Jan 30

/

Alef Dias

Grains, Oilseeds and Livestock Weekly Report - 2024 01 30

Back to main blog page

Wheat: Planting and exports grow amid war in Ukraine

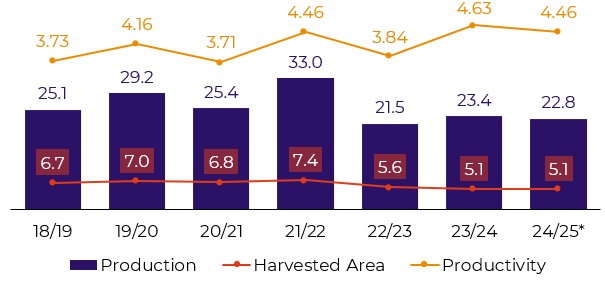

- Looking at various indicators for Ukraine's 24/25 crop, everything points to another harvest of more than 20M mt - a lower level than that seen in the pre-war period, but far from a bad crop or failure. We expect a reduction of only 0.6M mt compared to the previous harvest, which saw record yields.

- Planting data released until the end of November pointed to an increase in the area planted, while soil moisture remains close to the 5-year average. Snow cover has decreased recently, but temperature forecasts point to a low risk of winterkill.

- Ukrainian exports have also somewhat surprised the market. In December, Ukraine shipped 4.8M mt of food, mainly grain, from its Black Sea ports, surpassing the volumes achieved by the UN-promoted grain corridor for the first time. However, the escalation of tensions in the Red Sea could change this scenario.

Introduction

In recent reports, we have seen that, despite some risks, the main producers in the northern hemisphere have generally brought various bearish fundamentals to the wheat futures markets. In this report, we'll look at one more of these cases: Ukraine.

Another +20M mt crop is on the way

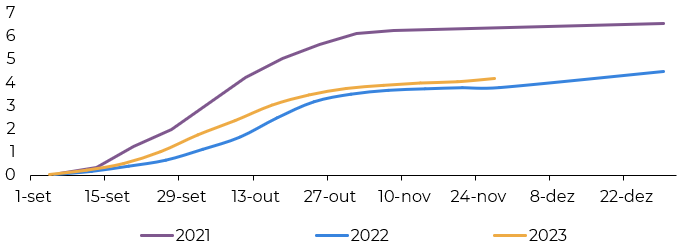

Looking at various indicators for the Ukrainian crop, everything points to another crop of more than 20M mt. Starting with the planted area, the data available so far leads us to believe that Ukrainian producers have planted a larger area in 24/25 compared to 22/23. By the end of November, the pace of planting was higher than in 2022, which was the first planting impacted by the war with Russia.

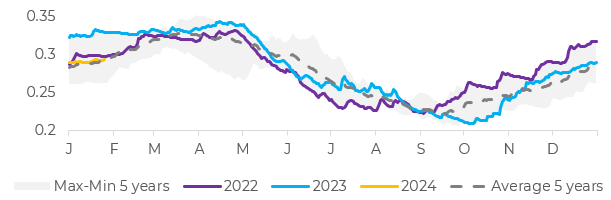

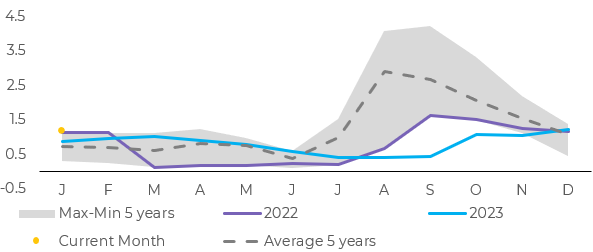

Soil moisture also contributes to this scenario. Although it is below the levels seen in the same period in the last twocrops, it is close to the average of the last five years.

Fig. 1: Planting progress - Ukraine (M ha)

Source: Minagro

Fig. 2: Daily soil moisture in the root zone - Ukraine (% within the top 1 meter

Source: Minagro

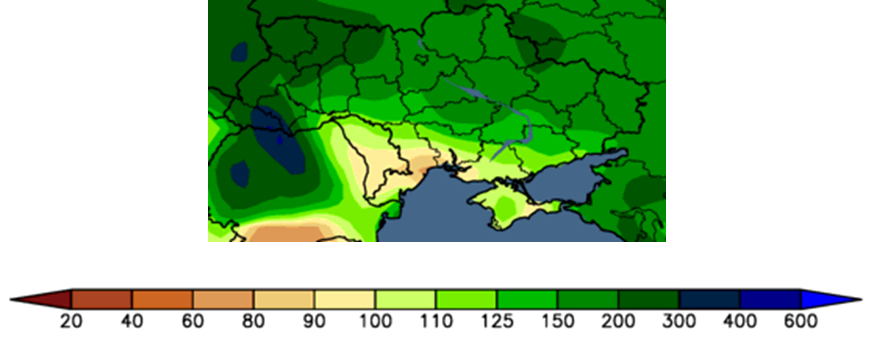

In other words, it's not an excellent scenario like the previous harvest - where Ukraine saw almost perfect weather conditions, leading to a record yield even in a context of war - but it's far from a bad one. And looking at the rainfall forecasts, we can expect this scenario to improve in the coming weeks.

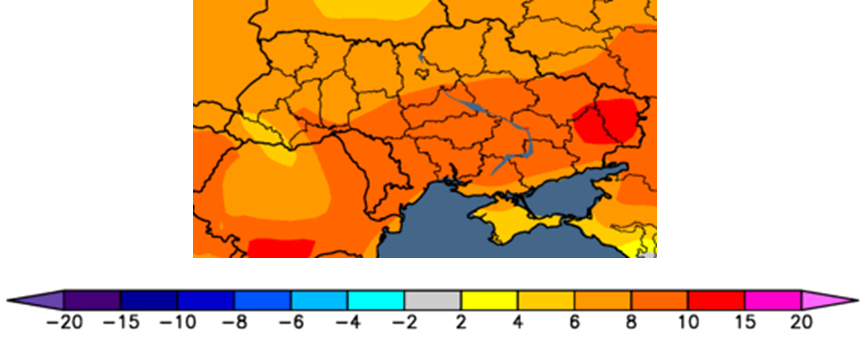

On the temperature side, the situation also gives cause for optimism with regard to yields. Although the latest data points to a reduction in snow cover, temperature forecasts point to warmer than average weather in the coming days, reducing the risk of winterkill.

Fig. 3: Temperature forecast for the next 15 days (difference from normal, ºF)

Source: World Ag Weather

Fig. 4: Rainfall forecast for the next 15 days (% of normal)

Source: World Ag Weather

The country has managed to increase its exports, but the situation in the Red Sea poses risks

Ukraine has managed to increase its grain exports from the Black Sea to a level not seen since before the Russian invasion, although the Red Sea shipping crisis represents a new challenge for its important agricultural trade.

Kiev's success in replacing a UN-backed Black Sea export agreement with its own transportation scheme brought relief to Ukrainian farmers and importing countries, while at the same time representing a naval breakthrough for Ukraine's armed forces once the ground counter-offensive was paralyzed.

Kiev shipped around 4.8M mt of food in December, mainly grains, from its Black Sea ports, surpassing for the first time the volumes achieved by the previous corridor promoted by the UN.

Moscow abandoned the agreement last July, saying that commitments to safeguard its own exports were not being respected. Before Russia's invasion, Ukraine exported around 6M mt of food a month across the Black Sea.

Moscow abandoned the agreement last July, saying that commitments to safeguard its own exports were not being respected. Before Russia's invasion, Ukraine exported around 6M mt of food a month across the Black Sea.

However, grain ships are increasingly being diverted away from the Suez Canal - Red Sea route, which is likely to hurt exports to more distant countries in particular. Ukrainian grain exports by sea in January could fall by around 20% compared to last month, a senior Ukrainian official said last week, mainly due to the Red Sea crisis.

Fig. 5: Monthly wheat exports by ship - Ukraine (M mt)

Source: Refinitiv

In summary

In short, we expect a slightly smaller harvest in Ukraine, as the larger planted area is unlikely to compensate for the lower yields. However, in our view, this is far from a bullish argument, given that in the post-war context it's a relatively good crop, higher than 22/23 and with higher yields than many pre-war harvests.

High Ukrainian exports have also been a bearish force for futures contracts, since the more the country is able to export its cheap wheat, the less importing countries need to buy from more expensive origins. However, escalating tensions in the Red Sea could change this scenario.

Fig. 6: Production, Harvested Area and Yield Wheat - Ukraine (M mt, M ha, m/ha)

Source: USDA, *hEDGEpoint estimate

Weekly Report — Grains and Oilseeds

Written by Alef Dias

alef.dias@hedgepointglobal.com

Reviewed by Natalia Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.