Aug 16

/

Ignacio Espinola

How much soybean is available in Brazil?

Back to main blog page

How much soybean is available in Brazil?

* Brazilian crushers have covered for the next 2 months of crushing.

* They will have to increase their purchase pace up to almost double versus previous years in order to cover their stock needs until the end of the year.

* Local Soybean prices should get more pressure, make it more attractive to sell Soybean for local crushers rather than for the export market.

In order to maintain the projected crushing pace, crushers will have to be more aggressive on their purchases or run the risk of having less emergency stock levels.

* The overall scenario for second half of the year: strong local basis.

Current situation

Analyzing the numbers published by the Abiove (National Brazilian Association for the Oilseeds Industry), we can get to some conclusions relating to the pace of crushing of soybeans, the level of stocks and the activity that could help us explain what is going to happen with the Soybeans local prices in the coming months.

Before we start, let’s take into consideration that for this study we will be using the average of the last 3 years as a proxy for the numbers that we need to project what is likely going to happen in the near future.

The Brazilian soybeans market has been exporting a lot over the past months. China has been very active, buying a lot of beans from Brazil due to a building stock policy. China has been very active in the market, continuing its stock building policy.

How that affects Brazil local market? Should local prices go up? Until when the crushers have stocks to use? Let’s try to figure it out.

Beans availability, crushing numbers and more

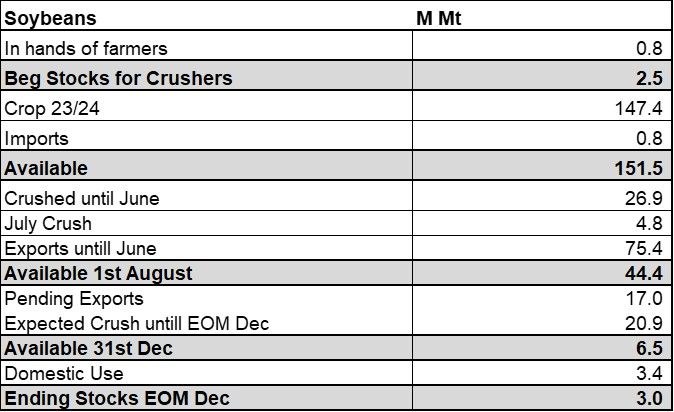

According to Abiove, until the end of June, Brazil has crushed 26.9 M mt of soybeans. In order to determine the crushing number for July, we will consider the average of the last 3 years, which is equal to 4.8 M mt. That leaves us to a total of 31.7 M mt soybeans crushed by the end of July, second biggest number since 2017.

Regarding the export numbers, Brazil has already exported a total of 75.4 M mt until July. We are going to assume that Brazil will export a total of 92.4 M mt which is the same number than CONAB printed on its last report. Brazil should export 17 M mt of Soybeans in the rest of the 2024 in order to match with the CONAB’s number.

Considering all the previously mentioned numbers, we get to the conclusion that as per the 1st of August there were 44.4 M mt of Soybeans available in Brazil.

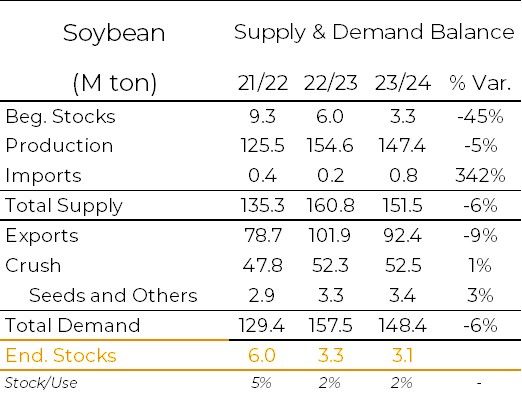

Brazilian Soybean Supply & Demand Balance - CONAB

Source: CONAB

How much Soybeans the crushers have available?

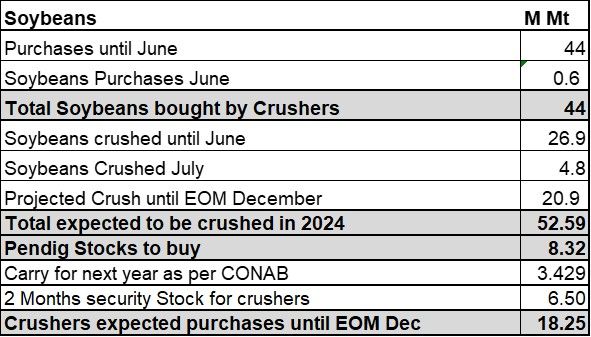

If we consider that according to Abiove the crushers have bought until end of June a total of 39.6 Mmt and we consider purchases for July for a total of 0.6 M mt (taking the average of the last 3y), that means that the crushers have bought until end of July a total of 40.2 M mt.

Following to that reasoning, we have concluded that the total crushing by the end of July would be 31.7 M mt (26.9 M mt until June plus 4.8 M mt for July) which means that the crushers still have around 8.5 M mt of beans available for crush (40.2 M mt purchases – 31.7 M mt crushed).

If we project from August to December, we should have 20.9 M mt crushed, or what is equivalent, a total of 4.19 M mt crushed per month. Considering the 8.5 M mt of stock, this means that crushers are covered for the next 2 months. This also means that in order to get until the last day of December and cover it’s crushing needs, the industry will need some extra 12.4 M mt to cover their crushing needs and they probably are now buying for Oct-Nov-Dec, and if we add a 2 months security stock, the number goes back to 20.9 M mt.

SyD Balance

Source: ABIOVE – CONAB - Hedgepoint

What is going to happen in the near future with Brazilian beans basis?

It is clear that each crusher has its own strategy. Some will be buying with 2-3 months anticipation; others could be looking at a wider or a ticker window. Regardless of the strategy, the industry as a whole in Brazil is covered for almost 2 months forward.

Considering the buying pace of the previous 3y, in which during the second half of the year the industry was buying at an average pace of 1.8 M mt per month, that would give us a total of 8.9 M mt, which is not enough to cover for the 12.4 M mt that the industry will need to match their crushing expected numbers and it’s not enough to cover the crushing plus the security stock. On top of that, we need to consider some carry stock for the next year. If we assume CONAB’s numbers, the carry should be around 3.1 M mt.

Finally, if we consider than the crushers use a stock policy of 2 months of stocks for their crushing plants, and we take the average of the last 3y for the crushing activity in Jan-Feb, that gives us a total of 3.25 Mmt each month. Therefore, crushers should be buying a total of 20.9 Mmt from now until the end of the year, that is almost 2.5 times the average of the last 3y. It’s also important to remark that 2024 has the lowest purchase pace since 2020 until June, therefore the crushers must catch up in the second half of the year in order to have the physical beans to crush.

Stocks Needs/Availability

In summary

This situation may bring some pressure into the local market prices for soybeans, which may potentially lift the prices and make it more appealing for the framers to sell soybeans for crushing than export. Considering the fact that now Brazil enters into a full corn export program pace, the raise on prices for beans to be used in crushing activities shouldn't be a surprise at all. Also, there’s Chins effect, while the Asians were buying a lot of Brazilian soybeans, it does seem like they are switching into ’ US origin beans as it normally happens by this time of the year.

All that being said, crushers will either have to be more aggressive on their purchases, or adopt a strategy of low security stocks, which are already low considering only 2 months of stock. We may potentially see some pressure on local prices due to more competition for the remaining Soybeans. Finally, there’s always the possibility than if the market gets way overpriced, crushers decide to do their annual maintenance during the second half of the year in order to adjust the plant and also to avoid crushing expensive soybeans.

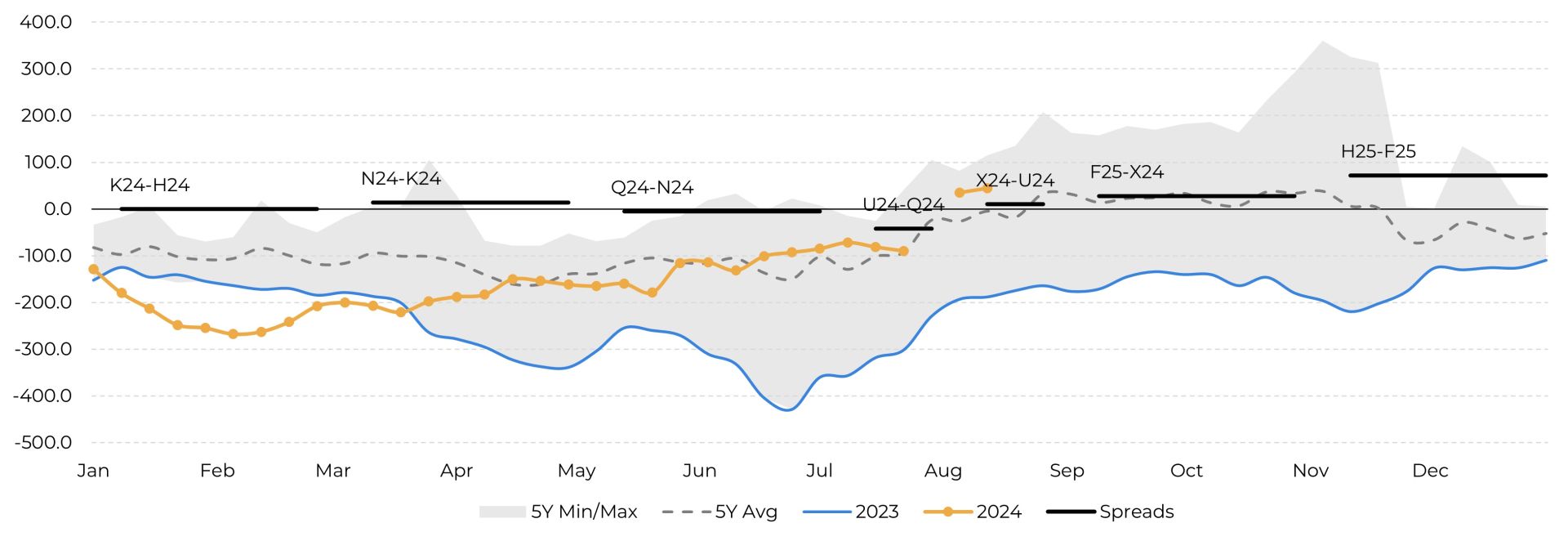

Here’s an example of the basis looking forward in Mato Grosso. Let’s wait and see..

Soybeans Basis Rondonopolis, Mato Grosso *USD/Bu(

Fonte: hEDGEpoint Global Markets, CME, ESALQ

Weekly Report — Grains and Oilseeds

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.