Macroeconomics Weekly Report - 2023 09 04

The Inflation Scenario Is Improving in the USA

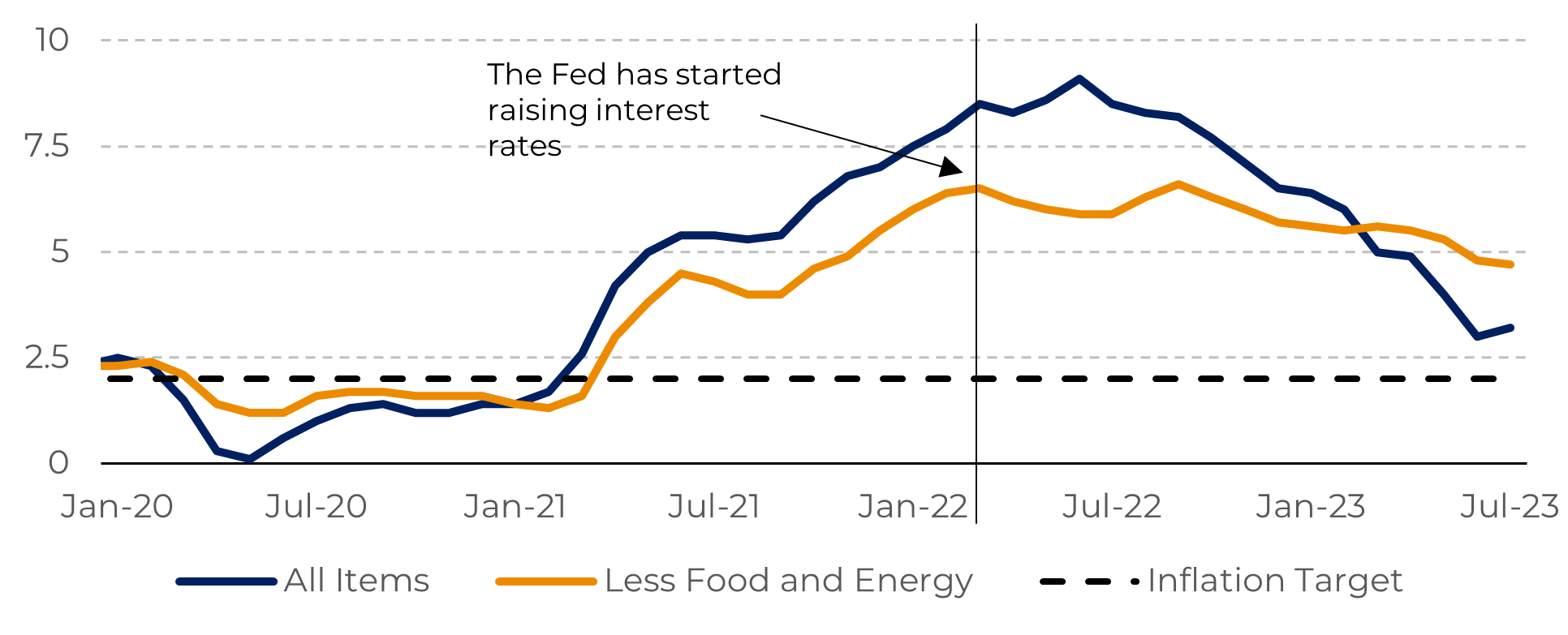

- The U.S. economy has recently demonstrated improvements in price trends, bolstering optimism that interest rates may not be raised again this year.

- However, despite the currently elevated interest rates, their full impact on the economy has yet to be completely realized, potentially posing risks for the economy.

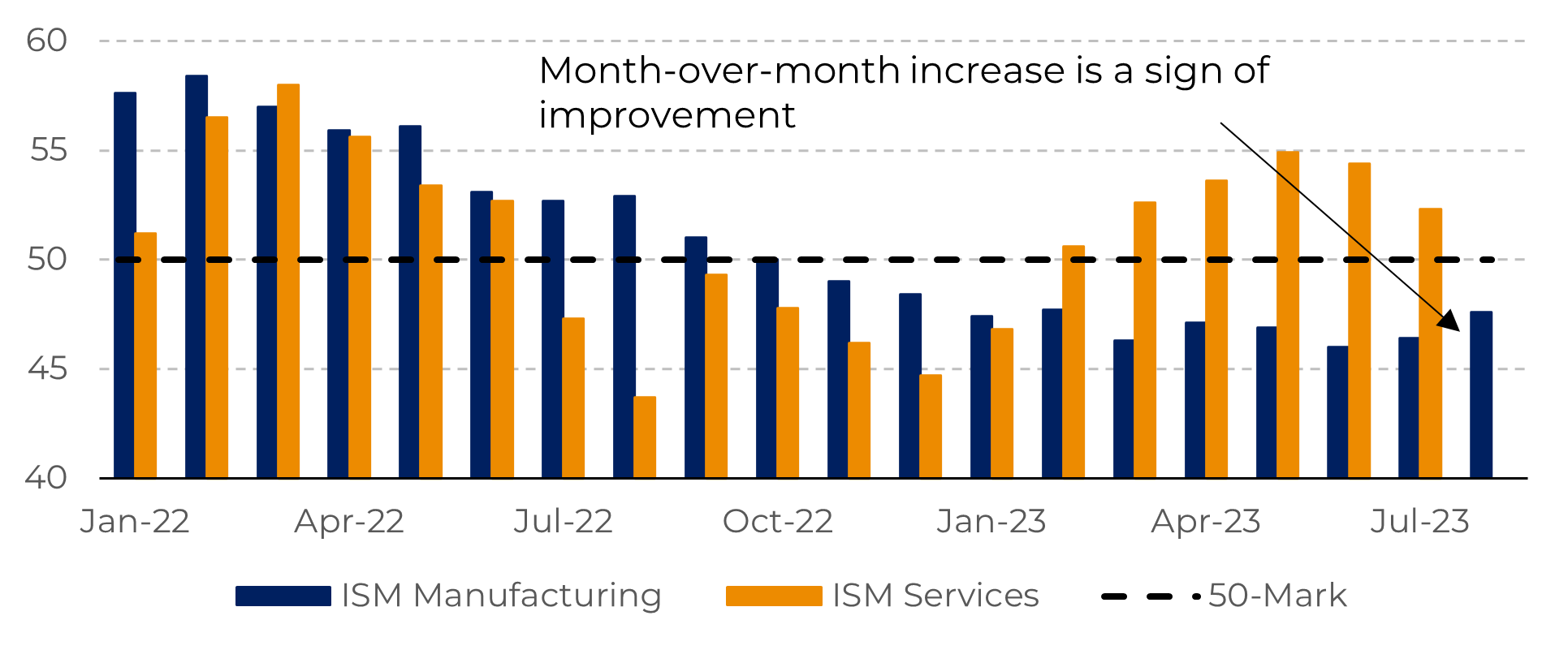

- In August, US’ manufacturing marked its 10th consecutive month of contraction. However, there are hopeful indicators that the pace of decline is moderating.

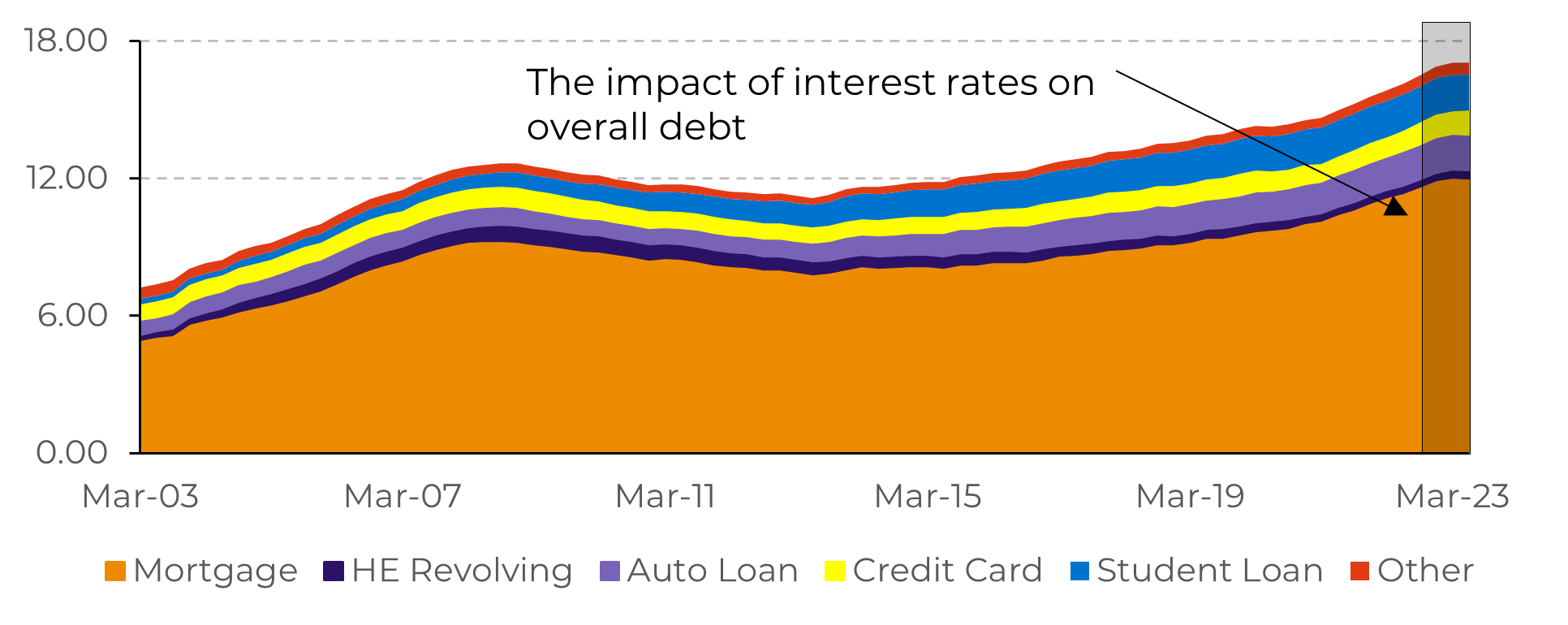

- The collective credit card debt has surpassed the $1 trillion mark, raising concerns. However, when adjusted for inflation, this figure is more favorable compared to previous years.

Introduction

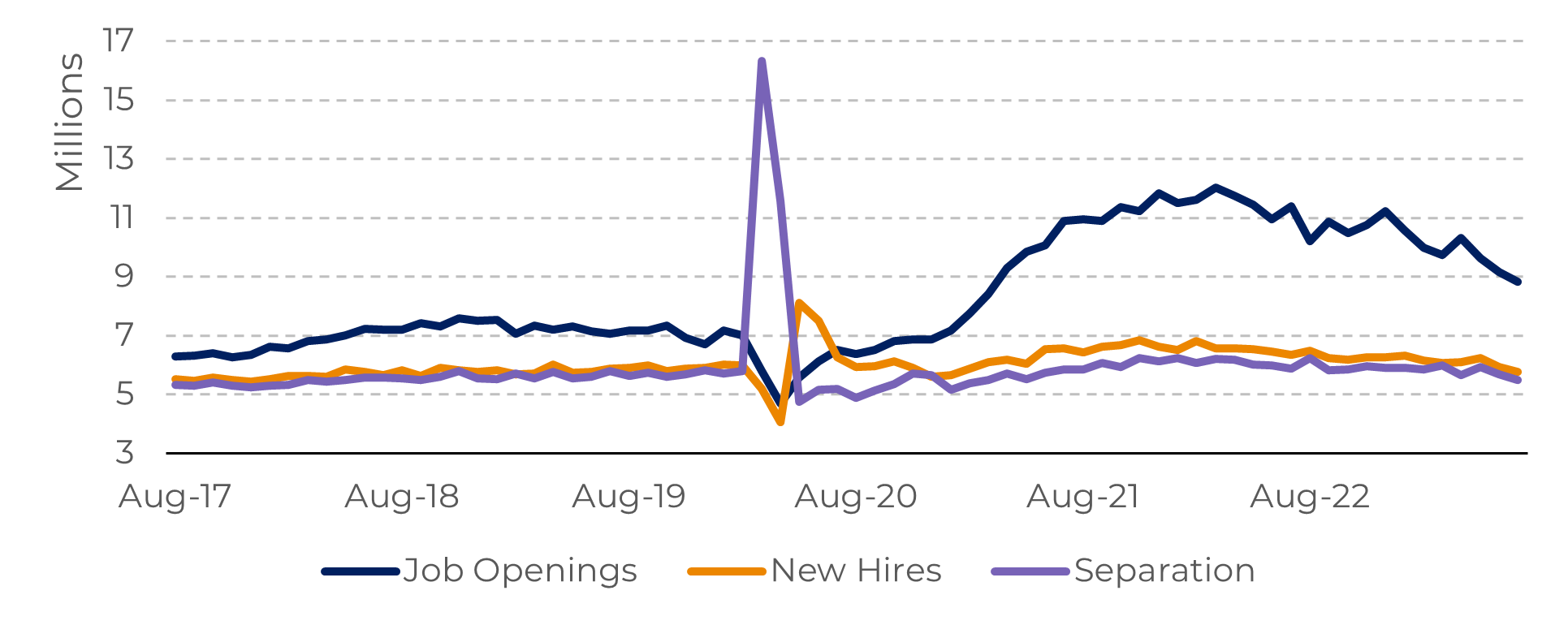

The deceleration in economic activity is expected to prompt a more accommodative stance from the Federal Reserve, heightening the likelihood that interest rates will remain unchanged this month. Furthermore, job openings declined to their lowest level in almost two and half years in July, reflecting a gradual slowdown in the labor market.

The intense and rapid increase in borrowing costs, totaling 525 basis points over the past 17 months, has indeed yielded results in curbing inflation. However, despite the pronounced impact of these elevated interest rates, as evidenced by the slump in manufacturing activity, their full impact on the economy has not yet been fully realized.

Image 1: Total Debt Balance by Composition (Trillions of U$)

Source: Refinitiv

Image 2: Job Openings and Labor Turnover Survey

Source: Refinitiv

Restrictive monetary policy showing results

The intense and rapid increase in borrowing costs by 525 basis points over the past 17 months has resulted in lower inflation, bringing prices closer to the 2% target. However, despite this highly restrictive level, the full impact of high-interest rates has not yet been fully transmitted to the economy. An example of this is core inflation, which generally shows a lower sensitivity to monetary policy adjustments compared to overall inflation. Therefore, considering the transmission delay, interest rates should remain at this level for now.

Image 3: US Consumer Price Index (%)

Source: U.S. Bureau of Labor Statistics

Image 4: US PMIs

Source: Refinitiv

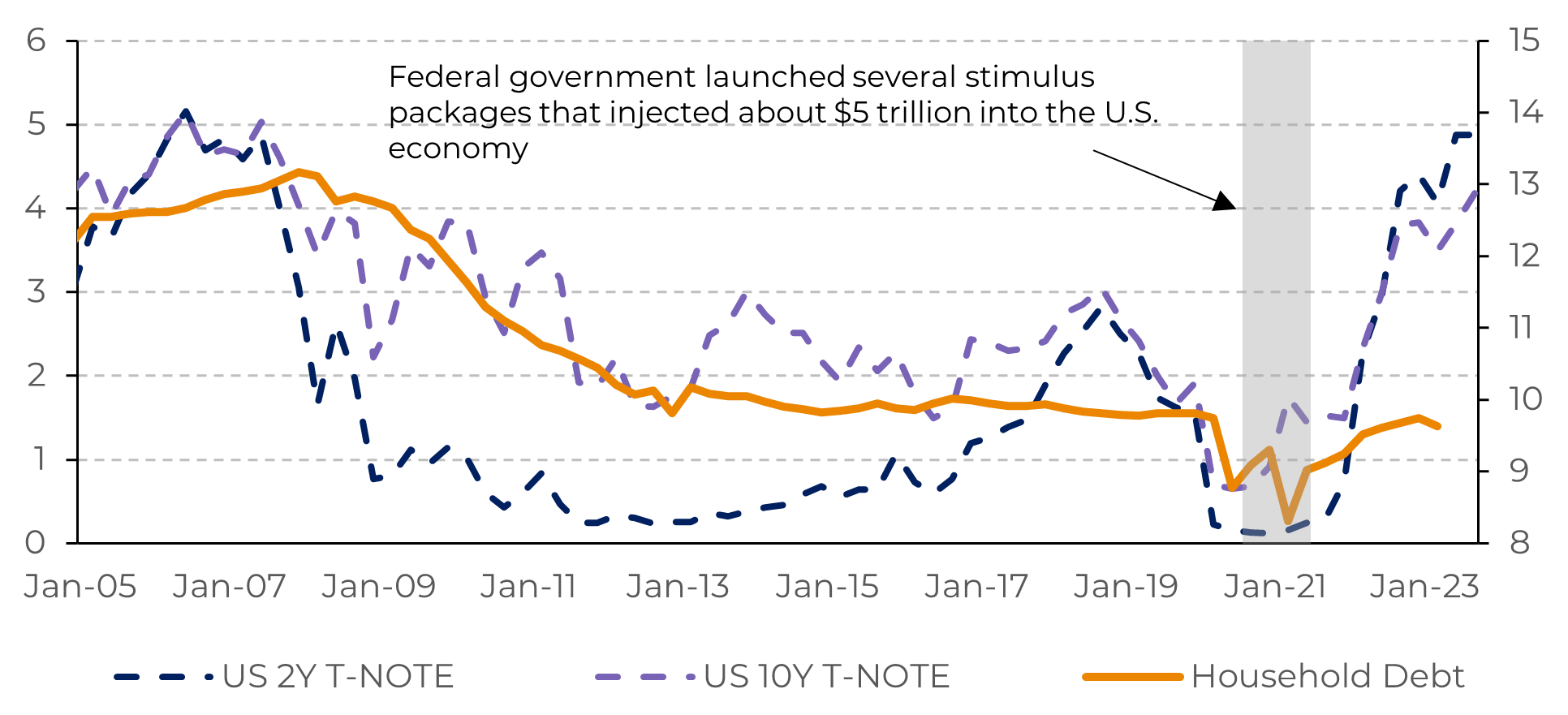

Debt escalating with high interest rates

Image 5: Household Debt vs. Treasuries Comparison

Source: Refinitiv

In Summary

Indications

of a weakening labor market are a welcome sight for those concerned about the

trajectory of interest rates in the United States. Despite the recent slight

uptick in unemployment figures, some segments continue to display significant

resilience, such as healthcare, restaurants, bars, and hotels.

Furthermore, wage growth has recently moderated in the United States. According to economists, the ideal pace of wage growth should be around 3.5%, as this figure does not exert upward pressure on the 2% inflation target.

Another

factor that should favor the fight against inflation is the reduced savings of

American households. According to a study conducted by the San Francisco Fed,

the surplus savings accumulated from government transfer payments could be

depleted in a matter of months.

The latest data suggests that the Fed is likely keep interest rates at their current level, as the economy has been displaying some signs of slowing down. While there are still risks of a rate hike before the end of the year, this risk is expected to decrease as higher interest rates continue to dampen economic activity, as evidenced by employment and manufacturing activity data.

Weekly Report — Macro

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.