Sep 11

/

Alef Dias

Macroeconomics Weekly Report - 2023 09 11

Back to main blog page

"The economy has benefited from increased employment, rising wages, high remittances and positive consumer confidence. Investment is benefiting as Mexico attracts more capital inflows: the country has been one of the biggest beneficiaries of the relocation of global supply chains, given its proximity to the US"

Mexican Peso continues with strong fundamentals

- After 8 months of strong performance, the Mexican Peso has been depreciating in September, with seven consecutive drops until last Friday (September 8th).

- The recent movements of the Mexican currency lack internal justification, given the solid economic growth and the slowdown in inflation. The devaluation seems to be more influenced by the appreciation of the dollar on the global stage, and the Chinese economic slowdown led to a greater impact on Latin American currencies in September.

- The combination of a strengthening economy and an extremely positive interest rate differential against the US makes a reversal of the current scenario of devaluation of the Mexican Peso in the coming weeks very likely.

Introduction

After 8 months of extremely positive performance, the Mexican Peso has been depreciating against the dollar in September. Up until last Friday (08/09), the Mexican currency had fallen seven consecutive times, with a depreciation of 5.07% in the period.

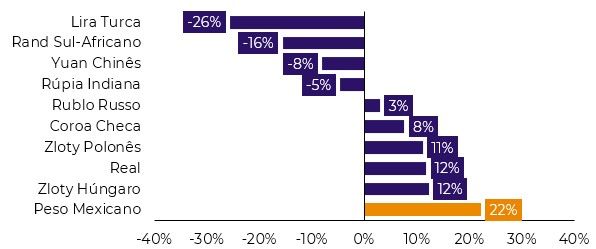

Nevertheless, the currency has accumulated an appreciation of 9.74% in 2023, making it one of the best performing emerging currencies of the year. This appreciation has been anchored in solid macroeconomic fundamentals, but the currency's recent movements have led analysts and traders to question whether anything relevant has changed in the Mexican economy.

Given this context, this report aims to discuss the reasons behind the recent devaluation of the Peso and update the fundamentals of the Mexican economy.

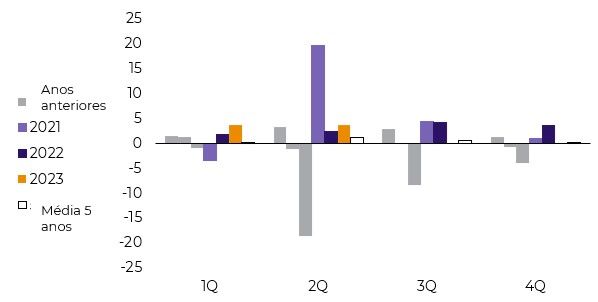

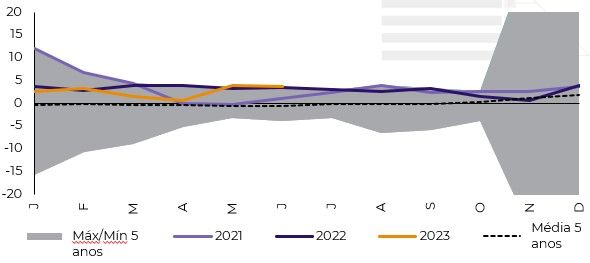

Image 1: MXN and Latin American currencies index

Source: Refinitiv

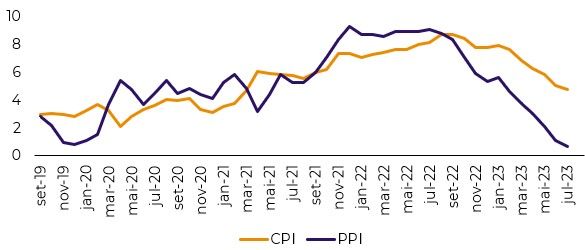

Image 2: Mexican GDP (YoY, %)

Source:Bloomberg

Suffering with its peers

Looking at the domestic fundamentals, it's hard to find any justification for the Mexican currency's recent movements. The most recent GDP data showed that the Mexican economy continued to grow rapidly in the second quarter, while inflation continues to slow down - as the August data showed.

This means that the recent devaluation of the Mexican Peso is much more closely linked to the external context of the dollar's appreciation, especially against Latin American currencies - which tend to suffer more from China's economic slowdown.

Fundamentals point to a reversal of the trend

The performance of the Mexican economy in 2023 is admirable, especially considering the global scenario of high interest rates and economic slowdown. Domestic demand remains robust, even in the face of restrictive fiscal and monetary conditions, as well as negative sentiment towards some government policies.

Image 3: Mexican Inflation (YoY)

Source:

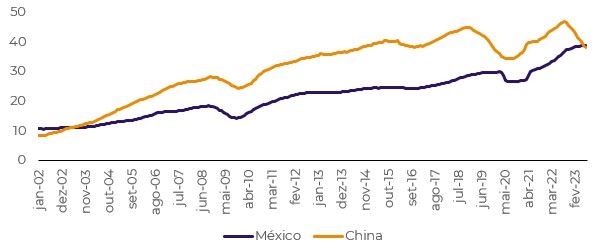

The economy has benefited from increased employment, rising wages, high remittances and positive consumer confidence. Investment is benefiting as Mexico attracts more capital inflows: the country has been one of the biggest beneficiaries of the relocation of global supply chains, given its proximity to the US. In July, for the first time in over 20 years, Mexico overtook China as the main exporter to the US.

Another point that favors the Mexican economy's macroeconomic scenario is the "homogeneity" of its growth. Both manufacturing and services have shown robust growth, which makes economic performance less dependent on specific sectors.

As Mexican economic data is coming in above the Mexican central bank's forecasts, signaling growth above potential, the likelihood of interest rate cuts this year is reduced. Consequently, the interest rate differential is likely to remain high, favoring the Mexican peso.

In Summary

As is common for emerging currencies, their movements are often the result of external rather than internal factors, given that the external sector is usually very important for these economies.

The Mexican Peso has suffered from this "evil" in September, with a devaluation very similar to that of its Latin peers. However, the Mexican economy has an almost unique combination in a context of global economic slowdown: the country has shown resilient growth amid high interest rates and slowing inflation.

The combination of a strengthening economy and an extremely positive interest rate differential against the US makes a reversal of the current scenario of devaluation of the Mexican Peso in the coming weeks very likely. The main risk for this scenario is a rise in risk aversion in the foreign exchange markets, which could impact Latin American currencies as a whole.

Image 5: MXN and Latin American currencies index

Source: Refinitiv

Image 6: Industrial Production - Mexico (YoY, %)

Source:Bloomberg

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.