Jan 9

/

Alef Dias

Grains, Oilseeds and Livestock Weekly Report - 2024 01 09

Back to main blog page

Wheat: American crop kicks off the year with bearish indicators

•The USDA's monthly report on winter wheat crop conditions in certain states indicated that, overall, conditions are better compared to the previous year, highlighting a notable improvement in hard red winter wheat (HRW) producing regions.

•However, the risk of winterkill for this crop remains relevant and deserves to be monitored closely.

•At this point, the scenario of a larger winter crop remains for the US. Improving conditions increase the chance of higher yields and less abandonment of area.

•As a result, the American crop continues to bring bearish fundamentals to wheat markets, and the improved conditions in Kansas indicate that the Kansas vs. Chicago spread should remain around the average.

•However, the risk of winterkill for this crop remains relevant and deserves to be monitored closely.

•At this point, the scenario of a larger winter crop remains for the US. Improving conditions increase the chance of higher yields and less abandonment of area.

•As a result, the American crop continues to bring bearish fundamentals to wheat markets, and the improved conditions in Kansas indicate that the Kansas vs. Chicago spread should remain around the average.

Introduction

It's been a few years since the US has had a really good winter wheat crop, but the 24/25 harvest started with hopes that this year should be different. And the data released last week by the USDA continued to point in that direction.

Report shows good conditions, especially for HRW

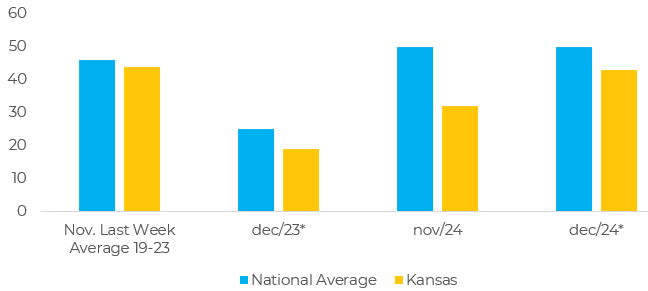

The USDA released its latest winter wheat crop ratings for the season on November 27, reporting that 50% of the US crop was in good to excellent condition, the highest for this time of the year in four seasons.

During the winter, the USDA's National Agricultural Statistics Service releases monthly reports for some states. The government resumes weekly reports on the progress of the US crop in April.

In its monthly crop report, the USDA showed that winter wheat condition ratings improved in December in Kansas, the largest winter wheat producer in the US, as drought eased in much of the southern plains, although ratings fell in other states, including Montana and Colorado.

The USDA rated 43% of the Kansas winter wheat crop in good to excellent condition on December 31, up from 32% at the end of November. Wheat ratings also improved in December in Oklahoma, Texas and South Dakota.

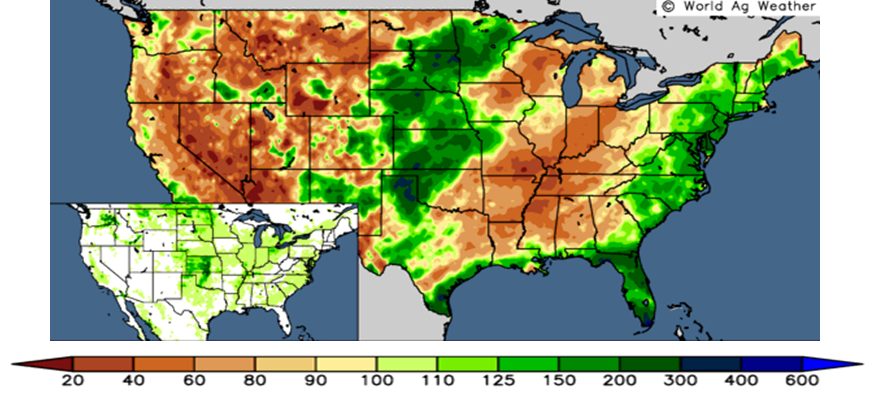

The improved conditions reflected a major precipitation event that drenched Kansas from December 13 to 15. Temperatures in the 30 degree (F) range meant freezing rain at times, especially early in the storm, which also included snow, the Kansas State University agronomy department said in an update in late December.

Nationally, 30% of the winter wheat crop was in a drought-stricken area as of December 26, the USDA reported last week, down from 32% a week earlier and a significant drop from 69% a year earlier. Farmers in the Plains states grow hard red winter wheat (HRW), the largest class of wheat in the US, which is milled to produce flour for bread.

Ratings fell in Illinois, where farmers grow soft red winter wheat (SRW), used to make cookies and snacks. The USDA rated 55% of the Illinois crop as good to excellent by December 31, down from 72% at the end of November.

Fig. 1: Good and Excellent Conditions Winter Wheat (%)

Source: USDA, hEDGEpoint ( *calculated based on states where conditions were reported)

Fig. 2: Rainfall over the last 60 days (% of normal - wheat production shown internally)

Source: WorldAgWeather

Winterkill worries

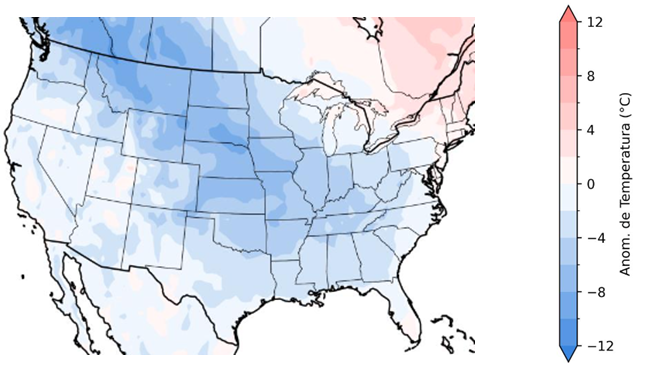

As winter wheat remains dormant for the next few months, temperature and insulating snow cover are the main characteristics to watch out for. In the dormant stage, winter wheat does not normally suffer damage at temperatures down to 0°F, but it becomes vulnerable to damage when temperatures reach and remain below -10°F for a significant period of time (as this can kill the submerged growing point, resulting in winterkill).

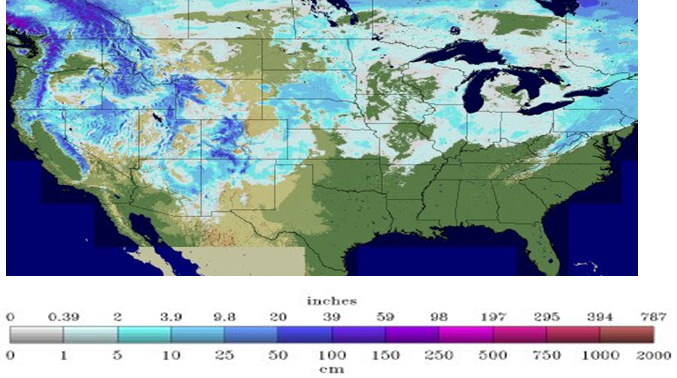

If there is snow cover (over 1 inch or more), these cold temperatures may not be able to penetrate the insulating qualities of the snow. Winterkill is not a common occurrence in US winter wheat production regions, as the combination of extremely low temperatures and little (less than 1 inch) or no snow cover is a rare event.

However, this year many regions have a snow cover that is thinner than usual, increasing the chances of winterkill, while the weather forecasts point to colder weather.

Fig. 3: Snow depth - US

Source: Refinitiv

Fig. 4: Temperature anomaly - Next 15 days (ºC of normal)

Source: NOAA, hEDGEpoint

In summary

The monthly report on winter wheat crop conditions for selected states showed that, overall, conditions remain better than last year, with a considerable improvement in conditions in the HRW producing regions. However, the risk of winterkill for this crop remains relevant and deserves close monitoring.

At this point, the scenario of a larger winter crop remains for the US. Improved conditions increase the chance of higher yields and less abandonment of area, which should compensate for the lower planted area. On this last point, the USDA will provide relevant data this Friday, when it will release - together with WASDE - the first official estimates of planted area for the 24/25 harvest.

As a result, the American harvest continues to bring bearish fundamentals to the wheat markets, and the improved conditions in Kansas indicate that the Kansas vs. Chicago spread should remain around the average.

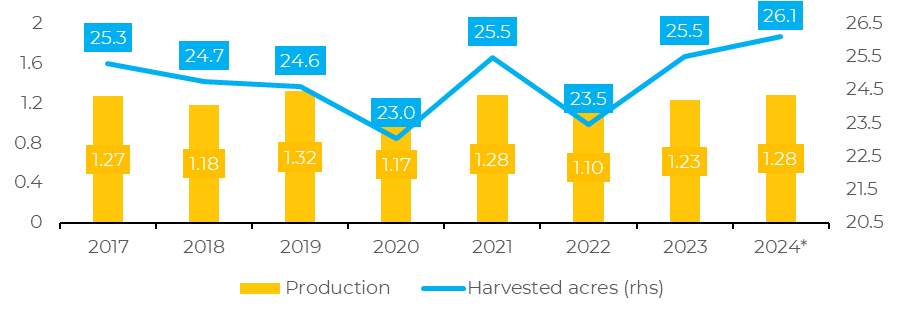

Fig. 5: Winter wheat production and hectares harvested (Bi bu; M ac)

Source: USDA, Refinitiv, hEDGEpoint *Refinitiv's cultivated area forecast

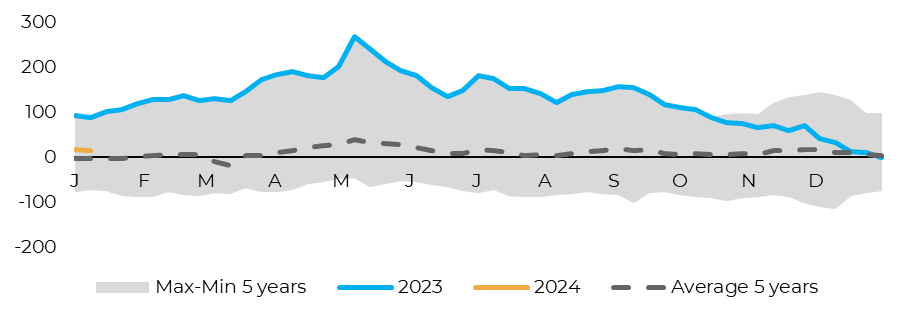

Fig. 6: Kansas vs Chicago wheat spread (USDc/Bu)

Source: Refinitiv

Weekly Report — Grains and Oilseeds

Written by Alef Dias

alef.dias@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.