US government bonds, changes to the IOF and the impact on the exchange rate.

US government bonds, changes to the IOF and the impact on the exchange rate.

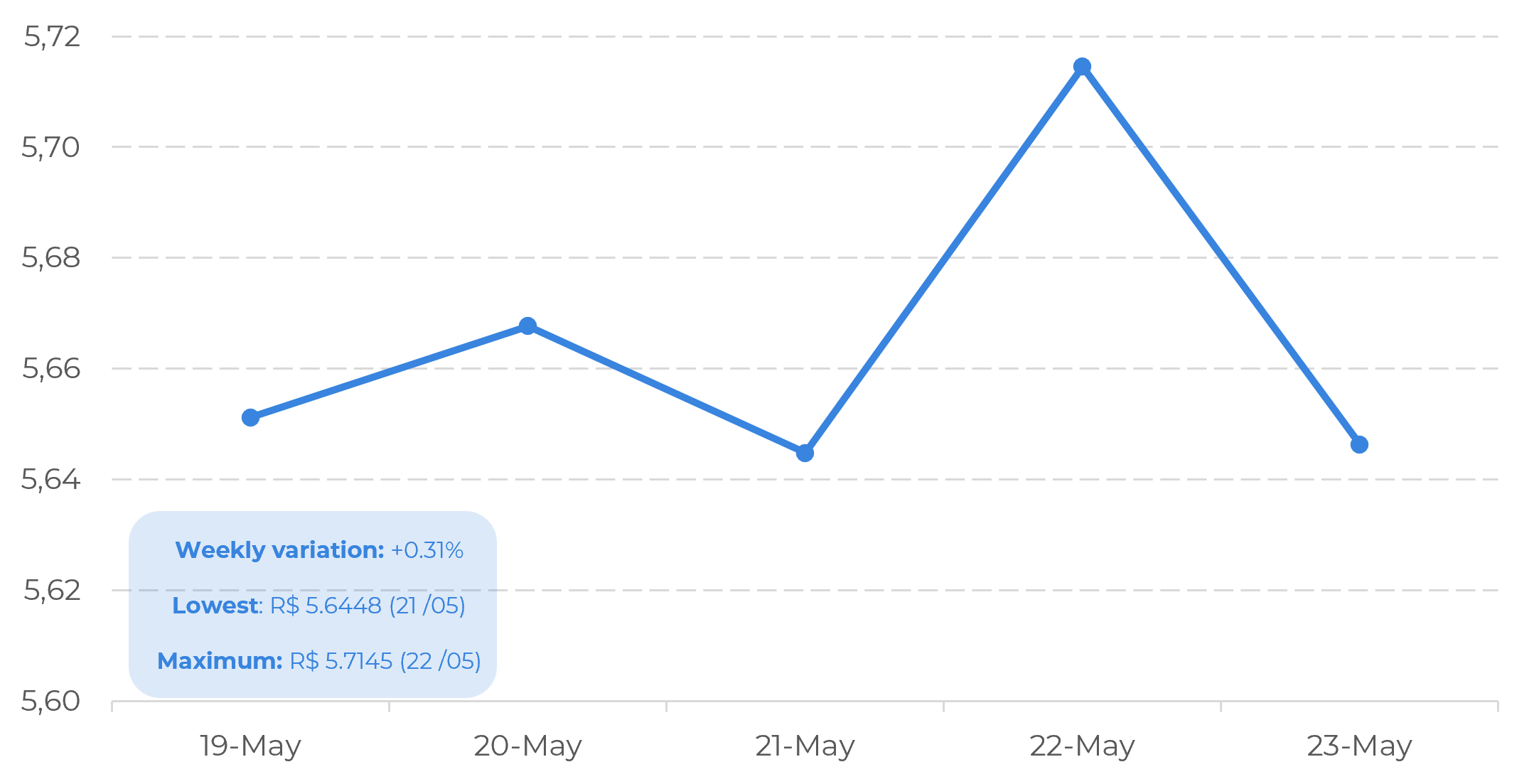

BRL/USD Weekly Performance

Source: Reuters, Hedgepoint

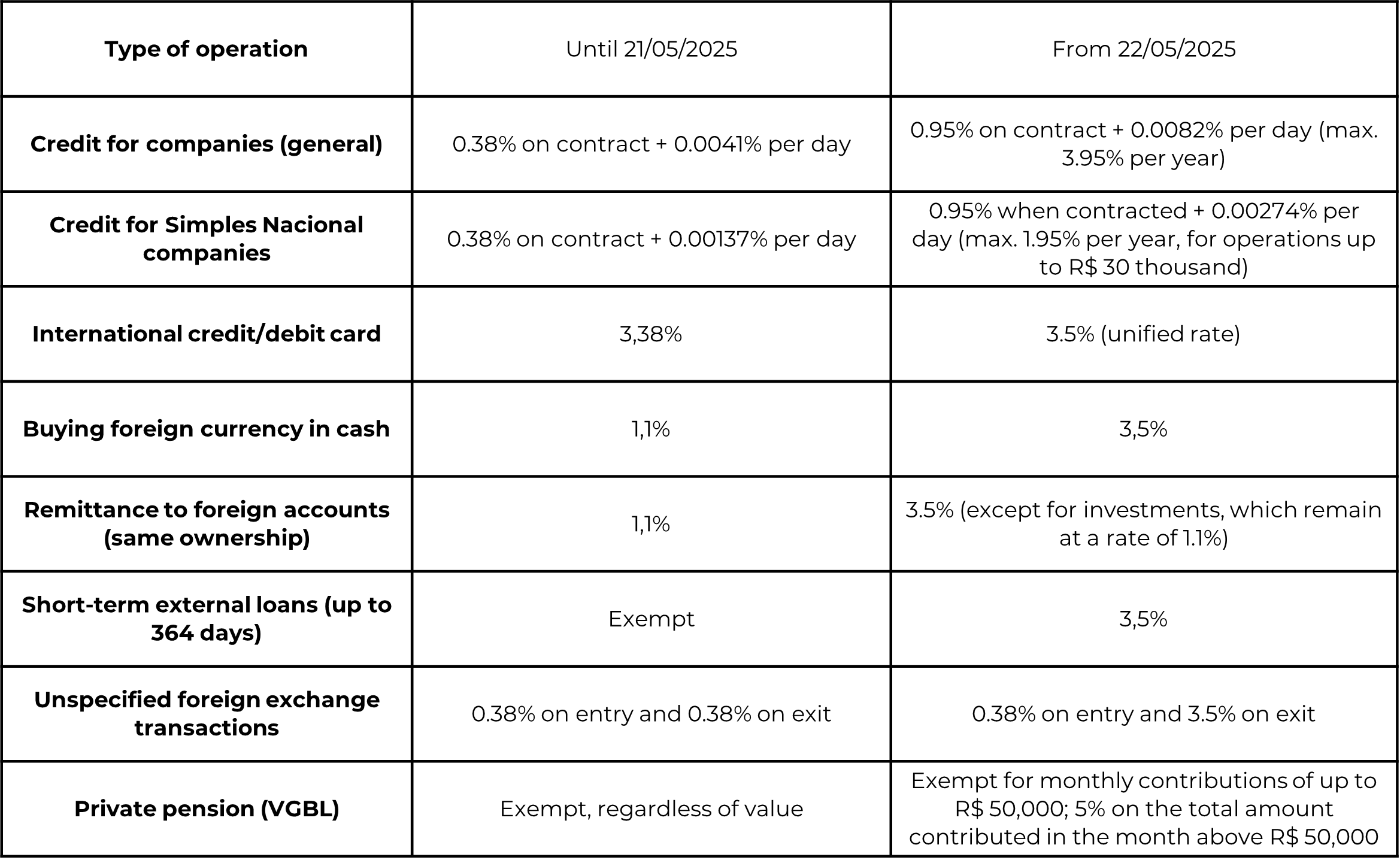

Brazilian Domestic Market

IOF Announced Changes

Source: InfoMoney and others, elaborated by Hedgepoint

Global Factors and Commodities

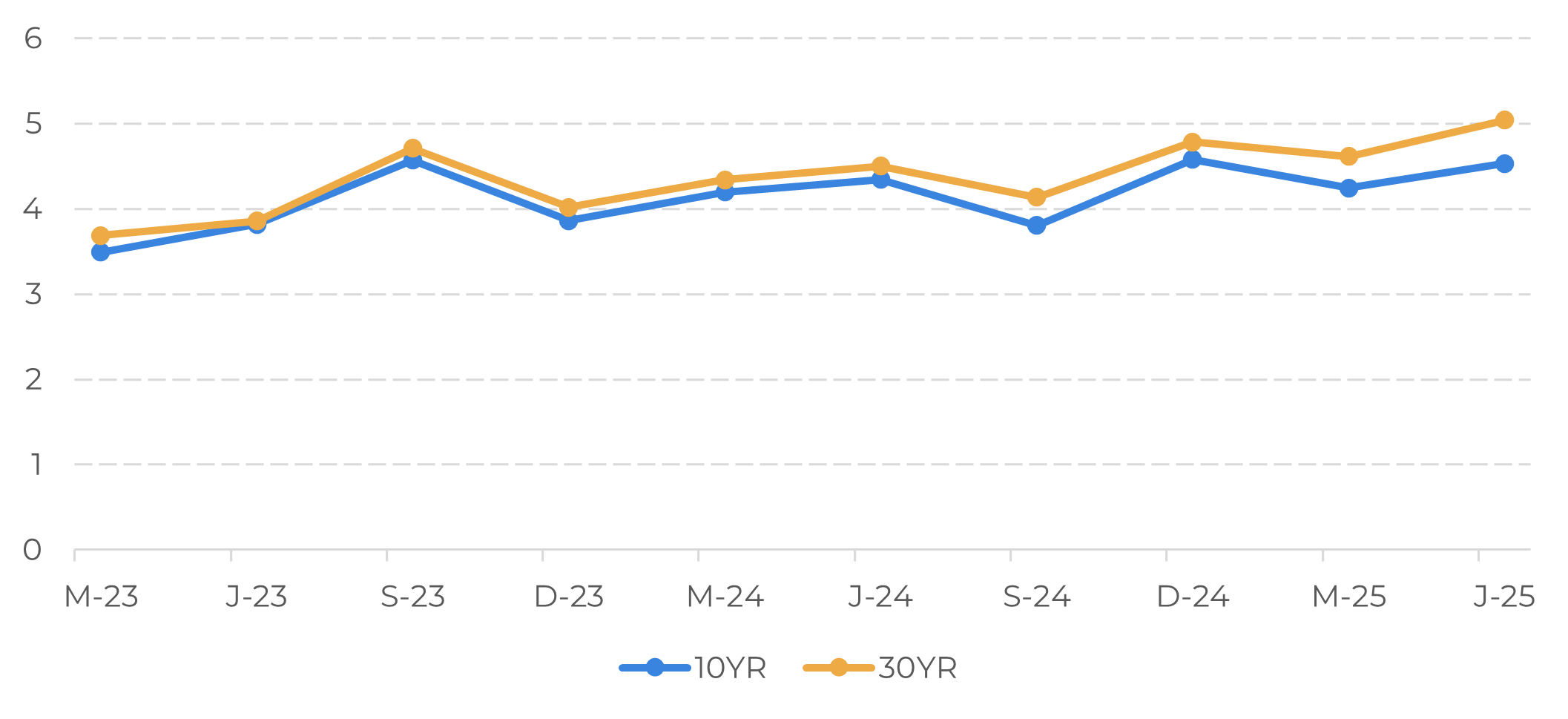

Evolution of American Bonds: 10Yr and 30Yr

Source: Reuters, Hedgepoint

US government bonds with high long-term yields

Considering recent events, we need to be clear about which variables we should monitor in order to better understand the market and its trends. Given the change in the US rating, the Treasuries are the main indicators to monitor.

Treasuries are debt securities issued by the US government to finance its operations:- T-bills (short term, up to 1 year)

- T-notes (medium term, 2 to 10 years)

- T-bonds (long term, 20 to 30 years)

- TIPS (inflation protected)

When investors demand a higher yield to buy long-term bonds, such as 30-year bonds:

- This indicates a loss of confidence in the fiscal or monetary health of the issuing country.

- It may reflect expectations of higher inflation in the future or a higher risk premium.

- Bond prices fall as yields rise (the relationship is inverse).

The fact that yields on 30-year bonds are at 5.1% sets off a warning signal in the market. As they are close to the highest levels in recent years, they reflect investors' growing concern about the sustainability of US debt, which leads them to demand a higher premium to keep these securities in their portfolios. Last Thursday (22), President Donald Trump won a victory in the US Congress by passing the bill dubbed the "One Big Beautiful Bill" (OBBB). In a narrow margin (215 votes to 214), the measure offers tax cuts for individuals, raising the deduction ceiling from $10,000 to $40,000, measures on energy, the environment, immigration and security, and most importantly, raising the US debt ceiling by $4 trillion for the next few years. All these factors together raise concerns about the total US debt and its solidity in the future.

Thus, the growing concern about the US economy, coupled with decisions such as raising the country's debt ceiling, can be interpreted as a restriction on the appreciation of its currency. This situation makes it difficult to understand a clear trend for the Brazilian real against the dollar, since both governments have taken decisions that could harm the strength of their currencies.

In a nutshell

The combination of the downgrade of the US sovereign rating, the rise in the yields of long-term Treasuries and the approval of new expansionary fiscal measures by the US Congress has significantly increased the level of uncertainty in global markets. This scenario puts pressure on the US yield curve and increases risk aversion, with direct effects on capital flows to emerging economies such as Brazil.

As for Brazil, the increase in the IOF from May 23, 2025, although intended to reinforce the Brazilian government's commitment to fiscal balance, could have an adverse effect in the short term by reducing the country's attractiveness to foreign investors and making international operations more expensive for companies and individuals. The market's response to these measures will be crucial to understanding the exchange rate's next moves.

Therefore, although the real has appreciated slightly in recent weeks, the balance remains fragile. The behavior of the exchange rate over the next few days will depend on the market's interpretation of the sustainability of the fiscal measures adopted in both the United States and Brazil, as well as sensitivity to capital flows in a more cautious global environment. Exchange rate volatility is likely to remain high, requiring extra attention from economic agents exposed to the risk of dollar fluctuations.

guilhermo.marques@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.