Market Update: Soybeans, Corn and Wheat

Market Update Soybeans Corn and Wheat

Brazilian corn production estimated at 128 million tons

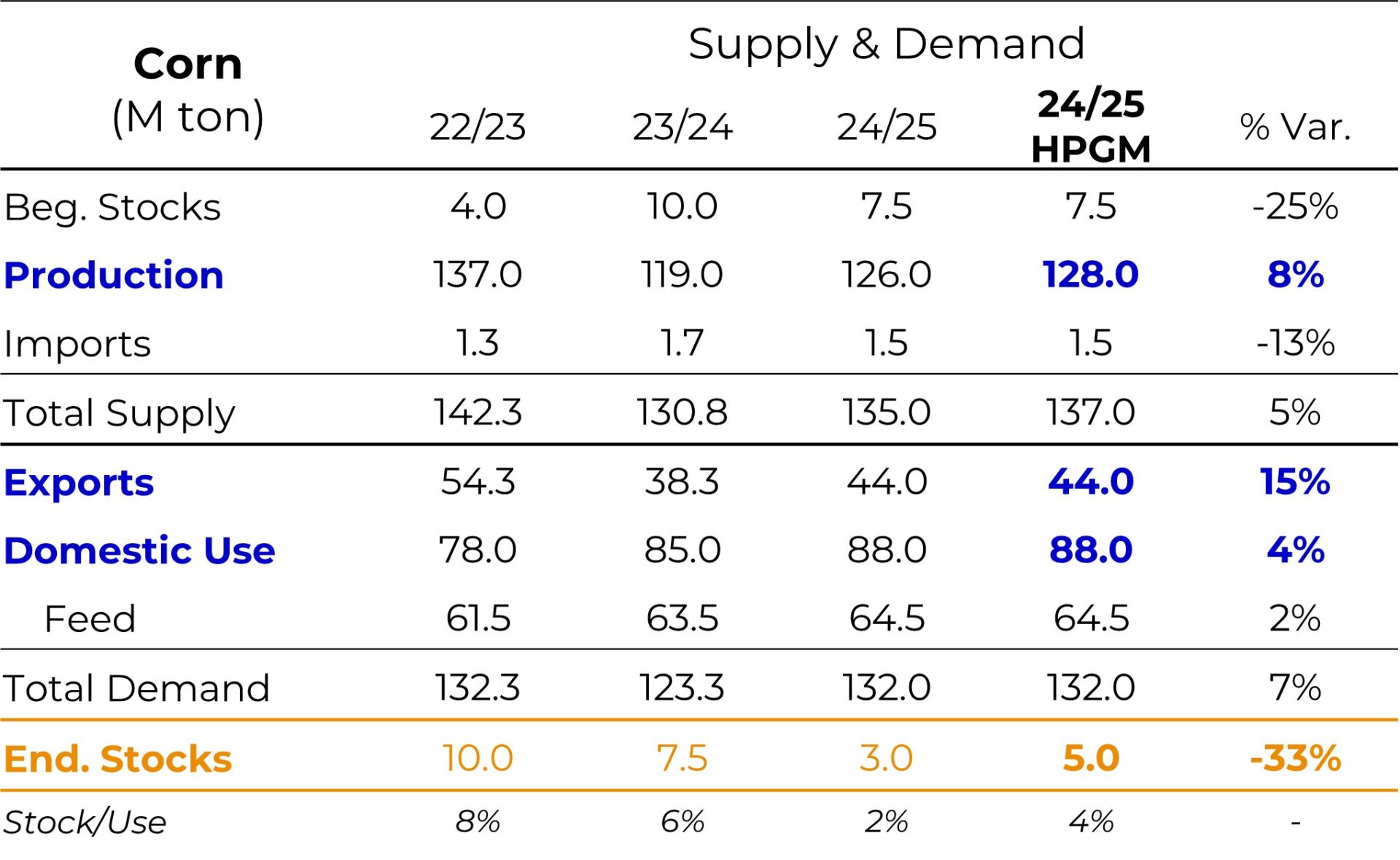

Our new estimate for Brazilian corn production points to a crop of 128 million tons in the 2024/25 season. This figure contrasts with the USDA's current estimate, which indicates a production of 126 million tons for Brazil.

We believe that Brazil's production potential is higher, based on both a summer crop that brought good results and a second crop with great production potential, derived from increased area and favorable weather so far.

On the demand side, we highlight the growth in domestic consumption, mainly supported by the increased use of corn for ethanol production, a trend that has become increasingly consolidated in Brazil. In addition, we also highlight the growth in consumption for animal feed, with a large share of animal protein exports, which had a record first quarter in terms of shipments.

Regarding corn exports, we expect growth compared to last season, with an estimate of 44 million tons. Despite this, there are doubts regarding the potential for shipments due to strong competition from US and Argentine products this season. In this regard, we must remain attentive to developments related to US tariffs and Argentine export taxes (retenciones), factors that may directly influence Brazilian shipments.

Regarding ending stocks, the trend is for stocks of 5 million tons, which indicates a reduction compared to the previous season. Even with a larger crop, we believe that strong domestic demand combined with possible higher demand for exports should lead to lower ending stocks than those recorded in the 2023/24 season, which may be a positive factor for the formation of prices in the Brazilian domestic market. Despite this, we emphasize that the final figure for exports is surrounded by uncertainty and will be fundamental for the consolidation of ending stocks.

We also believe that the outlook for Brazilian production in the second crop is quite positive so far, which, if the weather remains favorable in the coming weeks, may lead to positive adjustments to the current estimate. In any case, it is important to pay close attention to weather forecasts for May, as below-average rainfall may be recorded in the central part of the country.

Corn - Brazil - Supply and Demand (in M Ton)

Source: USDA, Hedgepoint

Planting of new crop advances at a good pace in the US

Planting of the new US soybean and corn crop continues to advance at a strong pace in the main producing states. Supported by favorable weather, with sunny days alternated with rainy days, machinery has been able to advance satisfactorily, while the planted crops are finding a favorable environment for germination and initial development.

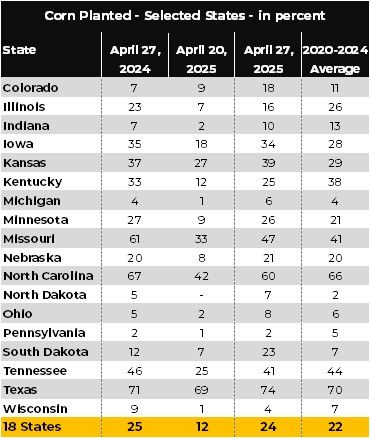

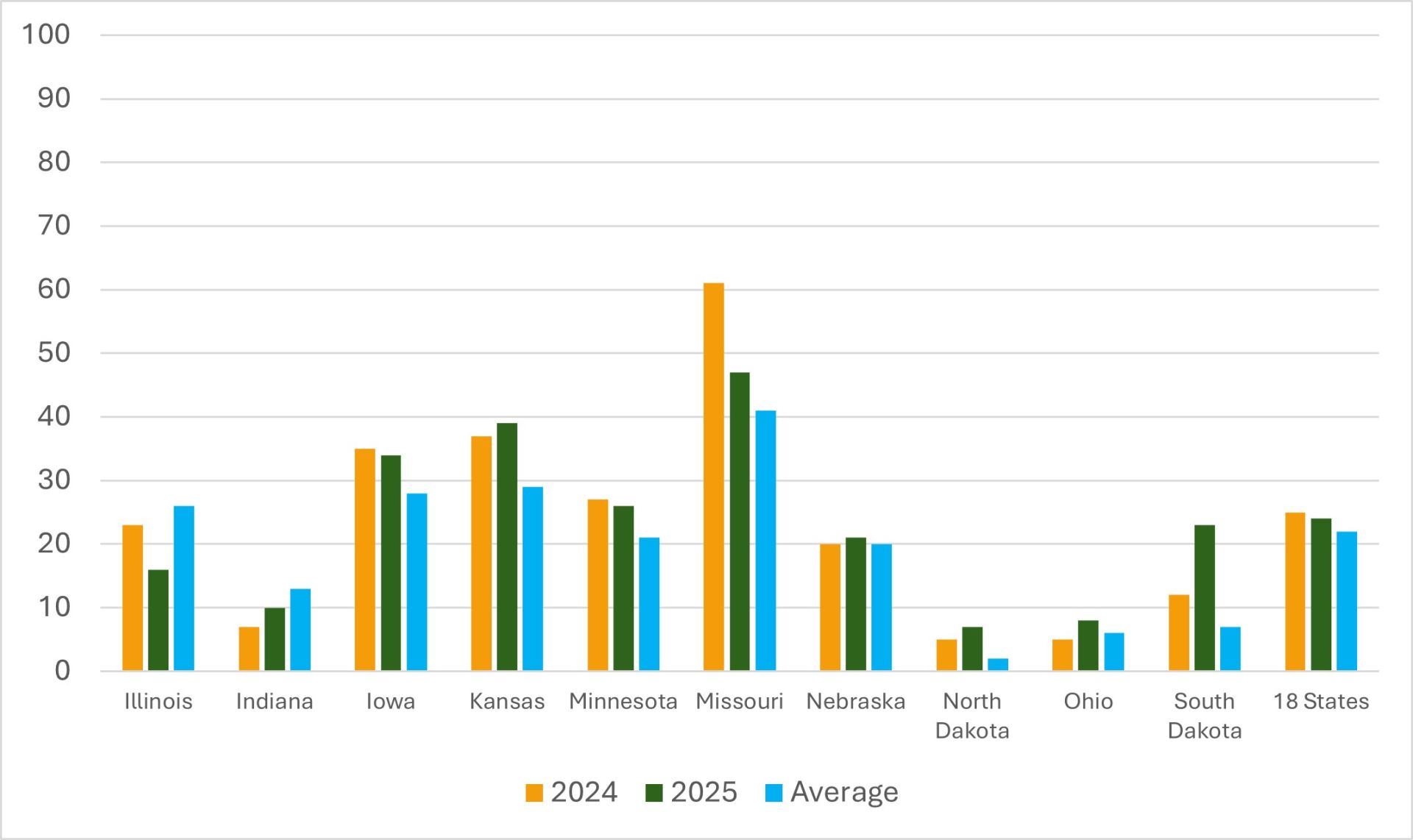

In its latest weekly report on planting progress, the USDA indicated that as of April 27, 24% of the corn area had been planted. In the previous week, the percentage was 12%, while in the same period last year, the percentage was 25%. The average for the last five crops for the period is 22%.

USA – Corn – Planting Progress – in %

Source: USDA, Hedgepoint

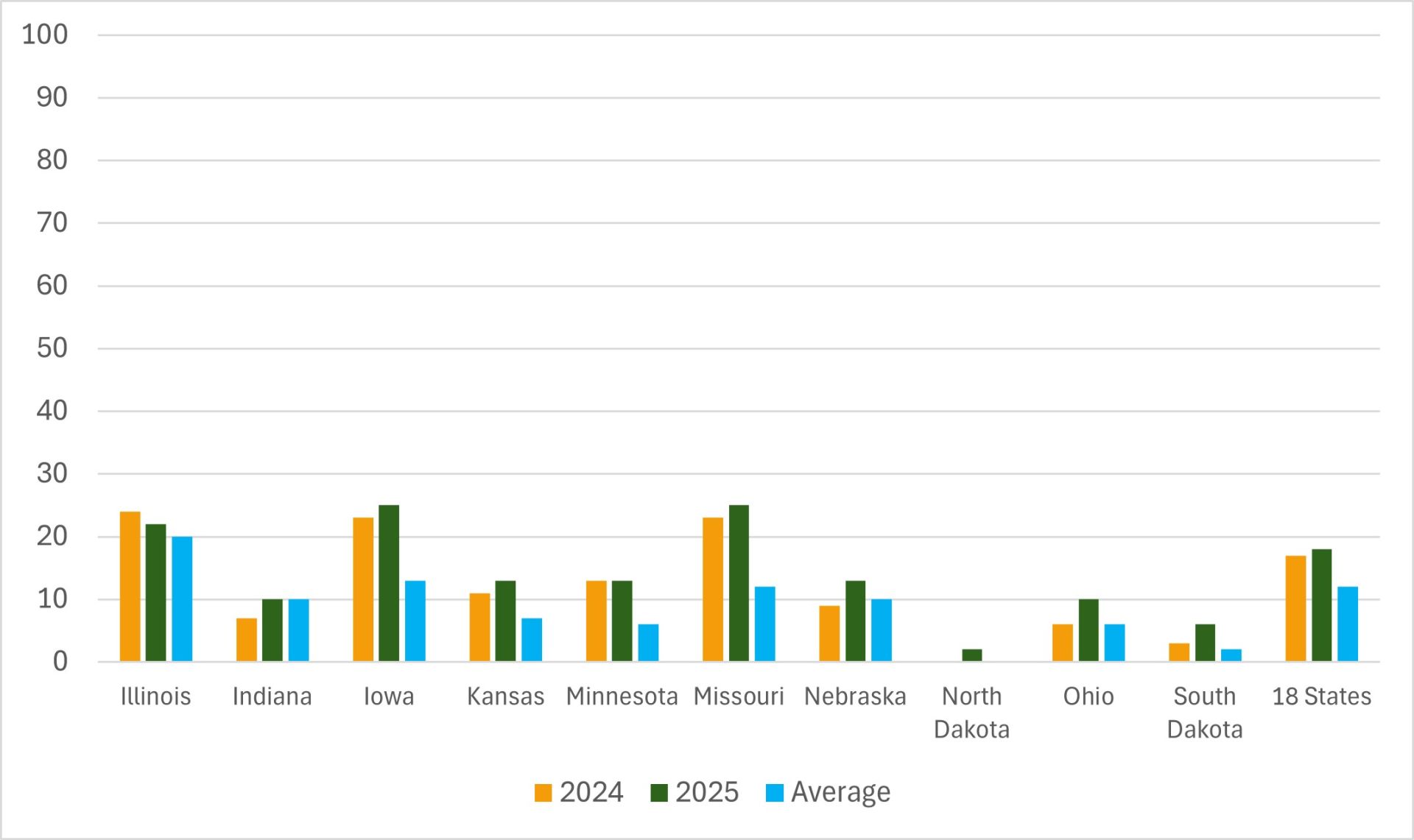

USA – Corn – Planting Progress – Top 10 States and USA (in %)

Source: USDA, Hedgepoint

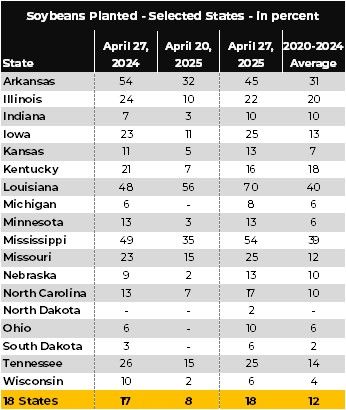

Regarding soybeans, the USDA indicated that 18% of the area had been planted by April 27. In the previous week, the percentage was 8%. In the same period last year, the percentage reached 17%, while the average for the last five crops for the period is 12%.

USA – Soybeans – Planting Progress – in %

Source: USDA, Hedgepoint

USA – Soybeans – Planting Progress – Top 10 States and USA (in %)

Source: Safras, Hedgepoint

Accumulated Precipitation Forecast US – 1 to 7 days (mm)

Source: NOAA

Accumulated Precipitation Forecast US – 8 to 14 days (mm)

Source: NOAA

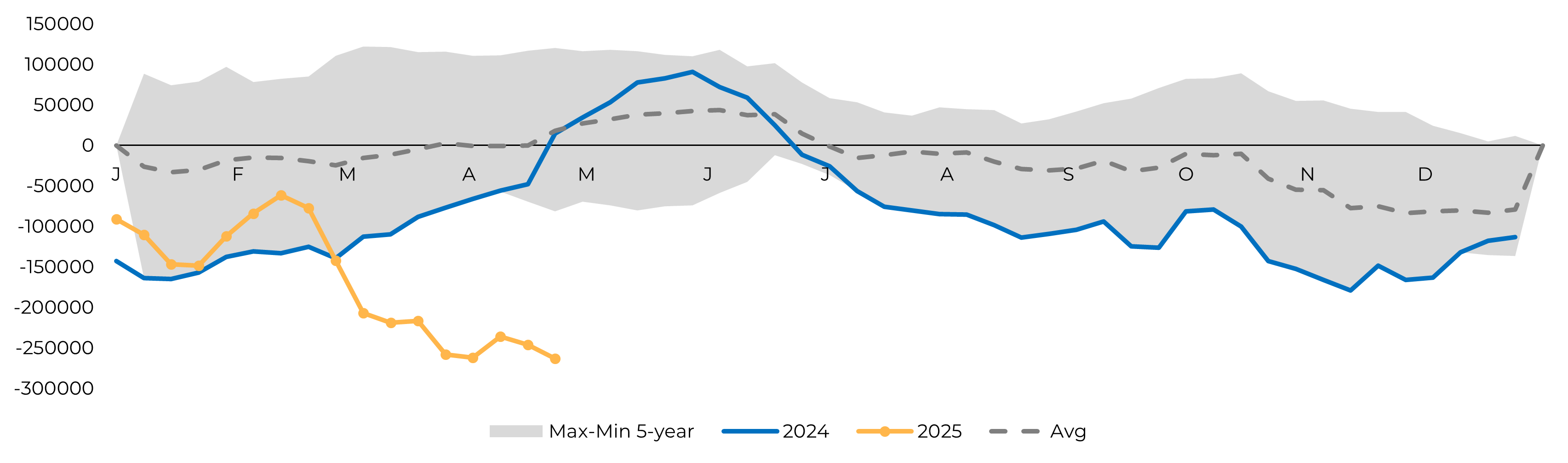

Funds activity

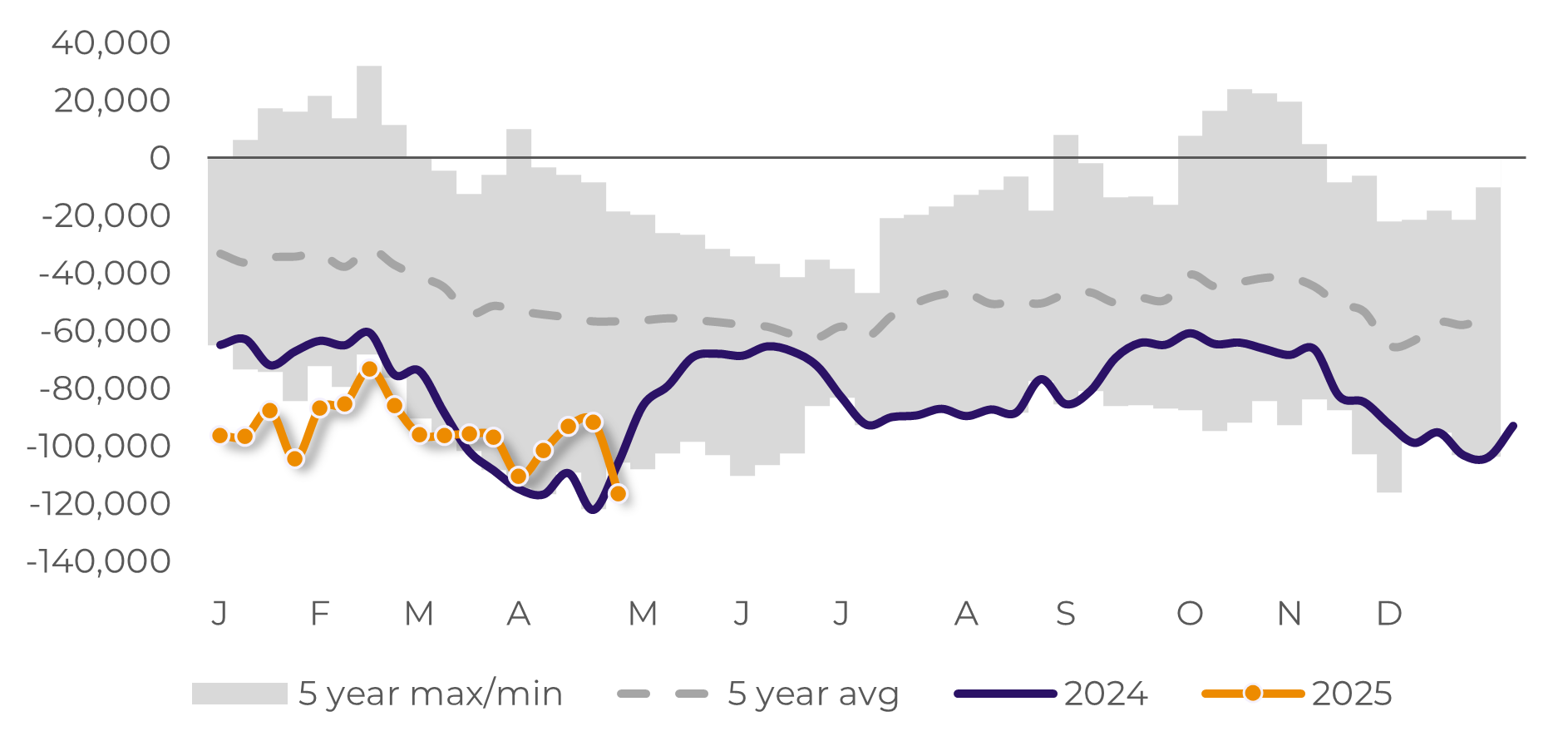

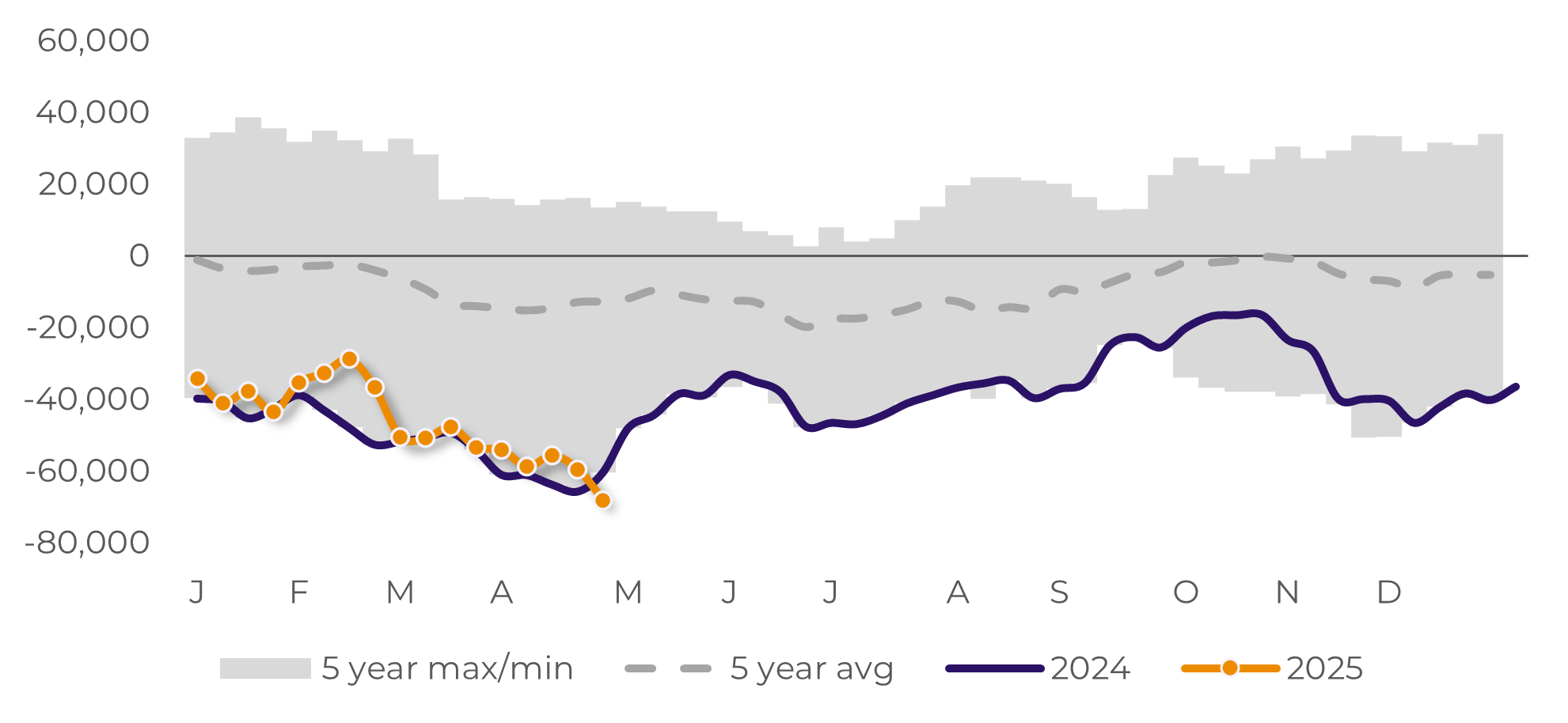

MATIF Wheat Non-Commercial (Spec) position in lots.

Source: MATIF Euronext

SRW Non-Commercial (Spec) position in lots.

Source: CBOT CFTC

HRW Non-Commercial (Spec) position in lots.

Source: CBOT CFTC

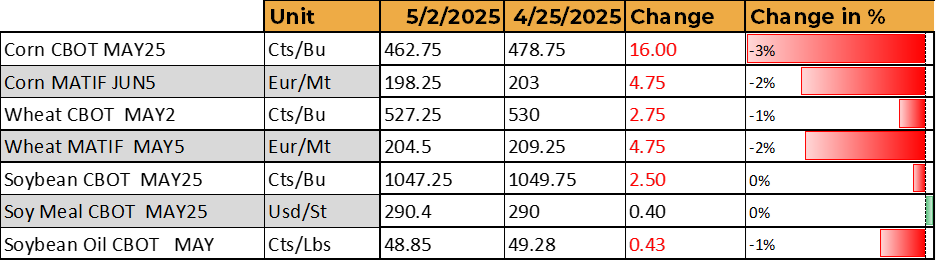

Price evolution

Source: Reuters

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Ignacio.Espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.