Exchange Rates and the Brazilian Fiscal Position

Exchange Rates and the Brazilian Fiscal Position

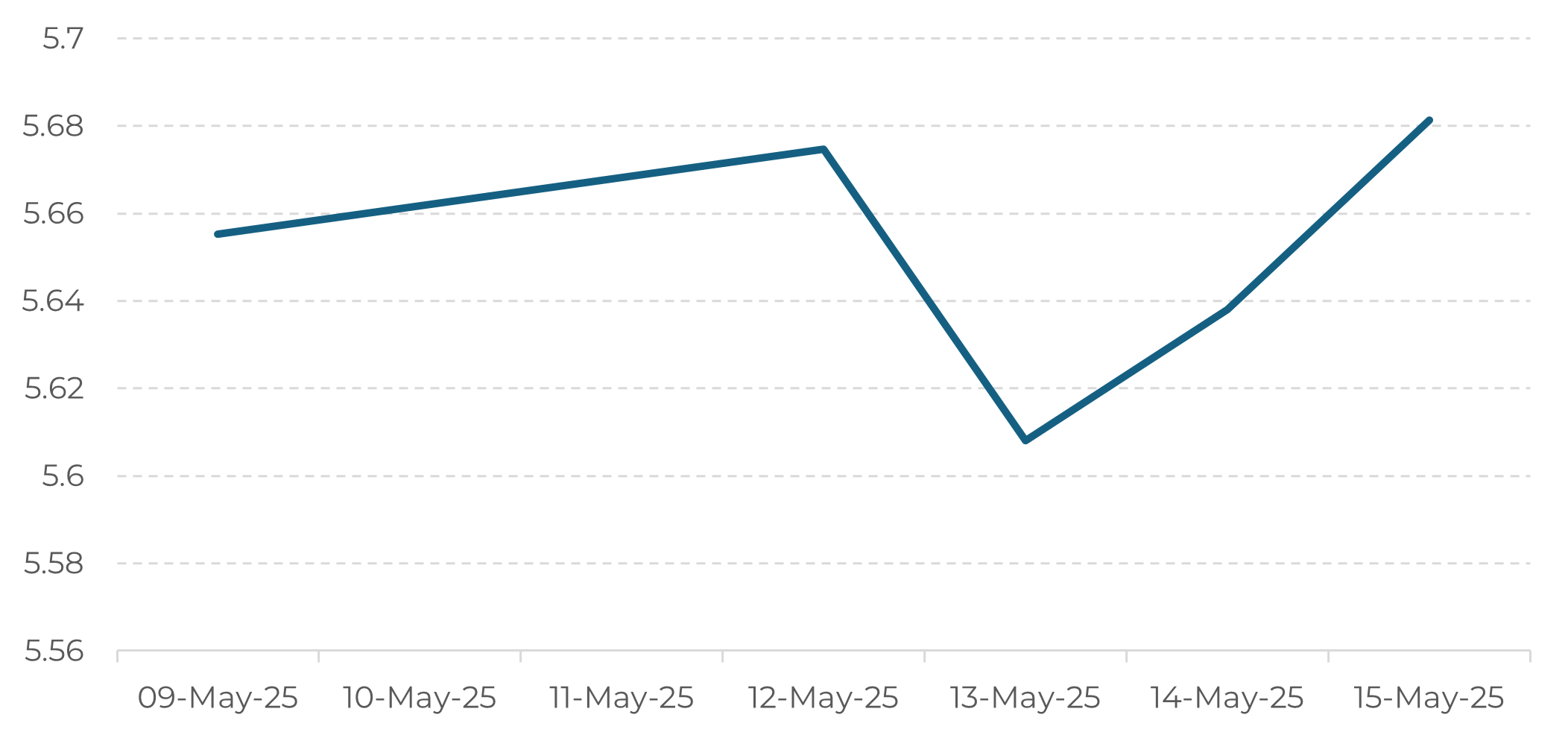

BRL/USD Weekly Performance

Source: Reuters, Hedgepoint

Brazilian Domestic Market

External Scenario

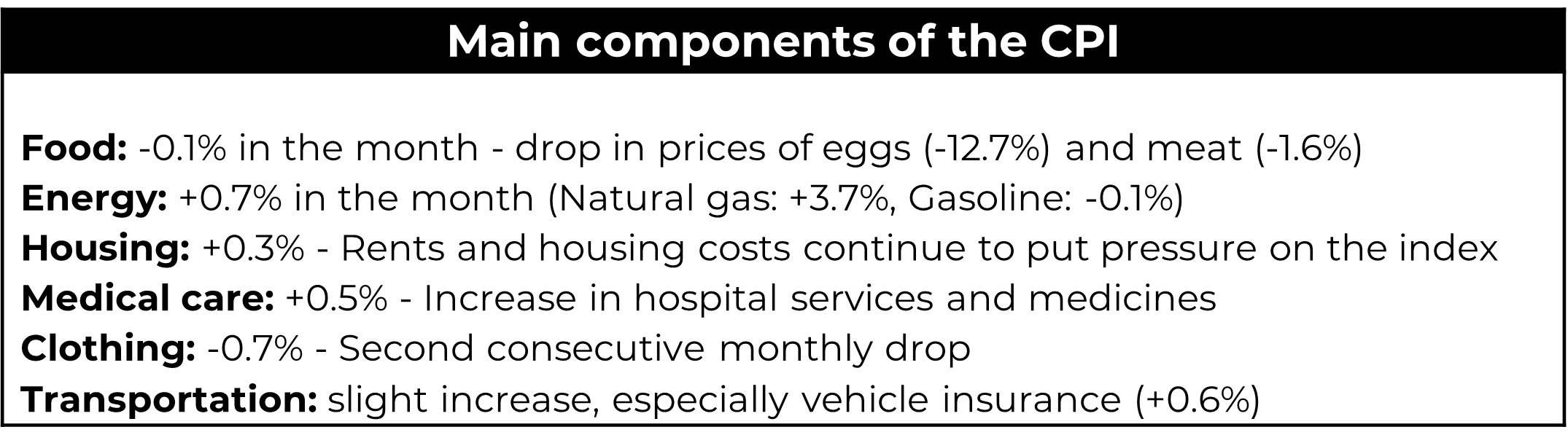

US Consumer Price Index (April/2025)

Source: Bureau of Labor Statistics (BLS), Hedgepoint

The softer reading of inflation was well received by the markets, but, as discussed here in previous reports, it is believed that the real effects of the tariffs have not yet been reflected in final consumer prices, either because of remaining stocks acquired previously or because they simply haven't been passed on yet. As a result, inflationary pressure could be seen in the coming months.

The behavior of the real against other currencies

In recent weeks, Brazil has distanced itself from the performance seen in other emerging markets, with the real depreciating against the dollar, despite a more constructive international environment. The improvement in global risk appetite, driven by trade negotiations between the United States and China - with significant progress announced on May 12, 2025 - was not enough to support Brazilian assets.

In a nutshell

Last week was marked by a combination of domestic and external factors that shaped the behavior of the real against the dollar. Although milder inflation data in the United States and progress in trade negotiations between the US and China provided a more favorable backdrop for emerging assets, the real continued to be pressured by domestic uncertainties, especially in the fiscal field.

guilhermo.marques@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.