Market Update - Soybeans and Corn - 2025 04 17

New North American crop: planting has begun!

The start of the new North American corn and soybean crops has been made. Planting works is already underway in states across the US producing belt, and the weather is now becoming a key factor for the market. From now on, players will position themselves daily against the weather maps forecasting, the progress of planting and the development of the crops sown. Attention will also be paid to the weekly data on planting progress and crop conditions released by the United States Department of Agriculture (USDA) every Monday.

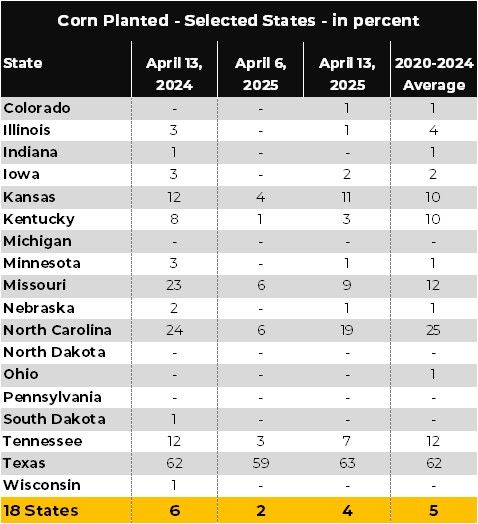

Regarding corn, the machines began to advance in the first days of April, with the first planting data being released on April 7. According to the latest weekly update from the USDA, by April 13 planting had reached 4% of the expected area, while the previous week the percentage was 2%. In the same period last year, the percentage was 6%. The average for the last five crops for the period is 5%.

It's important to remember that the area to be sown with corn in the US in the 2025/26 season is expected to grow significantly regarding the previous season, which could result in a record crop if the weather helps. The USDA is likely to point to a potential production of more than 390 million tons in its monthly supply and demand report for May, which will be released on the 12th.

US Planting Progress - Corn

Source: USDA, Hedgepoint

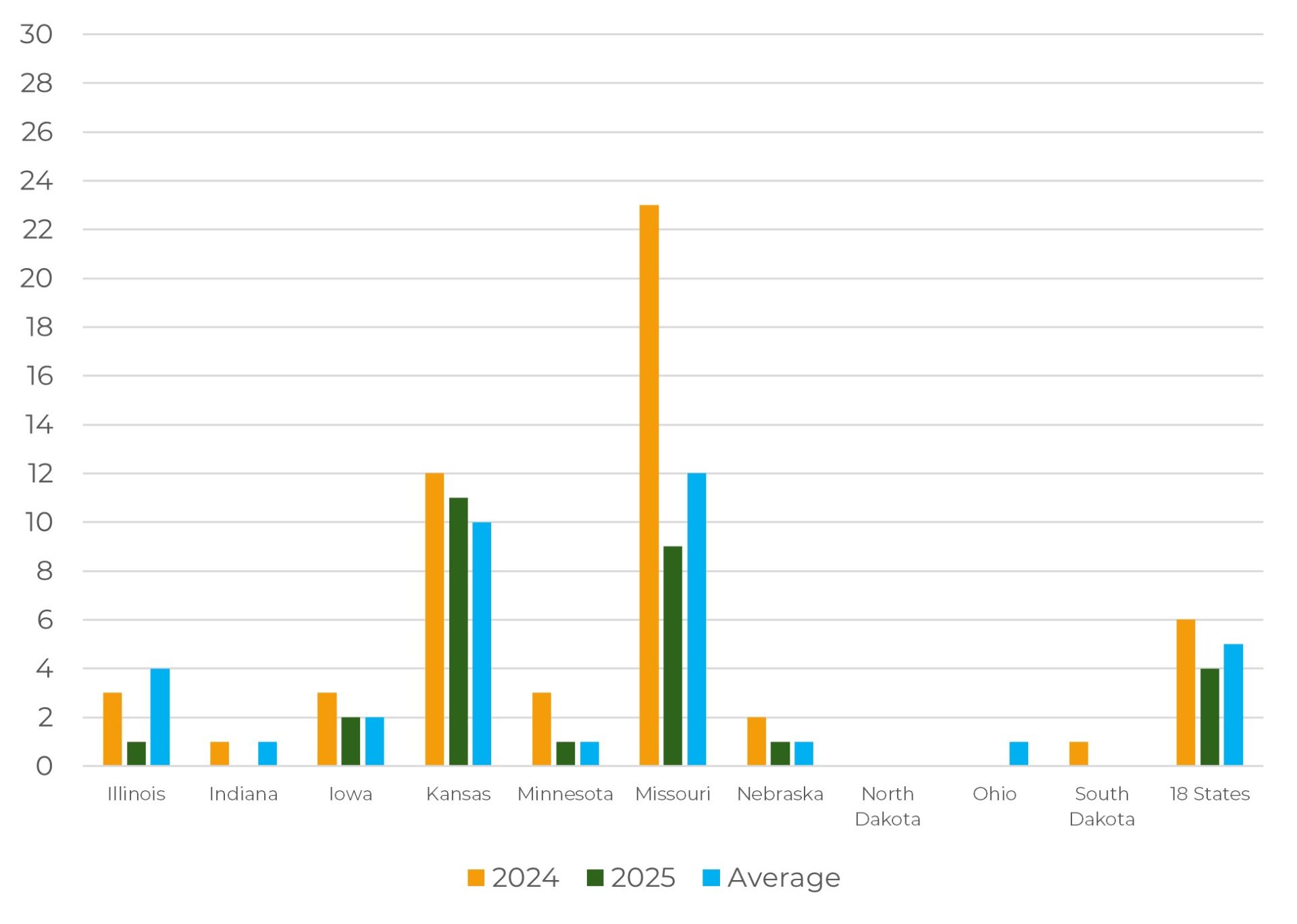

US Planting Evolution - Corn (top 10 states in %)

Source: USDA, Hedgepoint

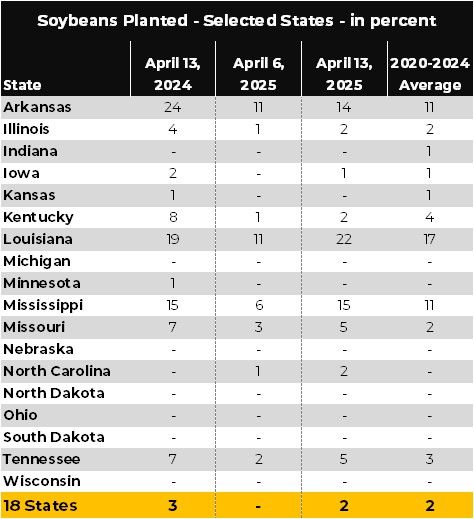

Regarding soybean, planting works began a week after corn, with the first data being released on April 14. According to the USDA, by April 13 planting had reached 2% of the estimated area. In the same period last year, the percentage was 3%, while the average for the last five crops for the period is 2%.

US Planting Evolution - Soybeans

Source: USDA, Hedgepoint

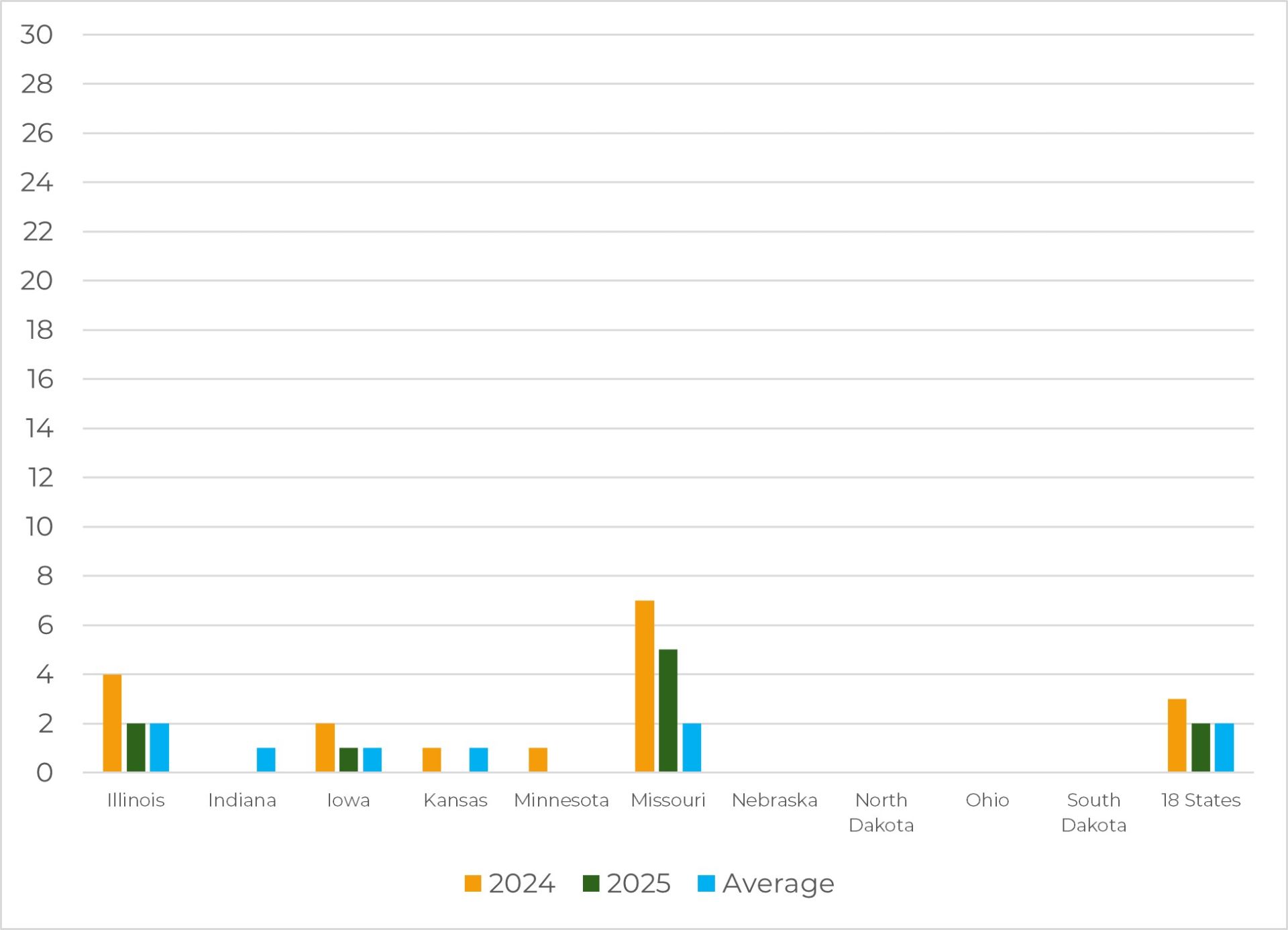

US Planting Evolution - Soybeans (top 10 states in %)

Source: USDA, Hedgepoint

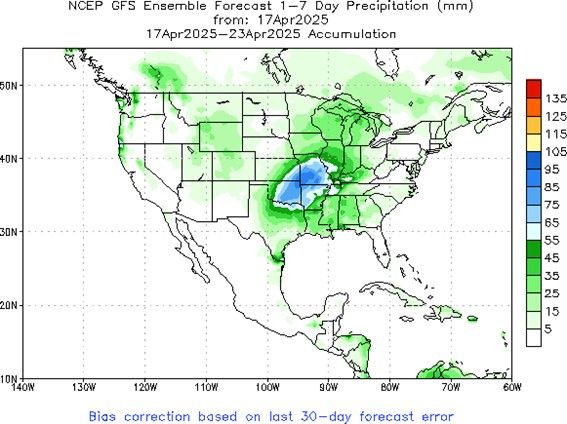

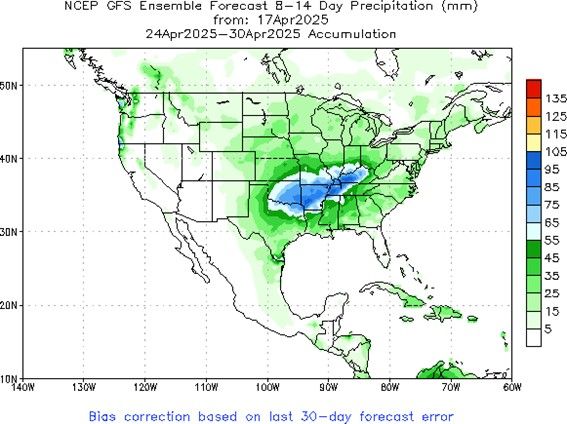

As commented, the weather is now becoming a decisive factor in the progress of planting works, the definition of areas and the development of soybean and corn crops in the North American producing belt.

In the period between April 24 and 30, the rains will spread across the entire producing belt, with the highest accumulations again expected in the central and southern states.

USA - Accumulated Precipitation Forecast (mm) - April 17 to 23

Source: NOAA

USA - Accumulated Precipitation Forecast (mm) - April 24 to 30

Source: NOAA

China and its current appetite for soybeans

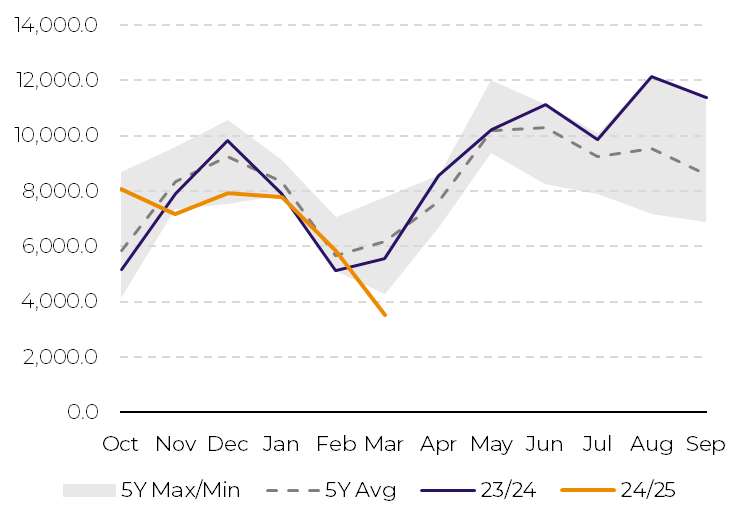

China - Monthly Soybean Imports (M Ton).

Source: China Customs

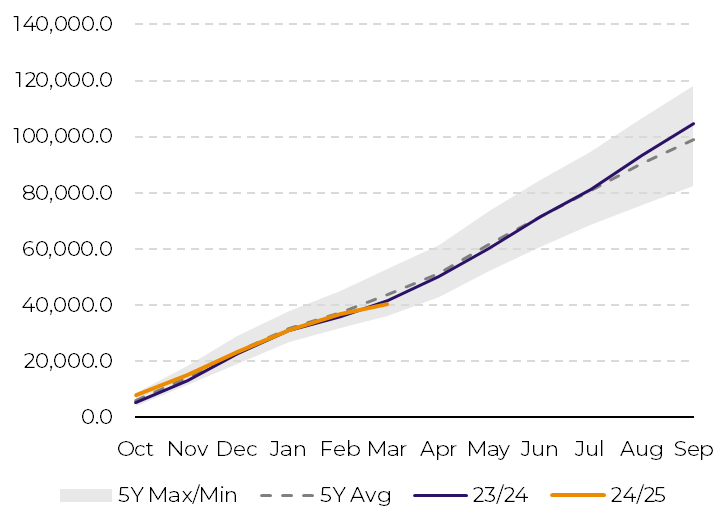

China - Accumulated Soybean Imports (in thousand tons)

Source: China Customs

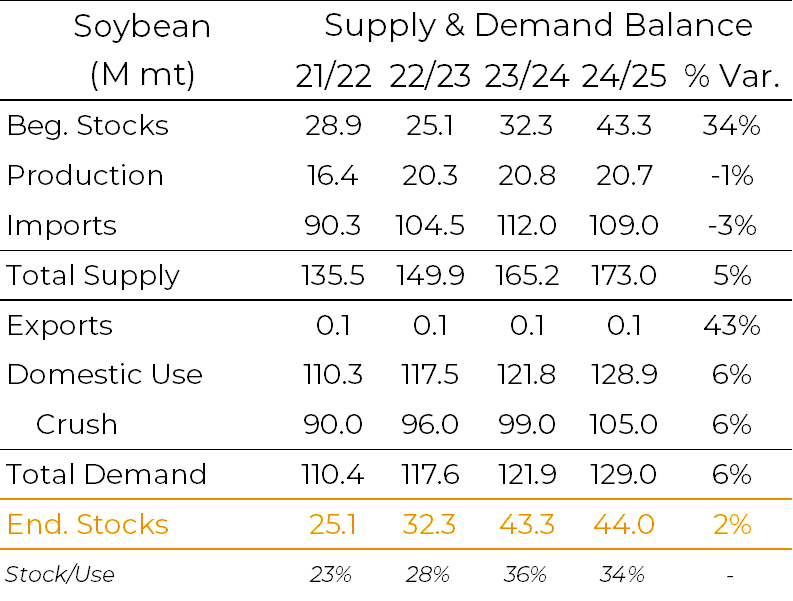

Although the recent tariff war between the US, China and other global players has brought significant uncertainty to the market, expectations remain for a strong year in Chinese soybean imports. According to the USDA, China is expected to import 109 million tons of soybean this year - close to the 112 million tons imported last year.

China - Soybean Supply and Demand (M Ton)

Source: USDA

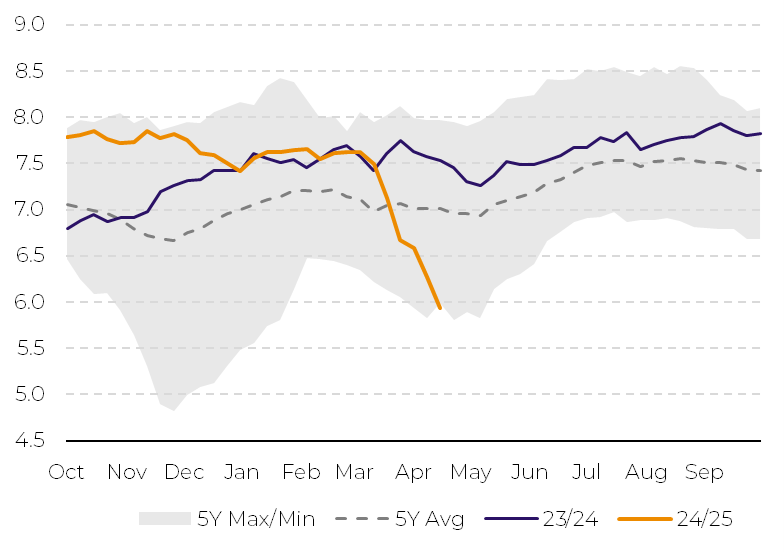

China - Soybean Stocks at Ports (in M Ton)

Source: China Customs

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Ignacio.Espinola@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com