Dec 19

/

Ignacio Espinola

Oilseeds Update

Back to main blog page

• USDA report neutral for soybeans.

• Brazilian soybean planting almost finished.

• Expectations of record soybean output in Brazil add pressure to soyoil prices who already tumbled to a four-year low.

• Indonesia will increase his biodiesel mandate as of 1st of Jan.

• US allowed year-round sales of gasoline E15 increasing the corn consumption and decreasing the oilseeds one.

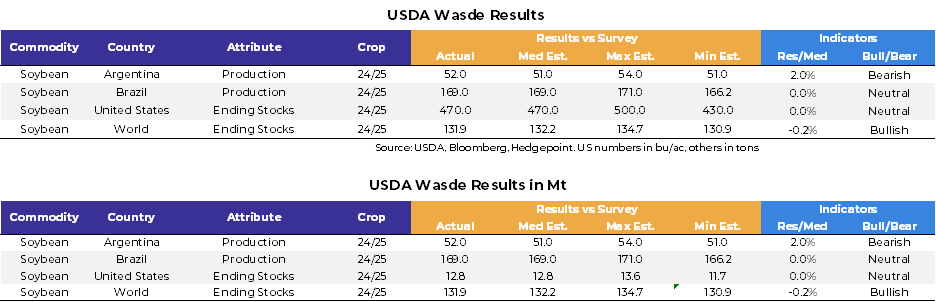

USDA closes the year with neutral report for soybeans

The USDA's December supply and demand report, released on the 10th, brought few changes to the main soybean figures and, consequently, had little impact on the futures contracts traded in Chicago, being considered a neutral report. The main projections for the United States and Brazil remained unchanged, while production in Argentina rose slightly. Regarding to the global picture, only minor changes were recorded.

Production for the 2024/25 season for the US and Brazil has been maintained at 124.1 mmt and 169 mmt, respectively. Argentina's production was raised from 51 million to 52 mmt. We believe that the South American figures make sense, given that the weather continues to be very favorable to crop development in the main producing states in Brazil and the main producing provinces in Argentina. In addition, climate forecasts continue to point to favorable weather in the coming weeks, although some maps may indicate a slightly drier January in Argentina, which deserves attention.

In any case, the feeling is that we will have a record crop in South America, supported mainly by the trend towards a record crop in Brazil, the world's largest producer. This, coupled with an almost record North American crop (the second largest in history) should lead to the largest world production ever seen, as well as stocks at record levels. This is the main factor supporting the trend towards a more pressured Chicago in the coming weeks, which needs to be at the center of the market's attention. For the time being, there is no major factor in sight that could counteract this production surplus and alter the trend for the coming weeks.

Source: WASDE

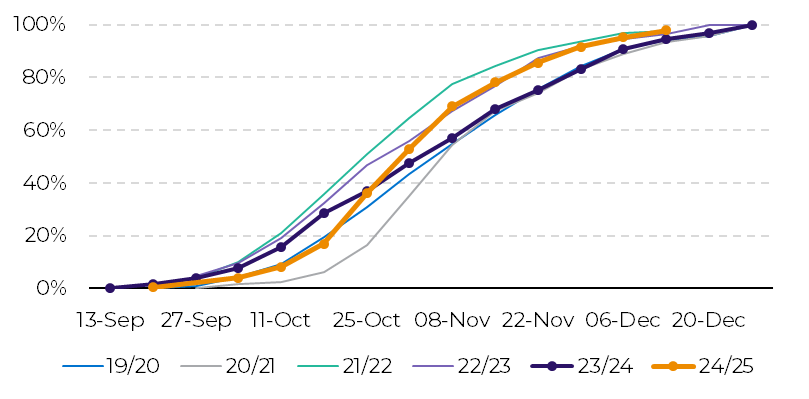

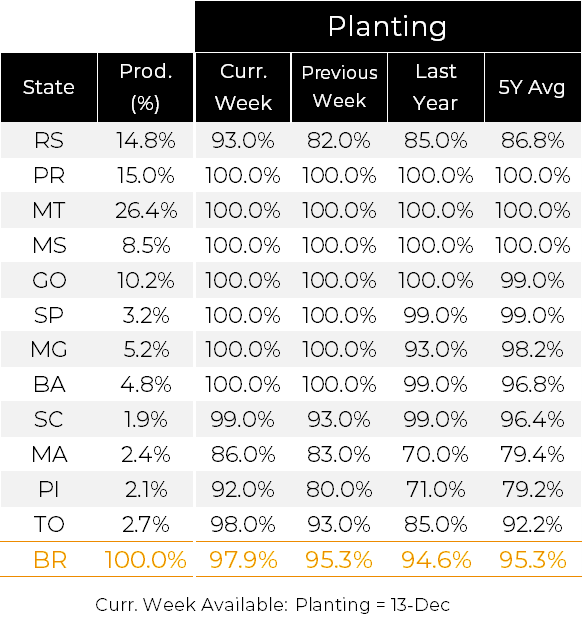

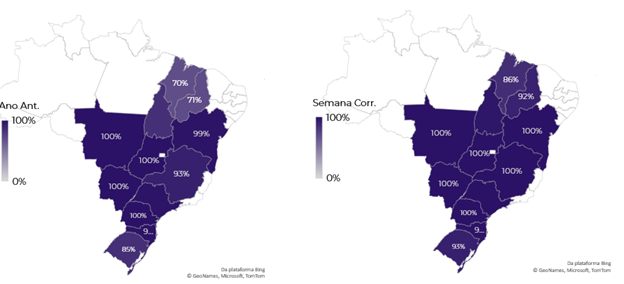

Brazilian planting in final straight; harvest due to start in January

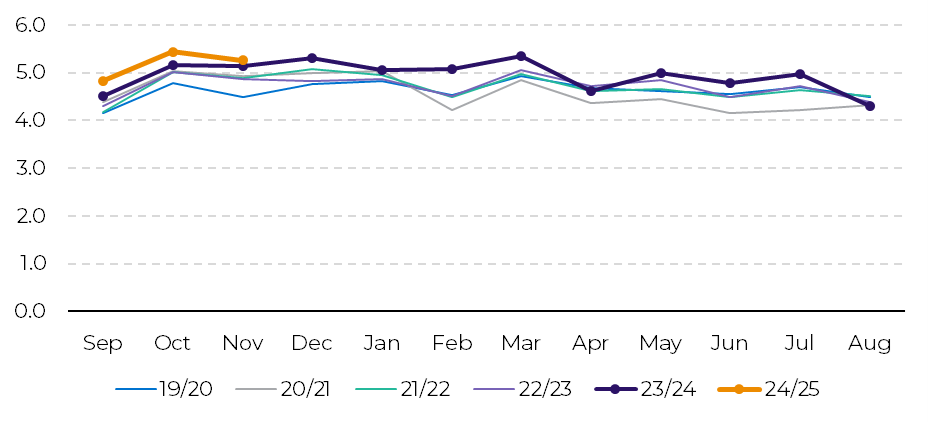

Planting works on the new Brazilian soybean crop has progressed to the last areas to be sown this season. Only a few states in the South (Rio Grande do Sul and Santa Catarina) and the North and Northeast (Maranhão, Piauí and Tocantins) are still working on the fields. The pace of planting remains above average for this time of year, with a significant recovery from the initial delays in September and October.

Brazilian crops remain in excellent condition in most of the country's main producing states, which supports the feeling of a full and record production. We're unlikely to see significant losses in any state, but it's still important to keep an eye on the weather maps for January and February, especially in the state of Rio Grande do Sul. If the weather doesn't worsen, the tendency is for production to exceed 170 mmt, a new record.

Meanwhile, the state of Paraná, the first to sow the new crop, should start harvesting in the second half of January (perhaps even in the first half), kicking off the biggest harvest in Brazil's history. From February onwards, the states of Mato Grosso and some other states in the Centre-West and Southeast regions could begin the first harvesting works.

Brazilian Soybean Planting Progress

Source: Safras

Source: Safras

Source: Safras

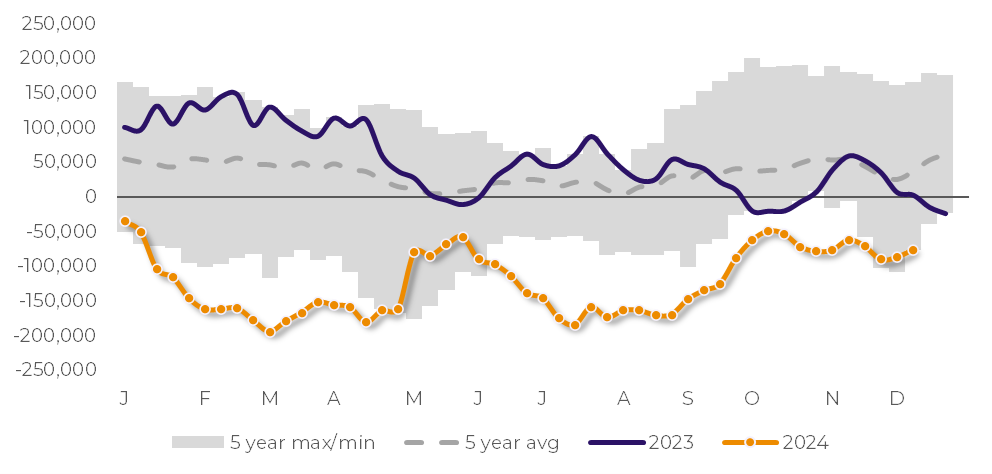

NOPA points to lower crushing in November in the US, but still strong

According to the NOPA (National Oilseed Processors Association), US soybean crushing in November was down on the all-time record recorded in October, falling short of most market estimates, according to data released on Monday (16).

NOPA members, which process around 95% of US soybeans, crushed 193.185 million bushels of soybeans in November. This figure was below the average market estimate of 196.713 million bushels in a Reuters poll of 10 analysts. Crush estimates for November ranged from 191 million to 207 million bushels, with a median of 195.911 million bushels.

November's crush was 3.4 per cent lower than October's record crush of 199.943 million bushels, a figure that NOPA revised down slightly from the 199.959 million bushels previously reported. Despite the drop, it was still the largest November crush on record, 2.2 per cent above the November 2023 crush of 189.038 million bushels, and the fourth largest ever for any month, according to NOPA data.

US crushing capacity has expanded in recent years as processors have built new plants and expanded existing ones to meet growing demand for vegetable oil from biofuel producers. Analysts noted that a maintenance shutdown at a large plant in Des Moines, Iowa, last month limited the monthly crush.

Even though the November figure was below expectations, we would point out that demand for soybean crushing in the US remains very strong, with the accumulated from September to November (marketing year 2024/25) being the highest ever recorded for the period. The trend is to see confirmation of the largest crush in US history this season, with a forecast of 65.589 mmt of soybean crushed (from September 2024 to August 2025), according to the USDA.

US Soybean Crushing - in million bushels

Source: NOPA

Chicago records heavy losses

Soybean futures contracts traded on the Chicago Board of Trade (CBOT) had a very negative week, with strong accumulated losses in the main positions. Positive weather and the imminent confirmation of a record crop in South America once again weighed on the market. In addition, the weakness of the Brazilian real against the dollar is also a negative factor for Chicago, given the loss of competitiveness of the US product on the international market.

The spot position (January/25) reached a low of US$ 9.5025 and closed at US$ 9.5175 per bushel in the session on the 18th, once again testing the important US$ 9.50 level. The contracts are close to their lowest levels in 4 years, showing weakness in the face of the current fundamental factors.

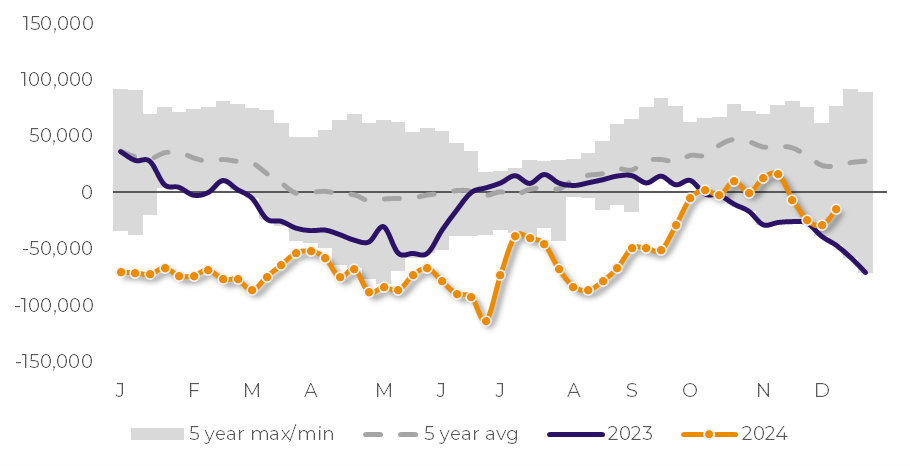

Speculative funds had reduced their short positions in soybean by around 11k contracts between December 4 and 10 (latest COT report), with a net position of -76.3k contracts. Now, it's quite likely that we'll see a sharp increase in short positions in the next COT report considering the sharp drop accumulated in Chicago over the last few sessions, endorsing the sentiment of a still bearish market.

Soybeans Non-commercial (spec) positions - in lots

Source: CFTC, Reuters

Soybean oil situation

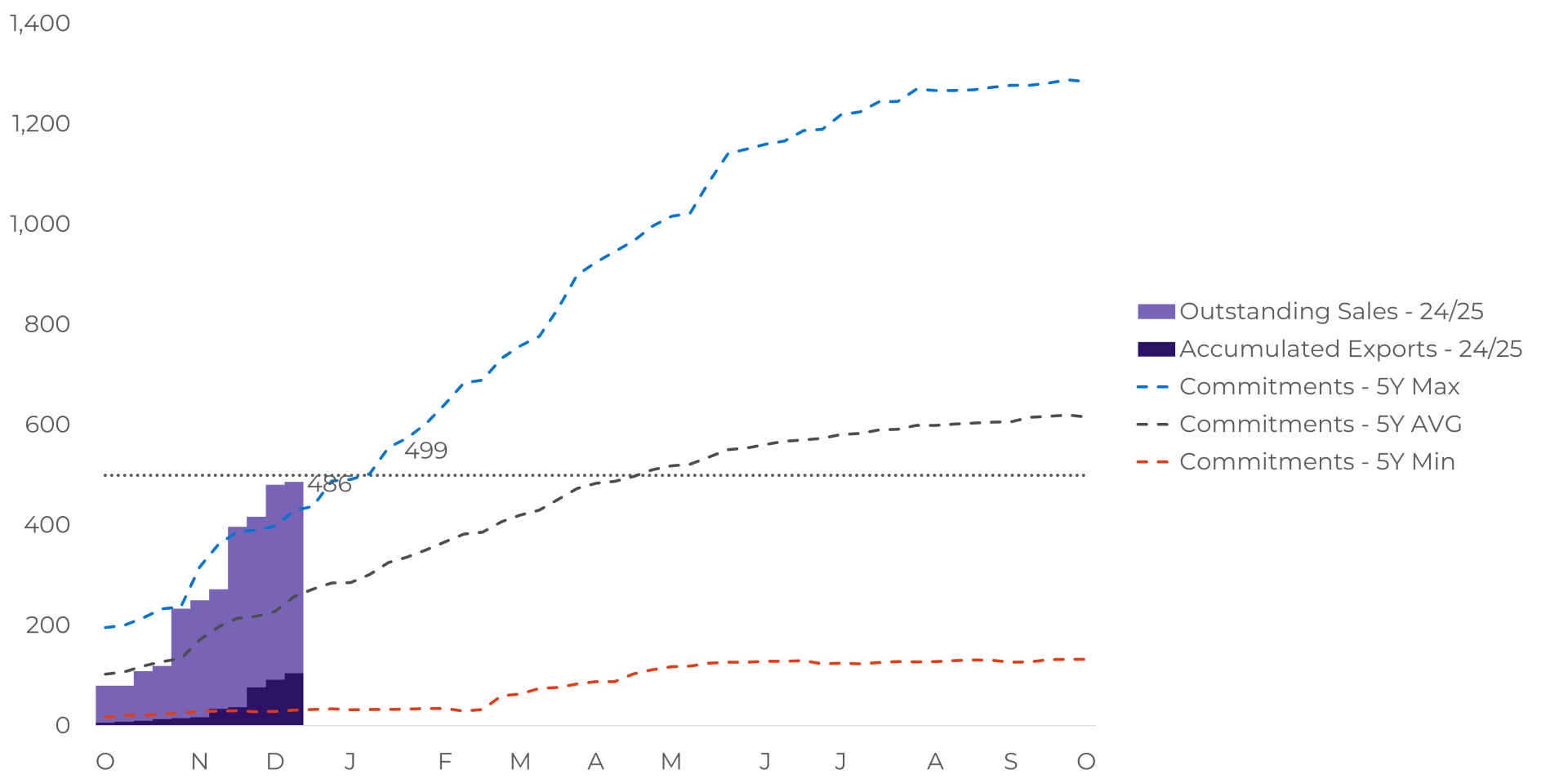

US Export sales

US Export sales

Last US export sales report has informed a total of 486k mt of SBO exports versus 499k mt reported on the last WASDE. As the graph below shows, this year the US SBO exports are going at a very good pace with current levels above the last 5-year range. At this pace, the US exports for the current campaign could settle a new export record in terms of volume.

US Soyoil Export Sales - lbs

Source: USDA

Funds activity

Funds have reduced their short position in SBO in half, from 29k contracts short to 14.6 contracts short, giving the signal that they are still bearish, but they want to reduce their exposure. During the period in between the last COT and the previous one, SBO prices had a price increase of 1%. Since the futures levels have been going down over the last week we could expect an increase in the funds short position for the next COT report. The record crop expected in Brazil and US also adds some pressure to push prices down.

Soyoil Non-commercial (spec) positions - in lots

Source: CFTC, Reuters

Palm oil situation

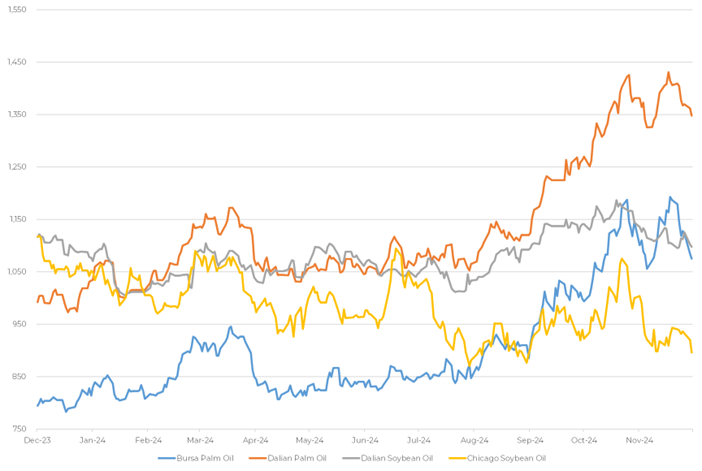

Over the last days, Palm Oil prices have entered a bearish trend following the same trend of the Soybean Oil futures (record soybean crop). Soybean Oil futures have dropped to a four-month low and Malaysian Palm Oil futures have followed that trend, losing 4%. This has positioned Palm Oil cheaper than the Dalian Soybean Oil futures priced but still above the current Soybean Oil levels in Chicago.

Oilseeds Spot Prices

Source: Reuters

The US government has released last Tuesday (17) that they will include a plan to allow year-round sales of gasoline high ethanol content (E15), which should increase the corn consumption. This can affect the soybeans demand, which is also pushing the SBO prices down. On the Europe side, there are concerns about the E15 blend and what is going to be the demand for vegetable oils.

On top of that, in just two weeks Indonesia will start its new blending policy, moving from a 35% blend into a 40% blend, which will increase the Palm Oil use on 2M lbs. Also, the Asian country will increase its export levy for Crude Palm Oil from 7.5% to 10% in order to finance higher biodiesel subsidies who are in need of extra funds due to the increase in the blend.

Written by Ignacio Espinola and Luiz Roque

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Reviewed by Luiz Roque

Luiz.Roque@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.