Apr 10

/

Guilhermo Marques

The economic impacts of the tariffs imposed by the US and Brazil's role in this framework.

Back to main blog page

The economic impacts of the tariffs imposed by the US and Brazil's role in this framework.

"The market is still cautious, as the movements of realizations and sudden gains are not related to fundamentalist aspects, but rather to expectations about the effects of a possible recession, not to mention the indecision about what the final values and deadlines of the tariffs imposed by Donal Trump will be, and really when they will start to apply."

- Over the past week, the global financial market has seen significant impacts from the recent tariffs imposed by the United States.

- Brazil saw a negative foreign exchange flow of US$ 1.317 billion, with the outflow of dollars consisting of more than US$ 1 billion in financial operations together with a deficit of US$ 221 million in the trade balance.

- The most active iron ore contract in China (Dalian Iron Ore) fell sharply last week on fears of recession in the Chinese market in the face of US tariffs.

- Global markets have accumulated devaluations and losses of around $10 trillion since the so-called "D-Day" imposed by President Donald Trump until April 9th .

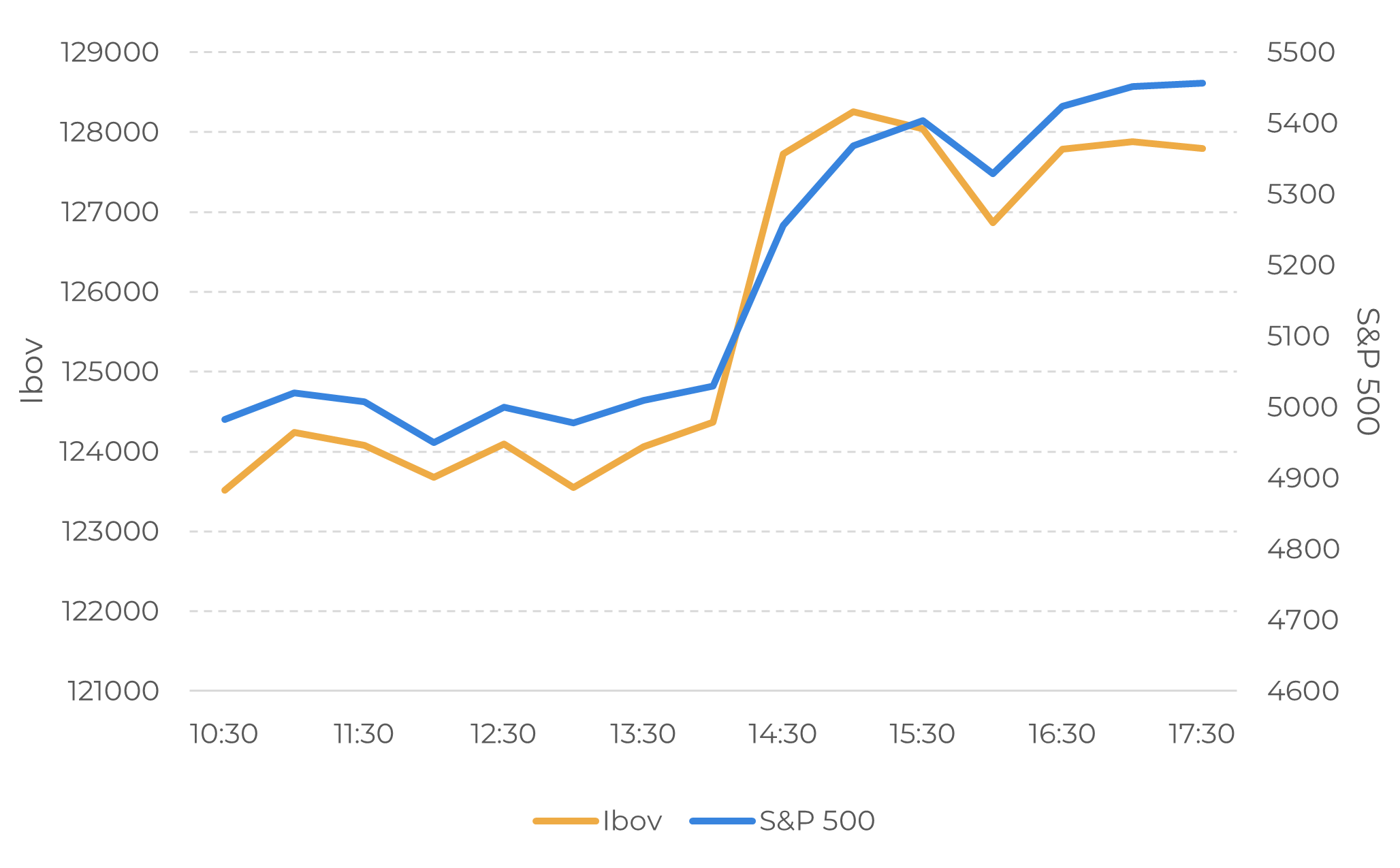

- On April 9th, at around 2:15 p.m. (Brasília time, or 1:15 p.m. in New York), the stock markets reversed their losses following Donald Trump's announcement to apply a minimum tariff of 10% to countries that have not retaliated against the United States after 90 days, except for China, which had its tariff raised from 104% to 125%.

Introduction

On April 2, 2025, US President Donald Trump announced new trade tariffs on the global market as part of a policy of "readjustment" in response to tariffs imposed by other countries. These new measures were called reciprocal tariffs.

In a week in which there was a whirlwind of facts and news, the real experienced initial resistance against the other currencies, appreciating by 0.7% against the dollar, reaching its lowest level since October 2024. This was because analysts believed that the 10% tariffs on Brazil were more lenient, and that the country could benefit in comparison to other economies, such as China and Europe, which suffered steeper tariffs.

However, this movement did not prevail for long, as retaliations from Europe and especially China began to be announced, leading to greater fears of a more energetic trade war. The Real closed the week of April 4th with a devaluation of more than 4% in 5.84.

An April 9, after intense reflections on the speeches and decisions between the United States and China, with tariffs raised to 125% on Chinese products, Donald Trump announced that he would relax tariffs on countries that did not retaliate against the United States for 90 days, which immediately made the market return. In addition, he openly recommended on his official social network that it would be a "great time to buy", indicating that stock values were already reaching their lows after the recent realization and sell-out, which spurred a recovery in the market, easing fears of recession. Despite the position of the current US president, the international scenario remains uncertain and highly volatile, requiring an extra dose of caution.

Image 1: Inversion of the American and Brazilian markets on April 9, 2025.

Source: LSEG, Hedgepoint

Exchange rate

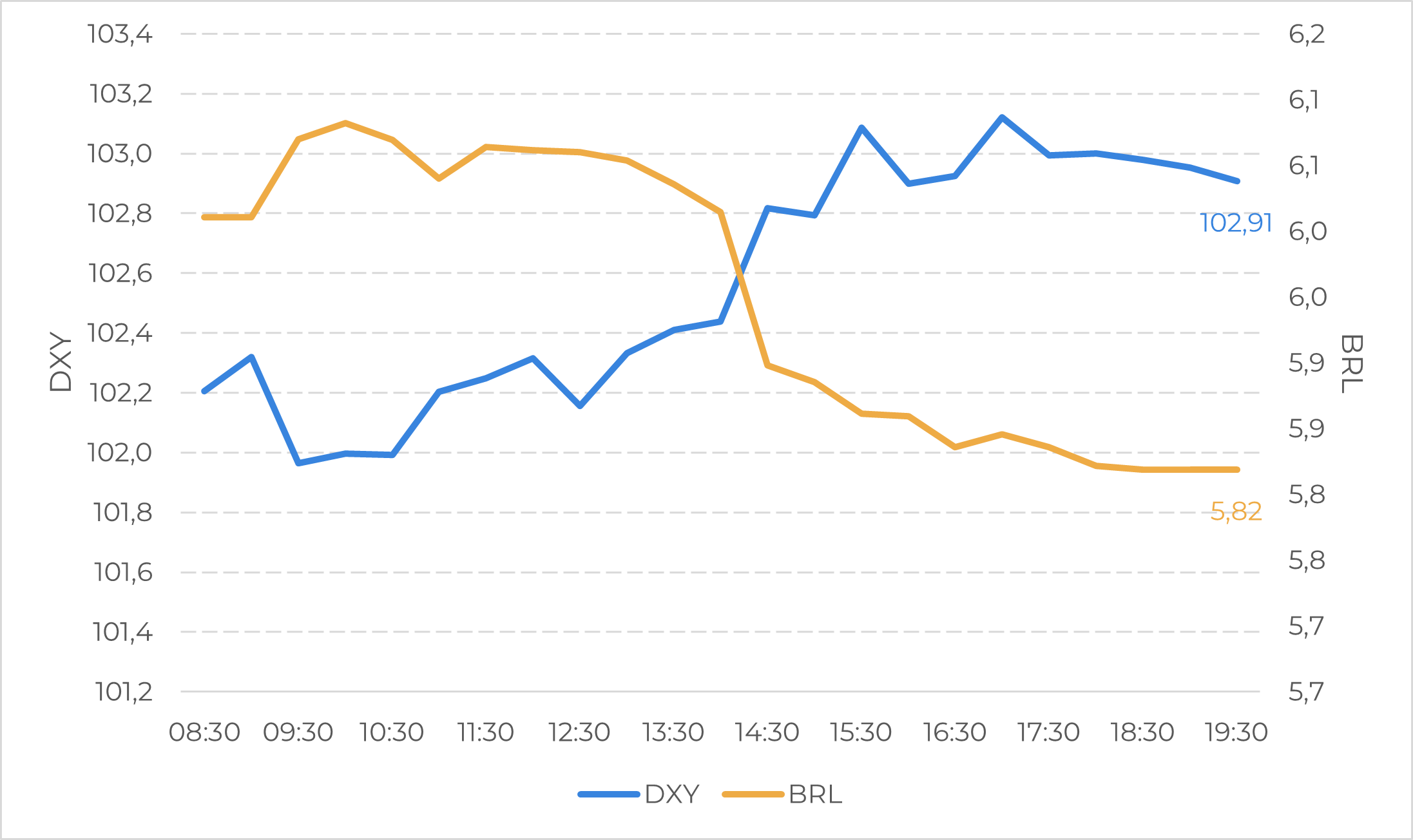

After experiencing initial resistance against the other currencies in the previous week the announcement of the first tariffs , with an appreciation of 0.7% against the dollar, the Real experienced high volatility on April 9th. After trading at around R$6.10 in the morning, the dollar followed the sudden optimism of the stock market and closed the session of the same day quoted at R$5.84. A fall of 4.26% during the same trading session, making it clear volatility will be present in the coming weeks.

Image 2: Performance of the Dollar versus the Real and the Dollar versus the currencies of developed countries (DXY);

Source: LSEG, Hedgepoint

Interest Rates

DIs interest rates continue to rise, in line with the recent devaluation of the real against the dollar and the continued rise in Treasuries with longer maturities. This sequence of events took place after the United States confirmed a new tariff on China.

Last Wednesday, President Donald Trump announced a 34% tax on Chinese products, generating worldwide tension and consequent reciprocal action by China with an additional 34% on US products.

Still during these announcements, Trump announced to the world that he would add 50% on Chinese imports if they didn't back down from his latest decision on additional tariffs on US products. As expected, China didn't back down from its decision and the US slapped a 104% tariff on Chinese products, two days after the original announcement. In the same wave of negotiations and retaliation, tariffs on China were raised to 125%.

Fundamentals contribute to a positive outcome for Brazil in the medium term, but we are still watching the unfolding of the United States' negotiations with the world.

The market is still cautious, as the movements of realizations and sudden gains are not related to fundamentalist aspects, but rather to expectations about the effects of a possible recession, not to mention the indecision about what the final values and deadlines of the tariffs imposed by Donald Trump will be, and really when they will start to apply.

The big issue, although the additional tariffs represent a global challenge, is that Brazil can benefit from being in a strategic position vis-à-vis the other economies, since the demand for products of alternative origin to the United States and China, mainly commodities - where the country is a leading exporter - could increase considerably.

Brazil's role in this reordering of global supply chains could be positive in the medium term, attracting investment flows to the country and a possible appreciation of the Real in the second half of the year and , but there are still many points to be observed as the United States' negotiations with the world unfold.

The European Union's responses to Trump's tariffs could be announced as early as next week, according to a spokesperson. The European Commission has been working on structuring a response to the tariffs, mainly on cars and other US goods. Thus, as discussed above, there are still uncertainties that should add volatility to the international market, making risk management essential.

Summary

The tariffs imposed by the US are reshaping global trade relations, provoking retaliation and increasing economic tensions.

Although Brazil faces specific challenges, the global economy is feeling the effects of these protectionist policies, with risks of economic slowdown and rising inflation in several regions.

Brazil can benefit when all the points are clarified, as an alternative route for supplying commodities and products to China and Europe.

The real effects of the tariffs are expected to be felt within two months, since companies are still working with existing stocks to meet immediate demand. Once supplies are needed, they will have to be priced in line with the new tariffs imposed by the US government. This could add inflationary pressure in the US as well as popular pressure if Americans' purchasing power is impacted.

We could see an even greater fall in the BRL against the USD for the first half of the year, and an opportunity for the second half. Even so, we continue to observe whether the global fear of recession will not make all investors focus on USD as a base currency, even with its recent devaluation against European currencies and the Yen, while it has gained strength in emerging markets such as Latin America. for all European currencies, the Yen and gaining strength only in emerging markets (Latin America mainly).

Written by Guilhermo Marques

guilhermo.marques@hedgepointglobal.com

guilhermo.marques@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

To access this report, you need to be a subscriber.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.