Macroeconomics Weekly Report - 2023 08 28

India may “export” food inflation

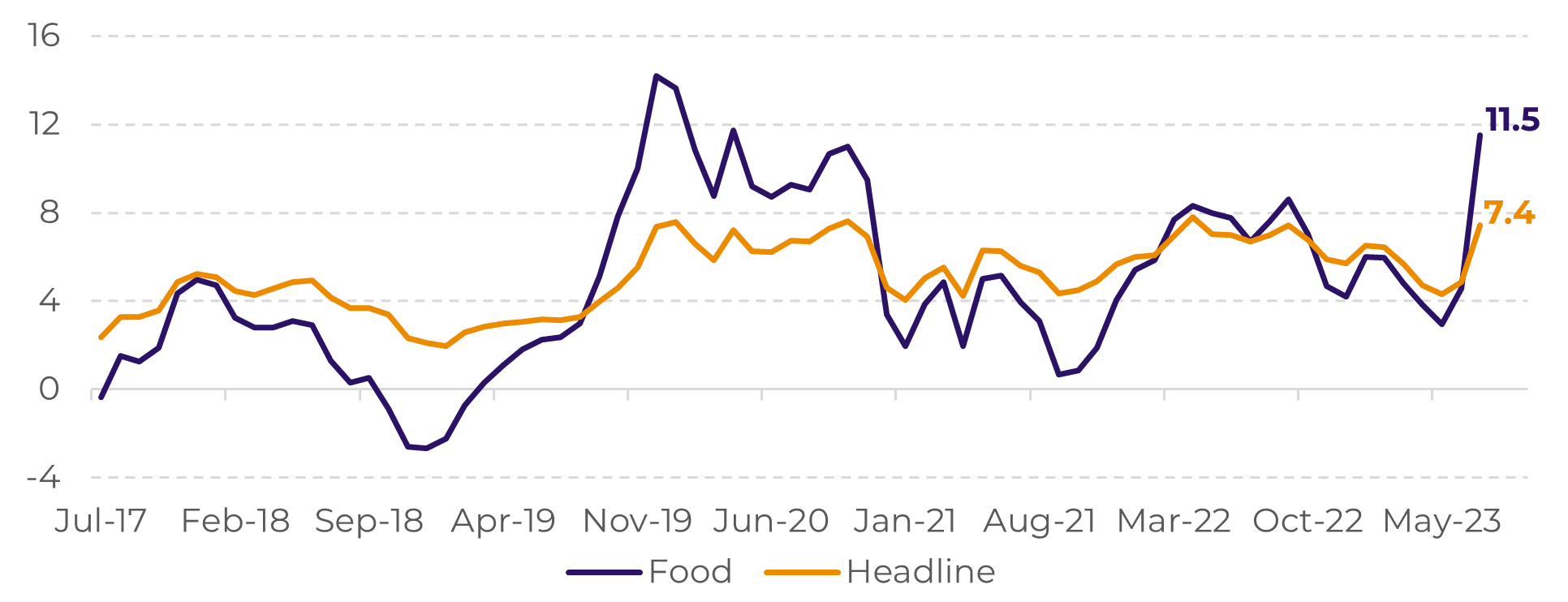

- In recent months, India has been dealing with numerous weather-related challenges that have severely impacted various crops. The most pronounced consequence of these challenges is the significant increase in food inflation, which jumped from 4.7% in the previous month to 10.6%.

- This could be a localized problem, but when it comes to the 5th largest economy in the world, with a relevant role in several agricultural commodity markets, there is a great chance that this problem will be "exported" to other economies.

- This "export" of inflation could be mainly due to protectionist measures to reduce/prohibit exports of agricultural commodities (such as rice and sugar) as well as initiatives to increase domestic supply through imports (such as wheat).

- With a rise in global food inflation, central banks around the world may have to keep their interest rates high for longer than is currently expected.

Introduction

India

has faced a myriad of climatic challenges in recent months, which have

disrupted agricultural markets, given the country's position as a major

producer and exporter. The biggest symptom of these challenges is food

inflation, which has risen to 10.6% from 4.7% in the previous month, led

especially by a 214% increase in vegetable prices from one month to the other,

but with consequences for many other products - including rice, sugar and

wheat.

As a

result, headline inflation also accelerated. India's CPI rose to 7.4%

year-on-year from 4.9% in June, the second consecutive month of gains -

exceeding the Reserve Bank of India's target range of 2% to 6% in July for the

first time in five months, and by a considerable margin.

Given India's relevance to the global economy (5th largest in the world) and its important role in several agricultural markets, this report aims to address the main impacts of Indian food inflation on the global economy.

Image 1: Headline and Food CPI – India (YoY,%)

Source: Refinitiv

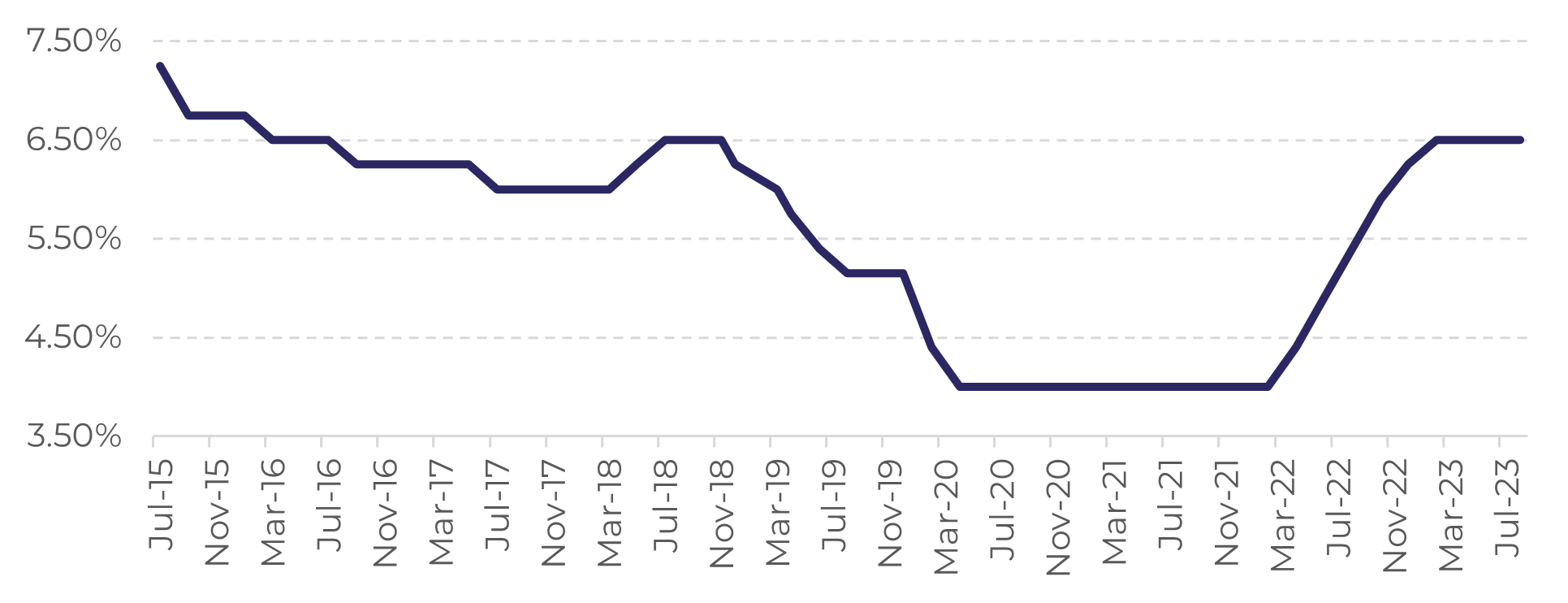

Image 2: Basic Interest Rate - India (%)

Source: Reserve Bank of India

Headline inflation escalates with higher energy costs

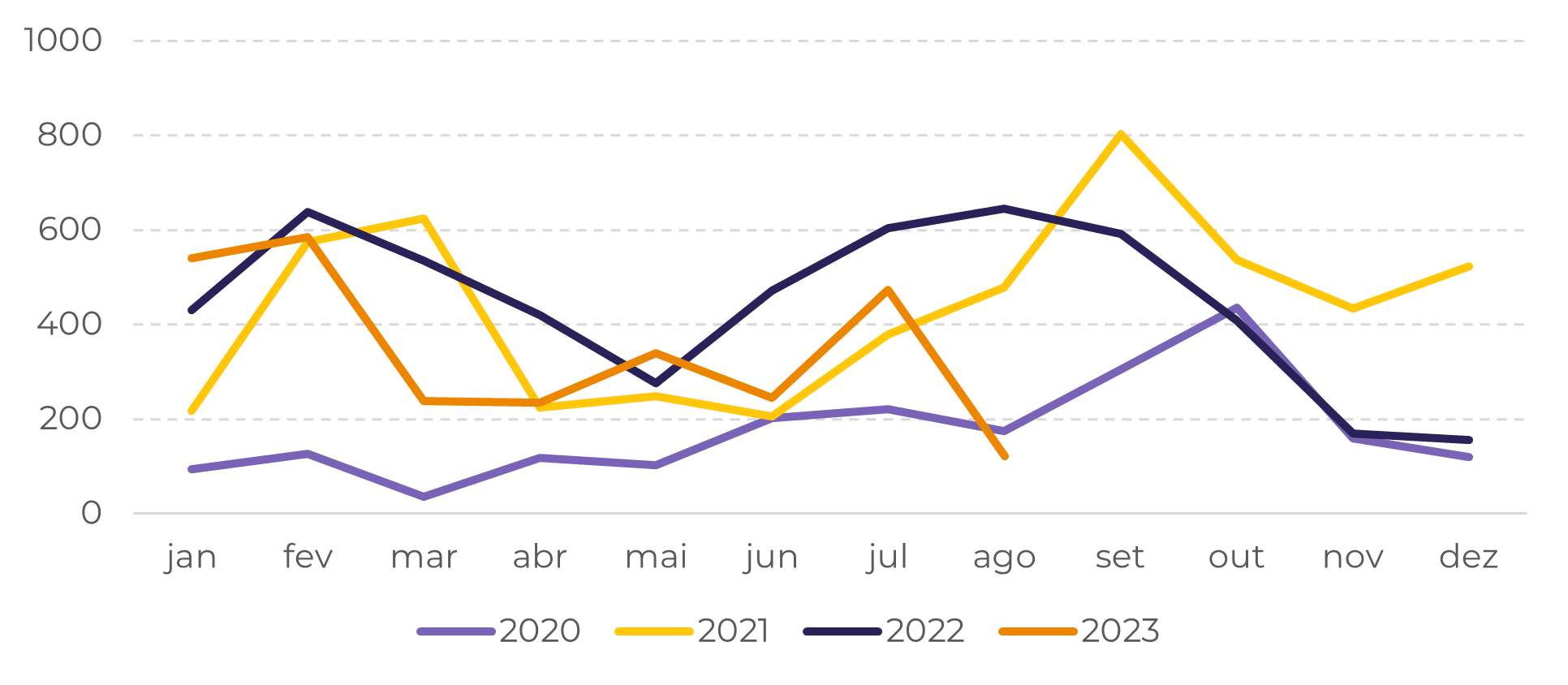

Image 3: Monthly Rice Exports – India (‘000 mt)

Source: Refinitiv

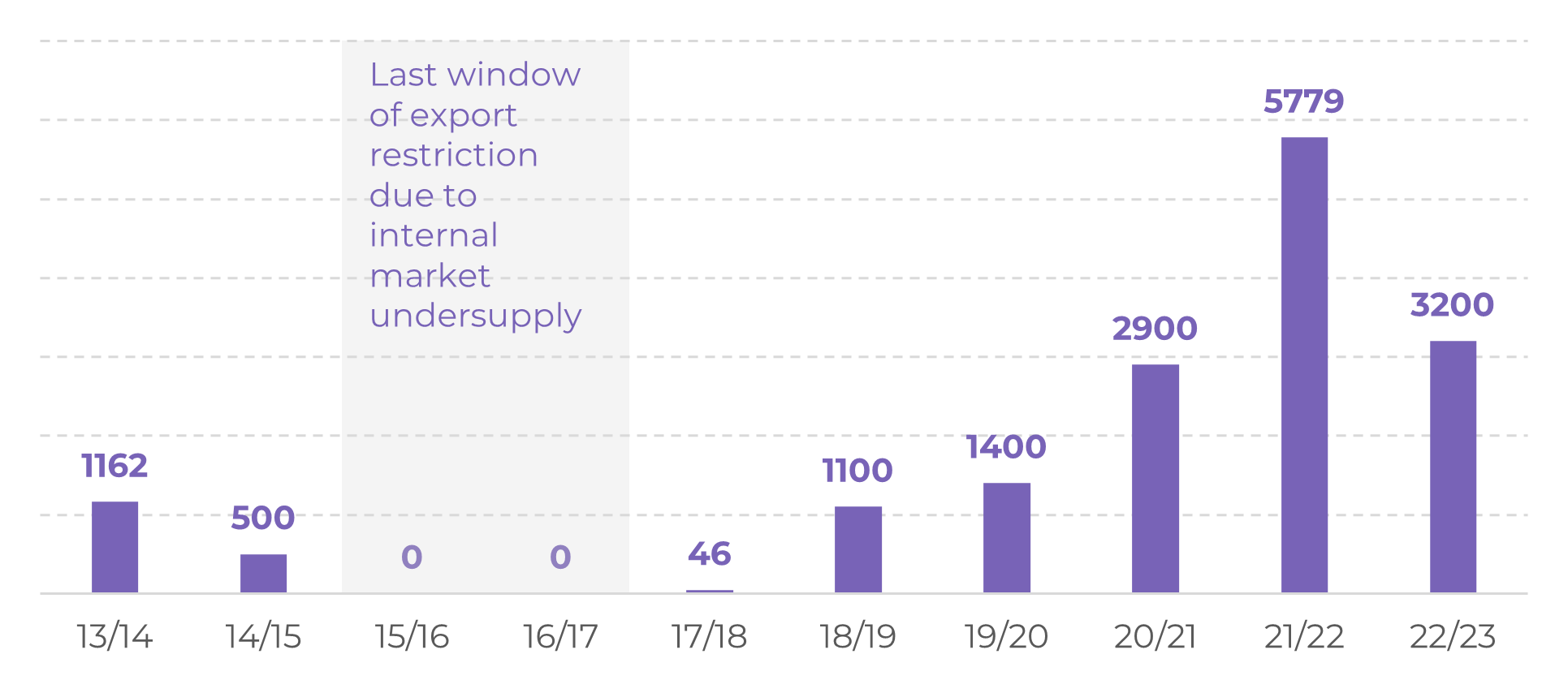

Image 4: India’s Raw Sugar Exports (‘000 MT)

Source: USDA

In summary

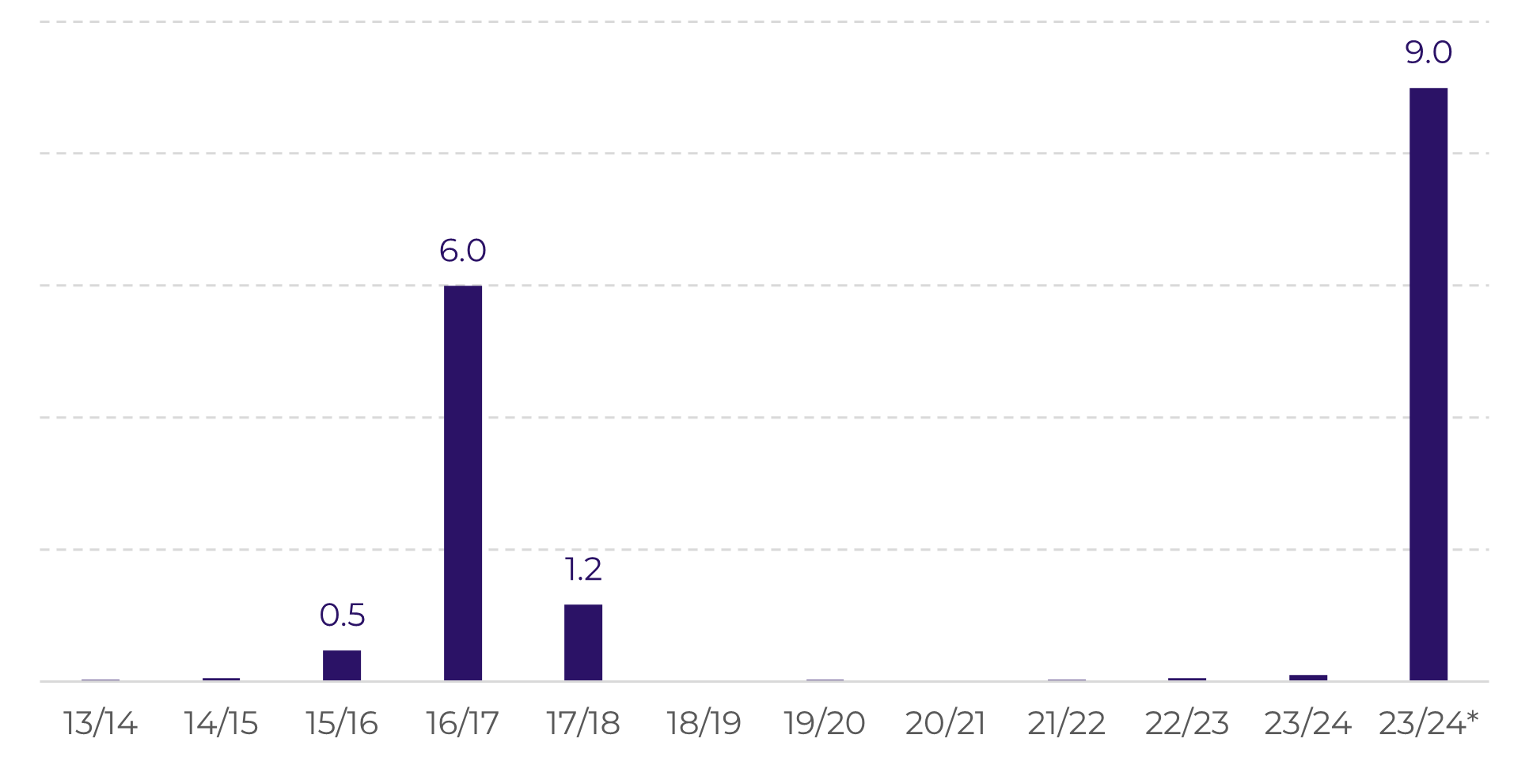

Image 5: Wheat Imports – India (M mt)

Source: USDA (* Volume to be imported from Russia according to rumors)

Weekly Report — Macro

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com