Dec 5

/

Ignacio Espinola

Palm and Soybean Oil Market Updates

Back to main blog page

• US soybean oil exports above expectations.

• Indonesia will implement the B40 rule for biodiesel blend.

• Malaysian flood issues.

• Funds activity.

Current Scenario

Price recap

Source: Reuters, Hedgepoint

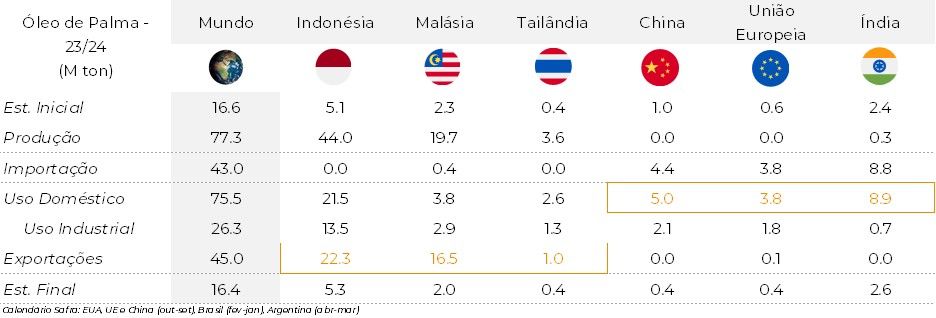

Top Palm Oil Players

Source: USDA

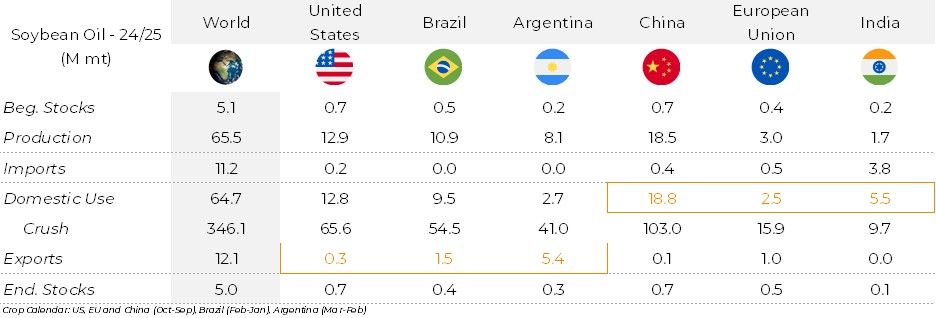

Source: USDA

Soybean oil situation

This year, the US has been exporting soybean oil at a higher pace versus what was expected for this period: 397k mt versus 272k mt expected by the WASDE for the same period. This also contributes to decrease the local domestic stocks, which are at the lowest levels since 2012/13 crop.

Last October was a record month for US crushers, who ended crushing a total of 5.87 mmt, which represents +7.1% above last year and +6.7% versus the amount crushed during last September (5.08 mmt). The expectation is that the numbers for November and December are also going to be big considering the large soybean meal export program in US, which will also increase the soybean oil availability. Price wise, soybean oil is trading at its biggest spread compared to palm oil, which also boosts the cash market, incentivizing sales.

US Soybean Oil Export Sales

Source: USDA

Indonesia plans to introduce B40 biodiesel next year

Indonesia’s wants to implement the 40% mandatory biodiesel mix with palm oil-based fuel, B40, on January 1st next year. Currently, the biggest palm oil producer uses a 35% blend of palm oil-based biodiesel.

This increase will allow the Asian country to reduce carbon dioxide emissions by about 40 million metric tons.

Indonesia currently consumes 11 mm for his B35 and this 5% increase will add 2.9 mmt more, leaving a 13.9 mmt palm oil consumption per year.

Finally, the Indonesian government has increased the export taxes for the crude palm oil, CPO, from a 124 USD/Mt to 178 USD/Mt, which adds support to the prices.

Malaysian Palm Oil

Malaysian Palm Oil futures prices have been in a bullish trend over the last 2 months, following the strength in the Dalian Palm Oil market. Also, the strength in the DXY index is another factor that has been given support to the palm oil prices, which are being traded in the Bursa Malaysia Derivatives Exchange in ringgit, the local currency.

There are some concerns regarding the local crop which has been suffering one of the worst floods in the last 20 years, especially in the east coast and the northern parts of peninsular Malaysia.

More than 10.000 people had to be evacuated. There was severe infrastructure damage, and some palm oil groves will temporally affect production. This also contrasts with one of the highest November exports in the last 10 years, which will bring tightness to the local stocks. Consumers, especially for the next low production season which occurs in Jan-March, are keeping a close eye on this market.

Palm oil tracks the price movements of rival edible oils, as it competes for a share of the global vegetable oils market.

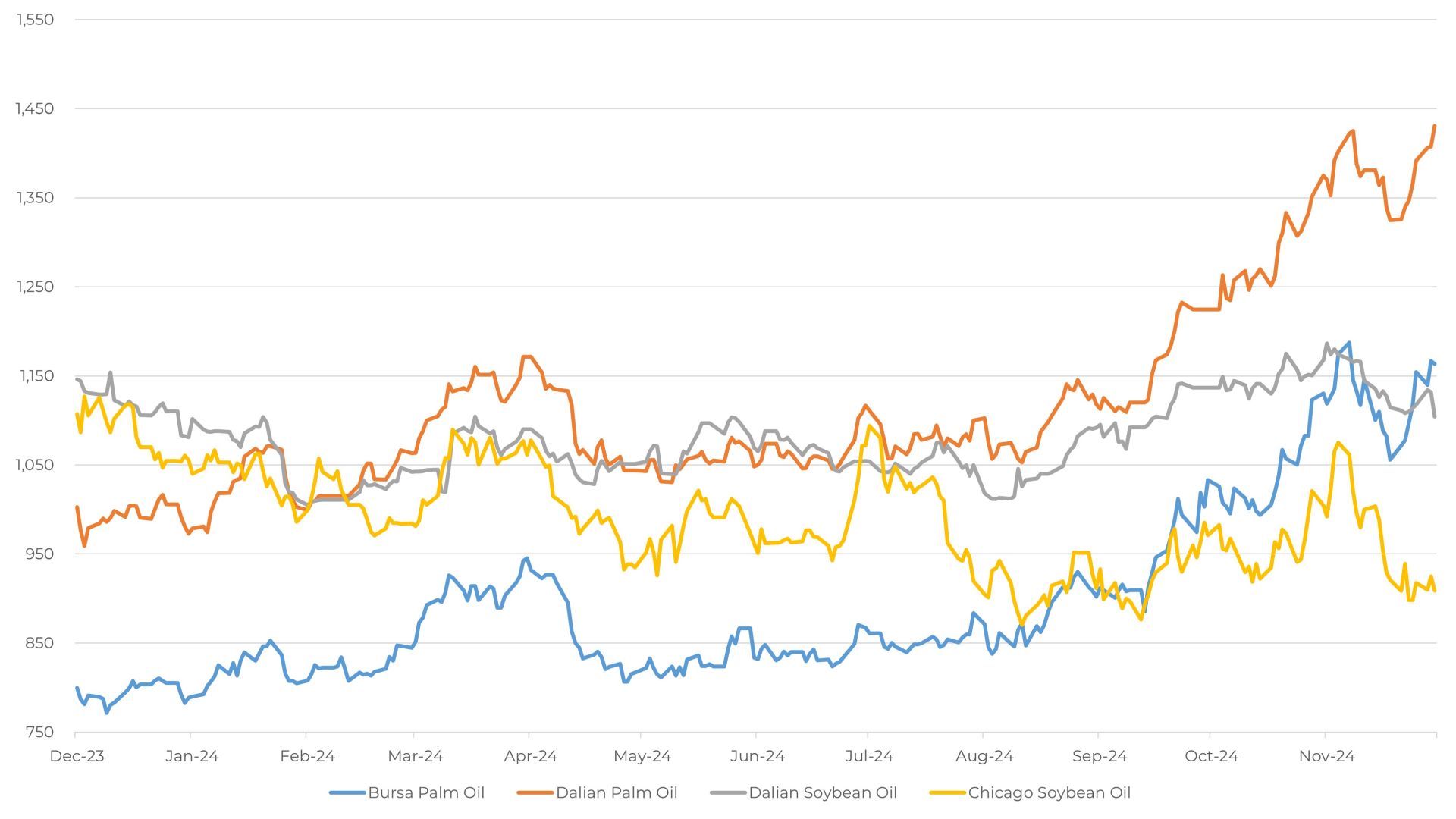

Below graph shows the price movement between Palm Oil and Soybean Oil in three different markets: Chicago, Malaysia and China exchanges.

Over the last 3 months, Soybean Oil has taken the first place as the cheapest oil in the market, leaving Palm almost at par with Dalian Soybean Oil and following the price trend of the Chinese Dalian Palm Oil market.

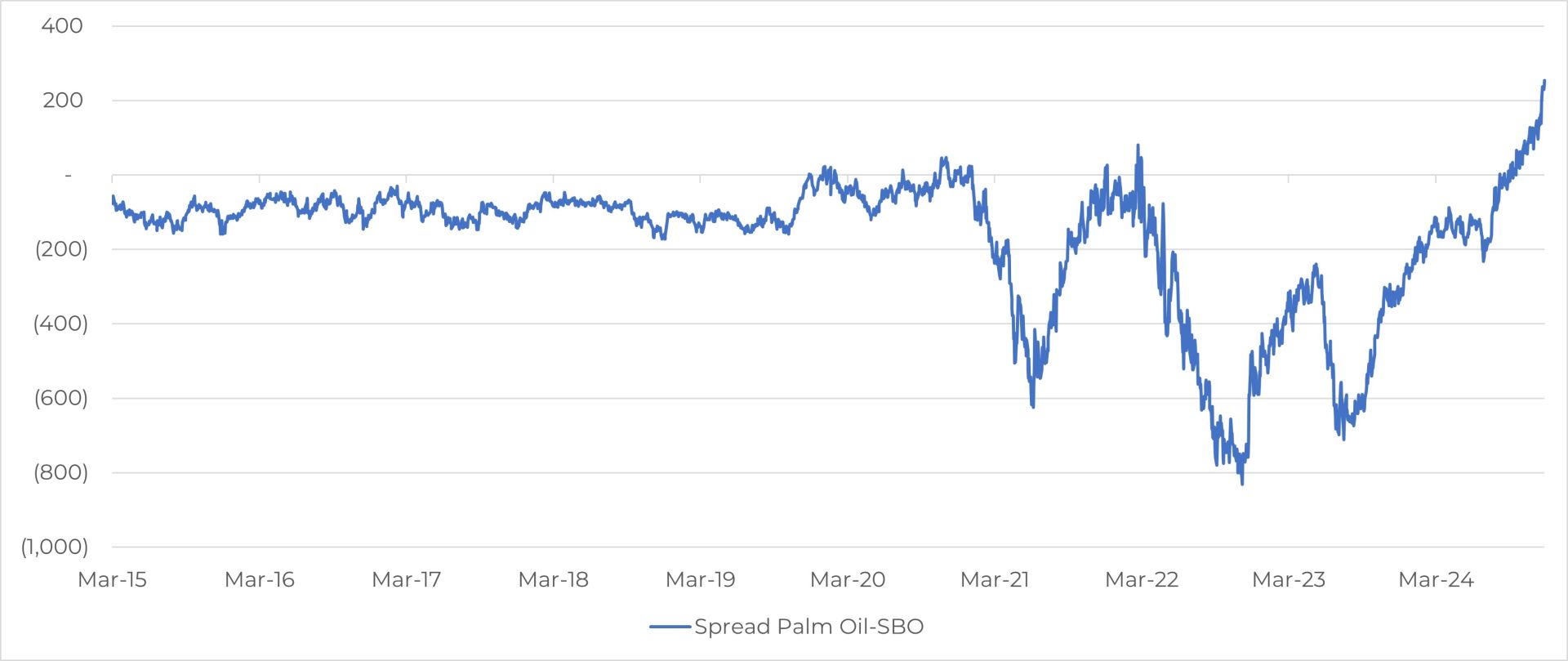

The spread between palm oil and soybean oil prices has reached its highest level in 40 years (March 1984). This high spread could make consumers shift from Palm Oil to Soybean Oil, which could help absorb the surplus of Soybean Oil, narrowing the actual spread.

Price in USD/Mt comparison

Source: Reuters

Spread evolution between Palm Oil and Soybean Oil, USD/Mt

Source: Reuters

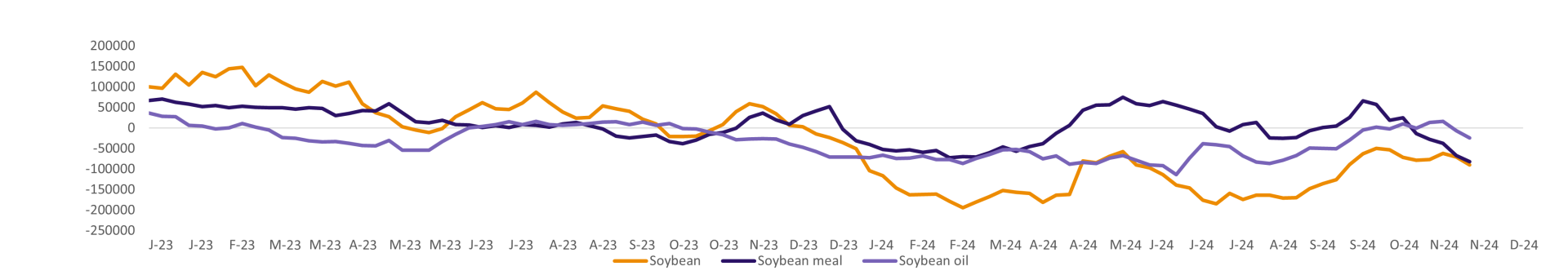

Funds activity

Over the last weeks, the whole soybean complex has entered a bearish trend following three different fundamentals. The first one is a strong Dollar, represented by the DXY index which has been on a bullish trend since the US elections resulted in Donald Trump triumph. The second reason is the weather, with good forecasts that bring hope for a large production in South America, which could lead to a record supply in 2024/25 crop. The third reason is the fear of new tariffs over China products from the next US administration, which could potentially affect the overall agricultural commodity markets.

Non-Commercial (Specs) – Soybean Complex

Source: CFTC, Reuters

Taking a deeper look at the soybean complex

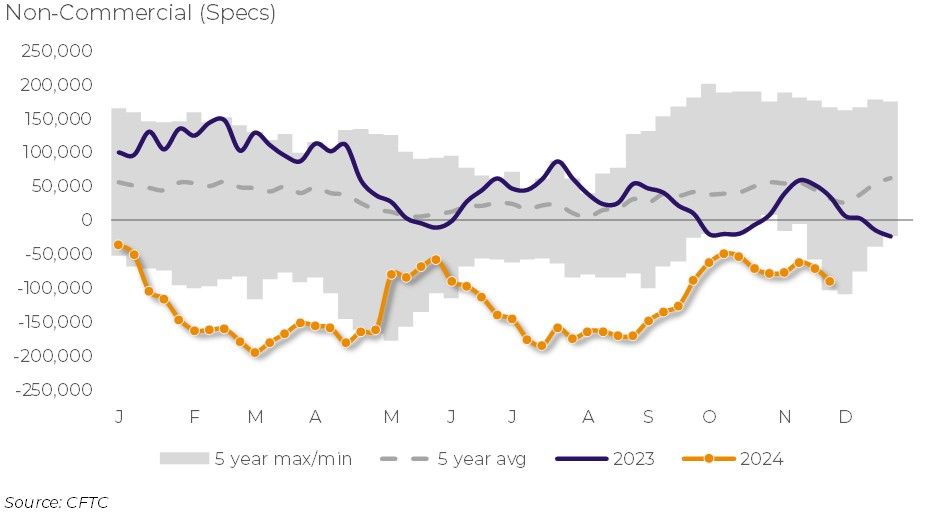

On the soybean side, funds have increased their short positions from 70k contracts into 90k contracts, leaving a short position close to the lowest part of the 5-year average range, but still far away from their record short position of 195k contracts. Price wise, when we compare from the Wednesday 19th November to Wednesday 26Th November, meaning the dates in between one COT report and the other one, soybeans futures spot price decreased in 15 cents/bu, 2% down.

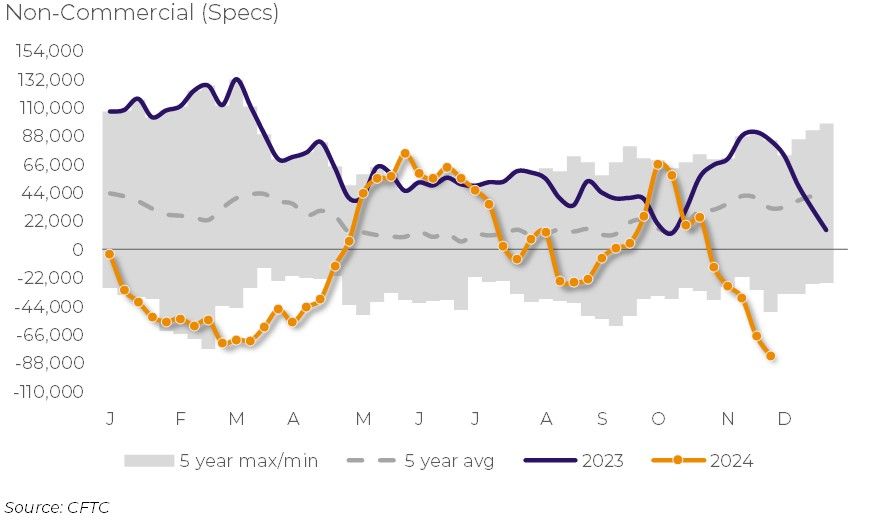

Special remark on the soybean meal funds activity as they have increased their short positions up to 82k contracts, only 4k contracts less than the 10-year lowest level at 86k and far away from the last 5-year average range. Price wise, soybean meal futures spot contract had a reduction of 0.5 usd/st in the period between the last COT and the previous one. That represents only 0.2% price reduction.

On the soybean oil side, the funds increased their short positions from 6k to 24k contracts, still far away from the 10-year lowest level at 114k contracts but close to the lowest level in the last 5 years for the same period. CBOT wise, the soybean oil contract for December in Chicago had a decrease of 2.25 cents/Lbs, or 5%.

Price revolution in CBOT

Source: Reuters

Non-Commercial (Specs) – Soybean

Source: CFTC

Non-Commercial (Specs) – Soybean Meal

Source: CFTC

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Luiz Roque

Luiz.Roque@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.