Jul 4

/

Ignacio Espinola

Grains, Oilseeds and Livestock Weekly Report - 2024 07 04

Back to main blog page

Soybeans Outlook

- The soybean market has continued the bearish trend that started last month in CBOT, hitting a 4y low due to an oversold wave that came after the last US Acreage report and US planting report.

- As a reference, the average price of soybeans for June23 was 14.4 cts/bu versus a current average of 11.7 cts/bu.

- South America's dominance in the export market remains intact despite a recent surge of U.S. exports, as China's dependency on Brazil crops grows stronger with its harvest season now complete.

Introduction

The soybean market has continued the bearish trend that started last month in CBOT, hitting a 4y low due to an oversold wave that came after the last weekUS Acreage report and US planting report. This bearish trend has been reflected in the CBOT prices, where last year at this point in time we were looking at prices around 14.4 cts/bu whereas today we have 11.7 cts/bu as an average.

U.S. farmers have planted +3% more soybeans this year increasing the expectation of a bigger harvest. On the other hand, the acreage report came out last week presenting a decrease in the area from 86.5 M ha to 86.1 M ha. The crop's critical growing period is usually in August, so there's still some uncertainty about the production.

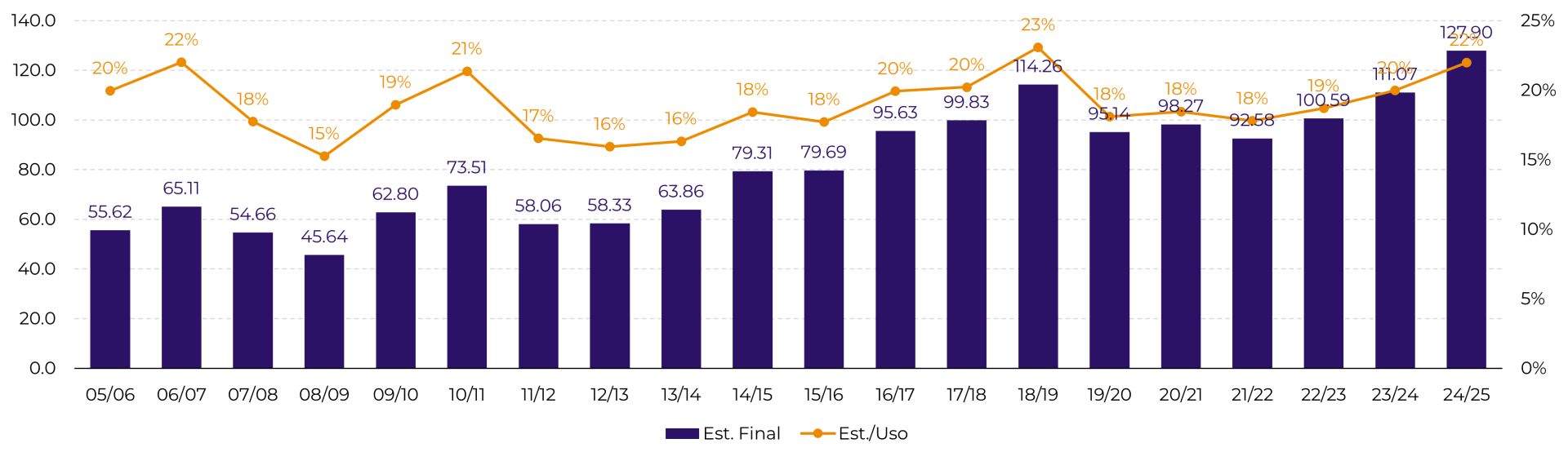

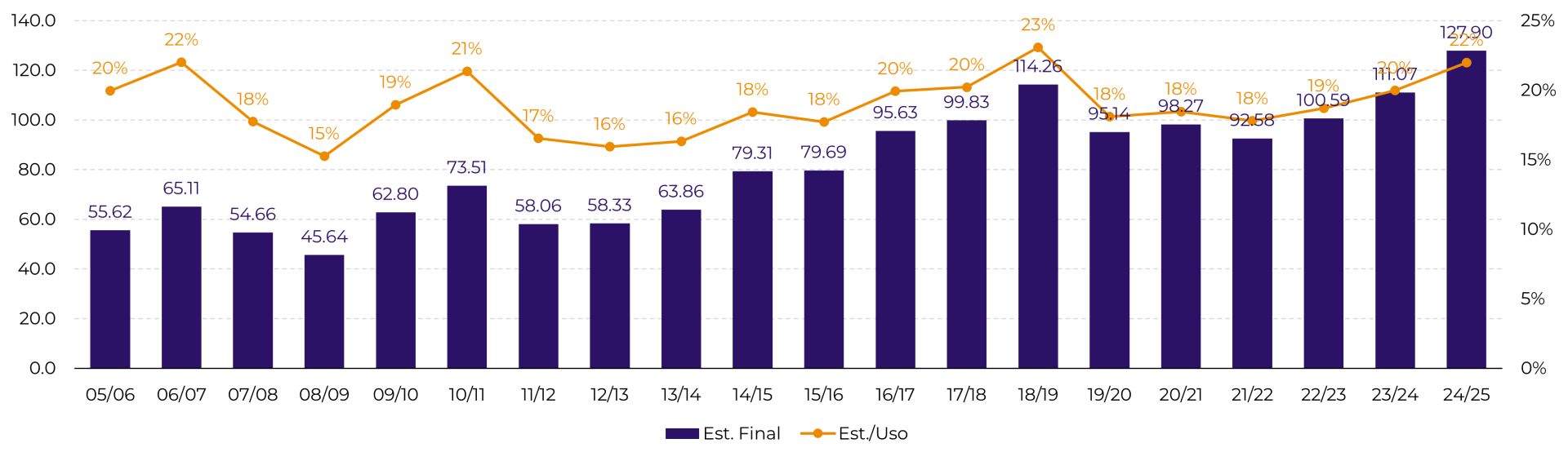

Soy World Stocks and Stocks to use (M ton, %)

Source: USDA

US Farmers.

The US farmer has been reluctant to sell his crop due to low prices. They are trying to hold and stock the grain to win some time and hopefully achieve higher prices. This is a usual tactic for any farmer.

As of June, 48% of the US soybean production was held on farms. This is the largest percentage for that time of year since 2006 and significantly higher than the 10-year average of 35%.

Their intention is clear: put some pressure on the product availability so that the local prices can increase.. Unfortunately for the US farmer, China has been very active, buying almost every week two cargoes of 55k Mt, mostly from Brazilian origin.

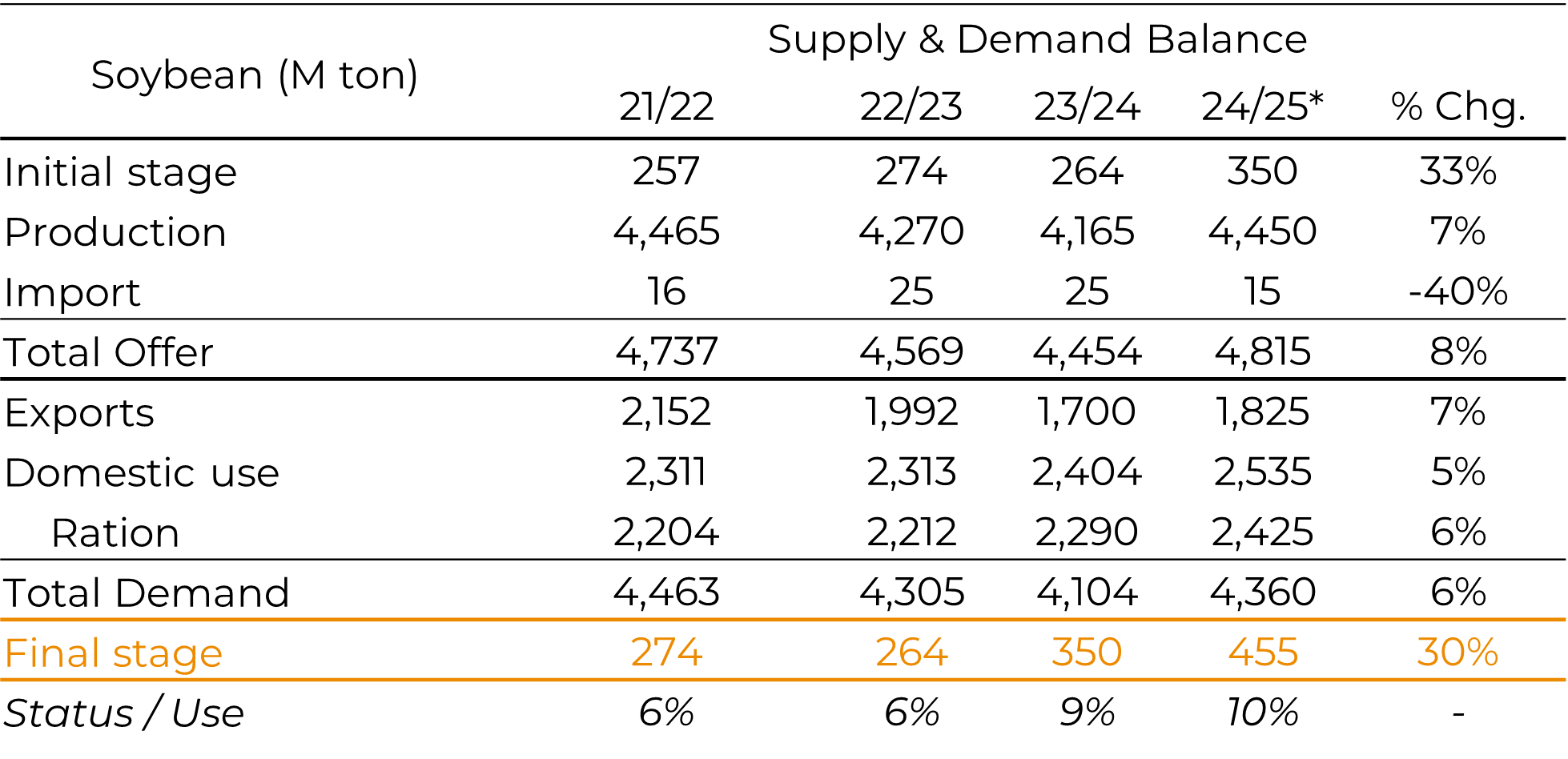

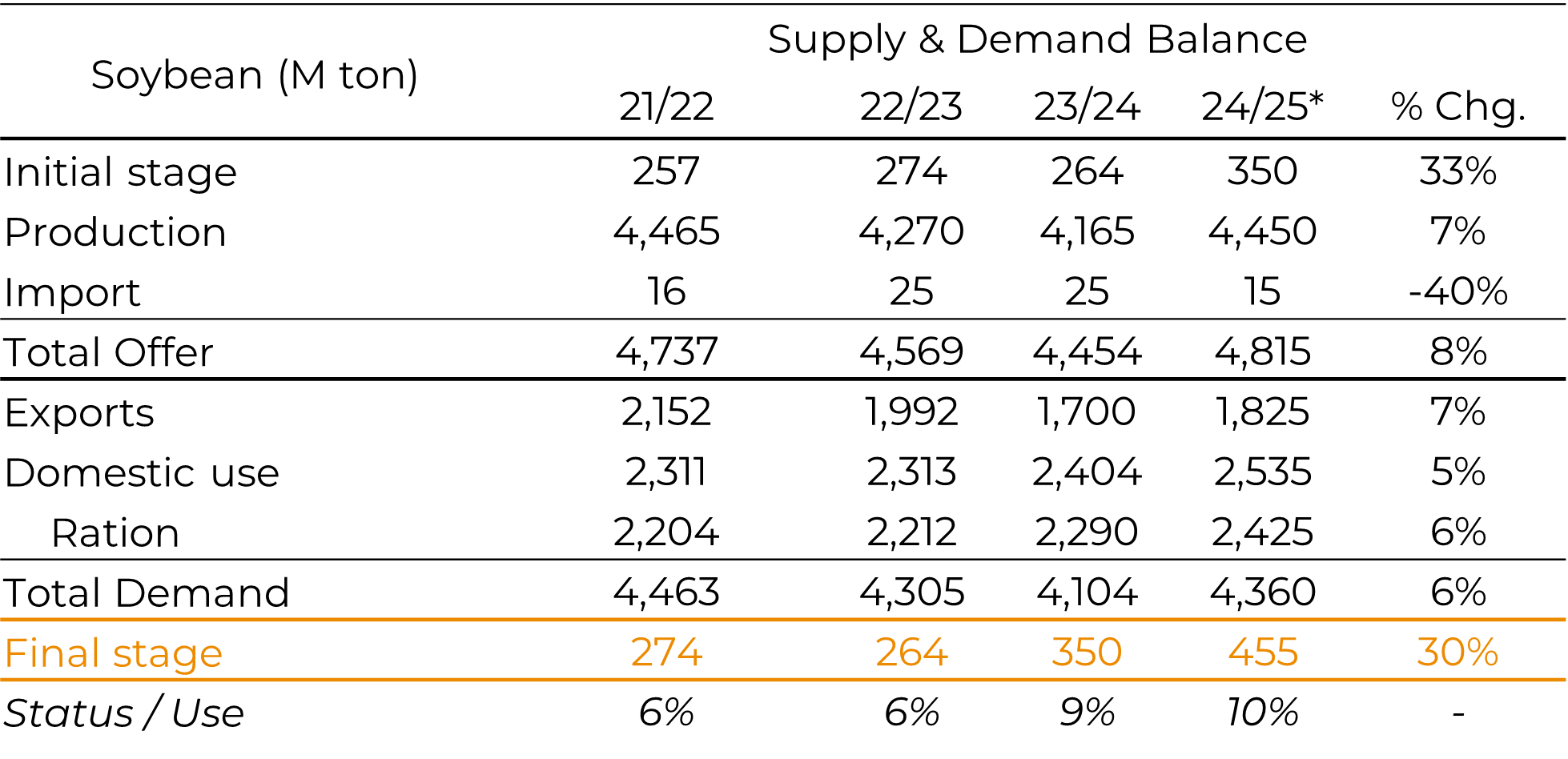

Supply and Demand Balance - Soybean USA

Source: USDA

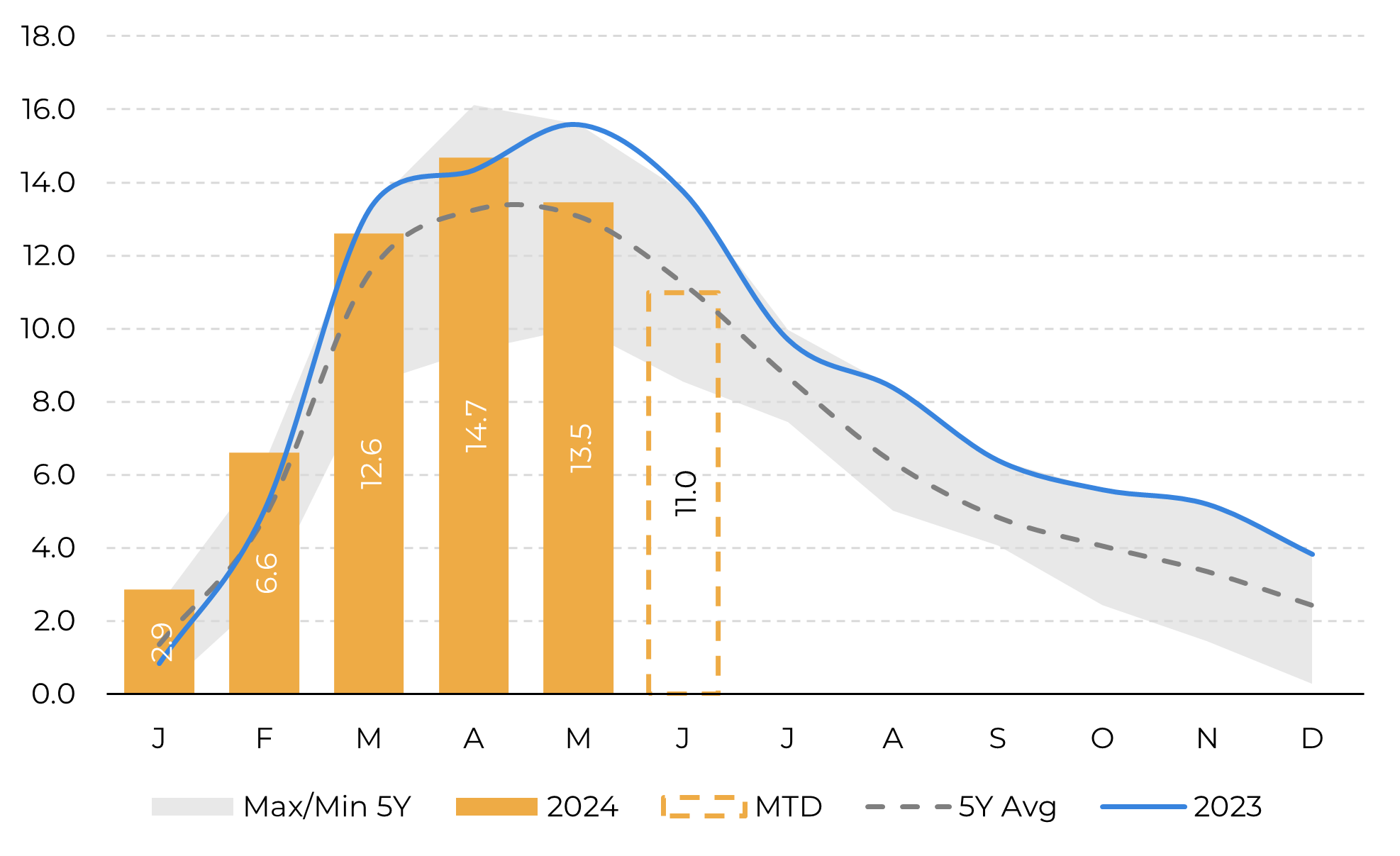

The current FOB market is benefiting Brazilian beans even though we are entering the last part of the export window for soybeans. July is the historical switching month in which Corn starts gaining space in detriment of soybeans.

China has had a good appetite for Brazilian soybeans this year, as they build stocks in case there is another economic war with US (supported by the threat of Trump being back in the white house) and also encouraged by the good brasil FOB prices.

This increase in Brazilian origin grains has also reduced the number of cargoes that the Asian Giant buys from US. For the US to be competitive again, specially on the last months of the year, the US premiums should go down so that the prices remains attractive, or the competitors should increase the prices, which usually is what happens considering that by that time of the year Brazil and Argentina are exporting Corn mainly.

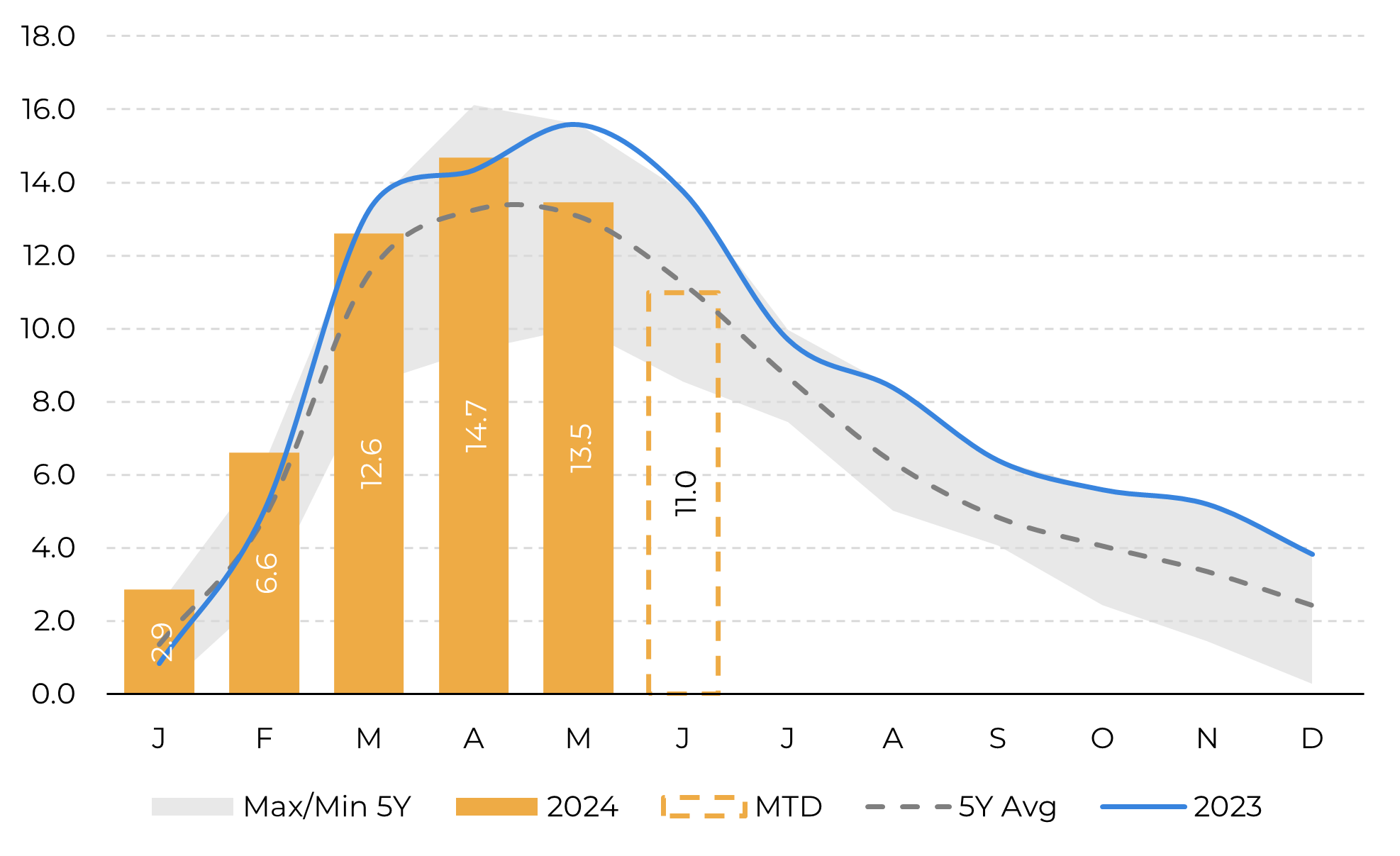

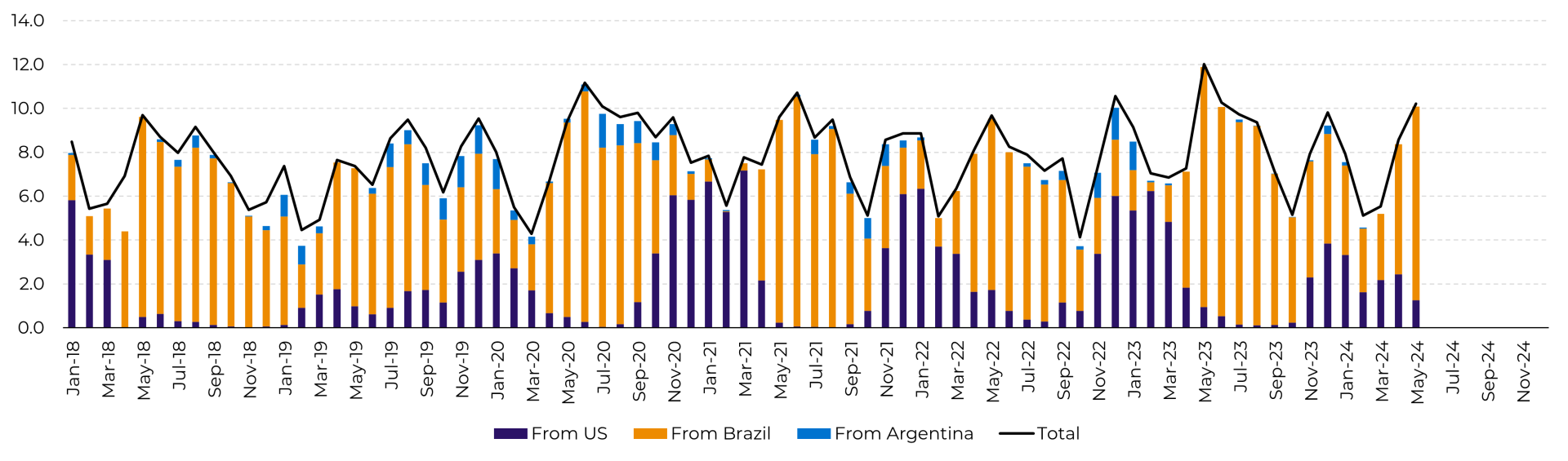

Brazil Soybean - Monthly Exports (M mt)

Source: USDA

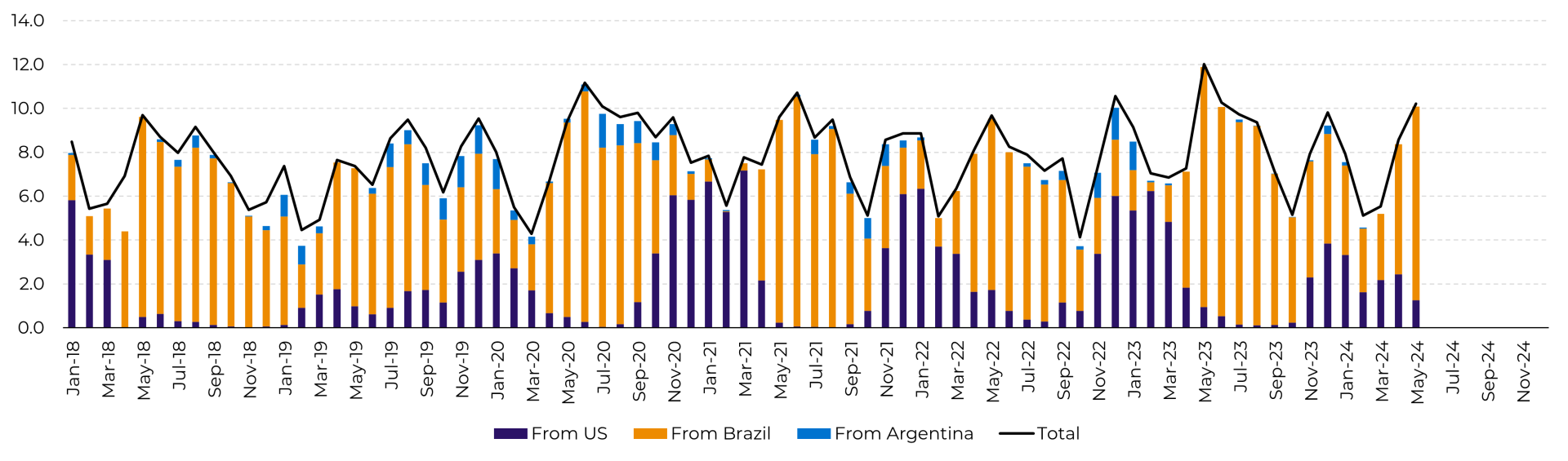

Soybean China – Monthly Imports (M mt)

Source: USDA

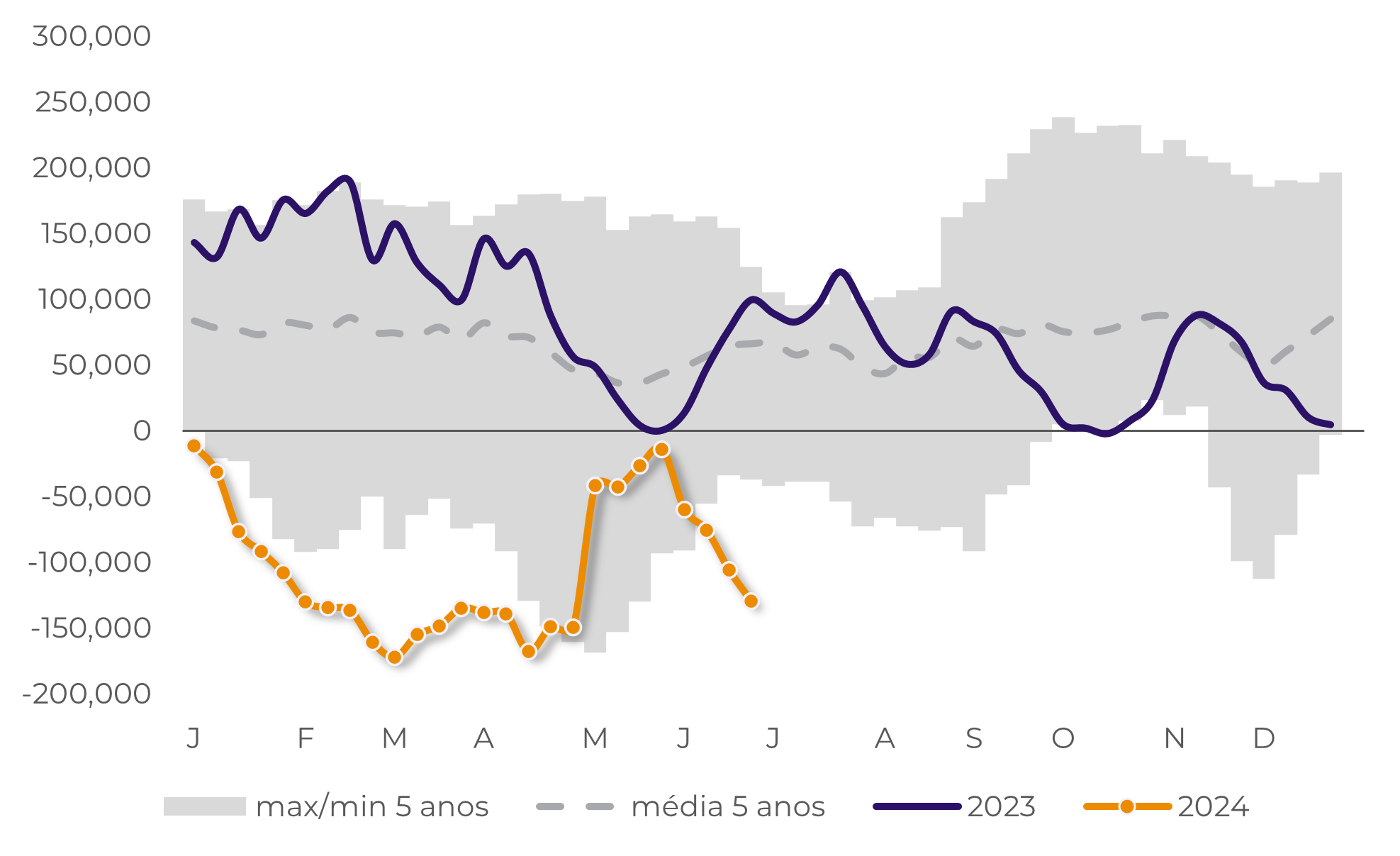

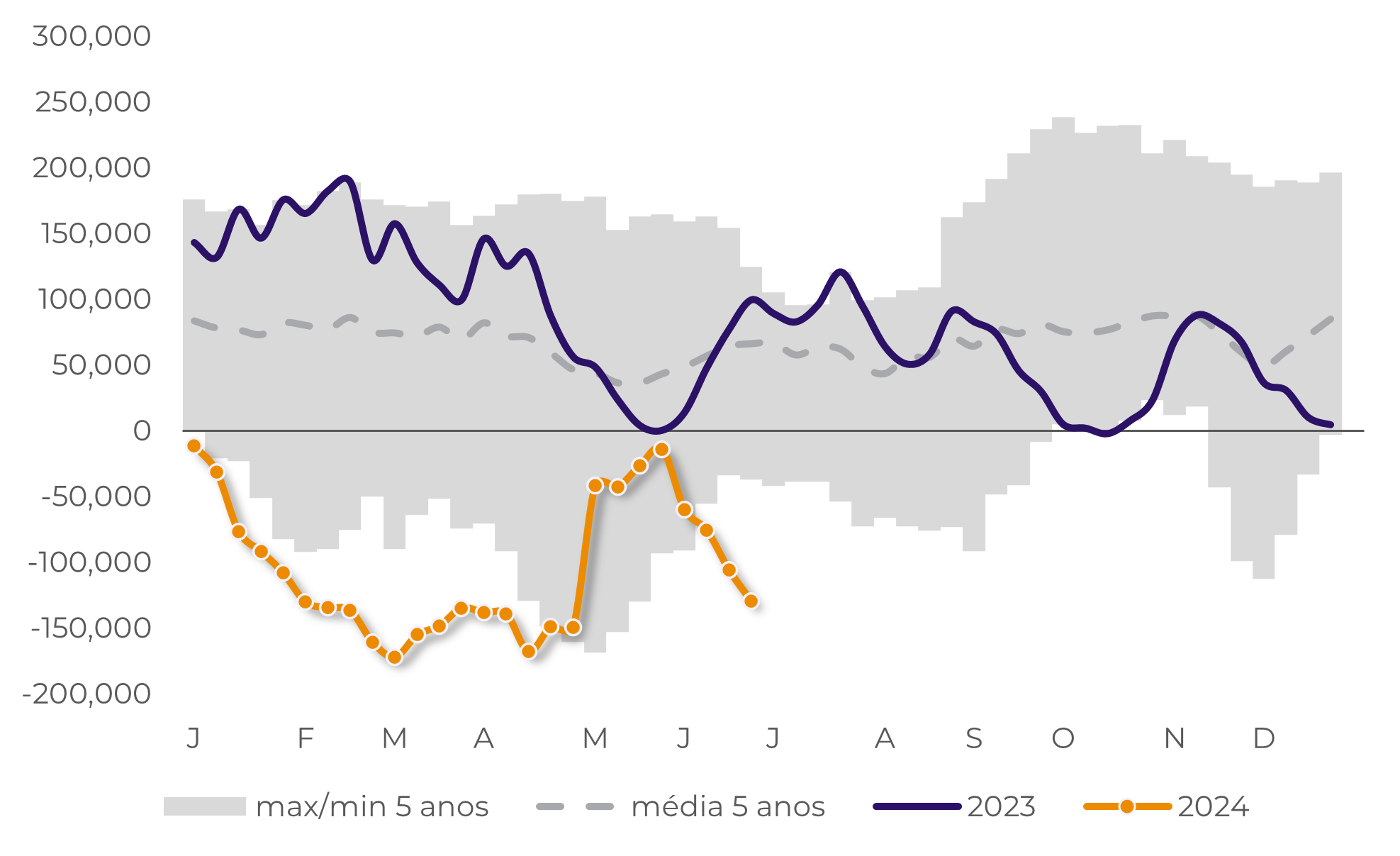

Funds activity

Looking at the last COT report, there are 140k contracts short as per the last update. This position is out of scale considering the last 5y min/max which indicates a Strong bearish view from the market.

It wouldn't be a surprise that some profit taking is being done during the week which could take us closer to the 30-50k short area, which is the minimum considering the last 5 years.

Clearly, funds and money managers believe there is still room for the market prices to decrease, which would be against farmers' interests. We'll have to see who's right or wrong in the coming weeks.

Money Managers – Net Position (lots)

Accumulated Precipitation Monthly Anomaly (inches) Jun-Aug

Source: CFTC

Conclusions

As a conclusion, we have an overall market flooded with beans. The US farmers holding the physical with hope that the prices can increase and only selling the minimum to keep the shop open.

On the Other side, Brazil is finishing its export window for beans and starting the corn window, which is great news for the US as they can start adding beans sales into their book, specially after November.

Finally, funds have been very aggressive with their short position, there should/could be some profit taking action in which the position should be reduced. Right now the short is too big and a reduction could help the prices bounce back. Last week we touched the 4 years low and that could also work as a resistance level for now... At least until we see any other bearish news.

Introduction

The soybean market has continued the bearish trend that started last month in CBOT, hitting a 4y low due to an oversold wave that came after the last weekUS Acreage report and US planting report. This bearish trend has been reflected in the CBOT prices, where last year at this point in time we were looking at prices around 14.4 cts/bu whereas today we have 11.7 cts/bu as an average.

U.S. farmers have planted +3% more soybeans this year increasing the expectation of a bigger harvest. On the other hand, the acreage report came out last week presenting a decrease in the area from 86.5 M ha to 86.1 M ha. The crop's critical growing period is usually in August, so there's still some uncertainty about the production.

Soy World Stocks and Stocks to use (M ton, %)

Source: USDA

US Farmers.

The US farmer has been reluctant to sell his crop due to low prices. They are trying to hold and stock the grain to win some time and hopefully achieve higher prices. This is a usual tactic for any farmer.

As of June, 48% of the US soybean production was held on farms. This is the largest percentage for that time of year since 2006 and significantly higher than the 10-year average of 35%.

Their intention is clear: put some pressure on the product availability so that the local prices can increase.. Unfortunately for the US farmer, China has been very active, buying almost every week two cargoes of 55k Mt, mostly from Brazilian origin.

Supply and Demand Balance - Soybean USA

Source: USDA

The current FOB market is benefiting Brazilian beans even though we are entering the last part of the export window for soybeans. July is the historical switching month in which Corn starts gaining space in detriment of soybeans.

China has had a good appetite for Brazilian soybeans this year, as they build stocks in case there is another economic war with US (supported by the threat of Trump being back in the white house) and also encouraged by the good brasil FOB prices.

This increase in Brazilian origin grains has also reduced the number of cargoes that the Asian Giant buys from US. For the US to be competitive again, specially on the last months of the year, the US premiums should go down so that the prices remains attractive, or the competitors should increase the prices, which usually is what happens considering that by that time of the year Brazil and Argentina are exporting Corn mainly.

Brazil Soybean - Monthly Exports (M mt)

Source: USDA

Soybean China – Monthly Imports (M mt)

Funds activity

Looking at the last COT report, there are 140k contracts short as per the last update. This position is out of scale considering the last 5y min/max which indicates a Strong bearish view from the market.

It wouldn't be a surprise that some profit taking is being done during the week which could take us closer to the 30-50k short area, which is the minimum considering the last 5 years.

Clearly, funds and money managers believe there is still room for the market prices to decrease, which would be against farmers' interests. We'll have to see who's right or wrong in the coming weeks.

Money Managers – Net Position (lots)

Accumulated Precipitation Monthly Anomaly (inches) Jun-Aug

Source: CFTC

Conclusions

As a conclusion, we have an overall market flooded with beans. The US farmers holding the physical with hope that the prices can increase and only selling the minimum to keep the shop open.

On the Other side, Brazil is finishing its export window for beans and starting the corn window, which is great news for the US as they can start adding beans sales into their book, specially after November.

Finally, funds have been very aggressive with their short position, there should/could be some profit taking action in which the position should be reduced. Right now the short is too big and a reduction could help the prices bounce back. Last week we touched the 4 years low and that could also work as a resistance level for now... At least until we see any other bearish news.

Weekly Report — Grains and Oilseeds

Written by Ignacio Espinola

alef.dias@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

hedgepointhub.ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@Hedgepointglobal.com) or 0800-8788408/ouvidoria@Hedgepointglobal.com (only for customers in Brazil).