Nov 6

/

Ignacio Espinola

Palm Oil Market Update

Back to main blog page

* US 45Z could change it all.

* Palm Oil prices going up while Soybean Oil prices touched 2Y low levels.

* Palm Oil prices going up while Soybean Oil prices touched 2Y low levels.

* Thailand bans Palm Oil exports until January 2025.

* Malaysian export raising 13.5% M-o-M.

Current Scenario

Over the last weeks, soybean oil prices have touched the 2 years lowest level while palm oil prices have rallied. There are some factors that can explain this movements.

While there are some important changes in the US tax policy that could change the dynamics of the markets while there is other news regarding palm oil that could also explain the movements in the futures.

Soybean oil, palm oil, ethanol, used cooking oil and tallow prices are all interconnected. We will try to bring some clarity to what is going on with the market in this article.

A law that could change the dynamics:

Recently, with the US 45Z Tax Credit is set to roll out in January 2025, agricultural and biofuel industries are having trouble anticipating what is going to happen. Many players are complaining about the unclear game rules due to a new amendment proposed which could bring some modifications into the 45Z clean fuels tax that should change the business dynamics.

The 45Z Clean Fuels Tax Credit was introduced in the 2022 Inflation Reduction Act and it is a financial tool that works as an incentive for producing and selling low/emission transformation fuels. This credit begins at 20 cents per gallon for non-aviation fuels and 35 cents per gallon for sustainable aviation fuel (SAF). This rule applies from January 2025 through 2027. Recently, a change was proposed in September in the “Farmer First Fuel Incentive” Act that could turn around the dynamics of the market. The changes proposed are:

* Restrict eligibility for the 45Z Clean Fuel Production tax benefits to only renewable fuels that use domestic (US) feedstock

* Extend the 45Z tax credit to a full 10-year credit (until 2034)

Also, the expanding “Clean Fuel Production Act” proposed in October requires the following important changes:

* Extend the 45Z tax credit to 2037

Why could this change the dynamics?

Over the last 2 years, the US has increased it’s imports of Used Cooking Oil (UCO) from China and tallow from Brazil in order to use this as feedstocks for biofuels production. This imports, who are done at a cheaper price versus the local alternative, have generated a negative effect for the US farmer and that is the main reason of this changes proposed in the above-mentioned act.

If this addendum goes through, the local soybean oil (soybean oil is used for biofuel production) production could increase its demand in the local market lifting the CBOT prices (SBO futures recently got a hit and came back to the lowest levels in 2 years).

Furthermore, there will be a global surplus in UCO and tallow. Finally, if the treats of a potential trade war between US-China occurs, probably the Chinese UCO production will have to find home somewhere else.

Finally, foreign-produced biofuels will be less competitive in the US market and that should reduce their imports, specially from Europe who exported 1 M ton of biodiesel to US last year. With this potential lack of exports, European prices should tend to decrease adding pressure to the global market.

Palm Oil vs Soybean Oil Prices Usd/Mt

Source: Reuters, Hedgepoint

Palm Oil market developments

Starting with Thailand:

Thailand’s government has decided to ban the export of raw palm oil until the end of the current year. This decision has been taken due to a low production caused by drought and plant diseases which has created an increase in the local palm oil prices up, forcing the government to ban the exports to protect the palm local market and it´s consumers. There are rumors that the government could even reduce the percentage of palm oil used for ethanol to control the situation.

Local vendors, who used to buy palm oil in 1-liter bags by dozen at 520 baht are now buying it at 690 baht, an increase of 33%. Also, they have reported not to drive this extra cost to the final consumer because it would make their products too expensive and therefore, their demand would fall.

The government is trying to control the situation until January 2025, where the production should go back to normal values.

How are Malaysia’s exports performing?

Malaysian palm oil exports in October ended up +13.7% higher than the previous month, with 200k tons exported. As a remark, crude palm oil numbers where 460 t ton versus previous month at 287 t ton.

In addition, the country stocks are decreasing due to the good export levels creating support for the Palm futures. Moreover, the expectation of a lower production combined with the optimism for an increase in exports to China has created some support in the market, driven mostly by funds buying futures above the 4,600-ringgit level (which also works as a psychological level).

Putting everything together:

The US 45Z Tax Credit could bring a big change in the world oil dynamics. If the amendments proposed get materialized, we could see an increase in the local SBO consumption together with a decrease in the UCO imports from China and tallow imports from Brazil. This should put pressure on the soybean oil prices in CBOT. So far, it seems than the soybean oil prices have not reacted yet into this new, but it could be a trigger for a potential future rally and a change in the global cash and futures dynamics.

Last news regarding palm oil in Thailand and Malaysia have brought some support for the palm futures which could explain the last rally in the futures.

When we compare both futures, SBO and Palm Oil, we can see that the spread between both have increased over the last weeks.

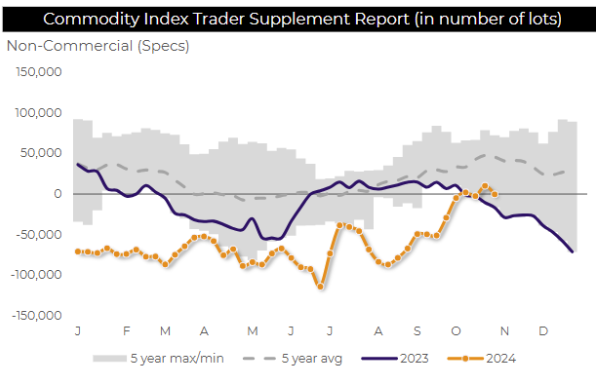

Moreover, when we see the last COT report we can see that the funds have turned around their SBO position, going long for the second time in a year with a 10k lots position (previous time was 2 weeks ago, with 2k long).

To conclude, we have to follow closely the palm oil activity to understand if prices are going to continue this trend of if they will have a pull back. At the same time, and due to their correlation with SBO, it is also important to follow what is going to happen in the US with the US 45Z Tax Credit and also the US elections, which will probably bring some clarity on the U.S. ethanol policy.

Funds SBO Spec Position in lots - Chicago - CBOT

Source: USDA - Hedgepoint

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Thais Italiani

Thais.Italiani@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.