Source: Ipeadata, Hedgepoint

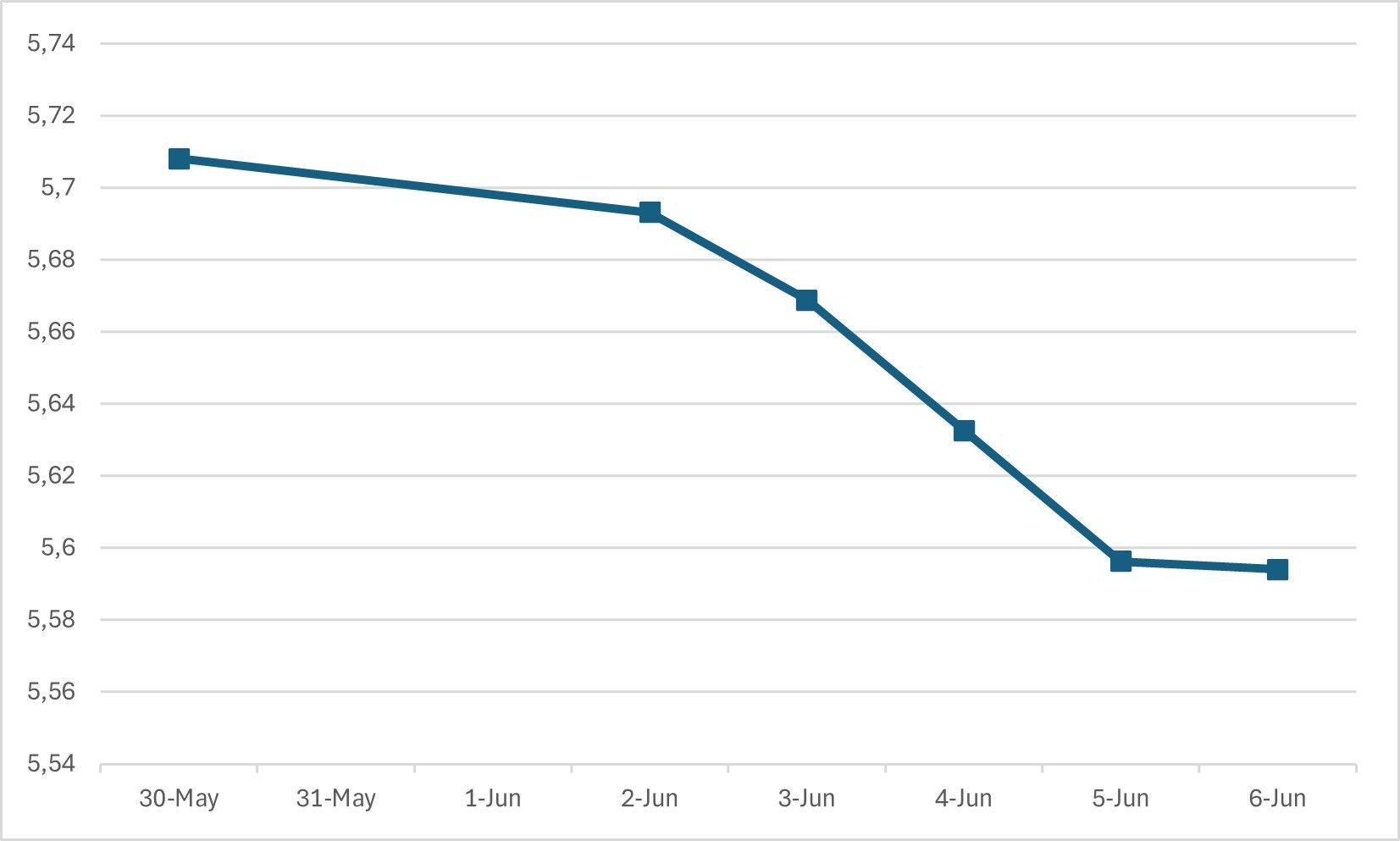

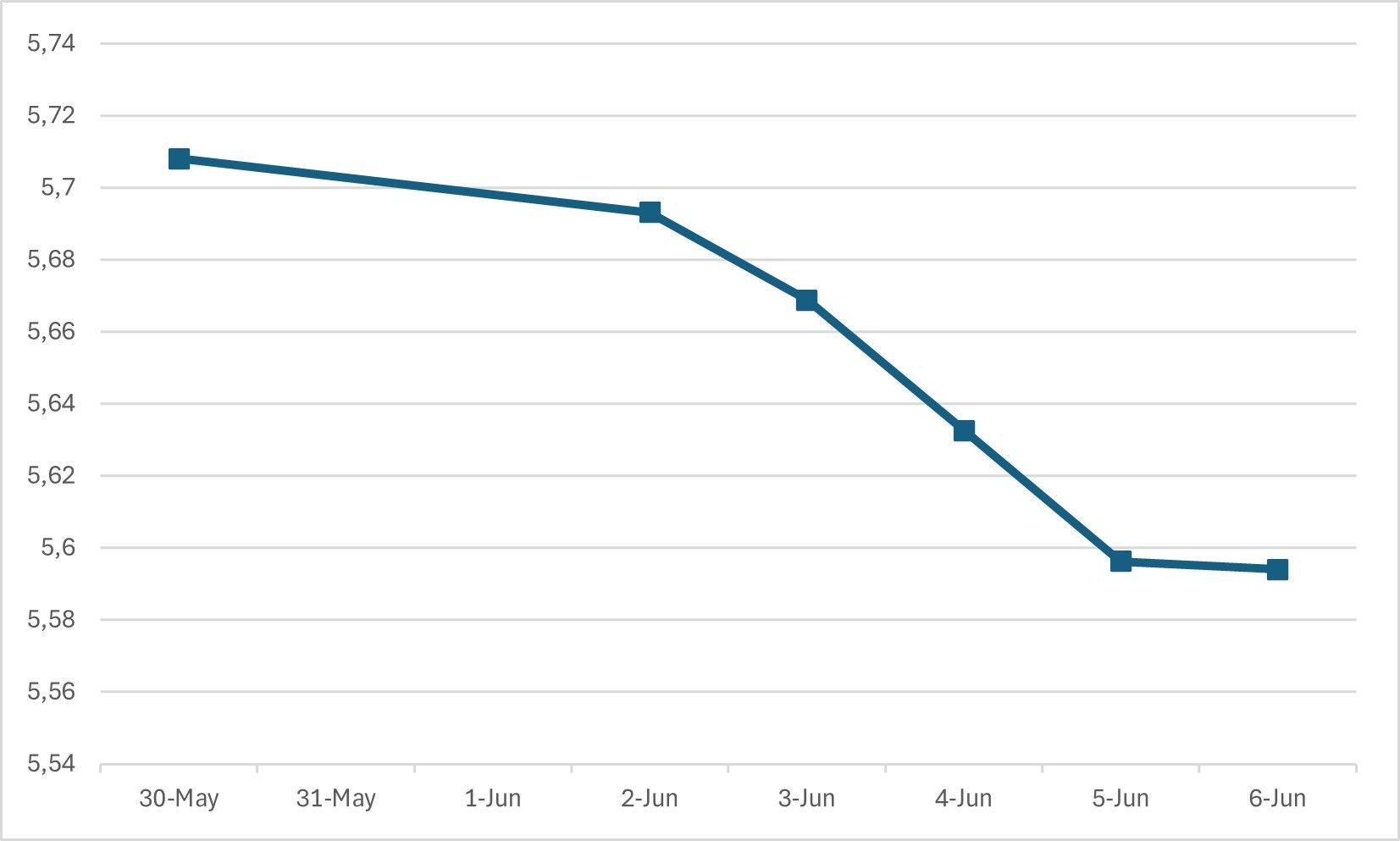

• Weekly variation: -2.0%

• Low: R$ 5.5941 (Jun 6th)

• High: R$ 5.6931 (Jun 2nd)

Decisions on the IOF took another turn this weekend. Last Sunday night (08), the Minister of Finance, Fernando Haddad, announced a rebalancing of the tax on financial operations - already revised in his first announcement due to the impacts on the financial market on 23/05 - with the idea of levying the tax on Fixed Income operations. The assets of the day are agribusiness and real estate bills of credit (LCA and LCI, respectively), with a 5% levy on gains, previously never applied.

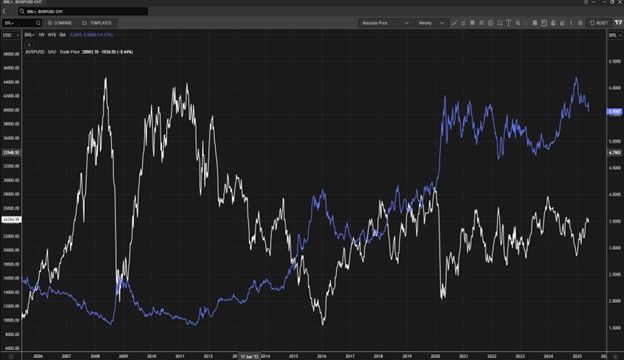

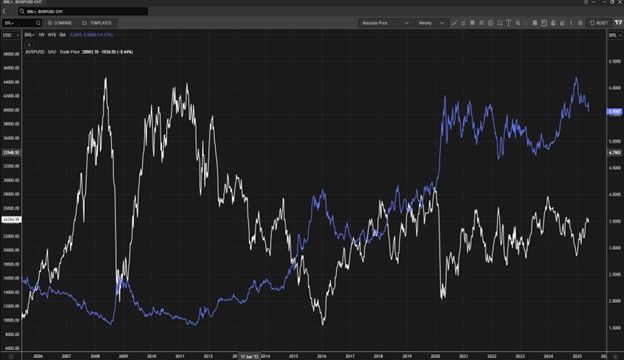

This whole situation is very critical in terms of Brazil's attractiveness to foreign capital. Capital stuck in the United States is looking for new destinations, and emerging markets are proving to be an opportunity. But Brazil, on the other hand, is positioning itself as a less desirable alternative. As we can see below, when we analyze the value of the Ibovespa (the index of the main shares traded on the Brazilian stock exchange) regarding the dollar over the last 20 years, we see that the index has remained practically stable due to the devaluation of the real against the American currency. What does this show us? That basically over the last 20 years the value of the Brazilian stock market in dollars has remained at the same levels. Now, imagine the foreign investor who invested capital in Brazil in mid-2005, earning practically stable returns 20 years later?

In Brazil, we continue to watch the fiscal situation very closely, as well as the fallout from the government's updates on the IOF, which will probably continue to put pressure on the real against the dollar.

The country has gone through an intense week of events and releases that have had an impact on the markets.

On the numbers side, data was released on new job creation, with 139,000 new formal jobs announced by the official Bureau of Labor Statistics report, beating market expectations of around 130,000 new positions. Special attention should be paid to the fact that significant updates were made to the figures for March and April - March was adjusted from +185,000 to +120,000 (-65,000) and April from +177,000 to +147,000 (-30,000); totaling -95,000 revised jobs. Overall, the adjustments show a cooling of the economy in April. However, with expectations being exceeded for the May figures, we believe that this could be considered neutral to slightly positive, as it shows a certain support and resilience in the American economy, for the time being warding off signs of recession. As we have explained here before, in an educational way as we do at Hedgepoint, figures such as inflation and employment directly influence the Federal Reserve's analysis of the US economy's thermometer. The consensus among market analysts is that the institution will possibly continue to monitor the economy over the summer, keeping interest rates unchanged. Between now and the end of the year, we believe there could be one or two interest rate cuts, with the first probably taking place in September 2025.

On the political side, President Donald Trump and businessman and former member of the current president's government entourage - and until then, friend - Elon Musk, publicly disagreed on the X platform, exchanging accusations about the fiscal situation in the United States. Musk publicly demonstrated his dissatisfaction after the US government extinguished the exemption on electric vehicles, directly impacting on a "bill" estimated at $ 2 billion for Tesla, the company of which he is the founder.

Against this backdrop, the financial market continues to pay attention not only to macroeconomic data, but also to political developments that could influence the confidence of economic agents and their appetite for risk. The recent tension between Trump and Musk raises concerns about possible interference in the economic and regulatory agenda, especially in strategic sectors such as technology and clean energy. In addition, investors continue to monitor the negotiations surrounding the federal budget and the debt ceiling, issues that could reignite the volatility of Treasuries and directly influence the dollar's trajectory. In the midst of this scenario, the behavior of risk assets should continue to be sensitive both to communication from the Federal Reserve and to domestic political developments, reinforcing the importance of a broad and integrated reading of economic fundamentals, the fiscal scenario and institutional stability.

On June 5, the ECB cut interest rates again - for the eighth time in a year - cutting the main rate from 2.25% to 2.00% per year. Inflation of 1.9% in May (below target), modest growth of 0.3% in Q1/2025 and increased economic risks from US tariffs were the main reasons for this decision. According to a statement from the ECB (European Central Bank), the cut may be the last for now, depending, of course, on future data.