May 2

/

Alef Dias

Grains, Oilseeds and Livestock Weekly Report - 2024 05 02

Back to main blog page

Chicharrita adds risk to Argentine Corn crop

- After a cycle marked by expectations of a recovery in Argentine corn production, the month of April brought significant concerns regarding the country's production due to a pest well known to Brazilian producers - the Chicharrita.

- During April, the Rosario Grain Exchange revised downwards its estimates for corn production in Argentina, reducing them by 6.5M mt. The Buenos Aires Grain Exchange (Bolsa de Cereales) made two cuts to its estimates this month, which amounted to a reduction of 4.5M mt.

- Despite the significant cuts, there is still room for further deterioration in estimates. Some local players are already talking about losses of around 10M mt compared to the stock exchanges' initial estimates, which could take total production below 45M mt.

- In short, South America should continue to provide support for Chicago corn, given that both the Argentine and Brazilian crops are still developing and need to be monitored.

Introduction

After a cycle marked by expectations of a recovery in Argentine corn production, the month of April brought significant concerns regarding Argentine production due to a pest well known to Brazilian producers - the Chicharrita. In this report, we'll discuss what the total impact on the crop could be and the consequences for the global corn market.

Impact of up to 10M mt

In April, the Rosario Grain Exchange revised downwards its estimates for corn production in Argentina, reducing them by 6.5M mt. This revision is mainly due to the damage caused by diseases transmitted by the leafhopper, also known as chicharrita in the region. The Buenos Aires Grain Exchange (Bolsa de Cereales) made two cuts to its estimates this month, which amounted to a reduction of 4.5M mt.

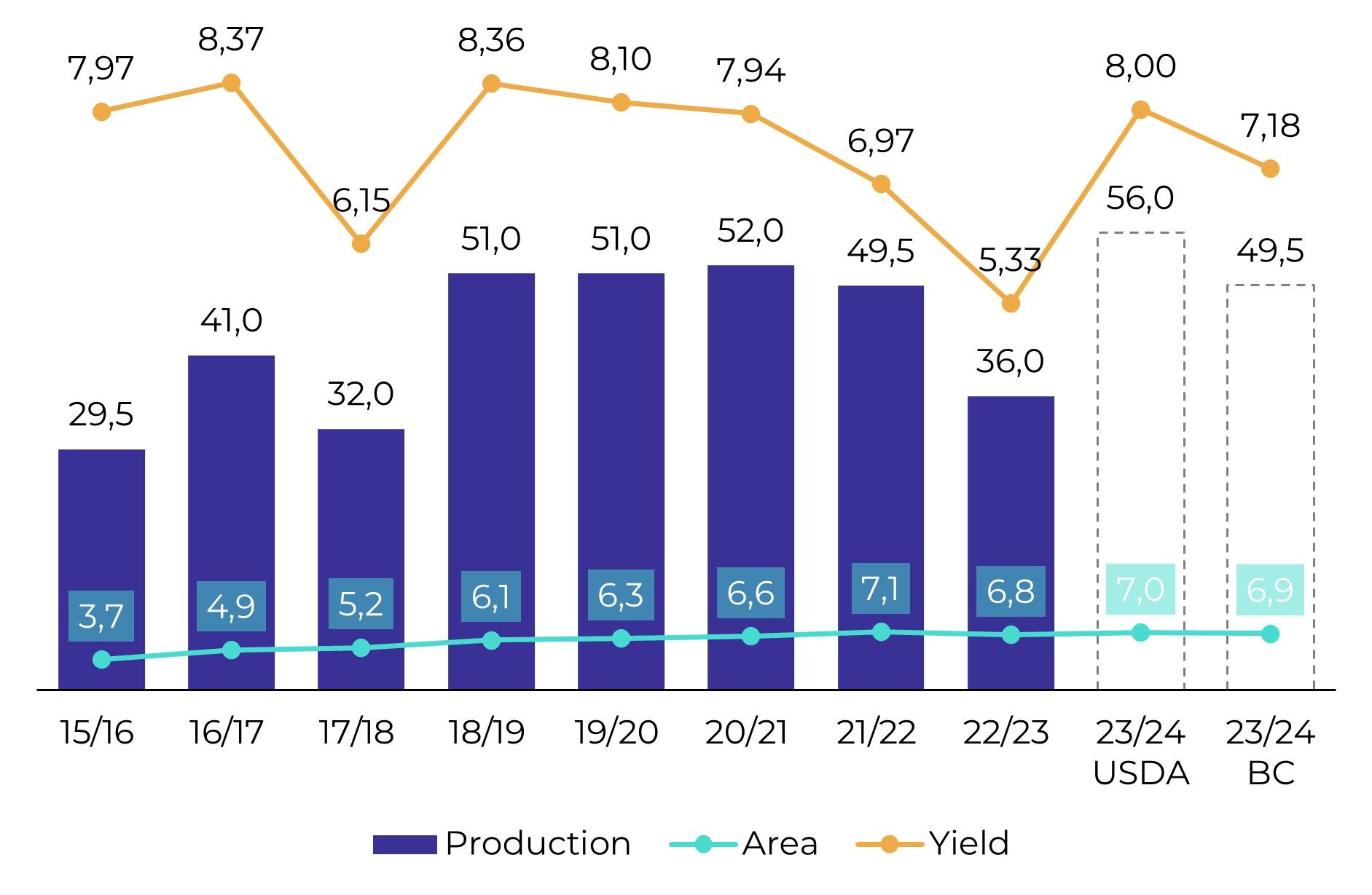

Fig. 1: Corn Argentina - Area, yield, production (M ha, ton/ha, M ton)

Source: USDA, Bolsa de Cereales

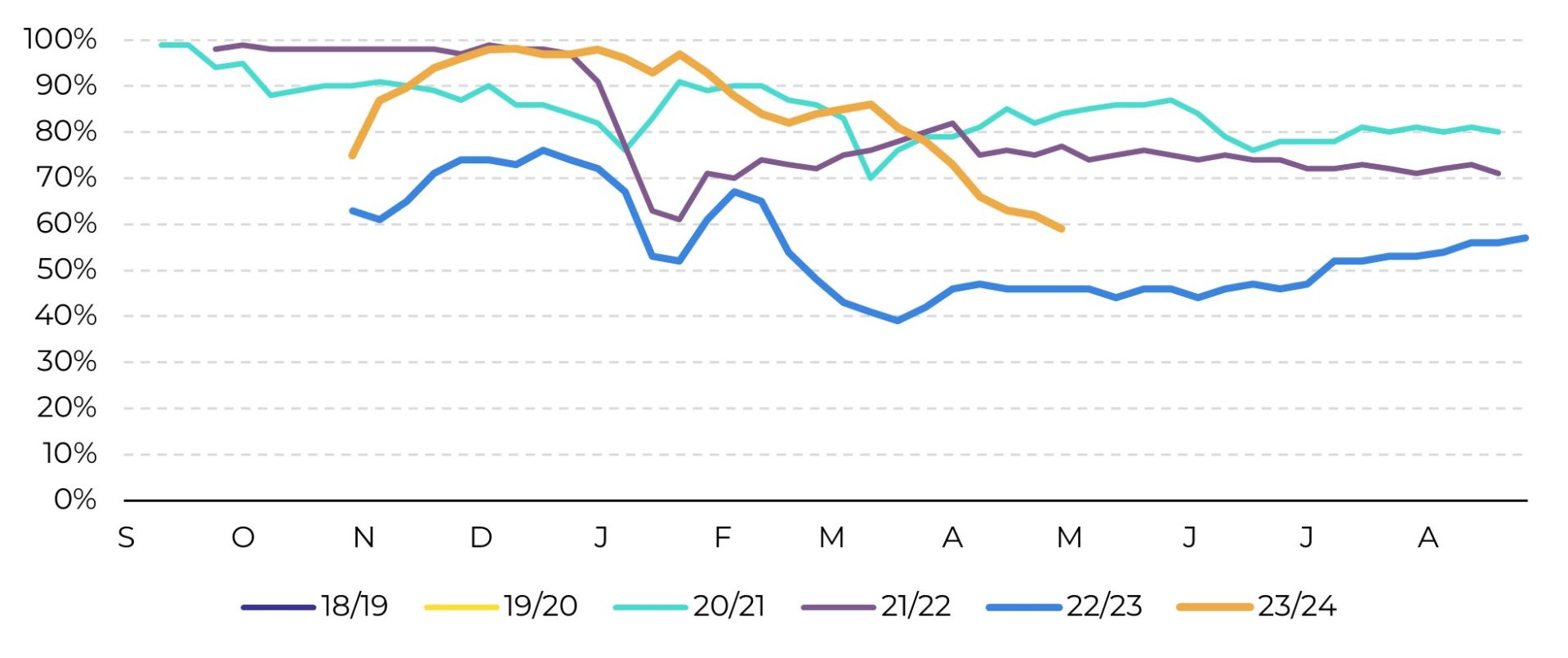

Despite the significant cuts, there is still room for further deterioration in the estimates. Harvesting is only at 19.8% of the area, and the latest crop progress report from the Bolsa de Cereales brought the percentage of good and excellent crop conditions down to below 60%.

Some local players are already talking about losses of around 10M mt compared to the initial estimates of local exchanges, which could take total production below 45M mt.

Fig. 2: Corn Argentina - Normal/excellent conditions (%)

Source: Bolsa de Cereales

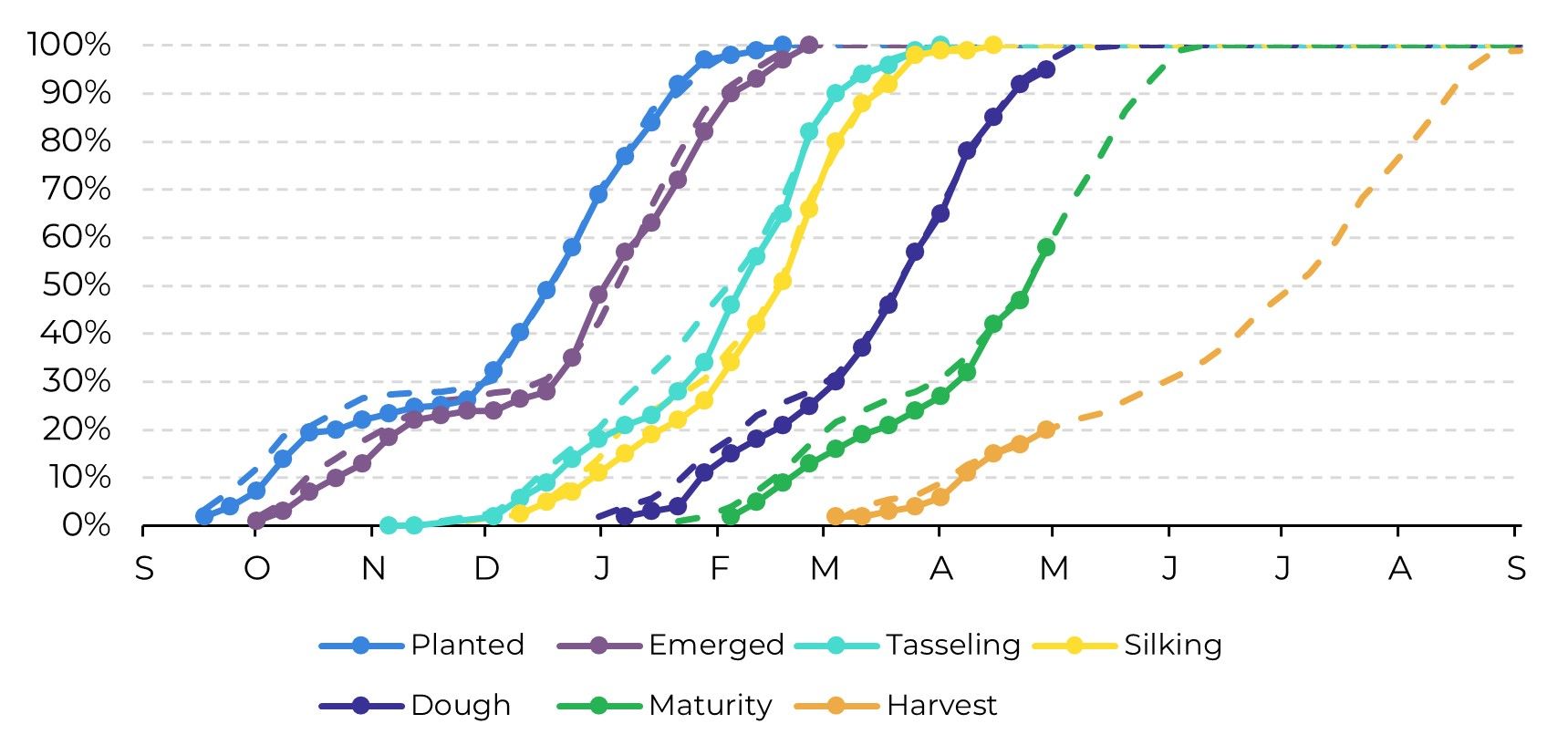

Fig. 3: Soil moisture - southern Russia (% within the top 1 meter)

Source: Bolsa de Cereales

But why was the impact so severe?

In the current crop, there has been an increase in the incidence of leafhoppers in some regions of Brazil, especially in the south of the country. This phenomenon helps explain the infestation situation observed in Argentina and Paraguay.

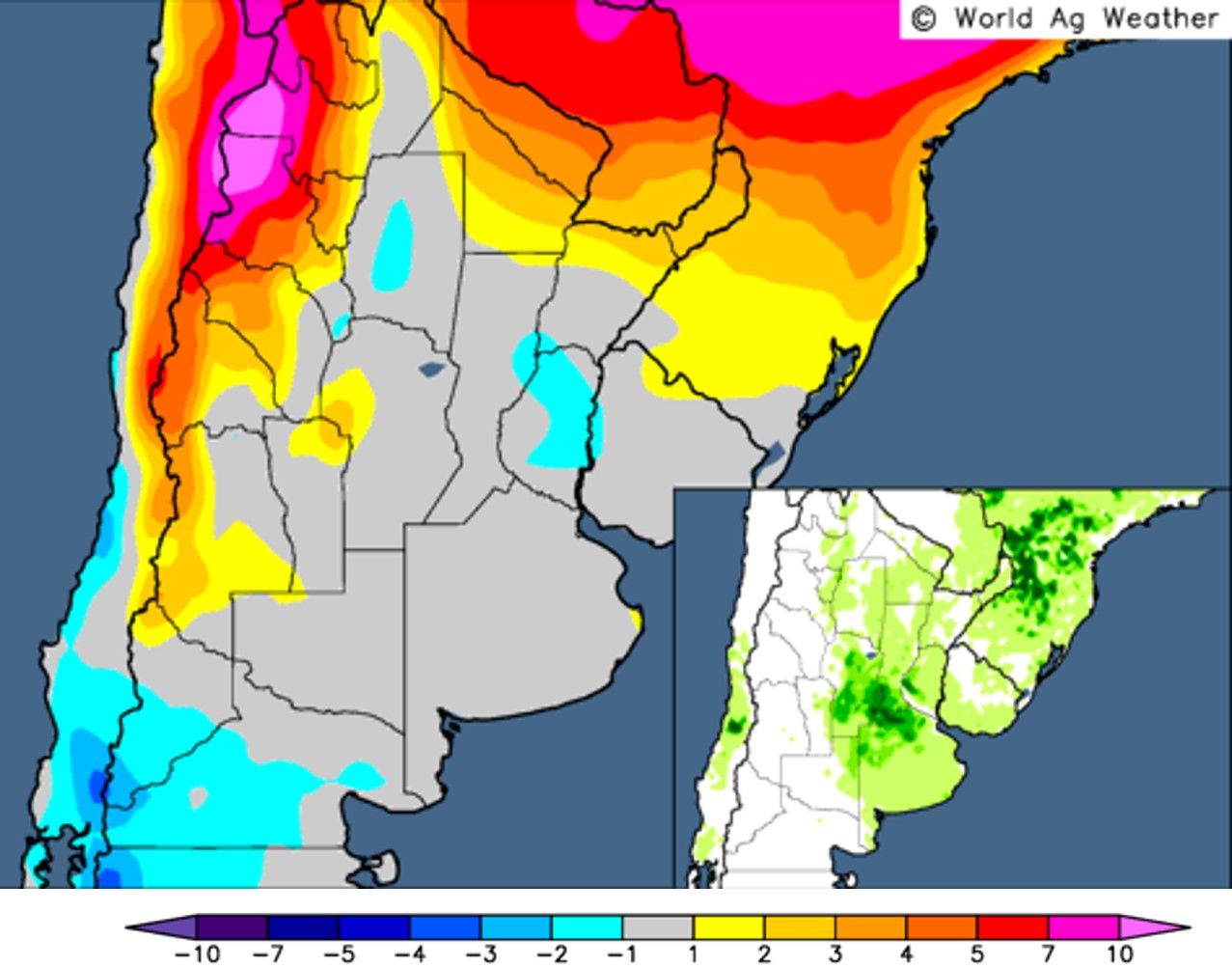

The weather has also contributed to the increase in the pest. The leafhopper is an insect whose proliferation is closely linked to climatic conditions. Due to the not so low temperatures in winter and the high relative humidity, the population of this insect tends to increase, as these factors favor its population dynamics.

The weather has also contributed to the increase in the pest. The leafhopper is an insect whose proliferation is closely linked to climatic conditions. Due to the not so low temperatures in winter and the high relative humidity, the population of this insect tends to increase, as these factors favor its population dynamics.

In addition to the increase in the number of insects in the country, another factor that contributed greatly to this problem was that the leafhopper appeared in regions where it was not common, taking local producers by surprise.

Fig. 4: Temperature observed in the last 60 days (difference from normal, ºF)

Source: WorldAgWeather (corn production shown internally)

In summary

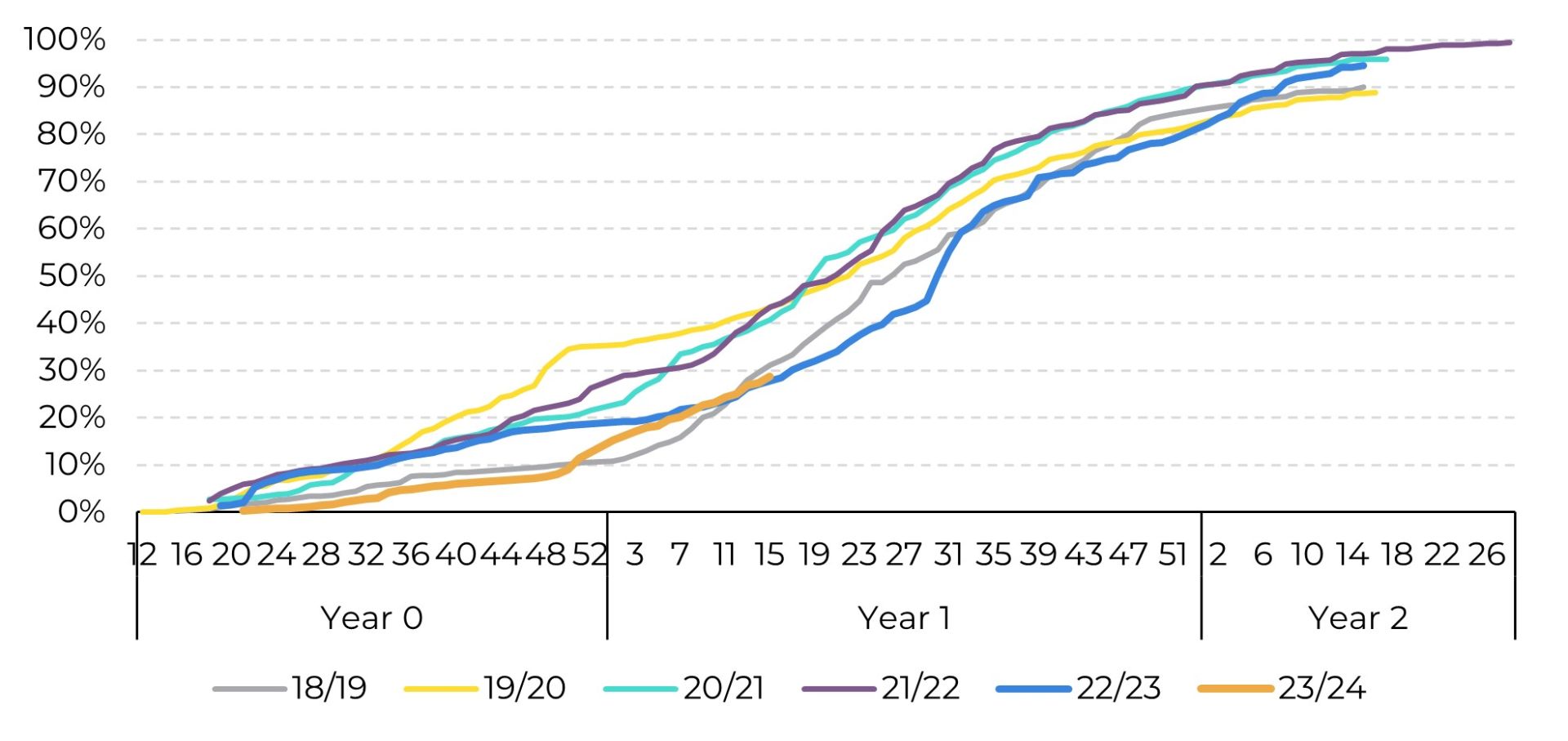

With the uncertainty surrounding the total amount of corn to be harvested, a slowdown in sales by Argentine producers can be expected, so the pace - which is still close to the lows of the last five years - is under threat. In addition to the slow pace of sales, the percentage of sales with fixed price is also below the levels seen in previous seasons, a clear sign of a more uncertain scenario.

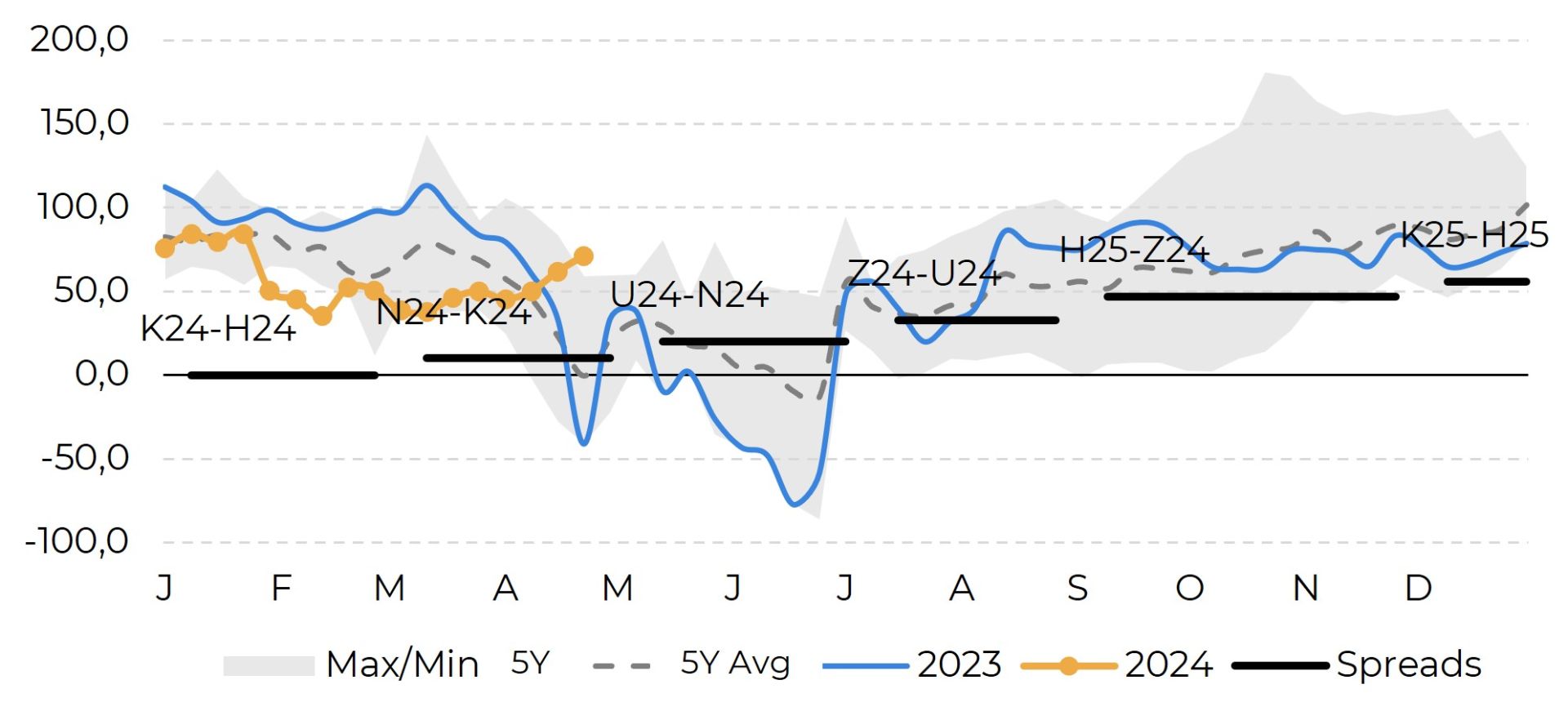

And demand for Argentine corn should also contribute to this scenario of the country's lower participation in global trade, given that local prices have already been heavily impacted by the "plague", with the basis in Argentina reaching the highest levels in the last five years. And the expectation of additional production cuts should support them for the next few months.

The macroeconomic side may alter this scenario a little, but the spread between the parallel and official exchange rates has not moved much in recent weeks, and today it is much lower than at the end of last year, so new devaluations tends to have less impact.

The repercussions of this problem could also extend to the next crop, which will begin to be sown in Argentina between August and September this year. Argentine producers may opt to reduce the area planted, given that there is no effective technological solution to combat the leafhopper. In short, South America should continue to provide support for Chicago Corn, given that both the Argentine and Brazilian crops are developing and need to be monitored.

The repercussions of this problem could also extend to the next crop, which will begin to be sown in Argentina between August and September this year. Argentine producers may opt to reduce the area planted, given that there is no effective technological solution to combat the leafhopper. In short, South America should continue to provide support for Chicago Corn, given that both the Argentine and Brazilian crops are developing and need to be monitored.

Fig. 5: Corn Argentina - Farmer Selling (%)

Source: MAGyP

Fig. 6: Corn Basis - Upriver, Argentina (USDc/bu)

Source: hEDGEpoint Global Markets, CME, ESALQ

Source: USDA

Weekly Report — Grains and Oilseeds

Written by Alef Dias

alef.dias@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.