

Source: CME, NYMEX

Brazil Soybean – Area, Yield and Production (M ha, ton/ha, M ton)

Source: EPA

Weekly Report — Grains and Oilseeds

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.