Nov 25

/

Ignacio Espinola

Funds, markets and Russia

Back to main blog page

• Increasing hostilities in the Black Sea conflict brings pressure in the grains market, especially on wheat.

• Brazil-China agreement opens new opportunities for Brazilian commodities.

• Freight rates from Black Sea could boost due to war risk premium.

• Funds activity.

Current Scenario

After the confirmation of Donald Trump triumph, markets have been on waiting mode, hoping to see a signal that defines how the next 4 years are going to be. So far, there are only speculation of how this change of government in the U.S. is going to affect the commodities markets.

The increase in the attacks on both sides, Ukrainian and Russian, in the Black Sea conflict brings more uncertainty into the grains market, especially the wheat market.

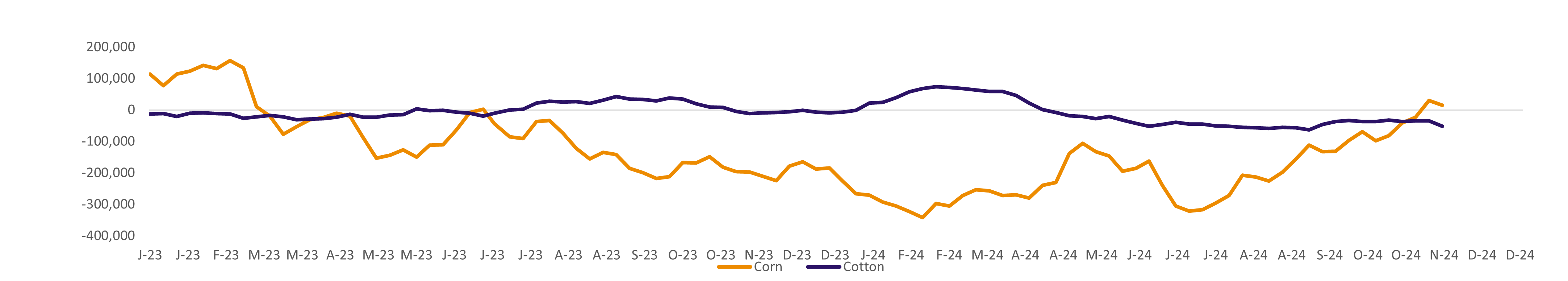

Funds are on waiting mode, reacting mostly on the corn market turning around the position from short to long over the last 2 weeks but increasing their shorts on the other agriculture commodities.

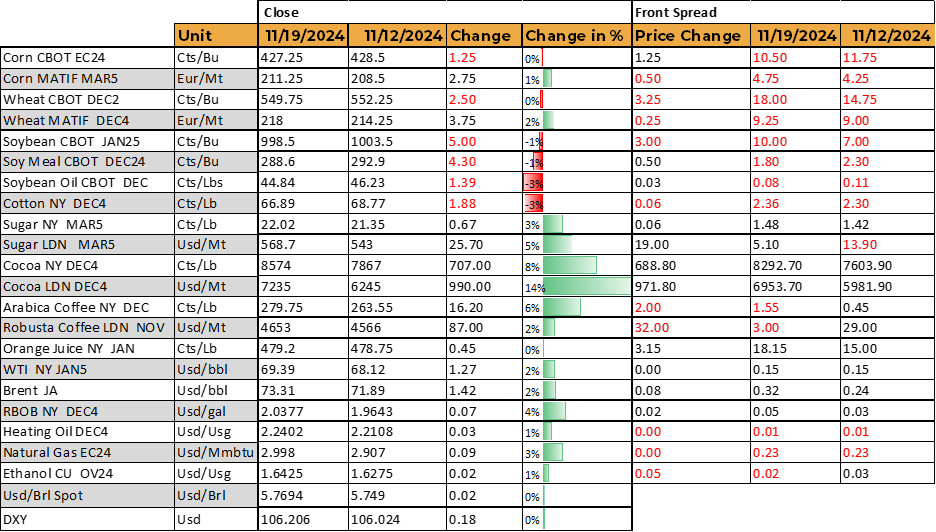

Price recap

Source: Reuters, Hedgepoint

Black Sea conflict

A few days ago, Ukraine launched Western missiles into Russian territory this week after they got the green light from the U.S. government. Russia, reacting to this attack, launched an ICBM attack on Ukraine. This is the first time a weapon designed to deliver nuclear strikes on a thousand-kilometer distance is used in a conflict.

This military escalation brings uncertainty and concerns into the market, from the physical side for Soybean, Corn and mostly Wheat crop, as well as freight wise. We shouldn’t be surprised if some vessels start denying being near Black Sea waters soon which could trigger the freight prices in that region which would push the CIF and CnF prices up.

Also, we are arriving to the end of the year, a particular period in which some waters in Ukraine and Russia get frozen and the freight gets more expensive due to what is called the ice premium which usually adds 1-2 Usd/mt to the price of the goods.

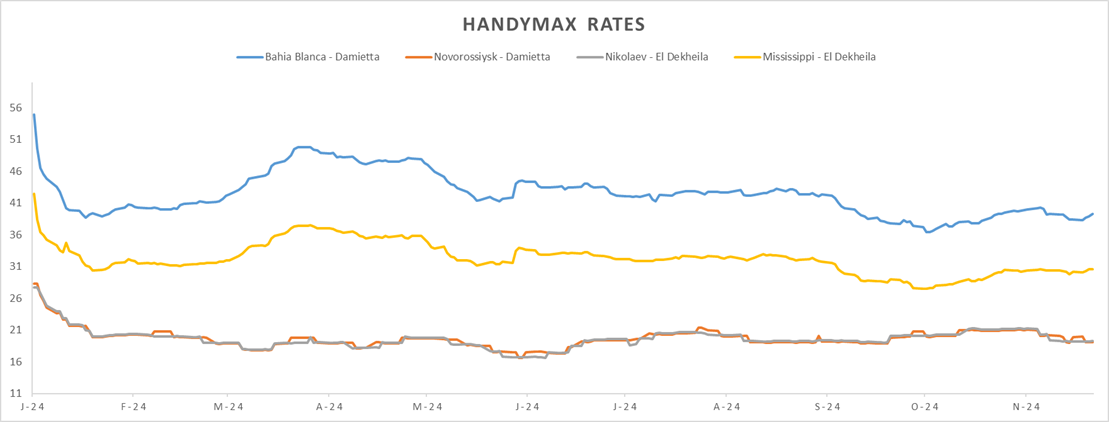

The impact of this conflict is reflected in the Freight Rates which could start increasing for the Black Sea route, impacting the final CIF cost, if ship owners start denying going to the region due to the last war news and the risk of getting hit by crossfire. If we take into consideration the freight rates of a Handymax, a vessel that can carry up to 36k mt, from different origins into Egypt we can conclude that the rates from Black Sea are 10 Usd/mt cheaper versus going from the US and 20 Usd /Mt cheaper versus going from Argentina. This spread was 5 Usd /mt cheaper in November 2023. (Source: Reuters).

Handymax rates to Egypt in USD/Mmt

Source: Reuters, Hedgepoint

Black Sea conflict

Last Wednesday, China gave Brazil the go ahead to start exporting sorghum to the Asian giant. This is a very particular agreement because Brazil does not export much of this type of grain which is a grain used for both animal feed and liquor. Comparatively speaking, Brazilian sorghum crop is 40% smaller versus the U.S. one and competes with one of the stars, the Corn crop.

This could be a strategy from China to gain a dominant position in the case of a possible trade war and possible trade discussions between China and U.S., especially after January once Donal Trump starts his second presidential adventure.

China has been the most important destination market for U.S. sorghum, who is the number 1 exporter of this type of grain in the world with 56% of the global export market, followed by Australia with a 23%. China has an 88% share of global imports, hence, is the key customer for this market. Over the 2023-24 campaign, 94% of the U.S. sorghum shipments went to China. Sorghum market worldwide is 58M Mt.

If this agreement works, this could incentivize Brazilian production (40% of the local sorghum is produced in Goias), substituting some corn area to produce sorghum. If this happens, then U.S. could maintain his position as N1 corn exporter in the World. Also, if China replaces part of their purchases with Brazilian sorghum instead of U.S. origin, the U.S. farmer would logically switch from sorghum to corn, something that already happened with the 2019 crop. Kansas represents 53% of the U.S. national harvest followed by Texas with a 24%. Sorghum was the first commodity that suffered the consequences of the trade war in 2018.

Conclusions

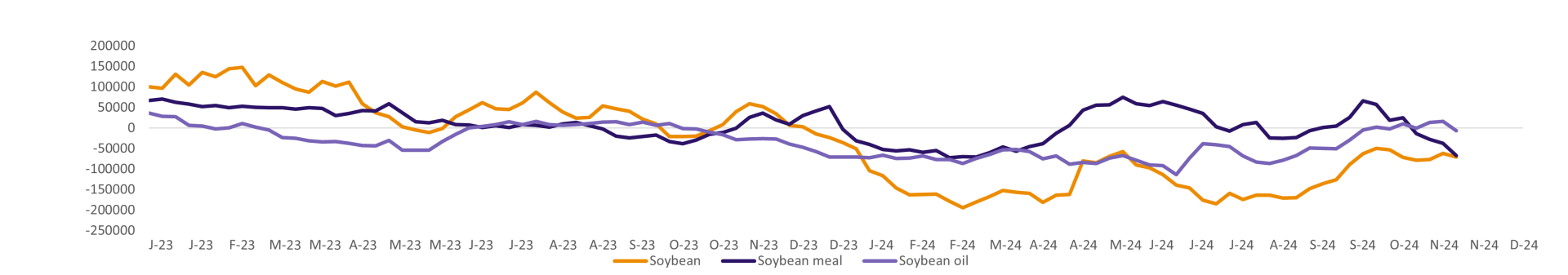

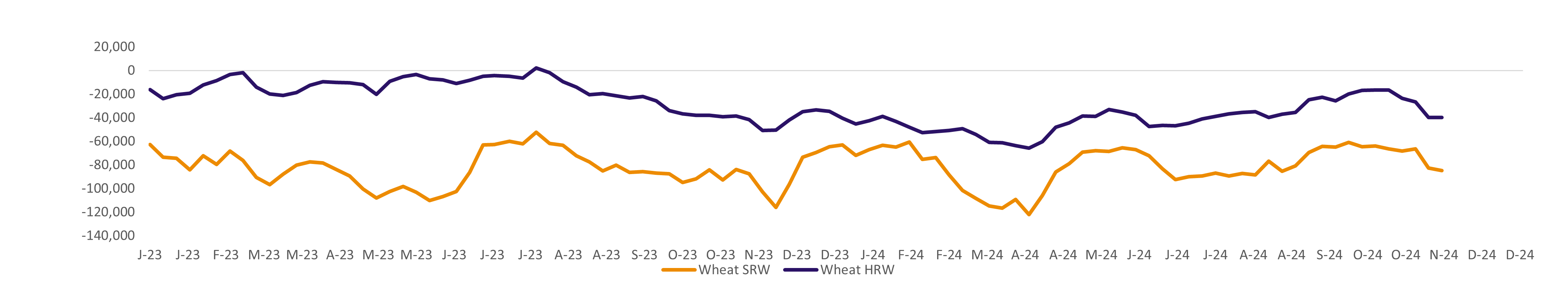

On the funds side, they are net short soybeans, soybean meal, soybean oil, cotton and wheat. On the corn side, they have reduced their long position to half, 15k contracts. Also, the funds have switched their net position from short to long 2 weeks ago, being the first time they are long since June23 when they were 2k long. If we count the last time the funds where at least more than 30k long, like last Friday 15th November, we must go back to late Feb23.

The potential Black Sea conflict and the last Brazil-China agreement bring several questions on what is going to happen with the agriculture markets, especially regarding Corn, Wheat and Sorghum. Moreover, China continues buying and stocking soybeans which also generates a big question mark for the soybean complex prices. So far, it does seem that the funds and other key players in the industry are waiting for a clear signal for the market. Let’s also remember that we are arriving to the end of the year which usually the markets suffer from the close of several positions to take over liquidity by the end of the year.

Funds Spec Position in Soybean Complex (Lots) – Chicago - CBOT

Source: CFTC

Funds Spec Position in Wheat (Lots) – Chicago - CBOT

Source: CFTC

Funds Spec Position in Corn and Cotton (Lots) – Chicago - CBOT

Source: CFTC

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Thais Italiani

Thais.Italiani@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.