Nov 13

/

Ignacio Espinola

Soybean global update: what is next?

Back to main blog page

• Trumps triumph is changing the markets dynamics.

• China continues to buy as many soybeans as it can.

• Last WASDE reduced the US production in 2.6%.

• Brazil planting progress has recovered from recent weather events.

Current Scenario

Within one week after the US election, in which Donal Trump got the triumph, markets are trying to adapt to this new reality. As we have mentioned during the last months, China has not stopped it’s buying pace over the last months. As a matter of fact, the Asian giant is still very active in the cash market.

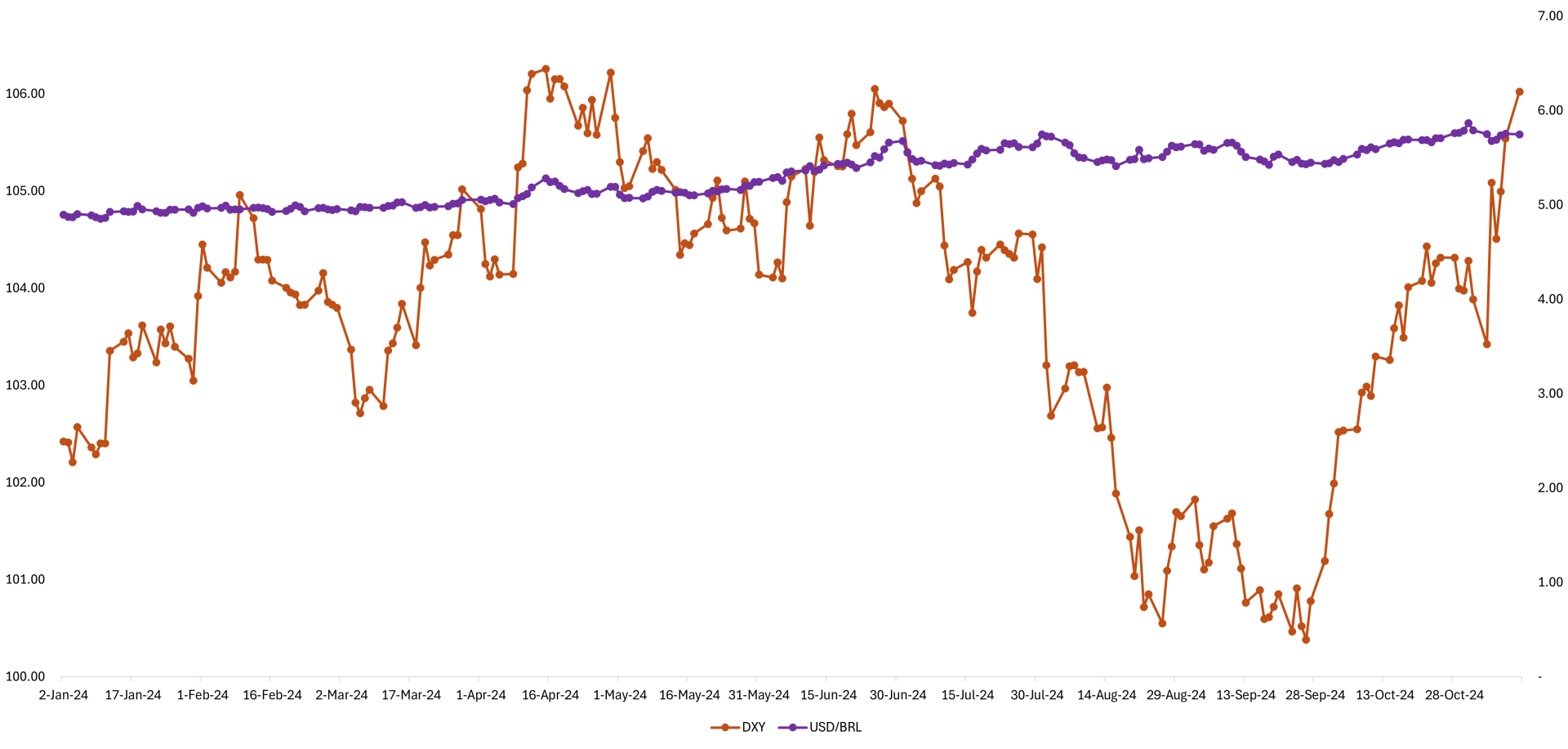

Currency wise, recent Trump triumph has generated a lot of expectations and the DXY index has reflected a growth over the last week from 103.9 to 105.5. The DXY index represents the relative strength of the USD versus other currencies which means that this week the USD has gained force versus other currencies like the Brazilian real, which adds competitiveness to Brazilian soybeans.

Macroeconomy, China and more

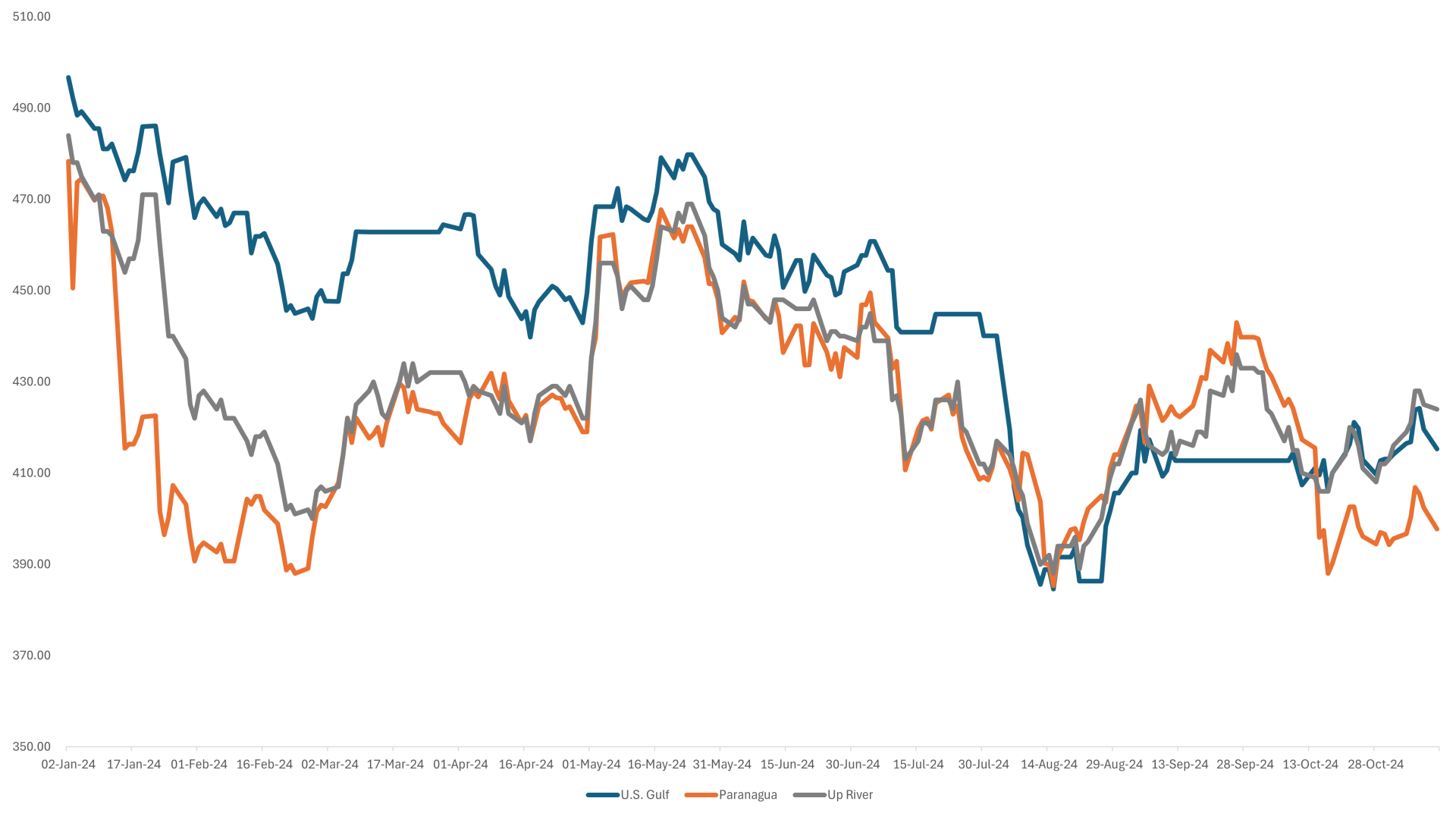

Recent movements in the DXY index have created a change in the economics of the FOB parities for beans. As the USD gets stronger, the Brazilian real gets weaker and therefore, the FOB prices from Brazilian origin goods are more attractive for the export market.

It’s been one month since Brazilian FOB soybeans took the first position as the cheapest origin (compared to the US and Argentina). On the same date (15 of October), the DXY crossed the 102-barrier, closing above 103 and it has been closing at 103 or higher since then.

Soybeans FOB Parity

Source: Reuters, Hedgepoint

DXY and USD/BRL

Source: Reuters, Hedgepoint

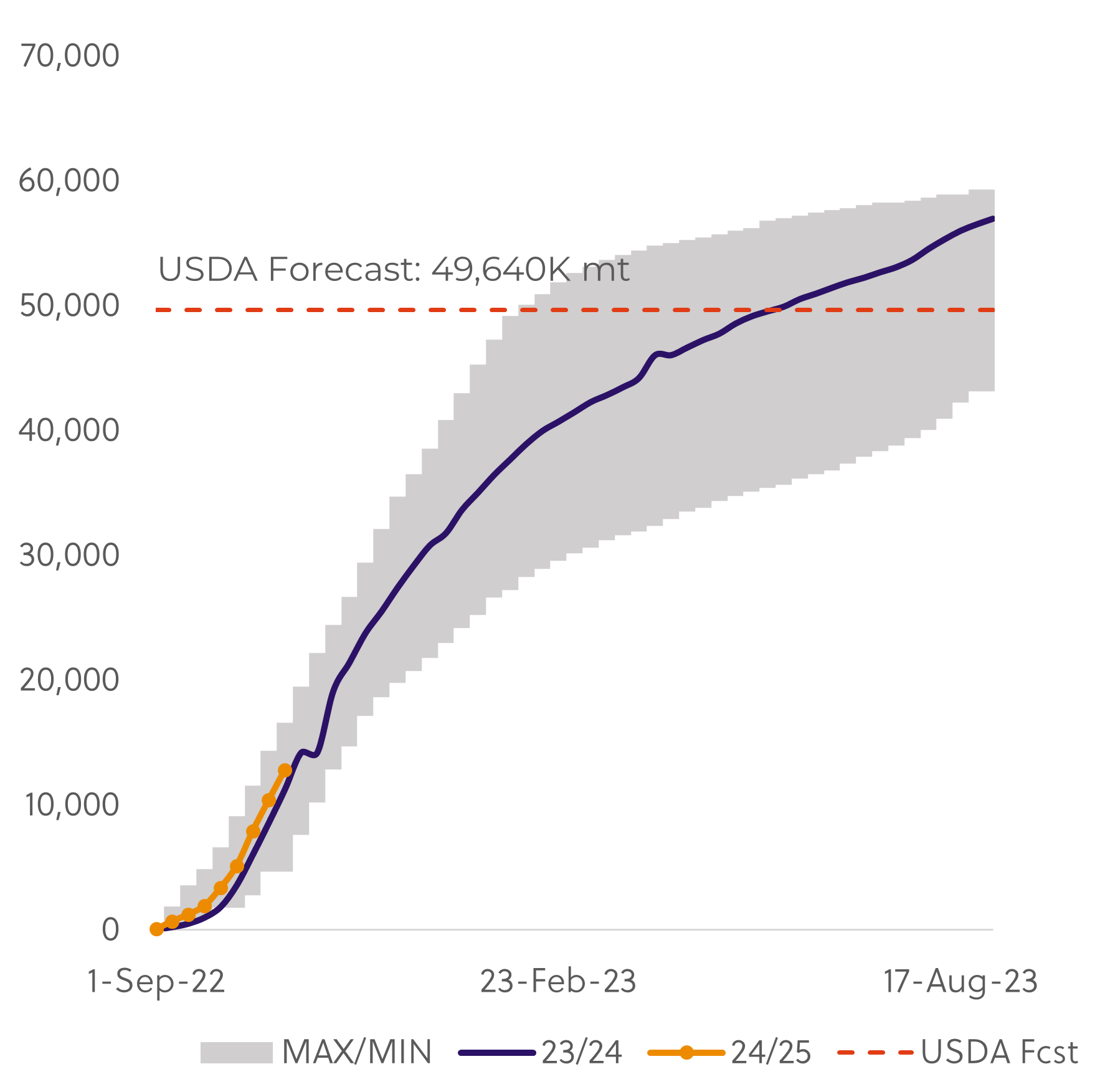

This year China has been following a stocks policy strategy to prevent any issue in case Donald Trump got reelected. The fear of a possible trade war has made the Chinese government anticipate demand and buy in advance as many soybeans as they can. Numbers wise, with their last 8 M mt imported in October (highest arrival month since the last 5Y) China has totalized 90 M mt of soybeans imported during 2024, which is 90% of their record year, 2020, were they imported 100.3 M mt. We have to remember that China numbers as as per the end of October while export numbers from the origins as US, Brazil or Argentina are updated as per the end of September.

If they continue importing at this pace this will be their record import year. Since Trump got elected and that he is going to take over the government in January, we could expect China rushing the imports over the next 2-3 months and probably they will not decrease the pace until they get some clarity of what is going to be the US strategy and approach with the Asian Giant.

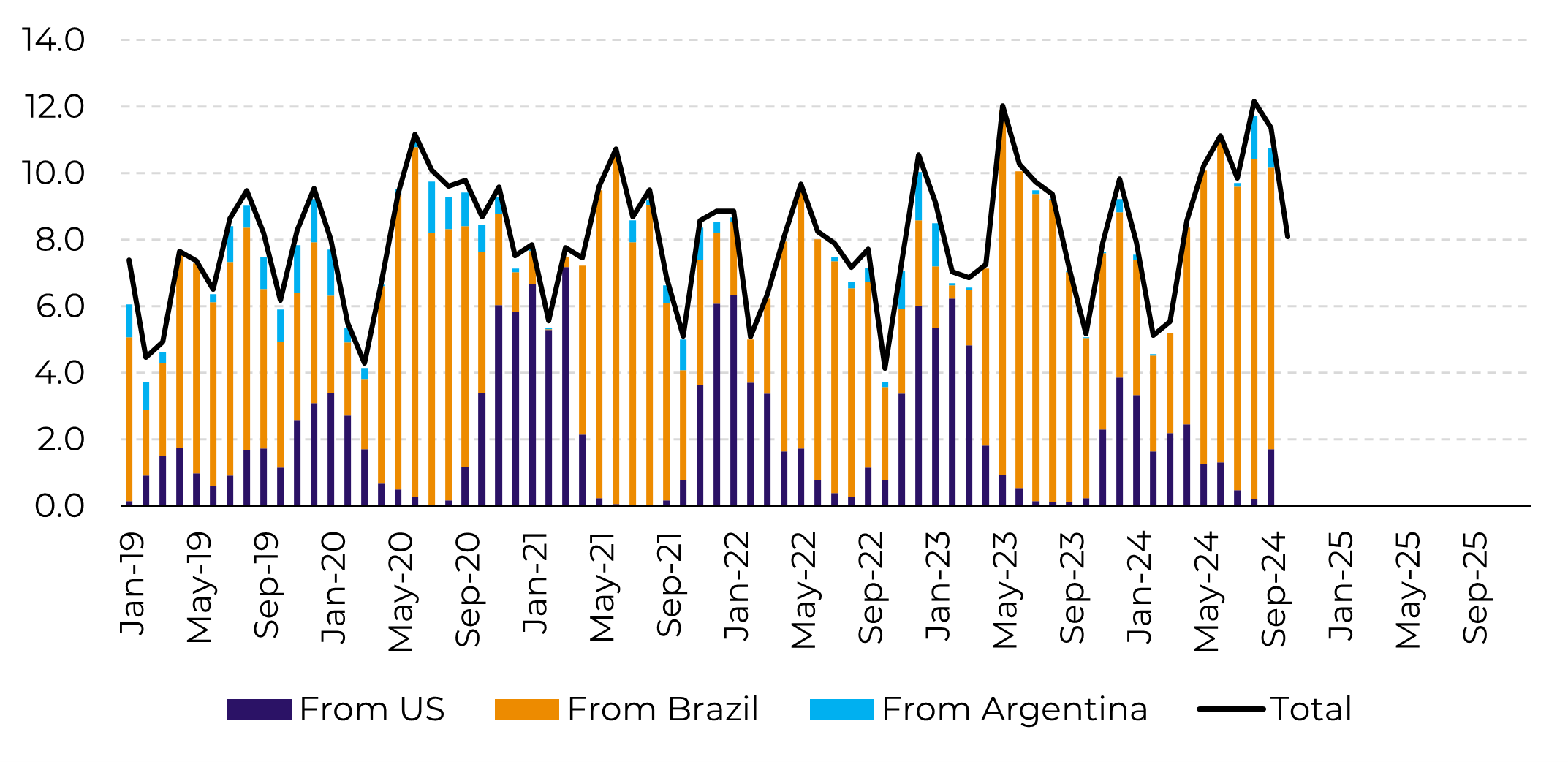

China accumulated imports

Source: China Customs

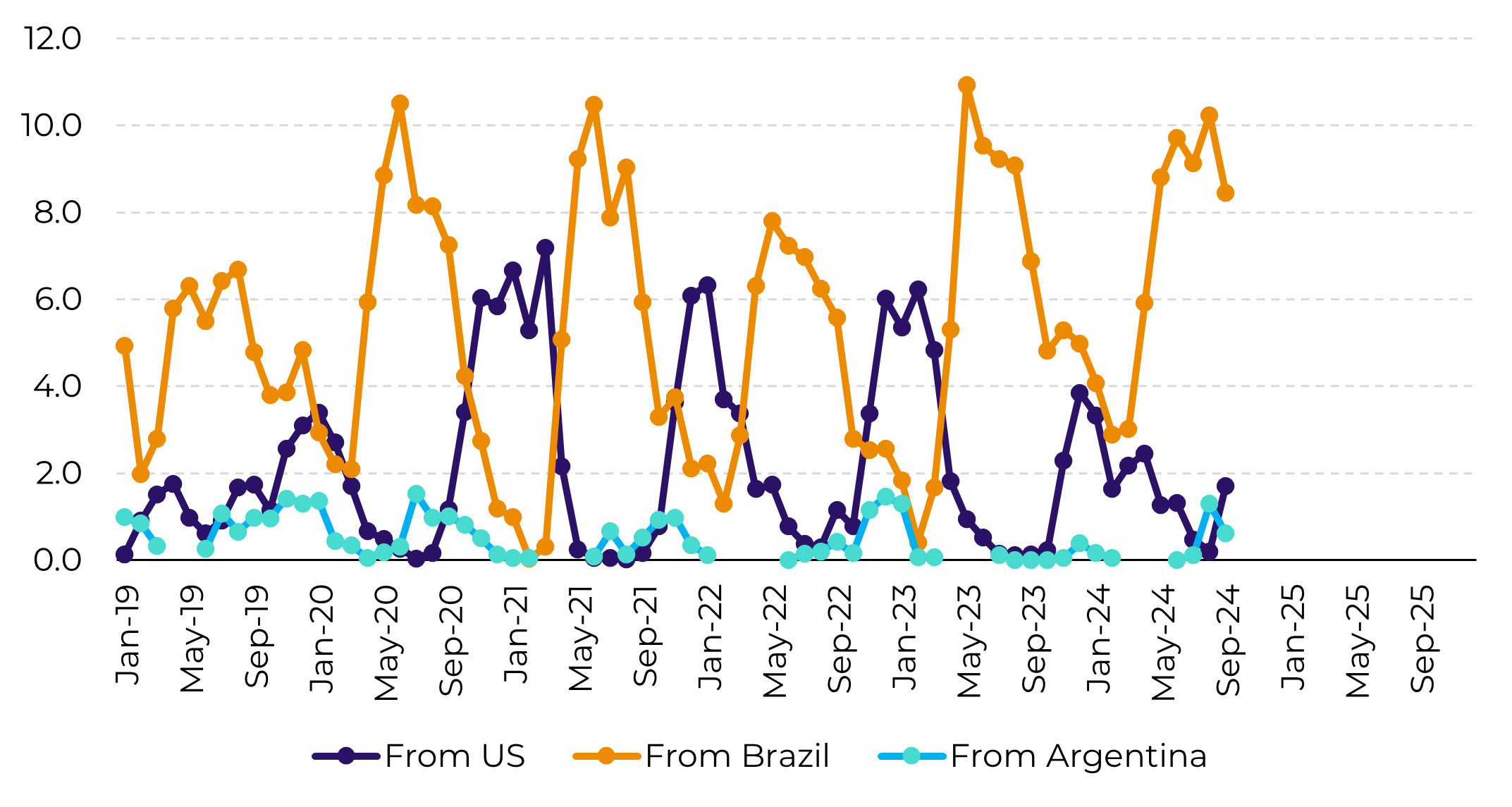

When we do a deep dive into the numbers of imports and the origins, we can get some interesting data. Comparing to the previous years, the US origin imports where 1.7 M mt, biggest ones in 5 years and it’s the first time since March that we see China importing above 1.5M mt of US origin. We also must consider the previous year they imported only 113k Mt.

For Brazil, numbers are showing a similar pattern. This September has been above the last 5Y numbers, with 8.4 M mt imported versus last year at 6.8 M mt and the same happens for Argentinean origin where China imported 0.6 M mt this month versus 0 in September 2023. Volume wise, it has been the biggest arrival since 2019 where they imported 1M mt from this origin in September.

Finally, if we compare volumes from January to September 2024, China imports from US origin have decreased from 20M to 14M but it has been compensated by an increase of 8M in Brazilian origin, from 54M mt to 62M mt.

China imports by country

Source: China Customs

Weather, crop conditions and WASDE

Even though the last WASDE report has reduced 2.6% the overall production of the US crop to 121.4 M mt due to a decrease in the yields, we are still close to a record crop, similar number than the 2021 crop, 121.5 M mt.

Regarding South America, the USDA did not report any change which means that we are still expecting a production of 169 M mt for Brazil and 51 M for Argentina. Conab released the November report today printing 166.1 Mt for Brazilian soybean production.

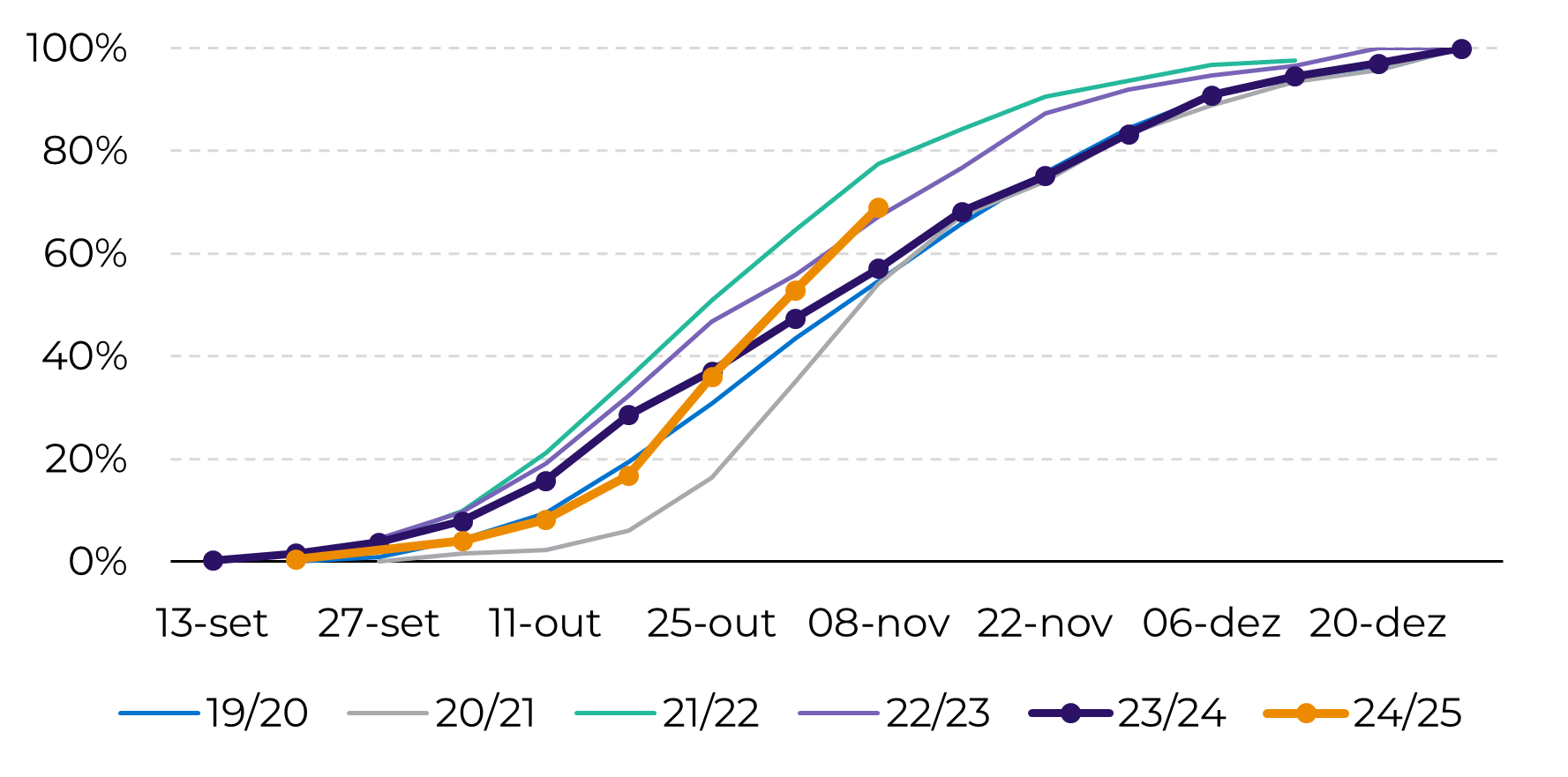

Last dry weather events from 1 month ago did not create any major effect in the planting pace and now the crops are at similar levels or above last year’s average. Taking Brazil as an example, the planting progress curve has recovered from the weather events occurred in October and right now its situated in a 69%, same number as 2021 and above last year number, 57%. All indicates that, all going well, there shouldn’t be problems with the planting process and crop development.

Brazil Soybean Planting Progress

Source: Safras

Crush Margins in China

Crush margins in China have had a fast recovery. Taking as a benchmark the crush margins of the Rizhao hub, the crush margins have recovered from -600 yuans, -83.72 USD, to -75 yuans, -10.47 USD, in August which goes in line with the usual seasonality where crush margins recover before the end of the year as the below graph shows.

These numbers could add incentives to the local crushers and the Chinese government to continue importing beans.

China’s crush margin evolution in yuan

Source: Reuters

Putting everything together

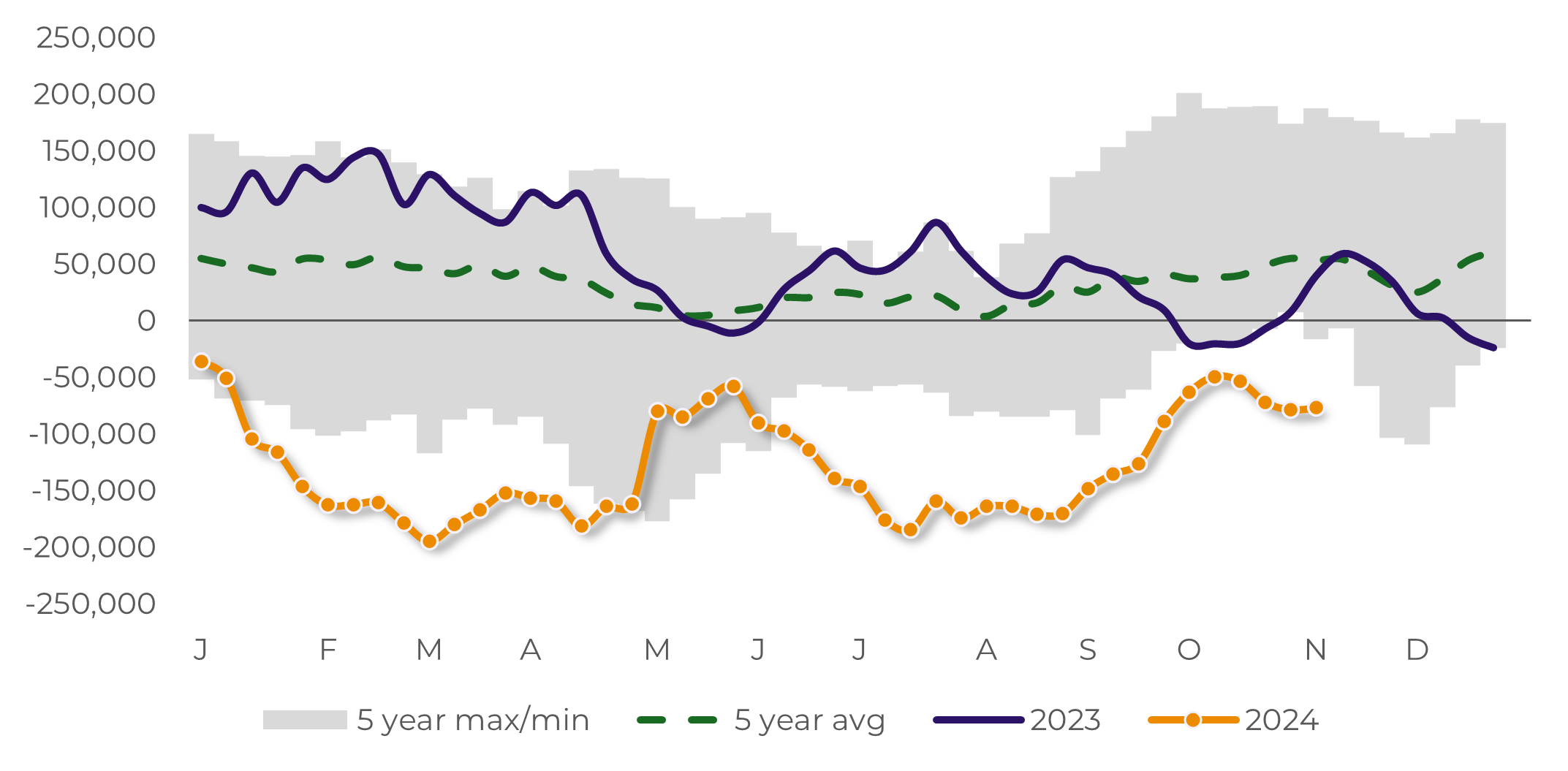

To summarize, recent elections in the US have created a blockchain of consequences all over the World. With a stronger USD, other origins such as Brazil or Argentina become cheaper for the export market versus US which could incentivize the physical sales and therefore, the exports . This could affect the export sales in the US but, so far, they are running in a good pace with levels similar to the previous year. On the China side, so far, it seems like they will continue with their policy of building stocks and if we continue at this pace, they will finish the 2024 with their highest import year ever.

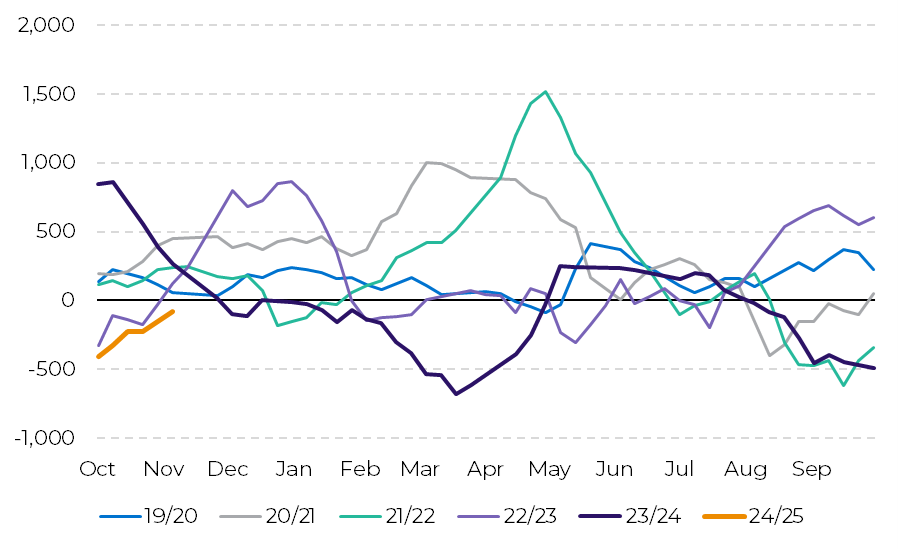

Funds wise, they are still short, below the 5Y average, and over the last 3 COT reports they have changed the tendency and have increased their short position.

Regarding weather, the last WASDE report did not change much in terms of production which means that we are ahead of big crops for US, Brazil and Argentina which should help prices go down due to supply and demand fundamentals. There is not enough demand growth for a ~30M mt increase in production (US, Brazil and Argentina together).

Finally, this week there are 2 reports that could bring more information and changes into the soybeans market, Conab will release its monthly update tomorrow and on Friday we will also have the NOPA report.

U.S. Soybeans Export Sales in k Mt

Source: USDA - Hedgepoint

Funds Spec Position in Soybean (Lots) – Chicago - CBOT

Source: USDA - Hedgepoint

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Thais Italiani

Thais.Italiani@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.