Dec 18

/

Pedro Schicchi

Grains, Oilseeds and Livestock Weekly Report - 2023 12 18

Back to main blog page

CBOT prices closed stable/lower last week, indicating nuanced market trends.

Soybean futures saw initial gains on Monday due to concerns over Brazil, but retraced throughout the week, while corn remains short on significant fundamental shifts.

Bullish developments on Friday included the Biden administration's announcement supporting ethanol-based SAF for tax, and NOPA reporting higher-than-expected crushed soybeans.

Looking ahead, potential short-term rallies in soybean and corn prices may occur due to weather sensitivity in Brazilian soybean crops and speculative factors. However, a broader outlook leans towards bearish sentiments with expectations of good production in South America and a comfortable U.S. corn balance.

CBOT Recap: Weekly Shifts in Soybeans and Corn

Introduction

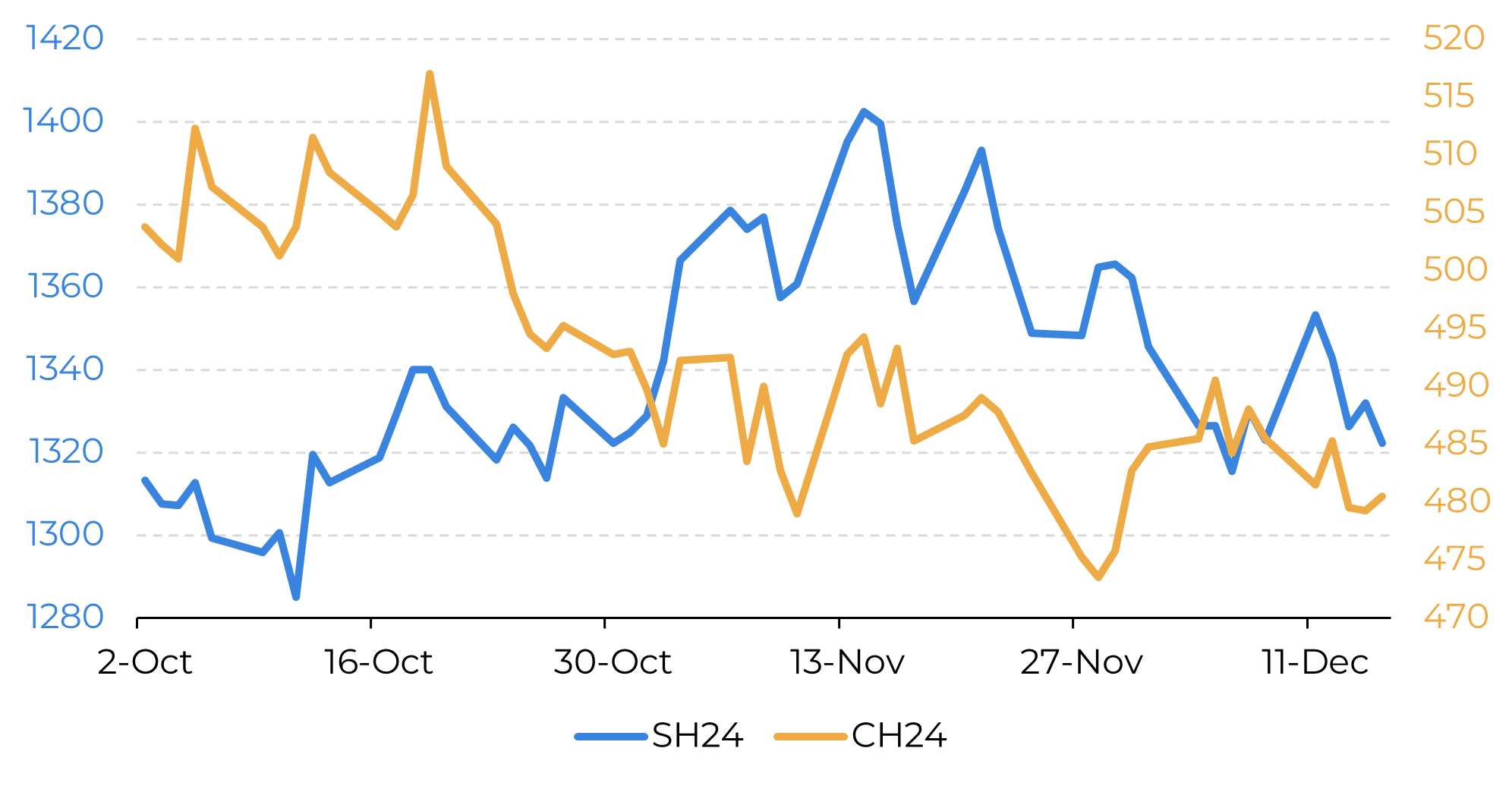

Corn at CBOT ended last week at lower prices, while soybeans edged slightly up. However, focusing solely on the start and end points fails to capture the complete picture. Soybeans futures, for example, had a very bullish day on Monday (11) due to increased concerns over Brazil but relinquished those gains over the week as concerns diminished.

Corn has been walking sideways for quite some time, lacking shifts from the already-known fundamentals.

Still, Friday (15) brought bullish news for both. For corn, Biden’s administration announced that it would enable ethanol-based SAF to qualify for tax credits, provided a certain methodology is followed. The specifics of the methodology will still be updated until March 1, but it has been seen as a win for the corn lobby.

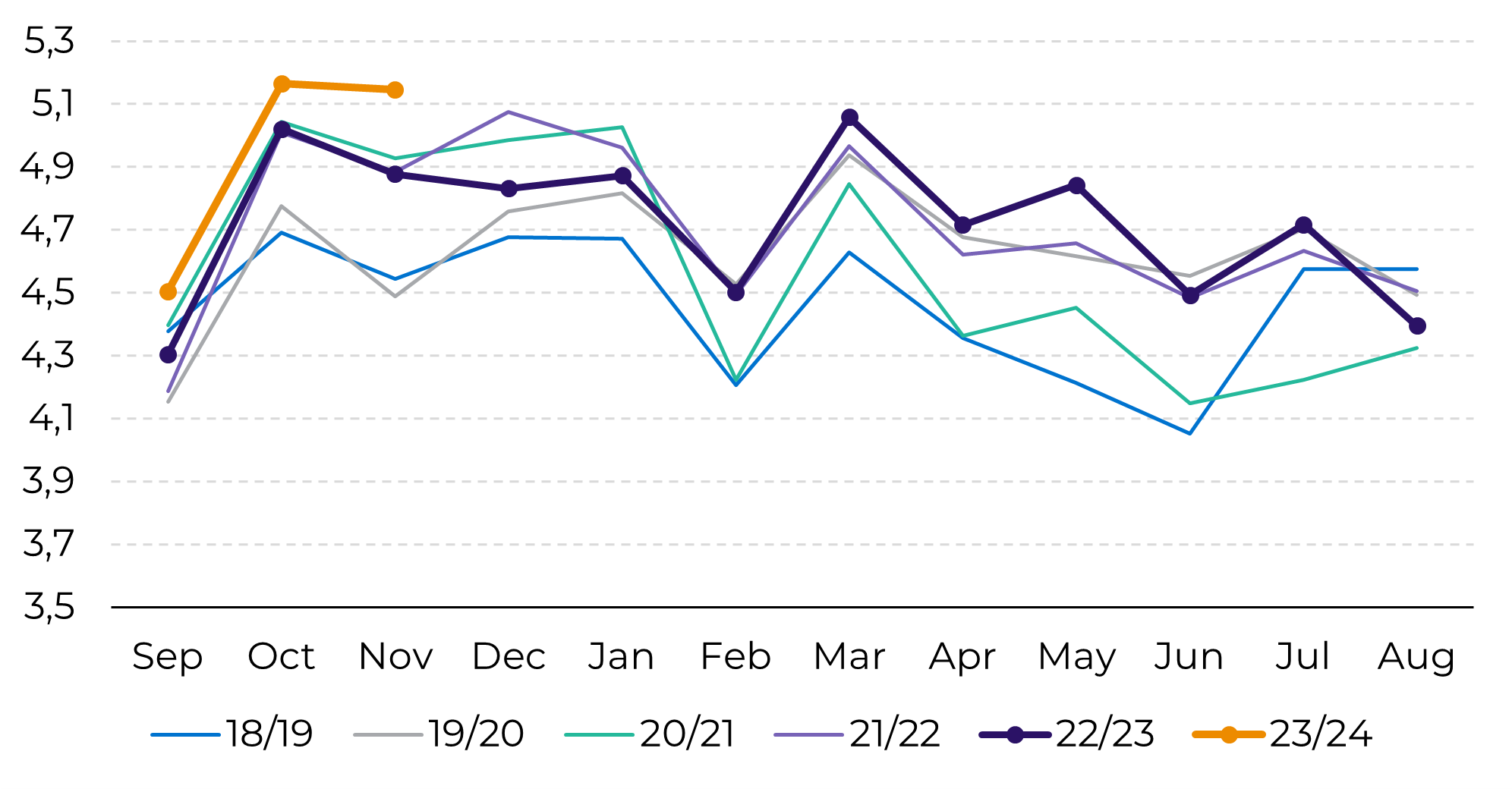

Meanwhile, NOPA reported the US crushed soybeans above the market’s expected range, providing some support during the last trading hours of the week.

Fig. 1: CBOT Corn and Soybean Futures – March-24 Delivery (USDc/bu)

Source: Refinitiv

Fig. 2: US Soybean – Crush (M ton)

Source: NOPA

Looking ahead, there are a few factors to keep on the radar

Since we are now in the middle of December, soybean crops in Brazil are entering the reproductive stages of development and will be the most sensitive to weather over the next 4 weeks.

At the same time, with the improved weather since the middle of December, Chicago soybean futures are not pricing as much risk as before. This combination may create the opportunity for rallies in the short term – especially if the weather forecasts turn suddenly drier for a couple of days.

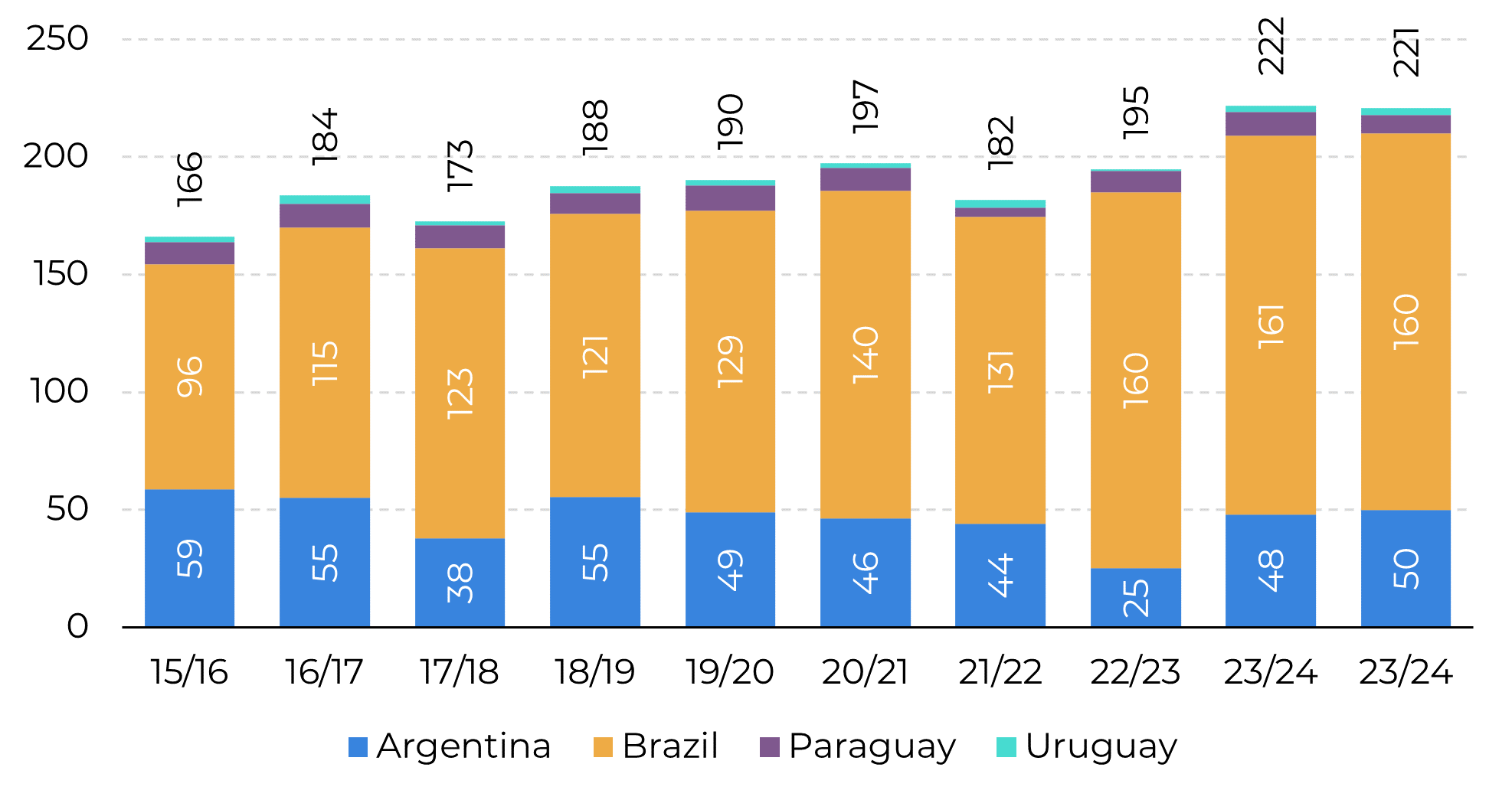

However, given the current weather conditions and NDVI, we still believe Brazil should produce a plentiful crop, at 160M ton – smaller than initially expected, but still large. As such, in the mid-to-long term, we lean still towards the bearish side.

Similarly, on corn, we think that the comfortable US balance should keep a lid on prices. However, in the short term, there could be plenty of reasons for prices to rally.

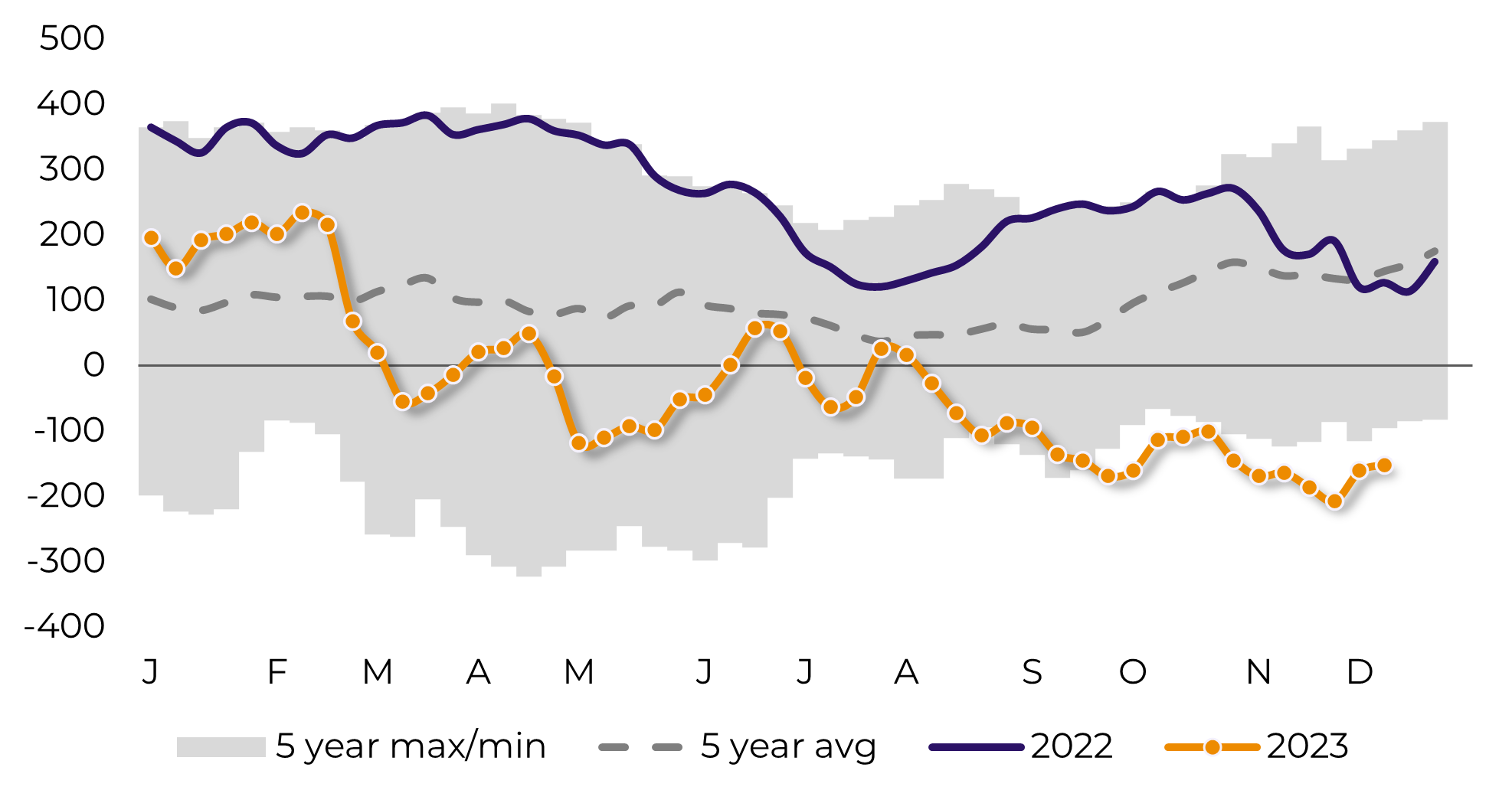

Spec funds (money managers) are way too short on the corn market, and this tends to make them more sensitive to bullish news. The increasing concerns over Brazil’s winter crop (loss of planting window, lower margins...), as well as a possible interest rate cut, could lead to a reaction from the speculators.

Fig. 3: South America Soybean – Production (M ton)

Source: CME, NYMEX

Fig. 4: CBOT Corn – Money Managers Net Position (‘000 lots)

Source: EPA

Conclusions

We believe in good production out of South America in 23/24 and, therefore, in lower prices in general. Still, a combination of market factors could add some support to both corn and soybean prices in the short term.

Weekly Report — Grains and Oilseeds

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.