Dec 19

/

Ignacio Espinola

Grains Update

Back to main blog page

• US corn exports at a good pace.

• Brazilian corn export numbers update.

• Brazilian corn export numbers update.

• China imports below expectations.

• Wheat crop situation.

• Funds activity.

Corn - Current Scenario

Price recap

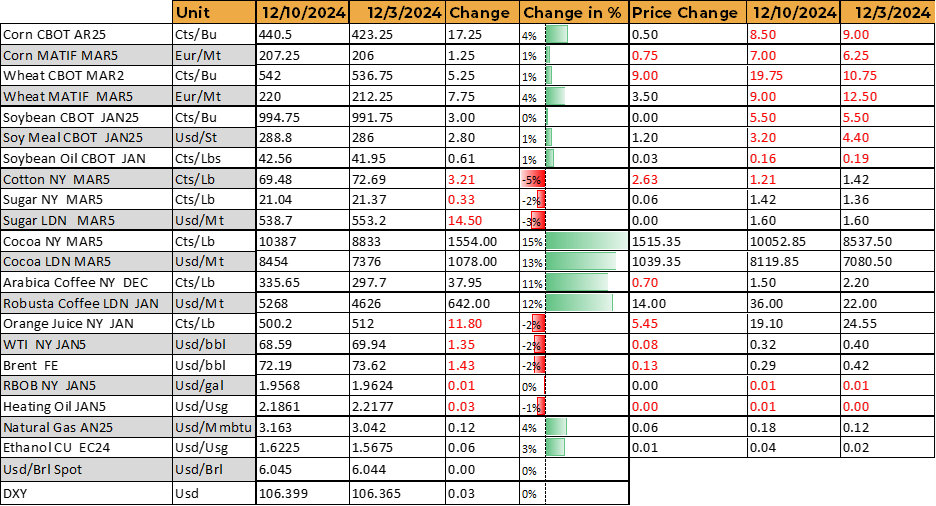

Below recap compares the futures close in between the last 2 COT reports

Source: Reuters, Hedgepoint

U.S. update

Last week we had the WASDE report, where there was an increase in corn export numbers (from 59.06 to 62.87 mmt) and domestic consumption (from 321.7 to 322.98 mmt) for US, which lead to a lower ending stocks number (49.23 to 44.15 mmt). This gave the market a slightly bullish view, which has pushed the spot futures to levels that we havent seen since last June, but far away from last year values.

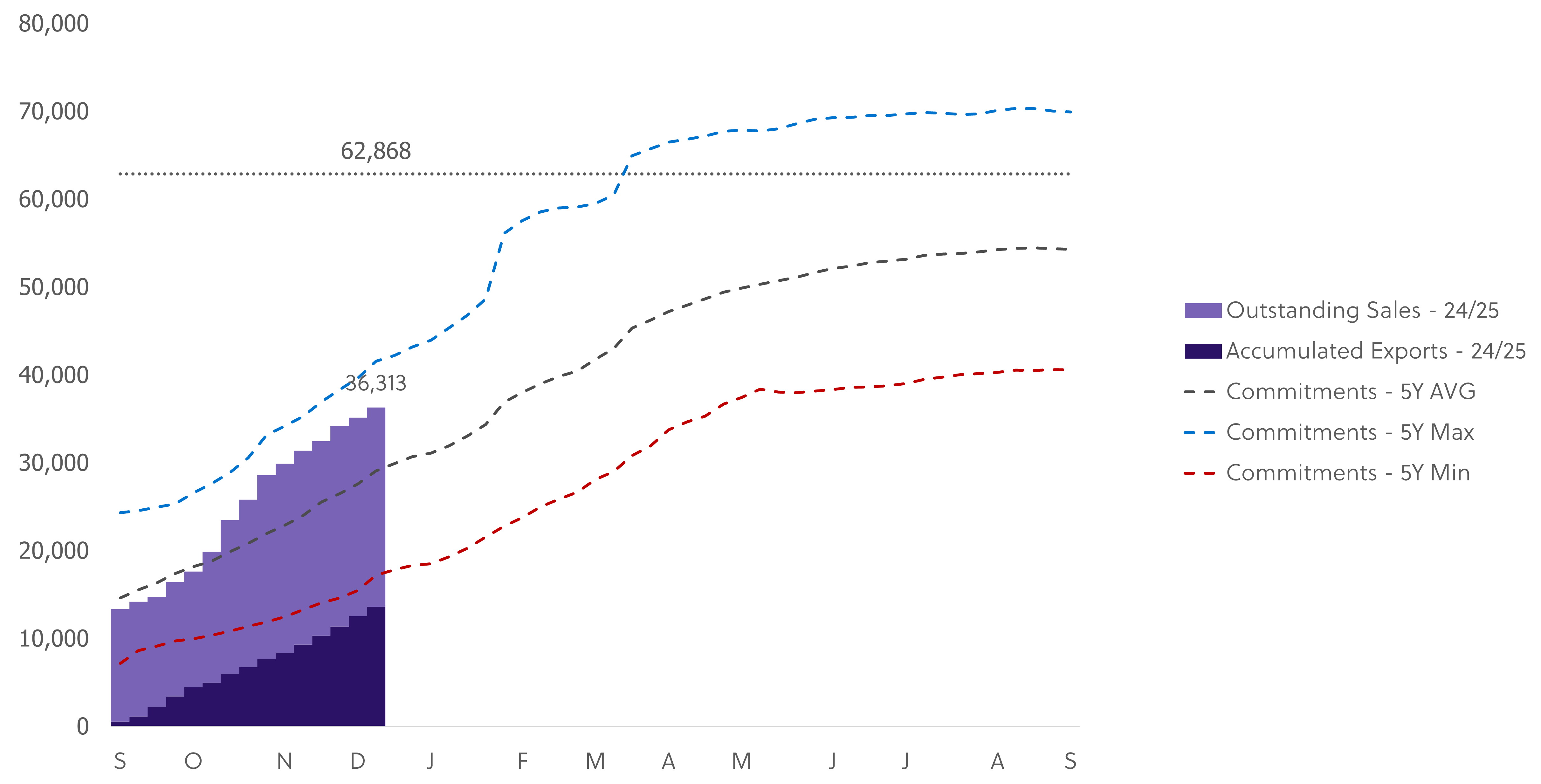

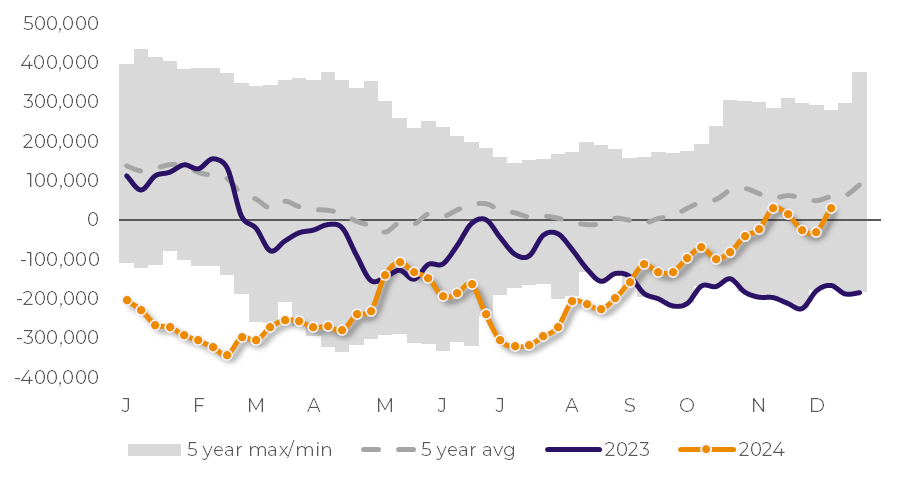

When we compare the increase in the export expectation and the export sales numbers, we can mention that the numbers that the USDA has released this week where dissapointing. The report mentioned 1.17 mmt versus previous year at 1.0.1 mmt, while the expectations where in between 0.8 mmt and 1.6 mmt. So far, the accumulated export sales represents a 58% of the WASDE estimate (Exported 35.1 mmtversus WASDE estimate at 62.8 mmt). if we compare this year with the previous one, the US corn exports have rised 31% y-o-y.

US Corn Export Sales (kmt)

Source: USDA

Brazil

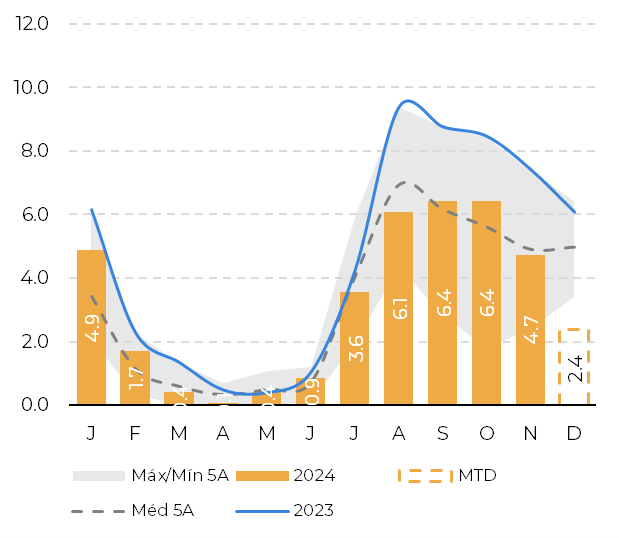

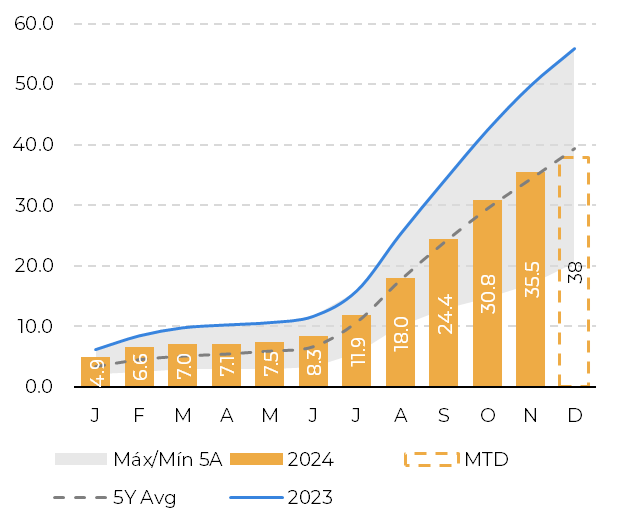

Brasil has exported a total of 38 mmt of corn so far this year, which goes in line with the 5y average, but is still far from the 48.3 mmt from 2023. That difference comes mainly from China, who imported 14.1 mmt in 2023 versus 2.1 mmt in 2024.

Brazilian monthly exports (mmt)

Source: MDIC

Brazilian aculumated exports (mmt)

Source: MDIC

Weather wise, for the upcoming weeks we can expect good conditions for South America, where there will be a good mix between rains and dry periods which should help the development of the crop.

China situation

Regarding China, the Asian giant has imported less corn than what was expected. Contrary to what has happened with the soybeans import, this year corn imports have been lower than expected for the Asian country, with only 14 mmt expected for this year, which is lower than the average of the last years (21.3 mmt), explained by the deaceleration of the chinese economy followed by the real state crisis that has affected the local consumers. China uses corn to feed its feedstock, and the lower demand in meat consumption has impacted the corn imports. For next year, the USDA is expecting a record local crop, which has also impacted the chinese purchases, leaving behind the record imports of 29 mmt in the 20/21 campaign. China has fell behind Mexico, the EU and Japan in terms of corn imports.

There is a lot of expectation for this next 2025, where we could see record crops in South America and the US that will push the prices down, but, at the same time, the bad crops in Europe, the Ukrainian-Russian conflict and Trump’s second presidency will also play a key role.

Geopolitically speaking, there is a big question mark regarding what is Trump going to do with the US-China commercial relationship. Also, over the last weeks there has been some speculation about his policy towards Brazil with rumors of possible taxes increases from US. Over the last Mar-a-Lago meeting, Trumo has emphasized about trade reciprocity. The trade between the two countries add up to 73.8 billion dollars, with brazil exporting 36.5 billion dollars to US and importing 37.3 billion dollars. Brazil has a complex tax structure that can reach up to 60% of import taxes for the US products.

This is not the first time Trump mentions the idea of increasing taxes for brazilian products. Over 2019, he had mentioned his plans to increase tariffs on Brazilian aluminium and steel, but he later declined the idea after negotiations with Brazil’s ex president Jair Bolsonaro. The good news for the South American country come from the recent progress between the EU-Mercosul trade agreement, which could give them more strength to negotiate with Trump.

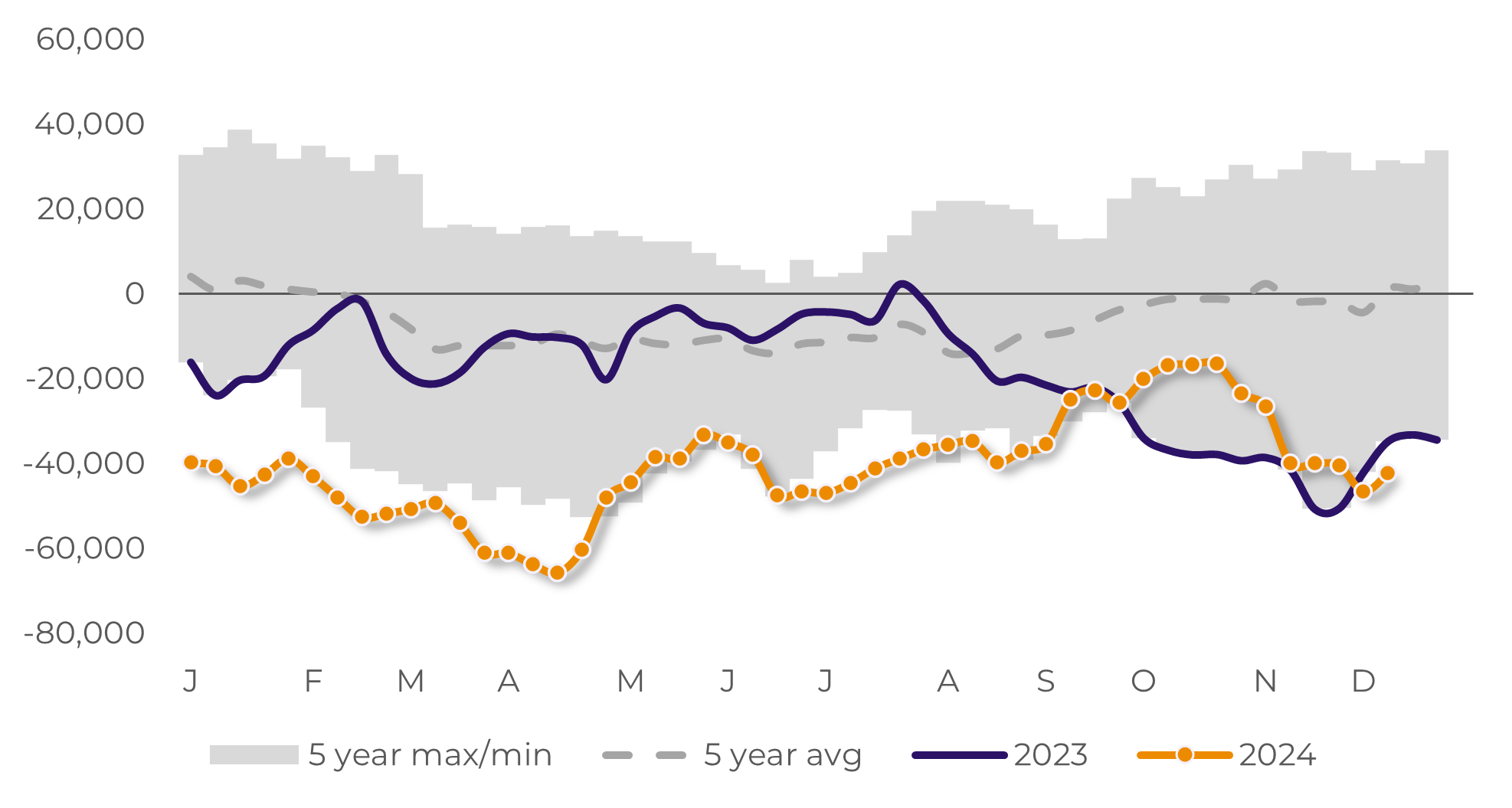

Funds activity

Finally, funds have turned around their net position from negative to positive, being the second time this year (previous time was in November with +30.4k contracts). This swing in the position, from -31k contracts to +31.5k contracts is the biggest net long position since middle of February 2023. This last explains the recent increase in corn prices in CBOT of 4% in the period between the last COT and the previous one.

Corn Non-Commercial (Spec) position in lots.

Source: CFTC, Reuters

Wheat - Current Scenario

The last WASDE report did not bring any major change for wheat. The biggest adjustment was a small reduction (1 mmt, total of 48mmt) in the Russian export numbers, which got partially offset by an increase in the Ukrainian exports (0.5 mmt, total of 16.5 mmt).

In the Black Sea region, there are concerns about Russian crop, where the last reports are forecasting a reduction in the wheat crop of 3 mmt down to a final 78,7 mmt (USDA is showing 81.5 mmt). If this happens, the next crop will be the smallest since 2021 (75.2 mmt).

The expectation is different for the other Black Sea country, Ukraine. Recent reports show a 77% ratio in good conditions, with only 3% of the expected crop in poor shape, even though there were some concerns for some underdevelopment due to the recent drought that the country suffered during the European summer and autumn. The USDA is showing a 22.9 mmt production number, which is similar than the last campaign but is still far away from the 33 mmt of the 21/22 campaign.

On the French side, the French Farms Ministry has raised his production number for next campaign up to 4.5 mmt, an increase of 8.7% compared to last year. That being said, this next year the expectation for the European crop is still low, with 121.3 mmt expected by the WASDE, the lowest number in the last 4 years. As a reference, 20/21 campaign number was 138.5 mmt.

Finally, the WASDE is showing 32 mmt production for Australian wheat (an increase of 6 mmt versus previous campaign), a 17.5 mmt production for Argentinean wheat (an increase of 1.6 mmt versus previous year) and a 53.7 mmt for US production (an increase of 4.6 mmt, or 9% compared to the previous campaign).

On a global view, the WASDE report is expecting a similar level of production than the last year for this campaign, in the 790 mmt area, but the biggest difference comes from the imports, which have been decreased in 12 mmt for next year, and an ending stocks number of 257.9 mmt for next year campaign. These last figures have incentivized the funds to increase/maintain their short positions.

Top Wheat Players

Source: USDA

Funds activity

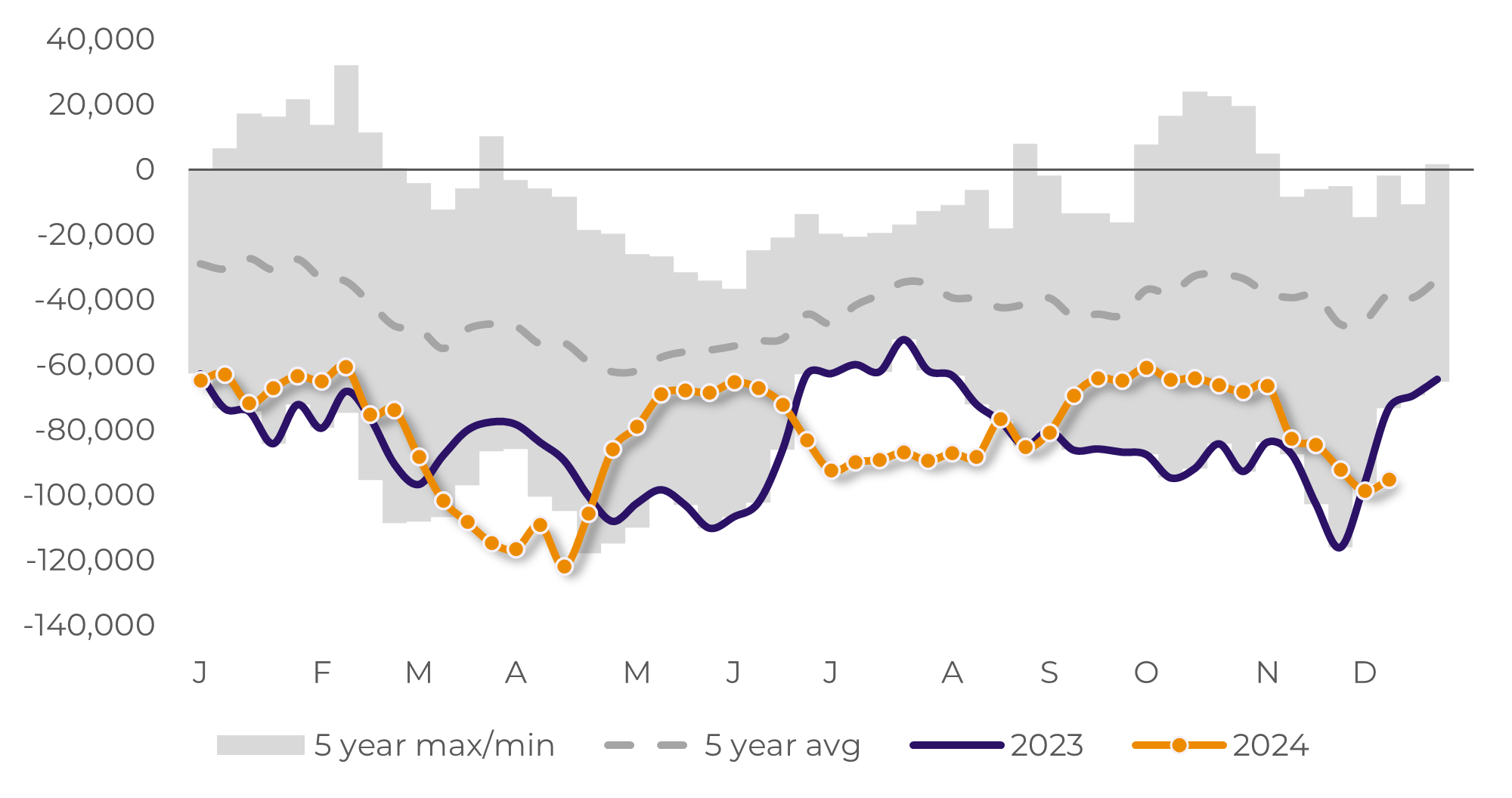

Position wise, funds have reduced their short positions in HRW, ending with a net short of 42.2k contracts and they have also reduced their short position in SRW to a final 95.2k contracts. Their position in SWR is similar to the one that they had in the last July and August period, falling below the 5y average. Same case for HRW, with an out of the 5y range short position which indicates their bullish view on the overall Wheat market.

SRW Non-Commercial (Spec) position in lots.

Source: CFTC, Reuters

HRW Non-Commercial (Spec) position in lots.

Source: CFTC, Reuters

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Luiz Roque

Luiz.Roque@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.