Apr 25

/

Guilhermo Marques

The continuing uncertainties about the outcome of the global negotiations and their impact on Brazil

Back to main blog page

The continuing uncertainties about the outcome of the global negotiations and their impact on Brazil

- Global trade tensions, driven by the negotiations and imposition of tariffs coordinated by the United States, have created uncertainty about the growth of the world economy.

- Since the beginning of April, investors have faced market fluctuations due to the disparity between the White House's statements and the market's interpretation of them. This has led to adverse reactions concerning the next steps in the negotiations. As a result, sentiment remains cautious. The US economy had its growth projection reduced to 1.8% in 2025, reflecting the economic slowdown resulting from trade tensions.

- Concerns about inflation in the United States, coupled with pressure from President Donald Trump for interest rate cuts and rumors about possible changes at the Federal Reserve involving Jerome Powell, have stood out as points of attention in recent days.

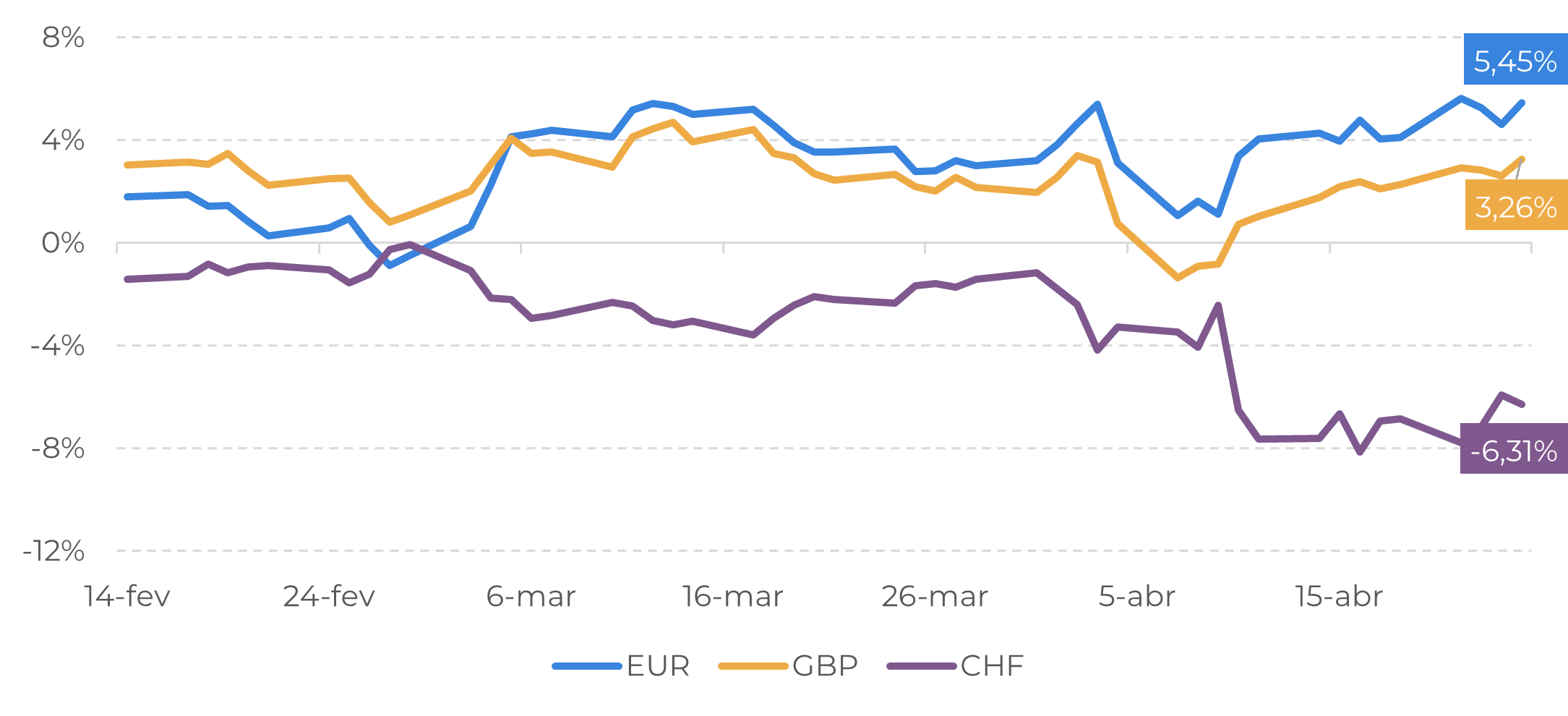

- The USD has been showing sensitivity and uncertainty as a safe-haven currency, causing it to lose value against more solid currencies (EUR, GBP, CHF, for example).

- Gold continues to reach record highs, surpassing $3,500.00 an ounce recently as investors look for safe-haven assets in times of uncertainty.

Introduction

The global economic situation has been characterized by an atmosphere of uncertainty and a feeling of caution about the outcome of negotiations between the United States and other countries. Among these, China stands out, on which tariffs of up to 145% have been established, with a retaliatory tariff of 125% in response.

The International Monetary Fund (IMF) has lowered its projection for global growth to 2.8% in 2025, down from the 3.3% previously forecast. According to the IMF itself, this revision is due to the uncertainties caused by the tariffs imposed by the United States. The US economy has also had its growth projection revised to 1.8% for 2025 only.

The general sentiment of investors, as well as the market consensus, revolves around the direction these negotiations will take - especially in relation to the actual amounts of the tariffs and the possible reciprocity on the part of the other countries in the face of any final decision adopted by the United States.

Since the beginning of April, investors have experienced market fluctuations due to the divergence between White House statements and their impact on the market, with adverse reactions to the next steps in the negotiations.

Exchange rate

In recent weeks, an interesting trend has emerged as investors increasingly seek out safer assets and currencies. This shift has led to a rise in the value of gold and has contributed to the weakening of the US dollar against major global currencies.

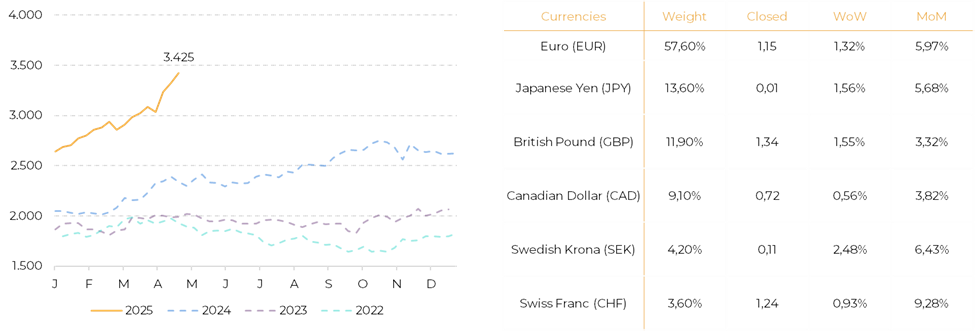

Gold (USD/oz) and behavior of the currencies that make up the dollar index

Source: LSEG, Hedgepoint

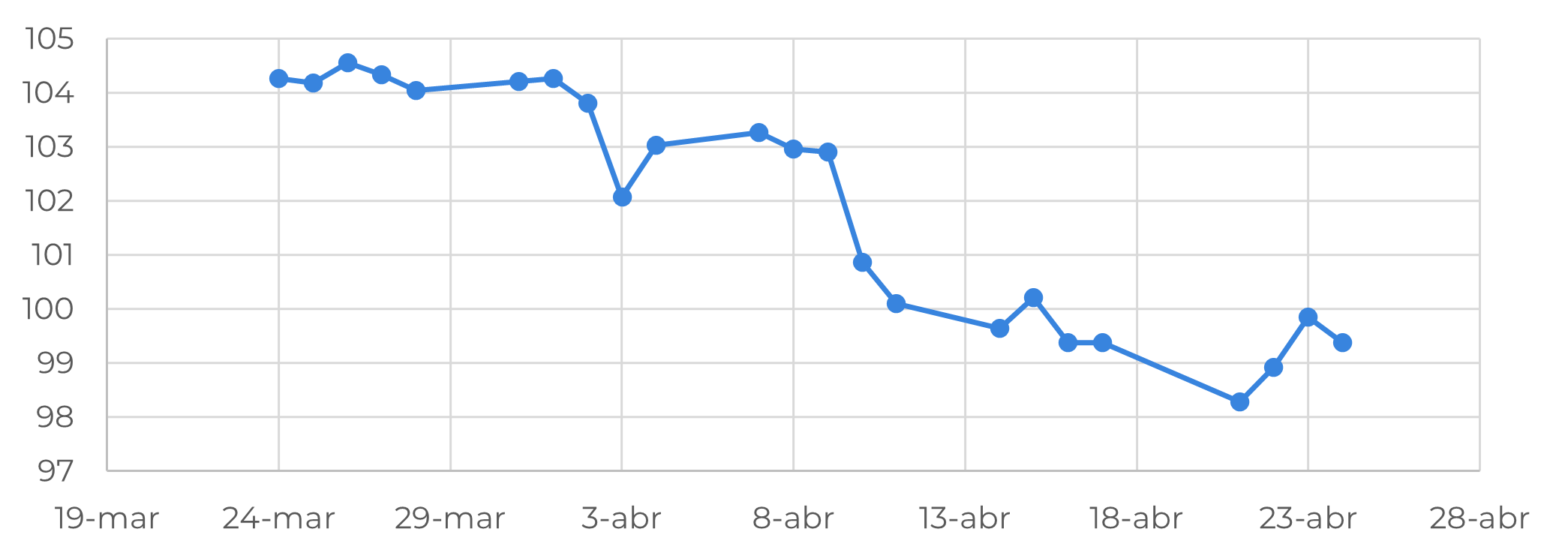

The DXY index has been registering recent losses, signaling a general perception of caution on the part of the market towards the United States, historically considered a “safe haven”, but challenged in this historic position.

Change in the DXY over the last 4

Source: LSEG, Hedgepoint

Donald Trump's harshest criticism of Federal Reserve Chairman Jerome Powell has sent a warning signal about the independence of the US central bank. Trump has demanded immediate interest rate cuts with the aim of accelerating the economy, blaming the current monetary policy as the main cause of the country's economic slowdown.

The tone of criticism intensified to such an extent that rumors of Powell's possible resignation surfaced on April 17 - a speech that was later reversed a few days later, on April 22, by Trump himself. These episodes generated tensions in the markets, which reacted with sharp falls, followed by slight recoveries, but without much optimism. Information mismatches have generated noise and instability, negatively affecting investor confidence.

EUR/USD, GBP/USD and CHF/USD - monthly change YTD

Source: LSEG, Hedgepoint

The impacts on Brazil

We still see a favorable position for Brazil in relation to the unfolding of the tariff negotiations between the United States and the world. So far, Brazil is on the "basic" tariff list, with a 10% tax on its products exported to the US. However, as we already know, the values imposed on Europe and especially China make Brazil attractive for a reordering of global consumption flows, especially in the field of commodities.

We can see that the dollar has been quoted at around R$5.726, the lowest it has been in recent months, following the global scenario of the devaluation of the American currency against other economies, albeit more timidly in emerging countries, but following the same trend. This trend could affect the competitiveness of Brazilian exports, since its product becomes more expensive for the American market at the same time that gains in purchasing power of other currencies could increase its demand in other countries. Thus, if tariffs prevail, it can be expected that major economies, such as China, could migrate their consumption flow from the United States to other origins, such as Brazil, favoring their trade balance and acting as support for the strengthening of their demand.

This trend is expected to occur in highly taxed markets where the United States is a relevant origin and suffers retaliation, for example, or grains. For those in which the US is a net buyer, the expectation becomes more bearish as inflation and economic slowdown may restrict consumption of these goods, especially if they are non-essential.

Summary

The global economy is facing a scenario of uncertainty, especially due to trade tensions between the United States and countries like China. We are cautiously observing the movements of both countries until material decisions are made on the direction of the global economy.

In a scenario of high volatility, risk management against currency exposures becomes essential, especially at a time when investors are migrating to safer assets. This trend has been evident in the depreciation of the dollar. Unlike the usual scenario where the dollar is viewed as a safe haven, the US currency has been weakening due to its significant involvement in the trade war, the US currency has been depreciating. The DXY index fell, reflecting the market's distrust of American economic stability, aggravated by Donald Trump's public criticism of Federal Reserve chairman Jerome Powell.

Regarding Brazil, the country could benefit indirectly from the tariff disputes by maintaining lower tariffs on its products and becoming a viable alternative for exports, especially of commodities.

Written by Guilhermo Marques

guilhermo.marques@hedgepointglobal.com

guilhermo.marques@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

To access this report, you need to be a subscriber.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.