Sep 2

/

Ignacio Espinola

What is going to happen with Corn and Soybean prices at CBOT?

Back to main blog page

What is going to happen with Corn and Soybean prices at CBOT?

* Next US crop scenario for both, corn and soybean, is expected to be very good. Similar numbers are projected for this year’s crop for corn and great numbers for soybeans in the United States.

* On the corn side, the expectation is for a similar level in terms of production 24/25, which shall be around 385 Mmt, similar to this year, 23/24.

* On the beans side, more planted acres and better yields bring good news in terms of production. As per the last WASDE report, it is expected that the US will have a production of around 125 Mmt of soybeans, which is 10% above the previous year and one of the biggest ones ever.

Current situation

We are September, where almost all crops have ended their 23/24 calendar and everyone is looking ahead for the 24/25 crop, we have decided to analyze what is going on with the corn and soybeans prices and what could potentially affect/contribute/give us a direction on what could happen in the near future regarding CBOT prices.

According to the last WASDE report, next crop scenario for both, corn and soybean, is expected to be very good. Similar numbers are projected for this year’s crop for corn and great numbers for soybeans in US.

On the corn side, the expectation is for a similar level in terms of production, with around 385 Mmt, similar to the 23/24 campaign. This 385 Mmt is explained by a better yield number and a smaller planted acreage.

On the beans side, more planted acres and better yields bring good news in terms of production. As per the last WASDE report, it is expected than the US will have a production of around 125 Mmt of soybeans, which is 10% above the previous year and one of the biggest ones ever.

Now, lets see how this is going to affect both Supply & Demand and prices in the near future.

Corn S&D, Price movements and more

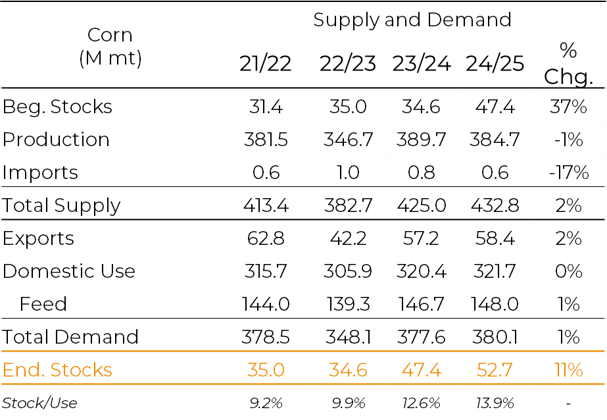

When we look at the corn side, according to the USDA, the production is going to fall 1% in the USA versus the previous campaign, which represents 5 Mmt. Another factor to take into consideration is the carry out from 23/24, which is estimated to be 47.4 Mmt (+13.2 Mmt versus 23/24 initial stock). All that considered, the total supply number will come at 432.8 Mmt, which is 2% bigger than the 23/24 campaign.

When we look at the demand side, we expect a small increase on the export and feed consumption too, leaving the total demand at 380.1 Mmt, only a 1% increase Year-over-Year. Finally, the ending stocks are going to continue growing, this time finishing the 24/25 campaign at 52.7 Mmt, which is 11% more versus the previous year and also represents a 13.9% stocks/use ratio. This ratio is telling us than the US will end the 24/25 campaign with a ‘buffer’ that can cover up to 14% of their total needs.

US Corn Supply & Demand Balance

Source: USDA

How does the US S&D numbers can affect the CBOT Corn prices?

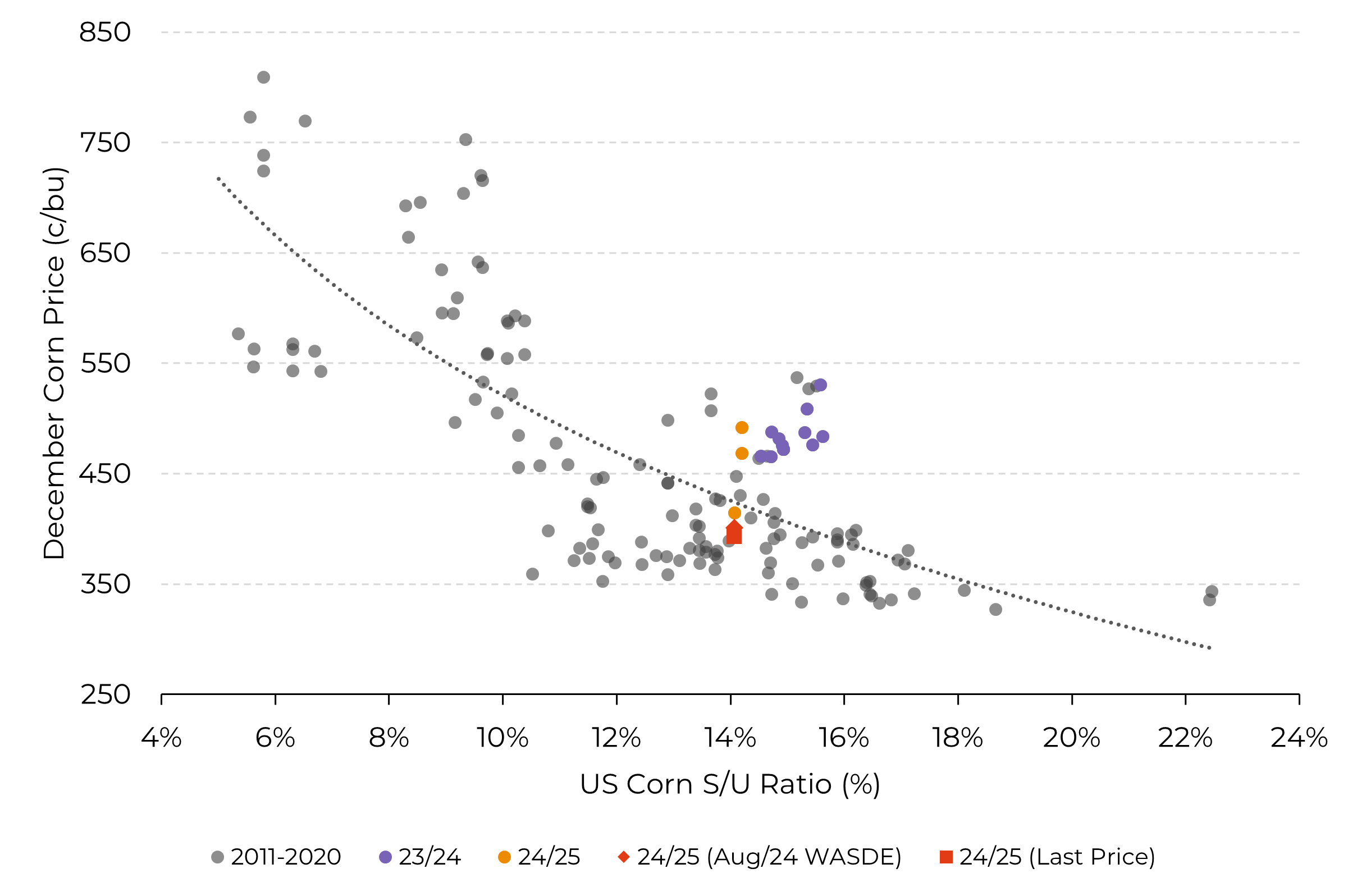

Taking into consideration the numbers that we were mentioning before, with a very good production level, a better than last year number on the supply side, a stable demand and a growing number, again, for the ending stocks, we get to the conclusion that the stocks/use ratio is going to be almost 2% bigger than the previous year.

If we look Price x Stock/Use graph, where we are comparing on one side, the CBOT prices for December corn contract and on the other side, the Stock/Use ratio for US Corn, we get to the conclusion that right now and for the 24/25 campaign we are on a good/fair spot, where we are located close to the trend line at 393 cts/bu for the 13% Stock/Use ratio level. The idea behind this study is to identify if either the US is not keeping too much grain that is overpriced or under priced depending on the red dot location in our graph.

It does seem that when the US keeps a Stock/Use ratio between 5%-7%, the market is more volatile, leaving almost half of the years above and the other half below the average line. Another interesting conclusion is that almost all the times the US has kept 9-10% of stocks/use, the market price was above the trend meaning the stocks where overpriced.

CBOT Corn Prices vs. Stock/Use in the US

Source: Reuters, USDA, Hedgepoint

What about Soybeans?

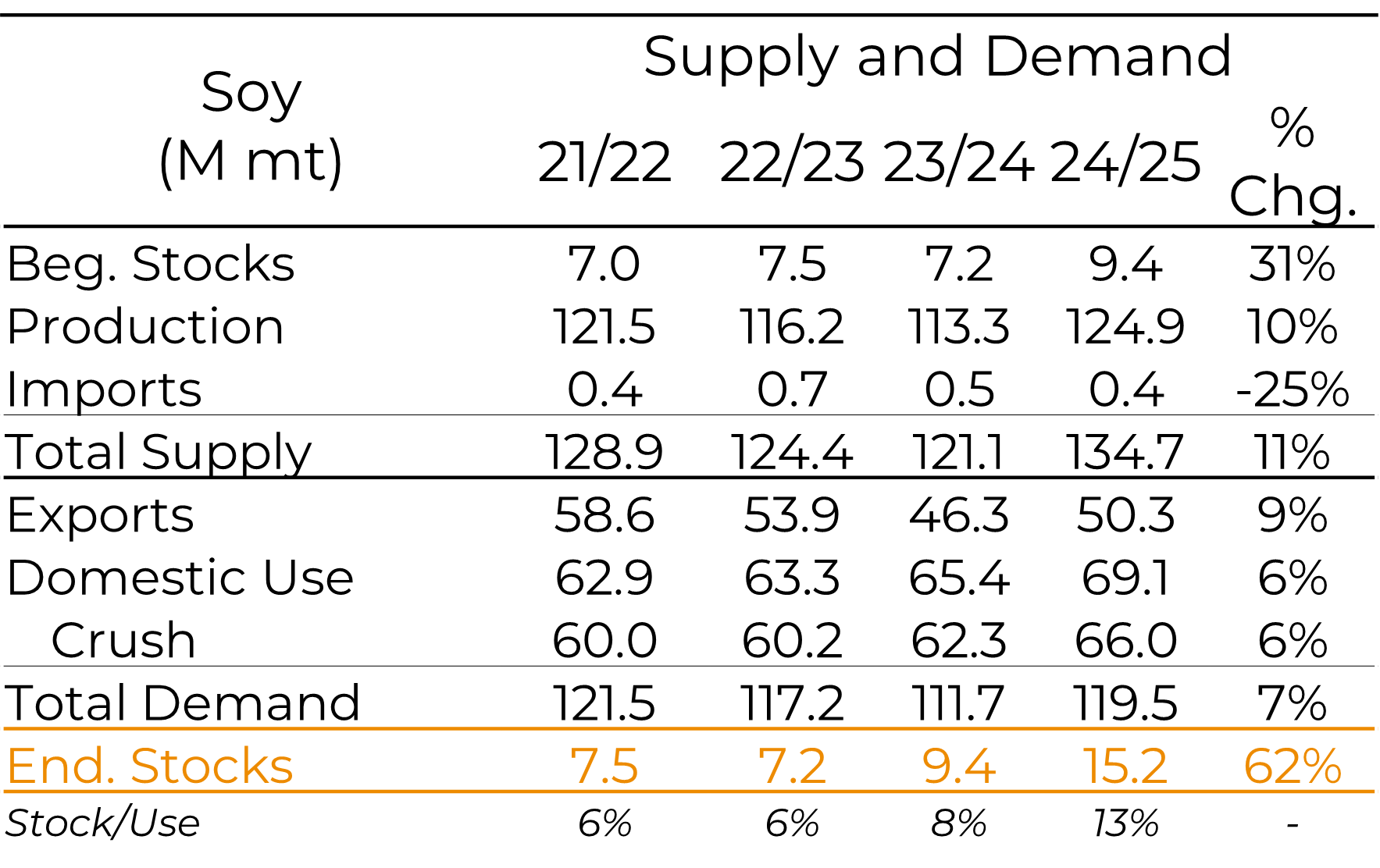

On the soybeans side the situation is similar. This year production is expected to be around 125 Mmt in the USA, 10% above previous year. Also, total supply number will reach 135 Mmt while total demand number will grow thanks to bigger exports, bigger domestic use and bigger needs for the crushing plants.

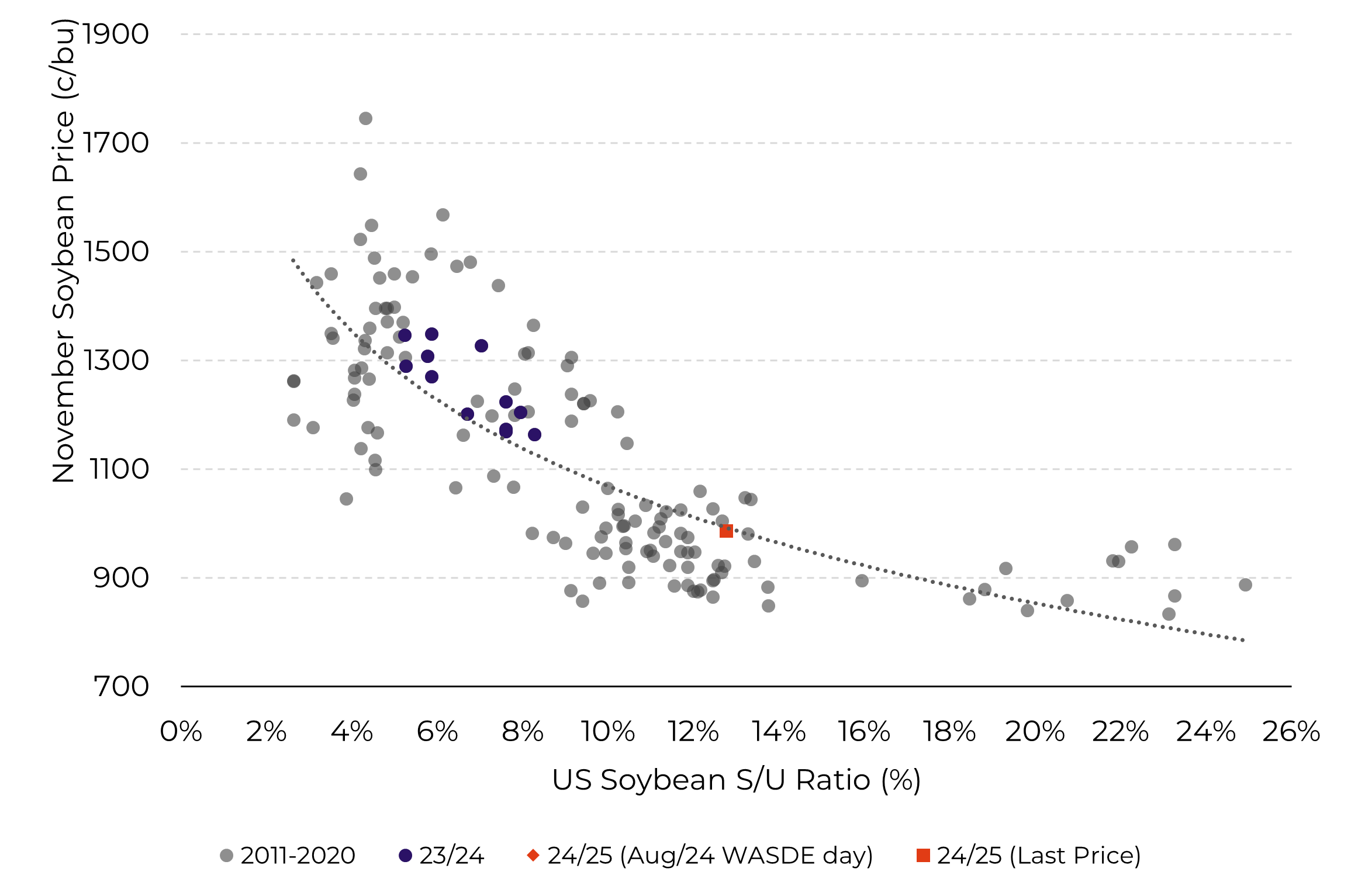

When we draw the line, this 24/25 campaign will end with 15.2 Mmt ending stocks, that represents a 62% increase versus the previous year. All that being said, this would represent a 13% Stock/Use, priced at 987 cts/bu, similar story than with the corn.

One of the differences between Corn and Soybeans on the Stock/Use vs Chicago Price graph comes from the distortion of the data. We can see that for beans, most of the data comes from a Stock/Use below 13-14% which means that this stock use projected for 24/25 is not a usual number but a number on the high side of the study. Regardless of this previous conclusion, we also have to point out than this ration together with the current future level is almost in line with the trend line so this should bring some stability on the prices as both variables are showing with the current numbers a good correlation.

US Soybean Supply & Demand Balance

Source: USDA

CBOT Soybean Prices vs. Stock/Use in the US

Source: Reuters – USDA - HedgePoint

What is going to happen with prices?

Over this article we have talked about the stock/use ratio and the correlation between the level of stock and the actual prices on Chicago. Clearly the S&D numbers for US are going to directly affect the CBOT for obvious reasons but this is not the only variable that affect the prices.

We have to keep in mind that there are many other factors that affect the markets. Hedge funds, global S&D numbers, weather market, expectations, war risk (Ukr-Ru, Israel-Arab countries), politics and several other factors tend to affect the futures market too and some of these factors will have a bigger or smaller influence according to the time and pace of the markets.

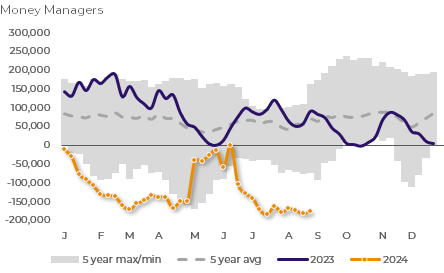

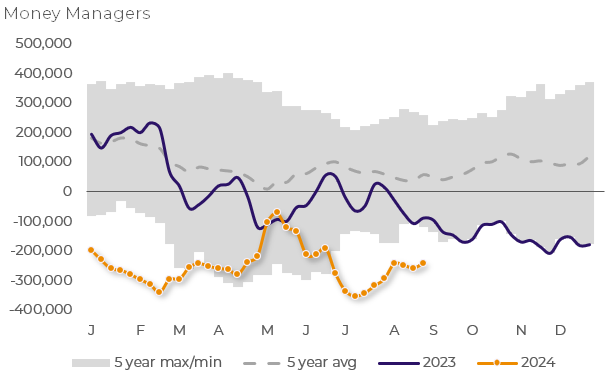

Currently, the hedge funds are still short corn and beans, outside the 5Y range and on the beans side, almost at it’s short record level and for the corn side, we have seen some covering but still the short is very big. The idea behind their position is that in theory the prices should go down and the funds will be able to cover their positions and generate some profit. If this happens, we should see some pressure for the market levels to go down before we see a rebound while the short covering stage occurs. It could also occur than the funds get tired of waiting and start cutting their positions even if this can lock a loss, that being said, the market could go up. As mentioned before, there’s nothing that can assure us on what is going to happen in the near future, but analyzing this kind of factors can always give us an idea of where we think the prices will go.

CBOT Soybeans – Funds Net position ('000 lots)

Source: CFTC

CBOT Corn – Funds Net position ('000 lots)

Source: CFTC

To conclude with our article, it is worth mentioning that the Stock Use/CBOT price ratio is a good advisor of what could happen with the market. All that being said, we can conclude using the historical data than the projected 24/25 campaign level of stock use for corn and soybeans in the US is located on a good/fair price level. Considering all the other factors that can affect the market that we have already mentioned before, we could expect prices to remain at a similar to the range that we have them today.

Weekly Report — Grains and Oilseeds

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Thais Italiani

Thais.Italiani@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.