May 9

/

Guilhermo Marques

SUPER WEDNESDAY: Rising Brazil/US interest spread keeps BRL strong against the dollar

Back to main blog page

SUPER WEDNESDAY: Rising Brazil/US interest spread keeps BRL strong against the dollar

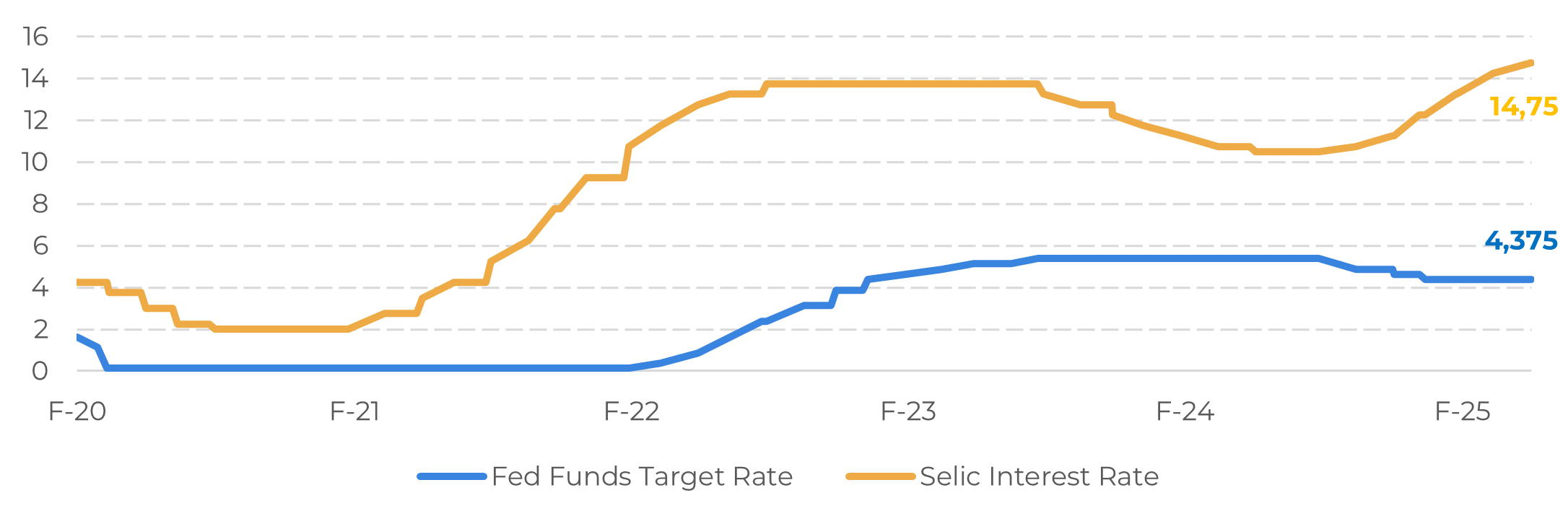

"Last week, the dollar traded between 5.69 and 5.75, boosted by expectations of the Brazilian Central Bank's decision to raise the Selic rate to 14.75%, which was confirmed on May 7. Also, in line with market expectations, the United States kept its interest rates between 4.25% and 4.5%. The scenario continues to call for greater caution due to uncertainties over the outcome of negotiations between the US, China and Europe on trade tariffs."

Brazilian Domestic Market

The Monetary Policy Committee (COPOM) raised the Selic rate (Brazil's basic interest rate) to 14.75% per year, marking its sixth consecutive increase. The main reason for the sequence of interest rate adjustments is to control inflation, which reached 5.5% in March, above the target set by the National Monetary Council (CMN) of 3% per year.

US vs. Brazilian interest rates: the interest rate differential has increased

Source: Refinitiv, Hedgepoint

The fact that expectations of future inflation (as indicated by the Focus report) are unanchored from the targets of the national monetary council (CMN) has led the board of the Brazilian Central Bank to maintain the policy of raising interest rates in Brazil to signal to the market the monetary authority's commitment to controlling inflation.

It is well known that inflation in Brazil has been sustained by structural factors, such as the weight of administered prices, the volatility of energy costs, the rigidity of the labor market and recurring fiscal pressures. These factors have limited the effectiveness of monetary policy in fully controlling prices. In addition, the fiscal scenario and the federal government's expansionary public spending policy also hinder the monetary strategy, contributing to persistent inflation expectations.

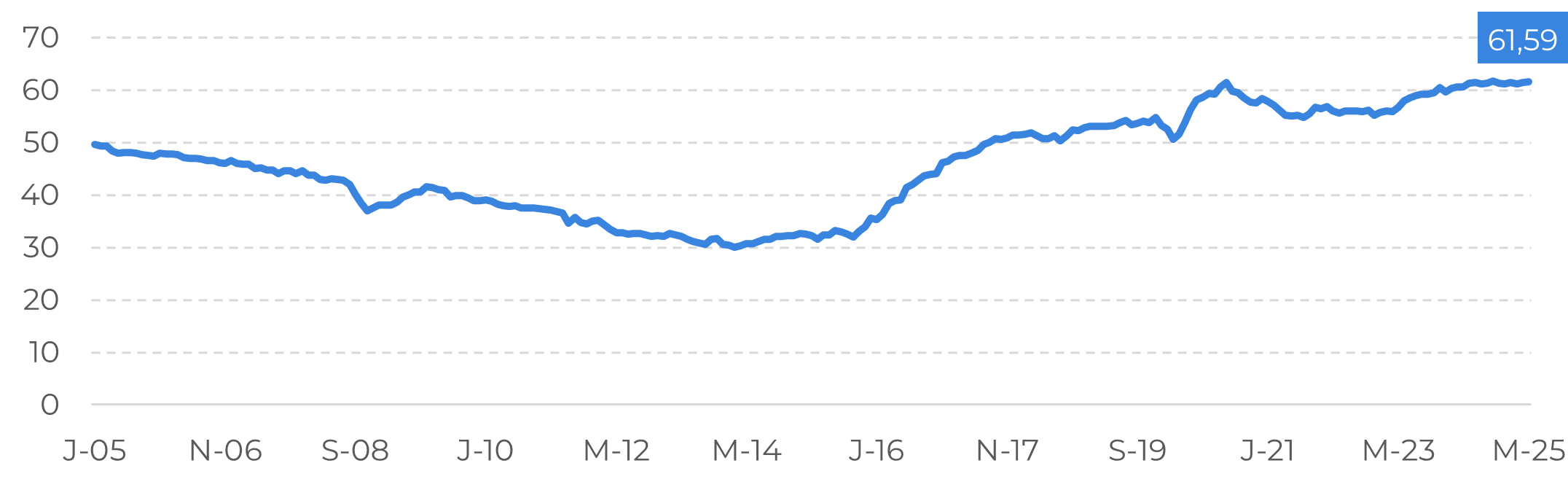

On the fiscal side, there are high risks related to public debt, which is close to 62% of GDP (IPEA data for March 2025). When we have high government spending, an increase in revenue becomes necessary through taxes or additional collections. If this doesn't happen, the government will have to resort to greater indebtedness, which can raise country risk, affect fiscal credibility, and reduce investor confidence in the economic environment. On the political side, the recent discovery of the so-called "INSS scandal", related to undue deductions from retirement and pension amounts, could directly affect the Brazilian economy.

Public sector net debt as a percentage of Gross Domestic Product (GDP)

Source: Ipea, Hedgepoint

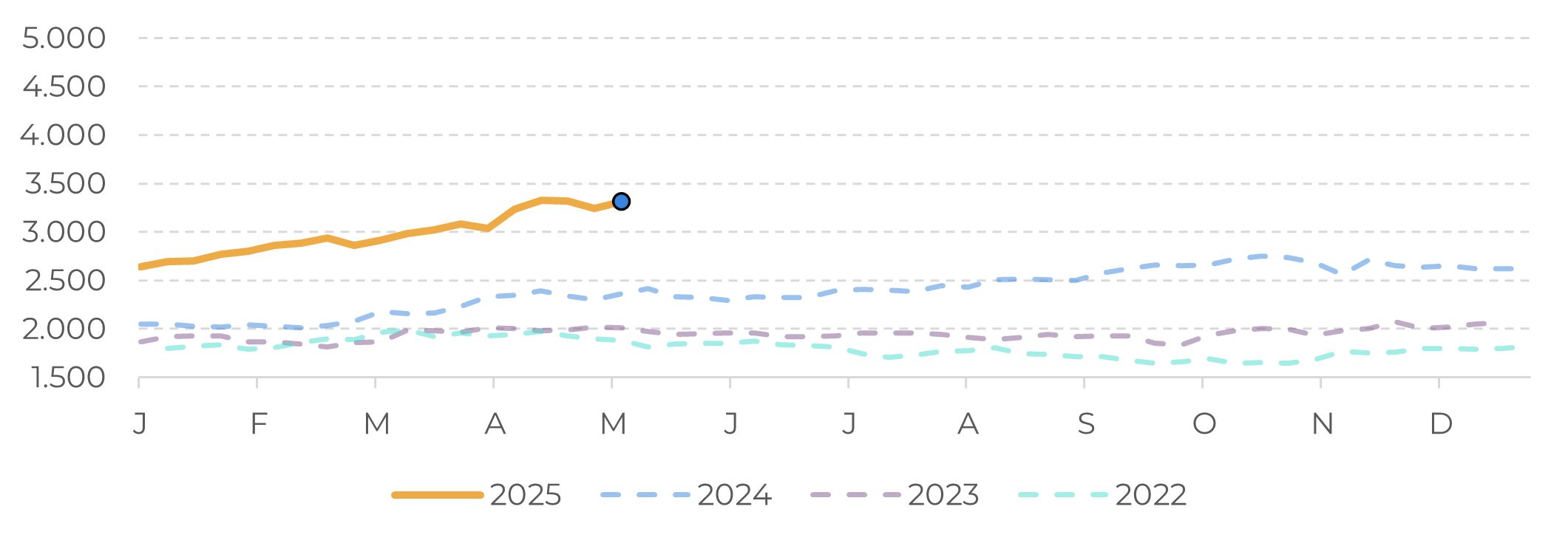

Even with all the points described above, the foreign exchange flow (value of total inflows and outflows of USD in the country) for April 2025 was positive at US$ 7.2 billion, marking the highest monthly inflow since February 2019 - a result that partly reflects the attractiveness of Brazil's favorable interest rate differential, which has stimulated appetite for local assets and boosted inflows of foreign capital. The trade balance shows a surplus (exports greater than imports) of US$8.153 billion in the country, with a slight drop of 3% compared to the same period in 2024.

International Market

On May 7, the Federal Reserve announced the US interest rate. Maintaining the rate between 4.25% and 4.50% was already expected and priced in by the market, despite pressure from US President Donald Trump to cut interest rates to stimulate the economy.

Federal Reserve Chairman, Jerome Powell has adopted a conservative stance, continuing to observe US economic indicators and not rushing to make any cuts. The market consensus revolves around cuts in the basic US interest rate from the third quarter onwards, which could drop by around 0.75%, all depending on how the US economy and inflation react to the tariffs recently imposed on global economies.

Commodities such as oil and metals have suffered recent devaluations. The first is due to recent announcements by OPEC about increasing daily production and the risk of a slowdown in global consumption, impacting supply/demand. In the case of iron ore, the loss in value is mainly due to fears of a slowdown in the Chinese economy, which recently announced stimuli to boost its domestic production, a factor of concern for the current government, along with developments regarding the tariffs imposed and reciprocated with the United States.

Hegemony of the dollar and continued search for gold.

The dollar has been losing value in recent weeks, mainly due to the risk of a global reversal towards a trend of monetary diversification and the questioning of American hegemony. Tensions arising from the ongoing trade war and the global political and economic imbalance have exacerbated these factors.

As a result, safer assets, such as gold, have been showing a daily appreciation, compared to the last week between May 2 and 7, 2025, from $3,243.30 to $3,401.94, a positive variation of 4.89% in one week.

Annual evolution of the gold price until the close of 05/07/2025

Source: Refinitiv, Hedgepoint

Prospects for Emerging Markets

When we compare the dollar with emerging market currencies, we see a significant downward trend for the American currency. The DXY index, which measures the value of the dollar against a basket of currencies, has fallen by around 1.3% in the last two weeks, reflecting a global movement of American risk aversion and greater appetite for assets from developing economies. This movement has been driven by three main factors:

- The search for monetary diversification, especially among central banks and large global funds, which have increased their reserves in currencies such as the yuan, the real and the dirham.

- Expectations of cuts in US interest rates, which could reduce the interest differential between the dollar and the currencies of countries with still high rates, such as Brazil and Mexico.

- Net inflows of capital into emerging markets, both via foreign direct investment and fixed and variable income, in search of more attractive returns given the relative stability of local fundamentals.

Source: LSEG, Hedgepoint

Summary

The economic environment remains complex, both domestically and internationally, marked by uncertainties over the direction of monetary policy, persistent geopolitical tensions and deadlocks in trade negotiations between the main global economies. Despite this challenging context, emerging markets have shown a capacity to adapt, driven by relatively solid economic fundamentals, greater attractiveness compared to developed countries and the prospect of easing monetary policies in central economies.

For the next few days, the market's attention will be focused on the following points:

- The release of the COPOM minutes, which could signal the end of the interest rate hike cycle or the possibility of additional adjustments.

- Inflation indicators in the US (CPI) and Brazil (IPCA), essential for calibrating monetary policy expectations.

- IPCA on 9/5/2025

- CPI (USA) on 13/5/2025

- New data on exports from China, which could redefine the prices of metal commodities, are directly related to the Brazilian market.

- The progress of tariff negotiations between the US and Europe, with a possible impact on global confidence and capital flows.

Written by Guilhermo Marques

guilhermo.marques@hedgepointglobal.com

guilhermo.marques@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.