Jun 6

/

Luiz Fernando Roque

Scenarios for vegetable oils markets in 2025/26

Production and consumption of vegetable oils likely to grow in the new season

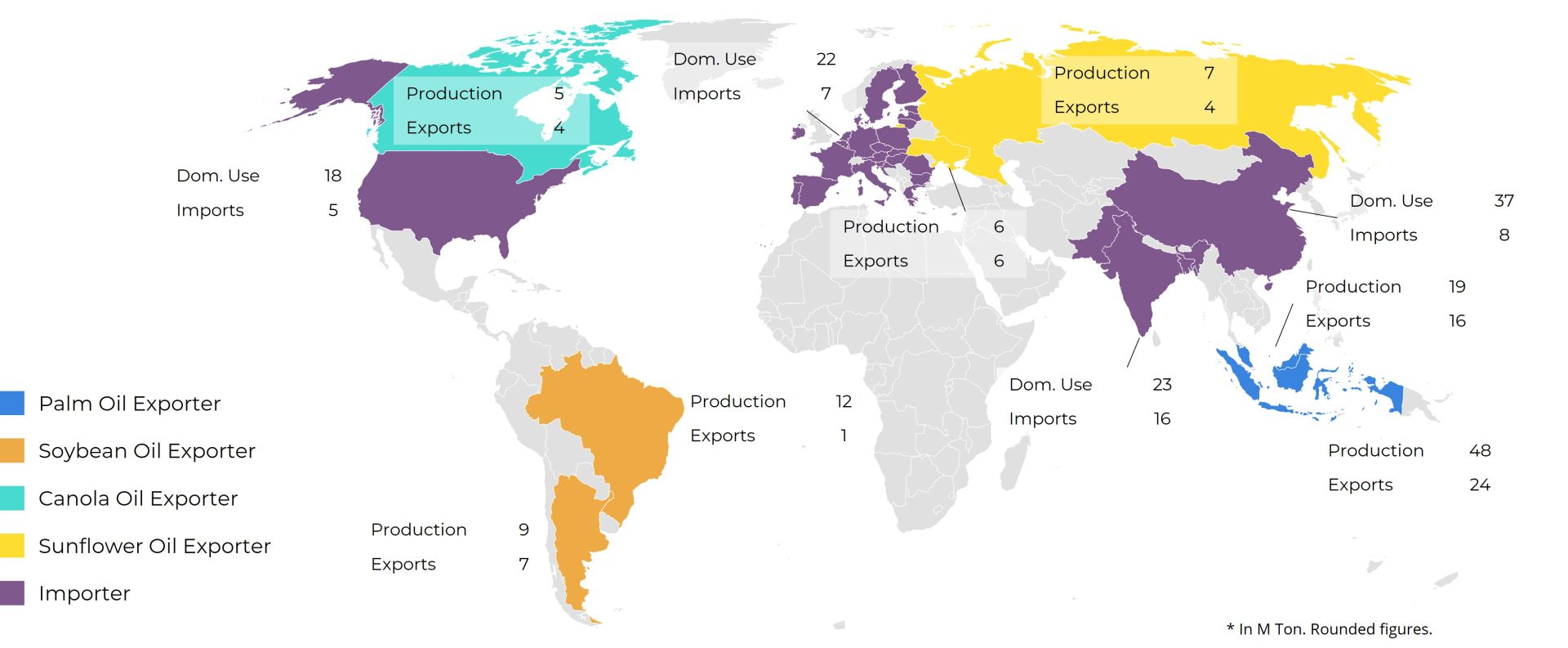

The 2025/26 season should see an expansion in the production and consumption of vegetable oils worldwide. The trend towards larger crops in major producing countries should lead to an environment in which supply expands, making it possible to increase use and imports from major consumer countries. Greater demand for the manufacture of biofuels should be an important driver for consumption in the new season, with increases in mandatory blends expected in some countries. Below are the scenarios for the four main vegetable oils produced and consumed worldwide.

World Map - Vegetable Oils (M ton)

Source: USDA, Hedgepoint

Soybean Oil

Soybean Oil

In the case of soybean oil, the 2025/26 season should bring an environment of greater supply on the global market, due to higher expected production in major producing and exporting countries such as Argentina, Brazil and the United States. On the demand side, there is a trend towards greater consumption in China and India, as well as an increase in domestic use in the large producers mentioned above. In the case of China, there is also an increase in supply due to a probable increase in soybean crushing, which will require greater imports of soybeans (112 M tons).

Even with the increase in supply, the trend is for world ending stocks to be only slightly higher regarding the 2024/25 season, given that world consumption tends to continue to grow significantly, mainly due to the greater use of soybean oil for biodiesel production in some countries. Therefore, if the crops of the major producing countries suffer losses, it is possible that we will see negative adjustments in supply, which could even lead to smaller ending stocks.

Along these lines, it's important to point out that the current figures are derived from projections of "full" yields in the main soybean producing countries, and that these yields have yet to be confirmed. For now, we only have a glimpse of what the new North American crop, which is in the final stages of planting, will look like. Even so, everything will depend on the weather in the coming months to define the new crop, and it is possible that we will see important adjustments to the projection if the weather is not favorable.

Finally, on the demand side, we would highlight the trend towards lower consumption and consequently less appetite for imports on the part of India, which should once again prioritize the use of palm oil with a possible increase in production from "its neighbors" Indonesia and Malaysia.

Soybean Oil - World Supply and Demand - Main Countries (M Ton)

Source: USDA, Hedgepoint

Palm Oil

Palm Oil

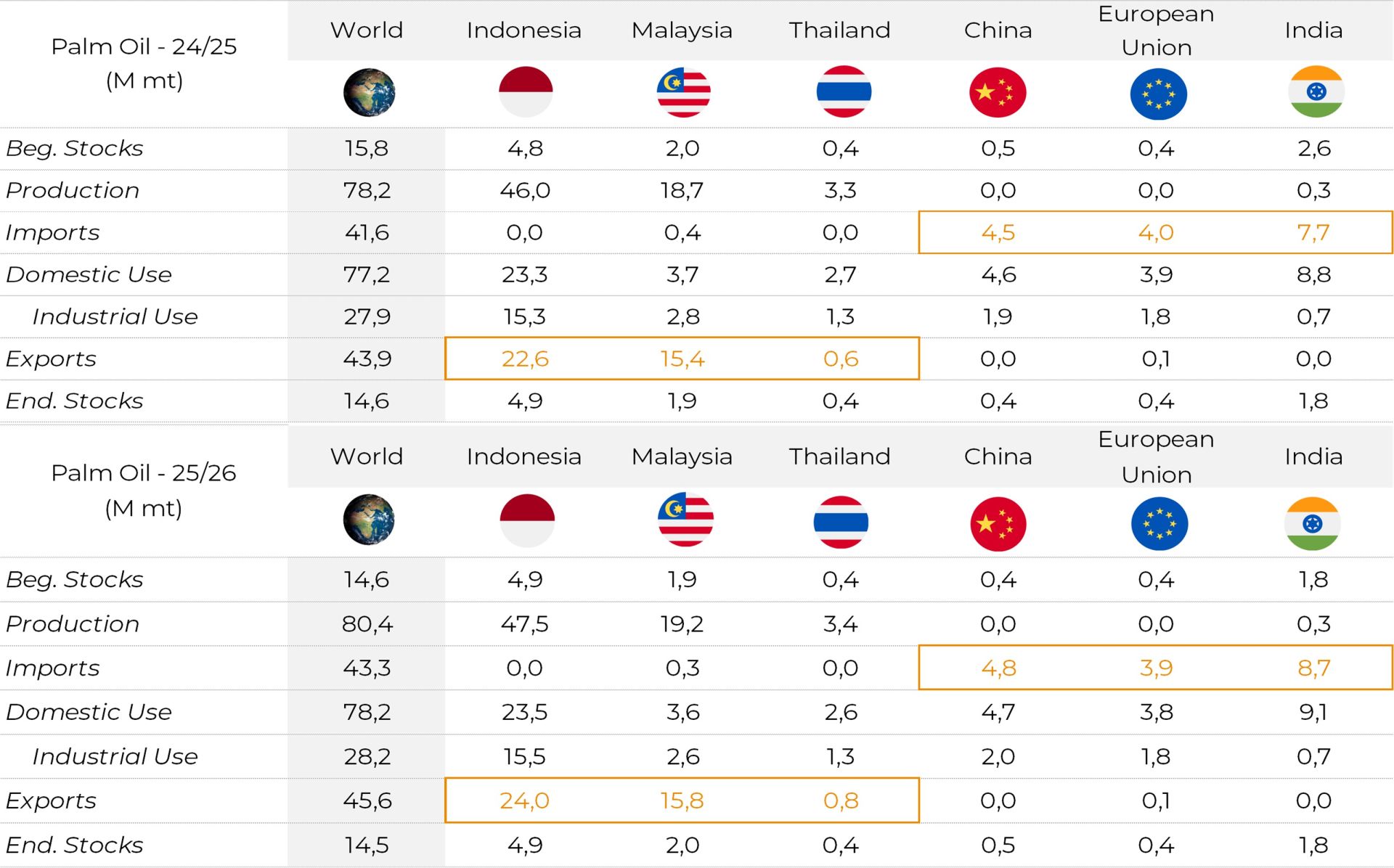

Regarding palm oil, the trend is also for an increase in supply in the 2025/26 season, supported by the likely increase in production in the two main producing and exporting countries, Indonesia and Malaysia. In this sense, if the higher productions are confirmed, we should see a further increase in palm oil exports from these countries.

Production in Indonesia, the largest producer and exporter of palm oil, is expected to rise from 46 M tons in 2024/25 to 47.5 M tons in the 2025/26 season. This growth should allow for an increase in exports, from 22.6 M tons (2024/25) to 24 M tons (2025/26).

Regarding Malaysia, the second largest producer and exporter, the trend is for production to rise from 18.7 M tons to 19.2 M tons, which should allow exports to rise from 15.4 M tons to 15.8 M tons in the new season.

On the demand side, we would highlight the strong growth trend in imports from India, which are expected to rise from 7.7 M tons to 8.7 M tons by 2025/26. This trend contrasts and is linked to possible lower imports of soybean oil, as mentioned above.

As with soybean, the current figures are based on full production and could still change significantly. Therefore, if palm production in Indonesia and Malaysia is lower than currently estimated, we could see significant changes in export and import figures, as well as ending stocks.

Palm Oil - World Supply and Demand - Main Countries (M Ton)

Source: USDA, Hedgepoint

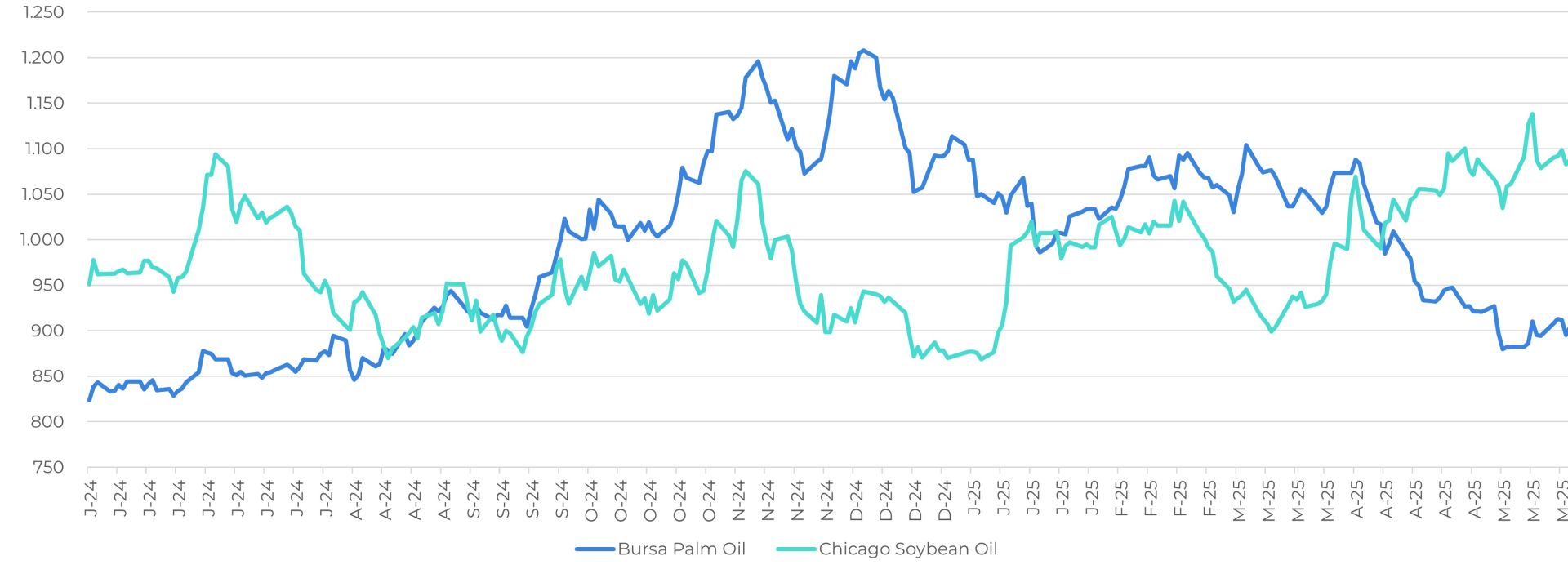

Regarding the price relationship between soybean oil and palm oil, the momentum points to a more favorable scenario for increased consumption of palm oil in the coming months, which after several months is registering prices at lower levels than the soybean-derived pair.

Prices - Soybean Oil vs Palm Oil (USD/ton)

Source: Refinitiv, Hedgepoint

Canola Oil

Canola Oil

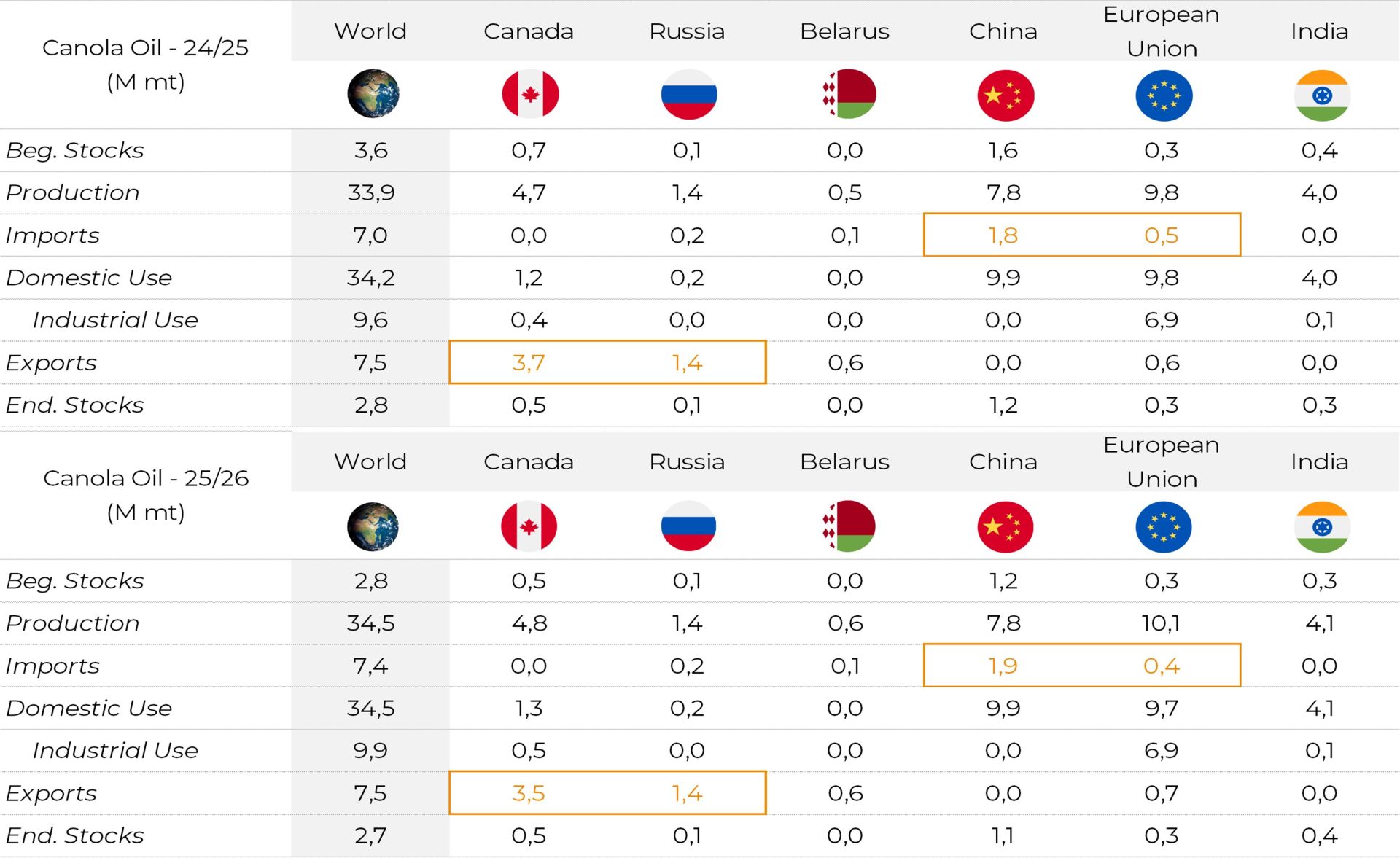

In the scenario for canola oil, initial projections for the 2025/26 season point to a very similar picture to that seen in the 2024/25 season, with few changes in the main figures.

On the supply side, there is a trend towards equal or slightly higher crops in the main producing countries: China, Canada and Russia, as well as the European Union.

Regarding exports, the highlight is the trend towards a small drop in sales to Canada, the world's largest canola oil exporting country.

World ending stocks are expected to be slightly lower than those recorded in the 2024/25 season, with no major changes.

Canola Oil - World Supply and Demand - Main Countries (M Ton)

Source: USDA, Hedgepoint

Sunflower Oil

Sunflower Oil

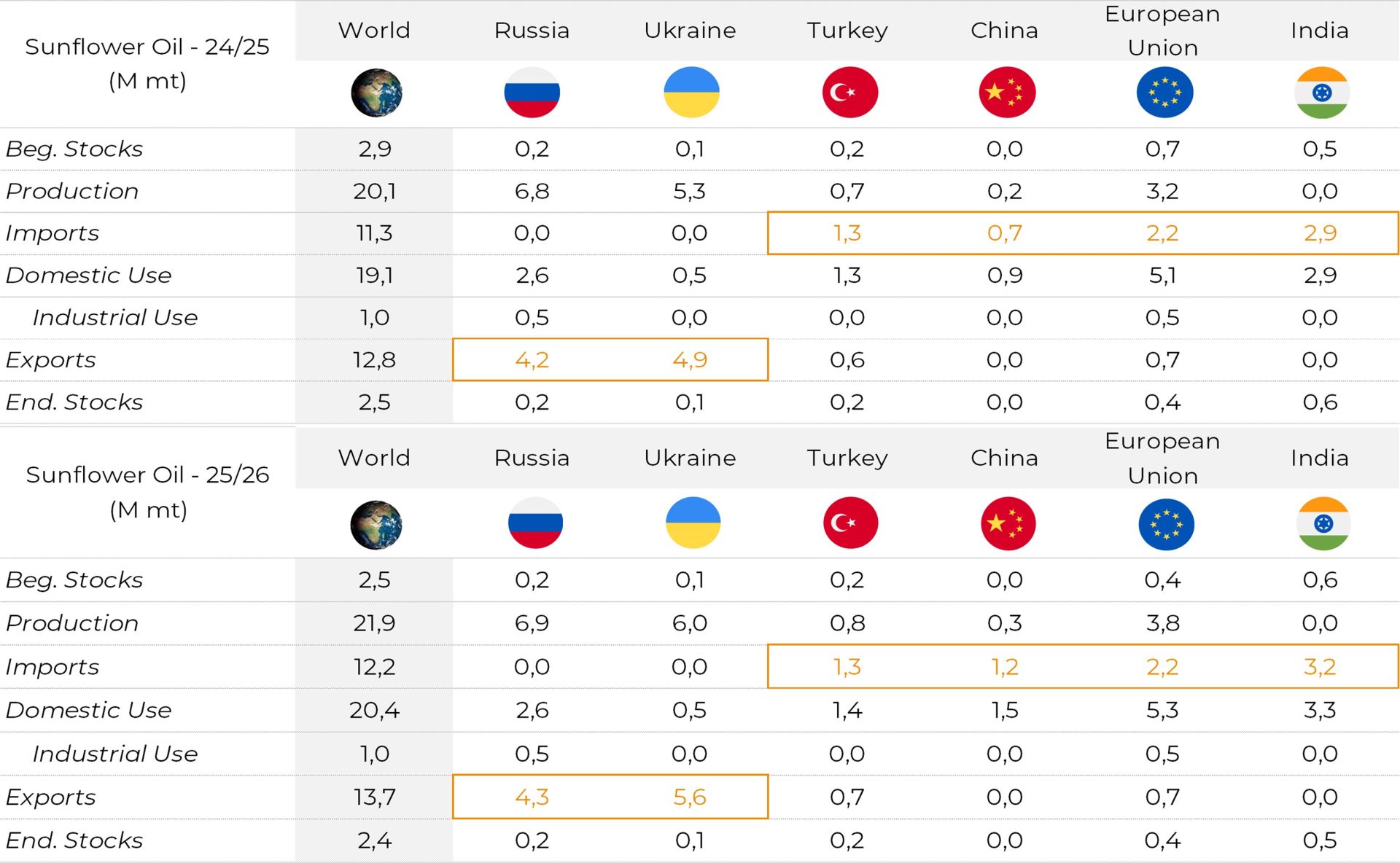

The world scenario for sunflower oil differs somewhat from other vegetable oils in that it is more influenced by the conflict between Russia and Ukraine, a fact that deserves special mention. This is because these two countries are the world's main producers of this oil, as well as naturally being the biggest exporters. Thus, the conflict affects not only production, but mainly exports from these countries, since the main route for exports is the Black Sea (a region considered key in the conflict).

In view of this, the current projections for the 2025/26 season may change even more in the coming months, depending on the course of the war, as well as the climate issue.

Current projections point to growth in Russian and Ukrainian production and a consequent increase in exports. The highlight is Ukrainian production, which is expected to increase from 5.3 M tons in the 2024/25 season to 6.0 M tons in the 2025/26 season. It's important to note that part of this growth should be due to an increase in the area sown to sunflower and part to an expected recovery from the losses recorded in 2024/25 due to the dry and hot weather that hit important producing regions in the country. With this production, Ukrainian exports should reach 5.6 M tons in 2025/26, compared to 4.9 M tons in 2024/25.

On the demand side, the trend towards greater imports by large importers/consumers such as India and China stands out.

Sunflower Oil - World Supply and Demand - Main Countries (M Ton)

Source: USDA, Hedgepoint

Market Intelligence - Grains & Oilseeds

Written by Luiz Fernando Roque

Luiz.Roque@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

Reviewed by Thais Italiani

Thais.Italiani@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products.

Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information.

The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions.

Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.

Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).

Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.

“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint.

Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.