Mar 4

/

Alef Dias

Grains, Oilseeds and Livestock Weekly Report - 2024 03 05

Back to main blog page

Wheat: USDA confirms expectations of higher supply in the US

- Looking ahead to the 24/25 harvest, the USDA released its latest Grains and Oilseeds Outlook on February 15 (at the Agricultural Outlook Forum) providing initial projections for US wheat.

- The USDA is forecasting total wheat area in 2024 at 47M ac (19M ha), down from 49.6M ac (20.1M ha) in 2023, but above the five-year average of 46.4M ac (18.7M ha). Despite the lower total planted area, the USDA outlook predicts a 2% increase in yield, to 49.5 bu/ac (3.33 ton/ha). After the record abandonment in 2023, the USDA's estimated harvested area of 38.4M ac (15.5M ha) increased by 3%.

- In most of the main producing states, conditions deteriorated in February, but they are still much better than in the same period last year - maintaining the expectation of less abandonment and higher yields.

- The combined impact of increased productivity and lower abandonment due to improved soil moisture conditions is expected to increase production to 51.7M mt from 49.3M mt in 2023/24.

Introduction

As the southern hemisphere's wheat harvest nears completion, the market's focus is now on trade flows and the upcoming northern crop. Already looking ahead to the 24/25 crop, the USDA released its latest Grains and Oilseeds Outlook on February 15 (at the Agricultural Outlook Forum) providing initial projections for US wheat. Although subject to change, these projections help provide a good basis for drawing up the US supply scenario.

Armed with this information, we will update our outlook for the 24/25 US wheat crop.

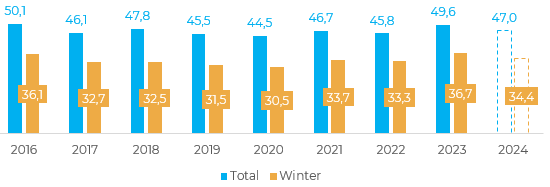

Forum confirms expectations of lower planted area

The Grains and Oilseeds Outlook projected total planted area for grains and oilseeds at 225.5M ac (91.25M ha), down from 227.8M ac (92.2M ha) last year due to lower prices. The USDA forecast total wheat acreage in 2024 at 47M ac (19M ha), down from 49.6M ac (20.1M ha) in 2023, but above the five-year average of 46.4M ac (18.7M ha).

The January Winter Wheat and Canola seedings report estimated that winter wheat area fell 6% to 34.4M ac (13.9M ha), leaving 12.6M ac (5.1M ha) for hard red spring wheat, white spring wheat and durum wheat. The USDA expects the combined area of spring and durum wheat to be slightly smaller.

The January Winter Wheat and Canola seedings report estimated that winter wheat area fell 6% to 34.4M ac (13.9M ha), leaving 12.6M ac (5.1M ha) for hard red spring wheat, white spring wheat and durum wheat. The USDA expects the combined area of spring and durum wheat to be slightly smaller.

Fig. 1: Wheat US - Planted Area (M ac)

Source: USDA.

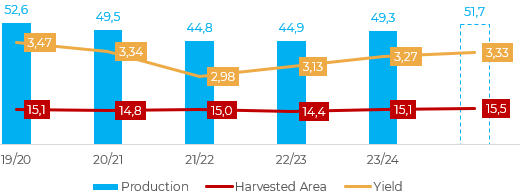

Higher yields and less abandonment should compensate for the area planted

Despite the lower total planted area, the USDA outlook predicts a 2% increase in yield, to 49.5 bu/ac (3.33 ton/ha). Following the record abandonment in 2023, the USDA's estimated harvested area of 38.4M ac (15.5M ha) increased by 3%. The combined impact of increased productivity and lower abandonment due to improved soil moisture conditions is expected to increase production to 51.7M mt from 49.3M mt in 2023/24.

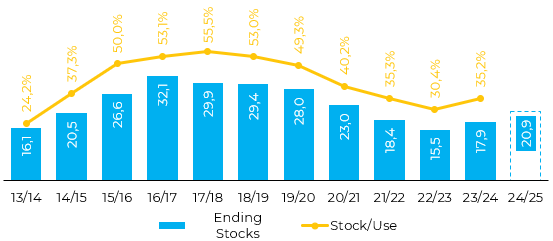

The estimate is for a 6% increase in the US wheat supply compared to the previous year. The USDA forecasts a slight drop in domestic consumption to 30.8M mt, marking a reduction of 272k mt from the previous year. In contrast, the USDA expects US wheat exports to recover to 21.09M mt in 2024/25 due to increased supplies.

The estimate is for a 6% increase in the US wheat supply compared to the previous year. The USDA forecasts a slight drop in domestic consumption to 30.8M mt, marking a reduction of 272k mt from the previous year. In contrast, the USDA expects US wheat exports to recover to 21.09M mt in 2024/25 due to increased supplies.

Fig. 2: Wheat US - Area, Yield and Production (M ha, ton/ha, M ton)

Source: USDA

Fig. 3: Ending Stocks and Stock/Use - US (M mt, %)

Source: USDA

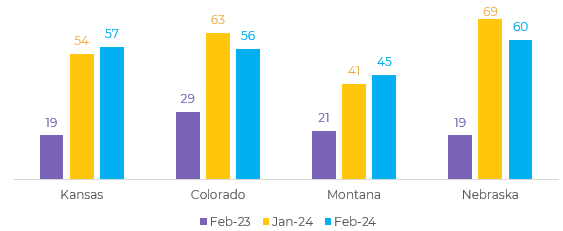

Despite deterioration, crop conditions support the view of yield recovery

On February 28th, the USDA released its Monthly Crop Progress report ("State Stories"), which is exclusive to winter wheat and is released while most of the crop is dormant - in April the organization resumes its weekly crop progress reports.

In most of the main producing states, conditions deteriorated in February, but they are still much better than in the same period last year - maintaining the expectation of less abandonment and higher yields.

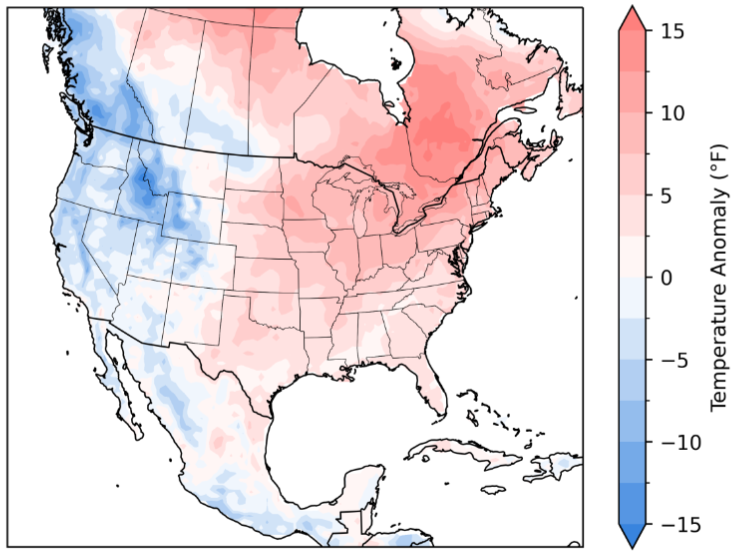

Looking at the forecast for the coming days, most of the main producing regions point to a recovery of these conditions in March, while the risks of lower temperatures are concentrated in the northwestern states, with a low potential impact.

Fig. 4: Good and excellent conditions - Main producing states (%)

Source: USDA

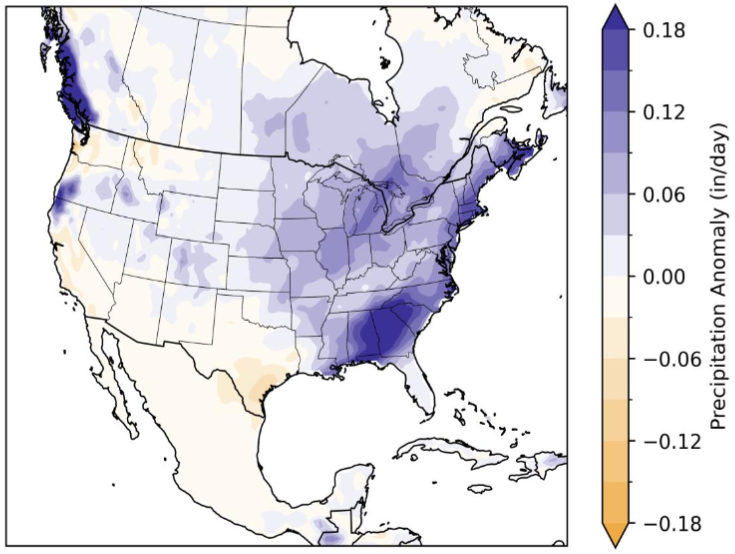

Fig. 5: Precipitation anomaly - Next 15 days (mm/day of normal)

Source: NOAA, hEDGEpoint

Fig. 6: Temperature anomaly - Next 15 days (ºC of normal)

Source: NOAA, hEDGEpoint

In summary

The current outlook has a bearish tone for the next crop, but there is enough time until the harvest for market and crop conditions to change. Winter wheat conditions are much better than in recent years, but the weather from now on could bring significant changes to the yield outlook.

The USDA's Prospective Plantings report, to be released on March 28, and the May WASDE will provide detailed revisions to the US wheat balance in 2024 and should have a relevant impact on future prices. Additionally, improved conditions in Kansas compared to other states should put pressure on the Kansas - Chicago spread in the coming months.

Weekly Report — Grains and Oilseeds

Written by Alef Dias

alef.dias@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.