The start of the corn crop conditions in the US was disappointing. Does this really threaten the 2025/26 production potential?

Planting progresses towards the final straight in the US, but corn crop conditions are below expectations

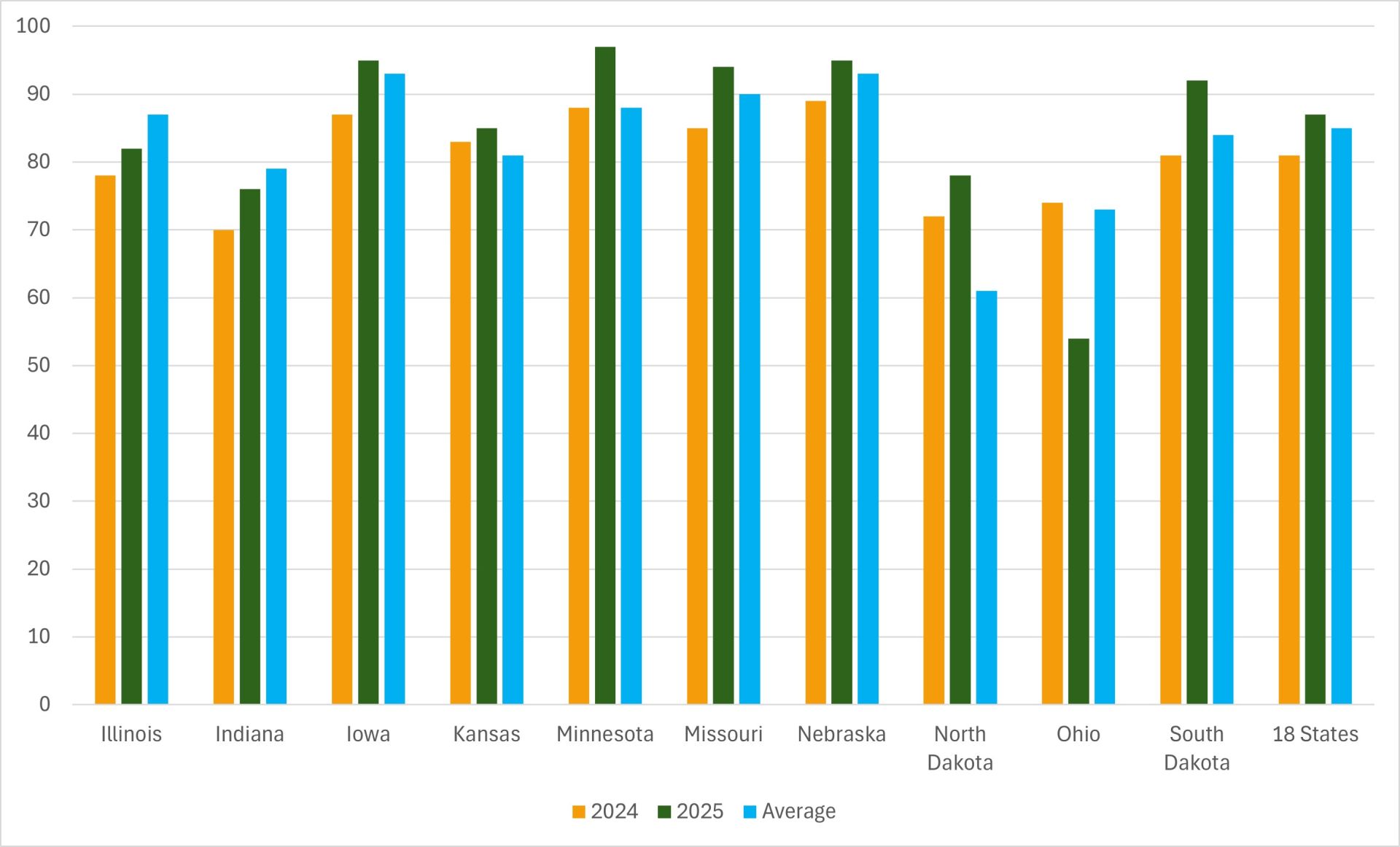

Planting of the new North American corn crop is progressing towards the final straight in the main states of the producing belt.

The strong pace recorded since work began in the first week of April has been maintained nationwide, keeping the percentage above the average of the last five crops for the period. Despite this, the advance of the machines has lost momentum in some states in recent days, leading to a slower pace regarding the average. This opens up speculation regarding the final area to be sown in states such as Ohio, Indiana and Illinois, since sowing within the ideal window, which brings crop insurance coverage, may not be achieved in some areas destined for the cereal. This also opens up the possibility of unexpected transfers of areas from corn to soybeans, given that the window for the oilseed extends a little longer than that for corn.

According to the United States Department of Agriculture (USDA), 87% of the corn area had been sown by May 25, an increase of 9 percentage points regarding the previous week (78%). In the same period last year, the percentage was 81%, while the average for the last five crops for the period is 85%.

Regarding delays, the state of Ohio stands out, with only 54% of the area sown so far, compared to 73% of the average for the last five crops.

In the state of Illinois, we see 82% of the area sown, while the average for the period is 87%. In the state of Indiana, the USDA indicates that 76% of the area has been sown, compared to 79% of the average.

US Planting Progress - Corn

Source: USDA, Hedgepoint

US Planting Progress - Corn (top 10 states and US - in %)

Source: USDA, Hedgepoint

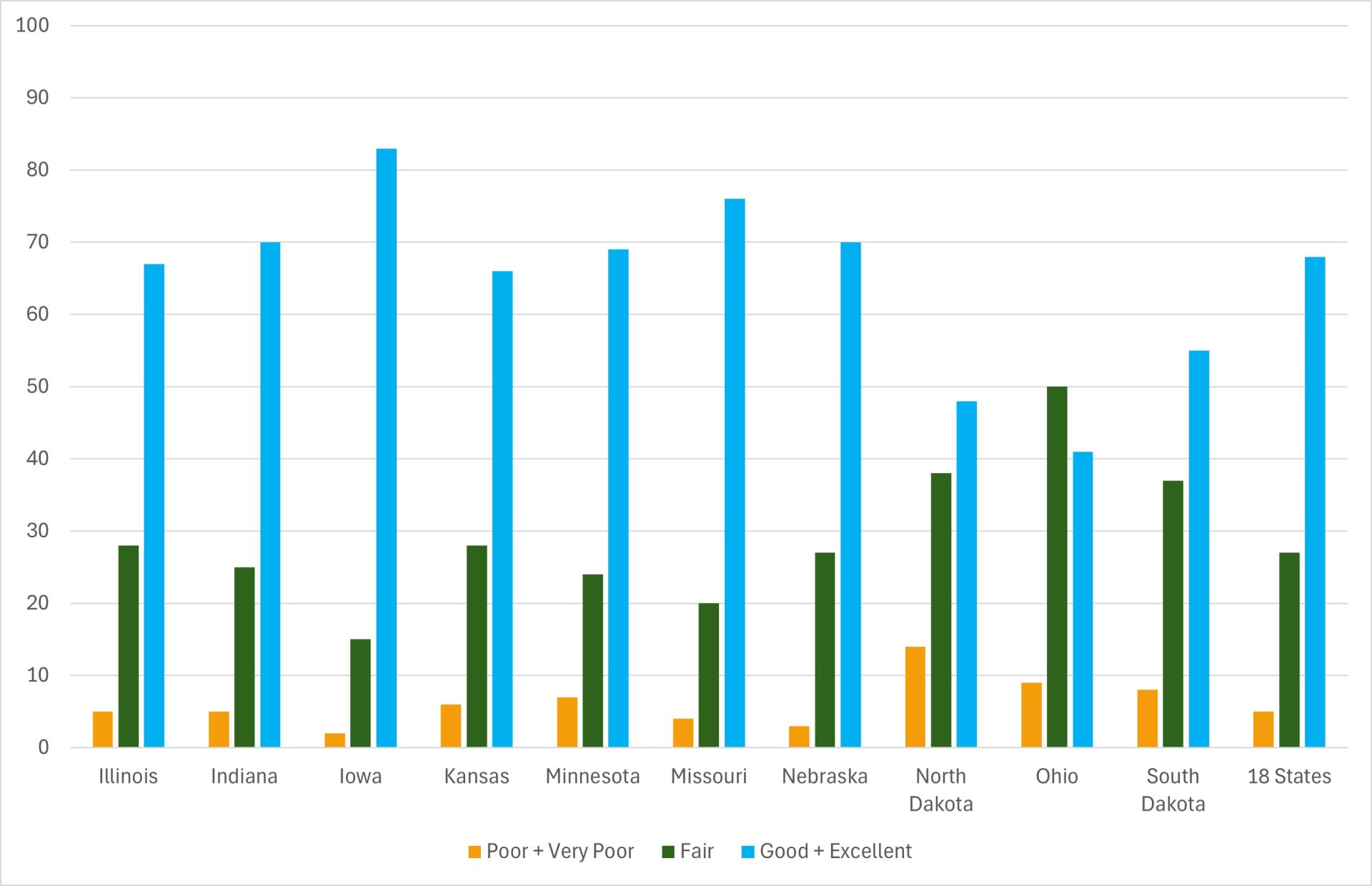

In addition to the delays, it is also important to note that the first data on corn crop conditions, relating to May 25, point to lower levels than those recorded in the first data for 2024, relating to June 3, 2024. This indicates that the initial development of North American crops is not as good as that recorded last year. In view of this, we would remind you that the USDA is working with an estimate of record yields for this season, and that for this to be achieved, conditions naturally need to improve over the next 90 days.

US Crop Conditions - Corn (top 10 states and US - in %)

Source: USDA, Hedgepoint

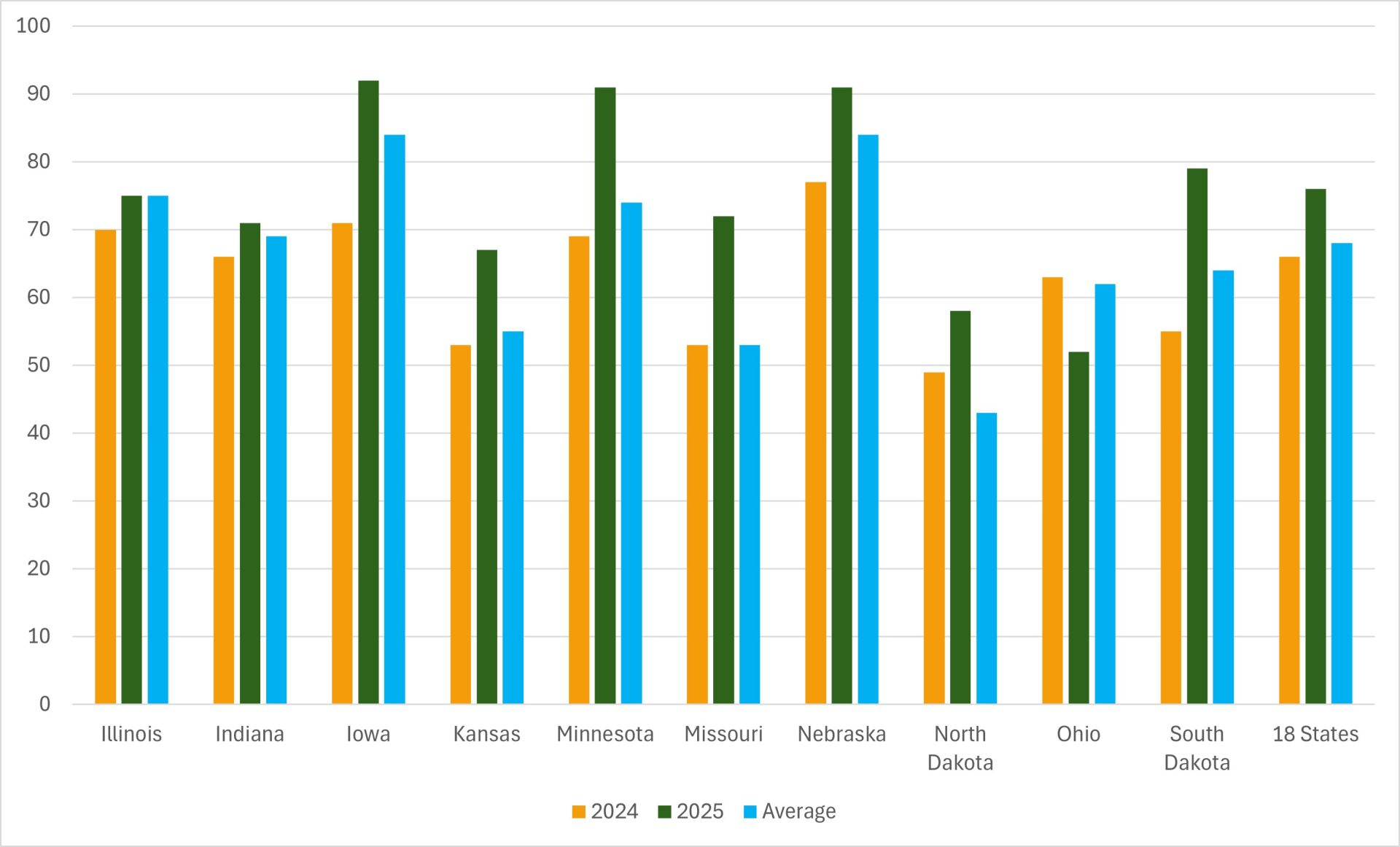

Moving on to soybean planting, the USDA indicates that as of May 25, 76% of the area had been planted, an increase of 10 percentage points regarding the previous week (66%). In the same period in 2024, the percentage was 66%. The average for the last five crops for the period is 68%.

The state of Ohio, as with corn, is also behind in sowing, with only 52% of the area planted (62% the five-crop average).

Unlike corn, the USDA has not yet released the first data on soybean crop conditions, which should take place in the first week of June.

US Planting Progress - Soybeans

Source: USDA, Hedgepoint

US Planting Progress - Soybeans (top 10 states and US - in %)

Source: USDA, Hedgepoint

Weather should be favorable for the development of crops in the producing belt in the coming weeks

USA - Accumulated Precipitation Forecast (mm) - May 31 to June 6

Source: NOAA

USA - Accumulated Precipitation Forecast (mm) - June 7 to 13

Source: NOAA

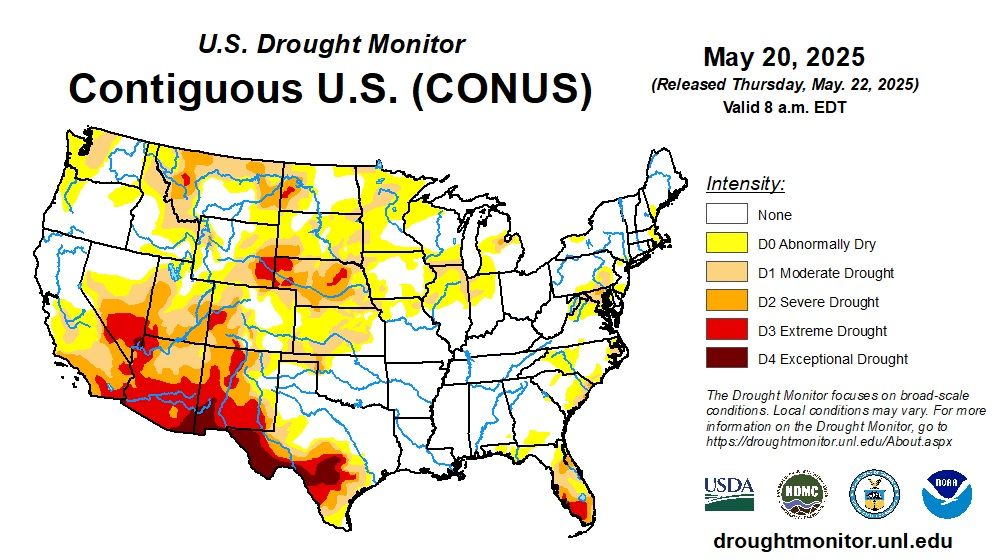

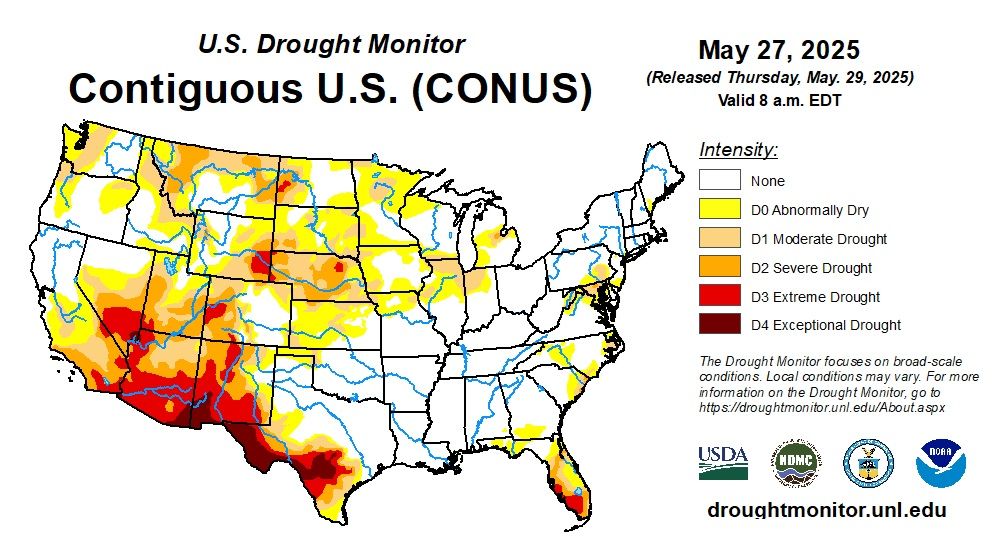

Regarding soil moisture in the North American producing belt, we noticed an improvement this past week compared to the previous week in the Northern Plains states (North Dakota, South Dakota, Kansas and Nebraska), which is quite favorable given that these states deserve special attention this season due to the low humidity recorded so far.

USA Drought Monitor - May 20, 2025

Source: NOAA

USA Drought Monitor - May 27, 2025

Source: NOAA

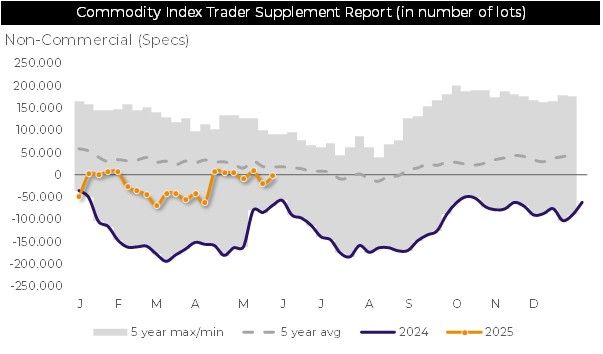

Funds Position

Funds Position

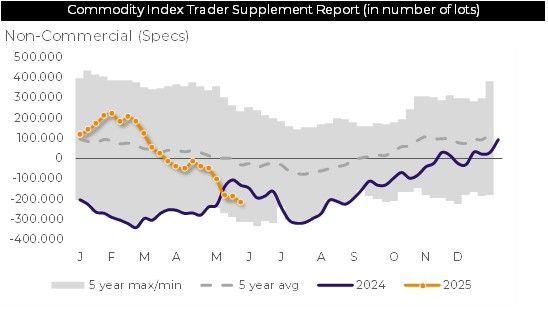

At the moment, speculative funds are positioning themselves mainly for the new North American crop, working on expectations of area, weather, production and stocks. In the background, the trade war continues to bring uncertainty, increasing the volatility of positions.

CBOT Soybeans - Spec. Funds Net position ('000 lots)

Source: CFTC, Hedgepoint

On the corn side, funds increased their short positions from 190,000 contracts to 216,000 contracts, recording a higher volume sold than at the same time in 2024 and close to the "low" of the last five crops. The trend towards a record crop given the strong growth in area this season is weighing on positions.

CBOT Corn - Spec. Funds Net position ('000 lots)

Source: CFTC, Hedgepoint

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com