Exchange rate: Performance of the Brazilian currency and what to expect

Brazilian currency behavior

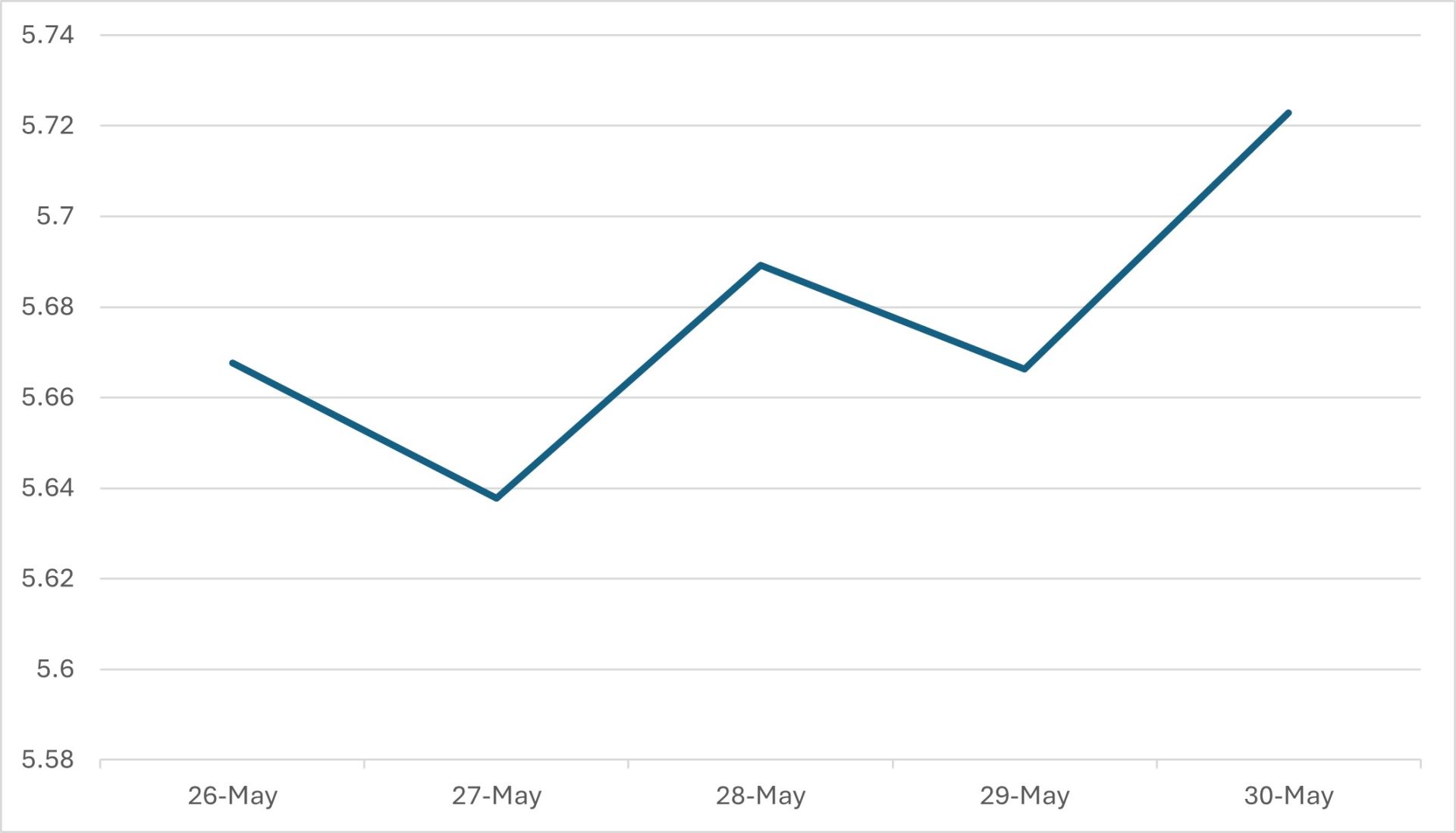

BRL/USD Weekly Performance

Source: Reuters, Hedgepoint

Brazilian Domestic Market

As a result, the Ibovespa accumulated a weekly drop, ending Friday (30/05) down 1.09% at 137,062 points, also influenced by a weaker performance in sectors linked to domestic consumption and banks.

International Overview

United States

Ukraine vs. Russia

Ukraine carried out a dramatic series of attacks on the whole of Russia with drones taking off from hidden trucks and timber containers in the interior of the country, disabling 40 Russian aircraft, some of which were even nuclear-capable. This caused Brent to rise, ignoring announcements of increased production by OPEC. Further tensions over a possible reciprocal action by the Russian army should draw attention this week.

Mexico

The Bank of Mexico has negatively revised its growth projection for the country in 2025, projecting a GDP expansion of just 0.1%, down from the 0.6% previously forecast. This reduction reflects a combination of factors, including a weakened domestic economy, a low rate of investment and consumption, as well as global uncertainties over the country's progress in trade negotiations with the US. The International Monetary Fund (IMF) projects a 0.3% contraction in Mexico's GDP by 2025

In a nutshell

In a week marked by fiscal pressures in Brazil and growing signs of a global economic slowdown, the dollar gained strength against the real, reflecting investors' risk aversion in the face of domestic and international uncertainties. The combination of deteriorating confidence in Brazil's fiscal policy, negative growth revisions in emerging countries such as Mexico and the strengthening of the dollar against the external backdrop contributed to the USD/BRL's weekly rise of 1.51%.

On the international scene, US inflation data still doesn't guarantee immediate interest rate cuts by the Federal Reserve, while geopolitical tensions - such as the conflict between Ukraine and Russia - and trade tensions - especially between the US and China/Mexico - reinforce global caution. These elements add volatility to emerging currencies and keep the dollar sustained at high levels.

Over the next few days, attention will continue to be focused on developments in the Brazilian fiscal scenario, new inflation data in the US and developments in geopolitical tensions, which should continue to influence the behavior of the exchange rate and global risk appetite.

guilhermo.marques@hedgepointglobal.com

luiz.roque@hedgepointglobal.com