Macroeconomics Weekly Report - 2023 08 14

Fundamentals still point to optimism with the BRL

- Brazilian monetary policy has undergone significant changes in recent weeks, with the start of the interest rate cut cycle by Brazil's Central Bank (BCB).

- Expectations were divided between 25 and 50 basis points (bps), and the decision for the 50-bps cut to 13.25% was not unanimous and was accompanied by a more "cautious" stance from the BCB in its post-decision statements.

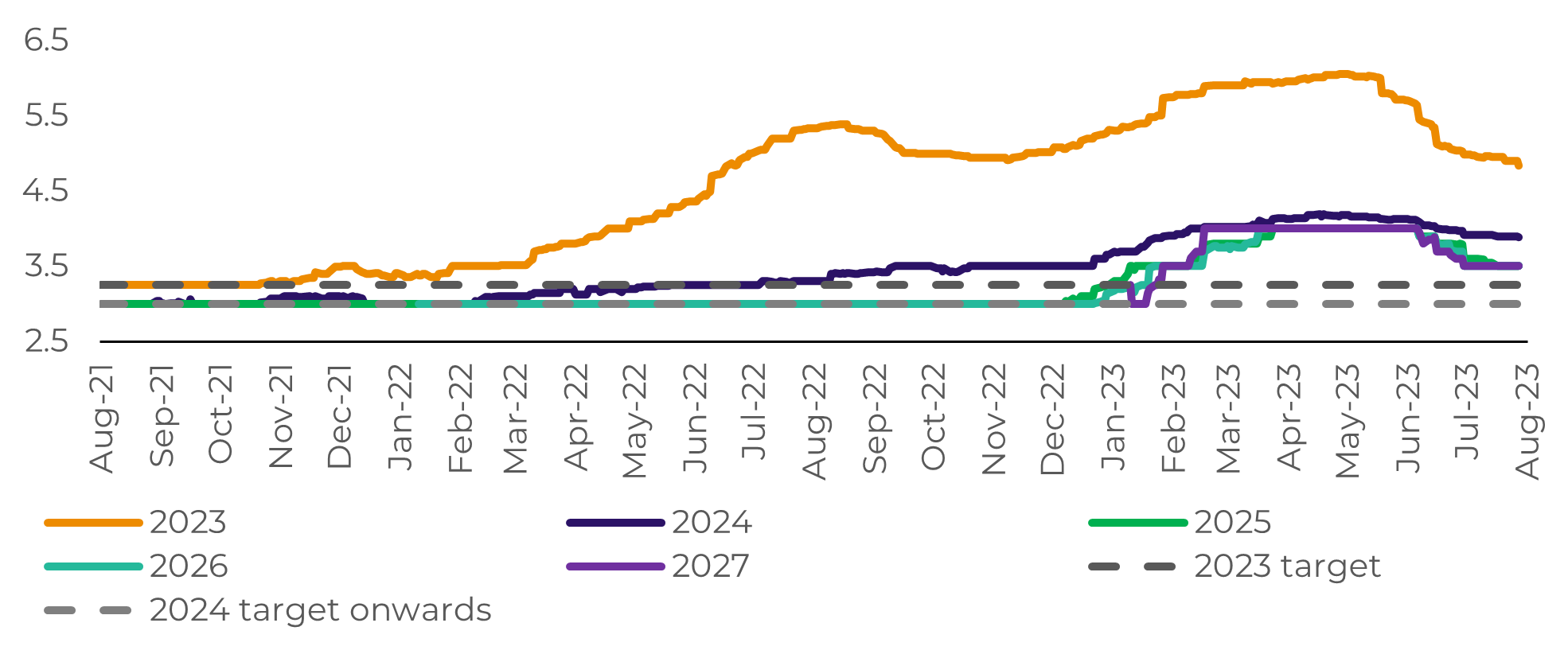

- Looking forward, we have fundamentals that should prevent further BRL devaluations. The BCB aims to keep real interest rates above the "neutral" level, suggesting moderate cuts ahead. Additionally, inflation expectations are falling, the Brazilian trade balance continues to show significant surpluses, and speculators remain optimistic about the Real.

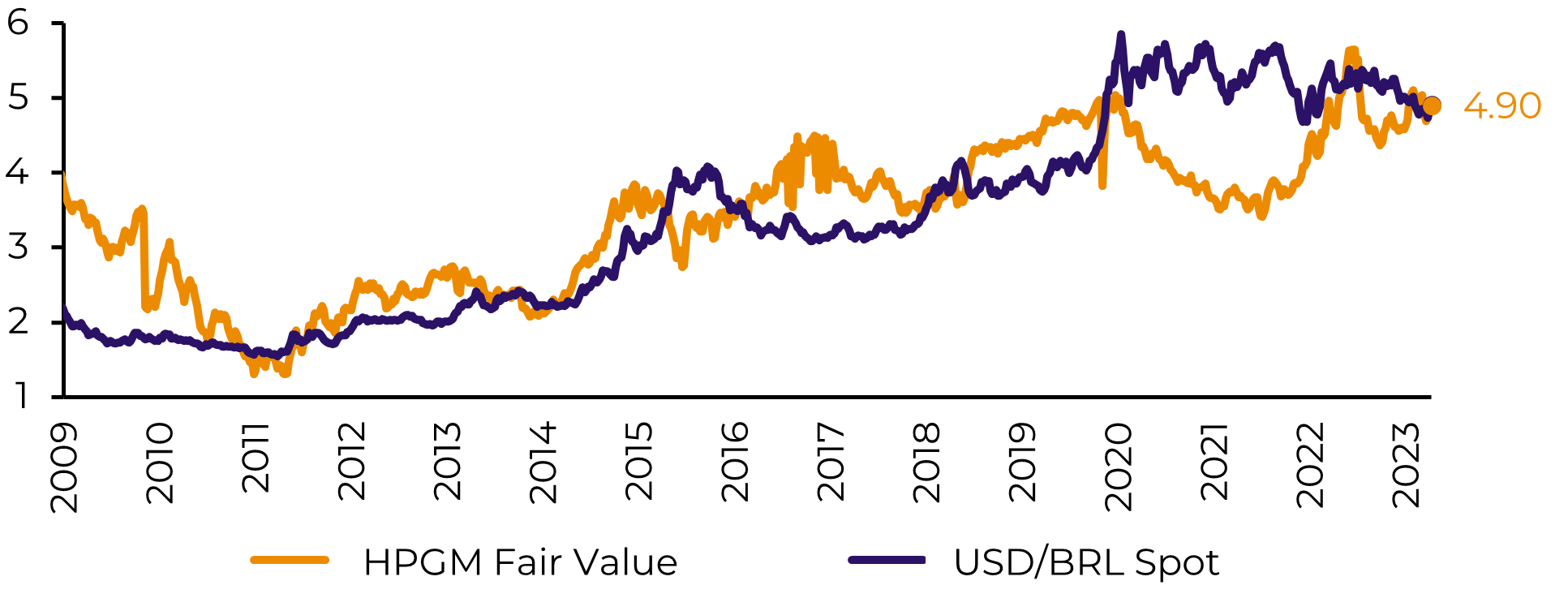

- However, our Real Fair Value model - which uses the DXY, BCOM, the interest rate differential and the Brazilian CDS as variables - shows that the Brazilian currency looks well priced at the moment.

Introduction

Image 1: USD/BRL – Spot and Fair Value

Source: hEDGEpoint, Bloomberg

Image 2: Inflation Expectations – Brazil (%)

Source: Bloomberg

Although expected, the cut had relevant impacts

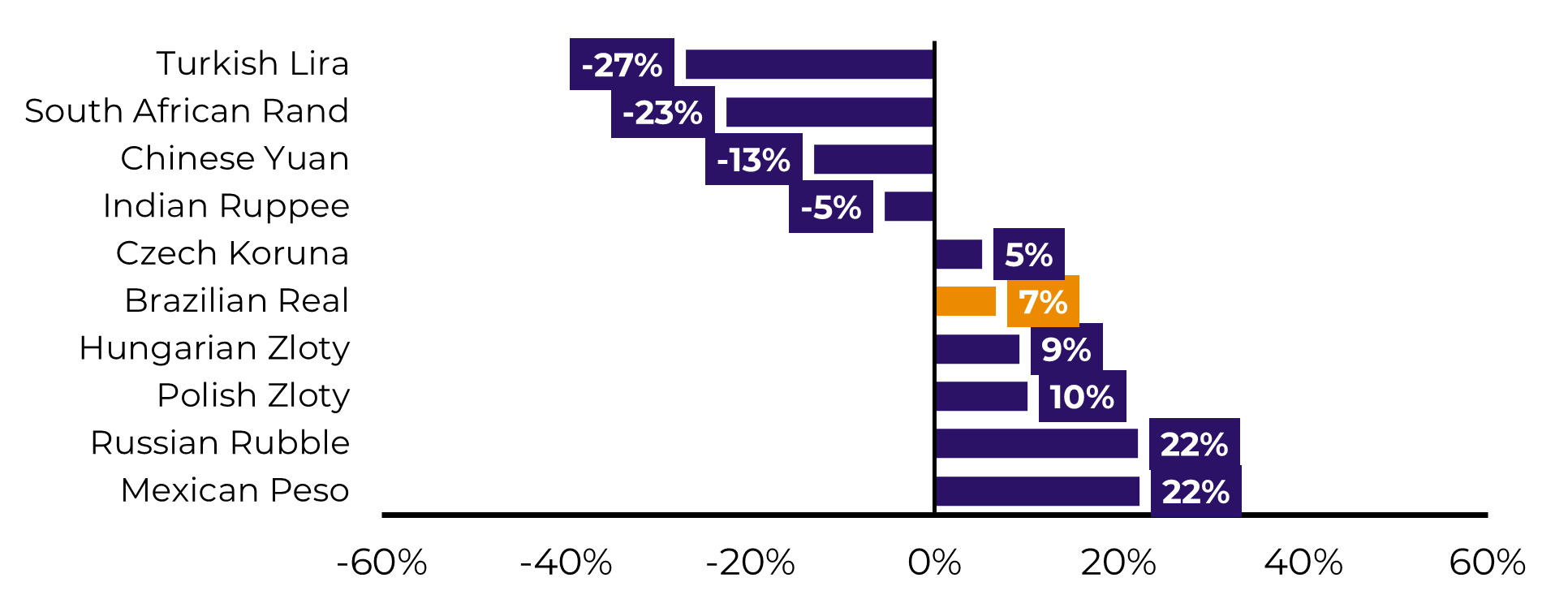

Despite a significant part of the market expecting the more aggressive cut, the post-decision reaction was still strong. Interest rates fell significantly and the Real depreciated strongly - given that lower interest rates tend to reduce the attractiveness of short-term investments (measured by the Return on Carry Trade, for example), leading to an outflow of foreign capital.

However, we still see several positive fundamentals for the Real that should prevent further currency devaluations in the medium to long term.

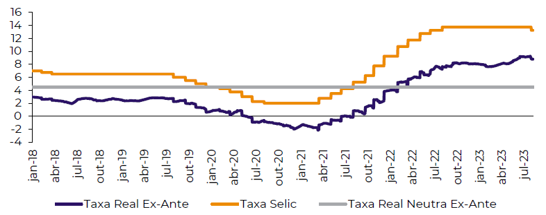

Even with a 50-bps rate cut, Brazil remains far from the neutral real rate of 4.5%

The BCB emphasized a "firm objective of maintaining a contractionary monetary policy to re-anchor expectations and bring inflation to the target over the relevant horizon", so we do not expect Brazil to accelerate the pace of cuts in the coming meetings, maintaining the attractiveness of real interest rates against central economies for quite some time.

Image 3: Carry Trade Returns (EMs)

Source: Bloomberg

In Summary

Image 4: Selic rate and real rates - Brazil (%)

Source: Bloomberg

In Summary

Weekly Report — Macro

alef.dias@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.