Sep 18

/

Victor Arduin

Macroeconomics Weekly Report - 2023 09 18

Back to main blog page

"Inflation expectations are a risk when they become unanchored, as they have the potential to lift up inflation. This can lead consumers to act in ways that continue exerting upward pressure on prices, beyond the desired levels."

Inflation Data in US Provides Signals for the Next Fed Meeting

- While energy costs have propelled headline inflation in the past month, core inflation continues to decelerate. The recent surge in energy commodities is expected to bring more volatility to the prices scenario.

- Services and housing inflation remain elevated, but are expected to diminish on the future, promoting a more favorable inflation outlook for 2024.

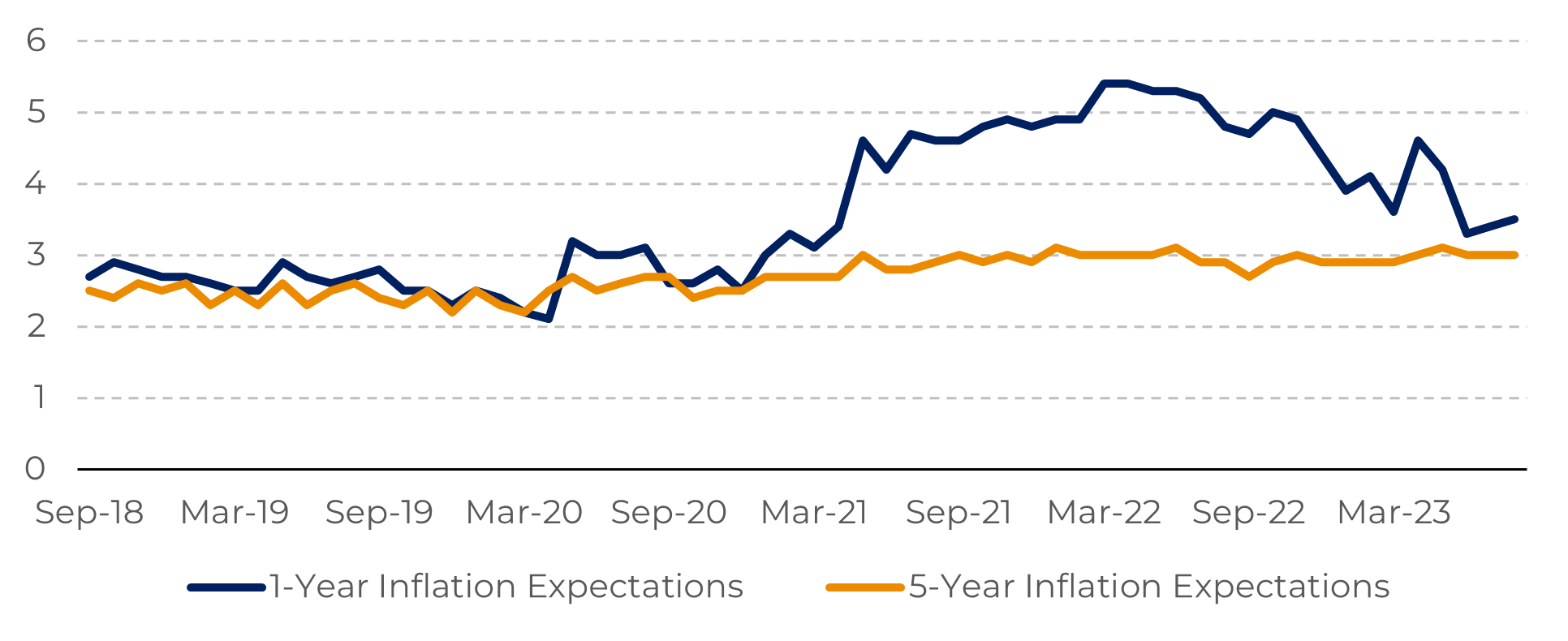

- In addition, unanchored inflation expectations pose a risk, potentially drifting upward and influencing consumer behavior, which could add to price pressure.

- However, it’s expected that interest rates will remain unchanged during the Fed meeting in September 19-20th. The uncertainty centers around the November meeting where chances of a hike are increasing.

Introduction

One of the most significant economic data releases last week was the Consumer Price Index (CPI). Despite headline inflation rising to 3.7%, core inflation continues to show improvement, which bolsters optimism for the possibility of unchanged interest rates in the upcoming Fed meeting.

However, there are concerns surrounding the US economy, as the labor market continues to show strength. The high level of services activity and salaries well above the 2% inflation target may exert pressure on inflation.

That inflation scenario is expected to improve in the first quarter of 2024, with the effects of interest rates being transmitted to the economy and improvements in the shelter costs component.

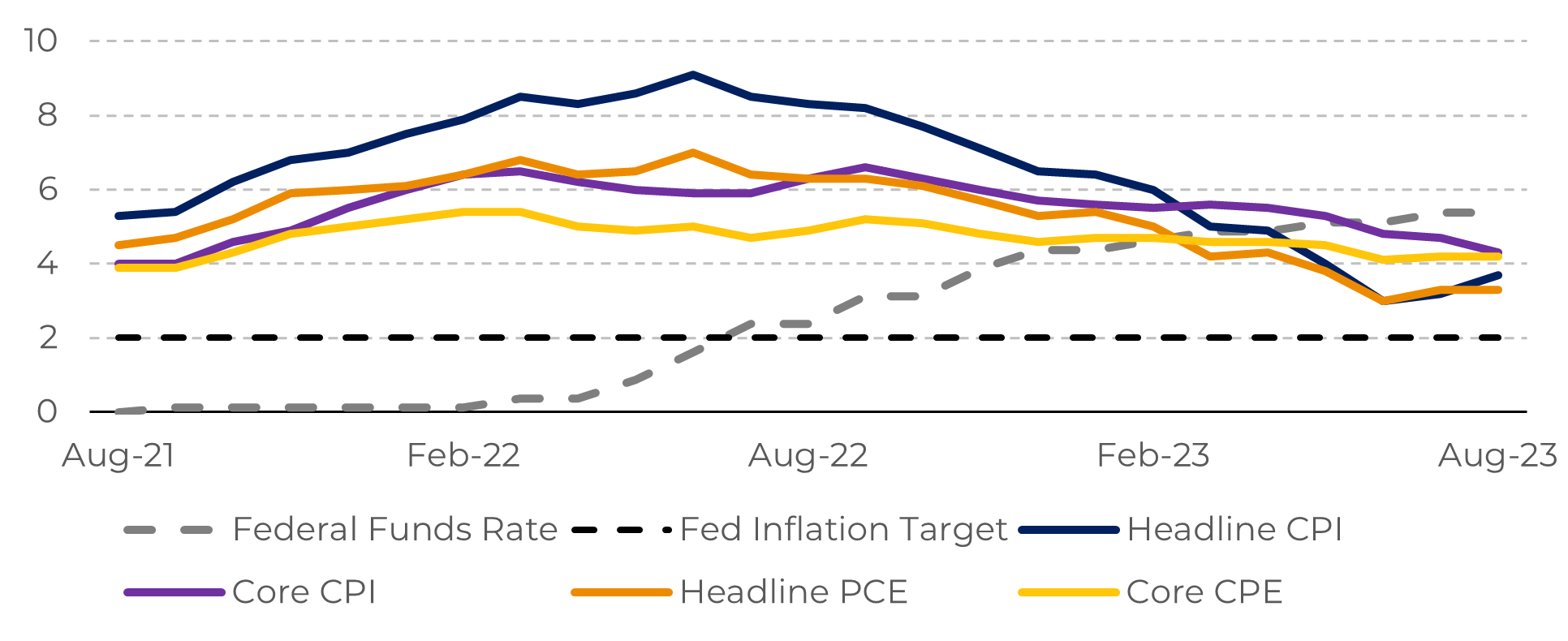

Image 1: US Inflation Scenario (%)

Source: Federal Reserve, Bureau of Labor Statistics

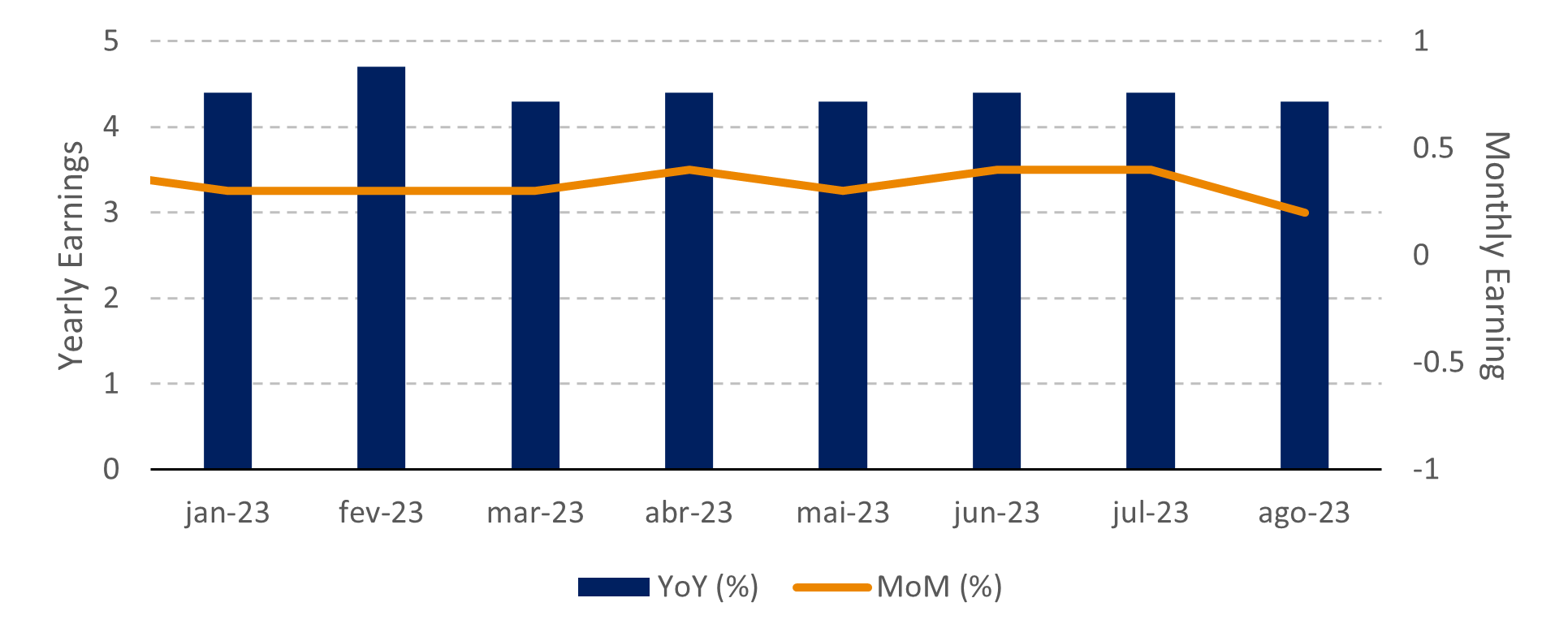

Image 2: Average Hourly Earnings Growth (%)

Source: Bureau of Labor Statistics

Headline inflation escalates with higher energy costs

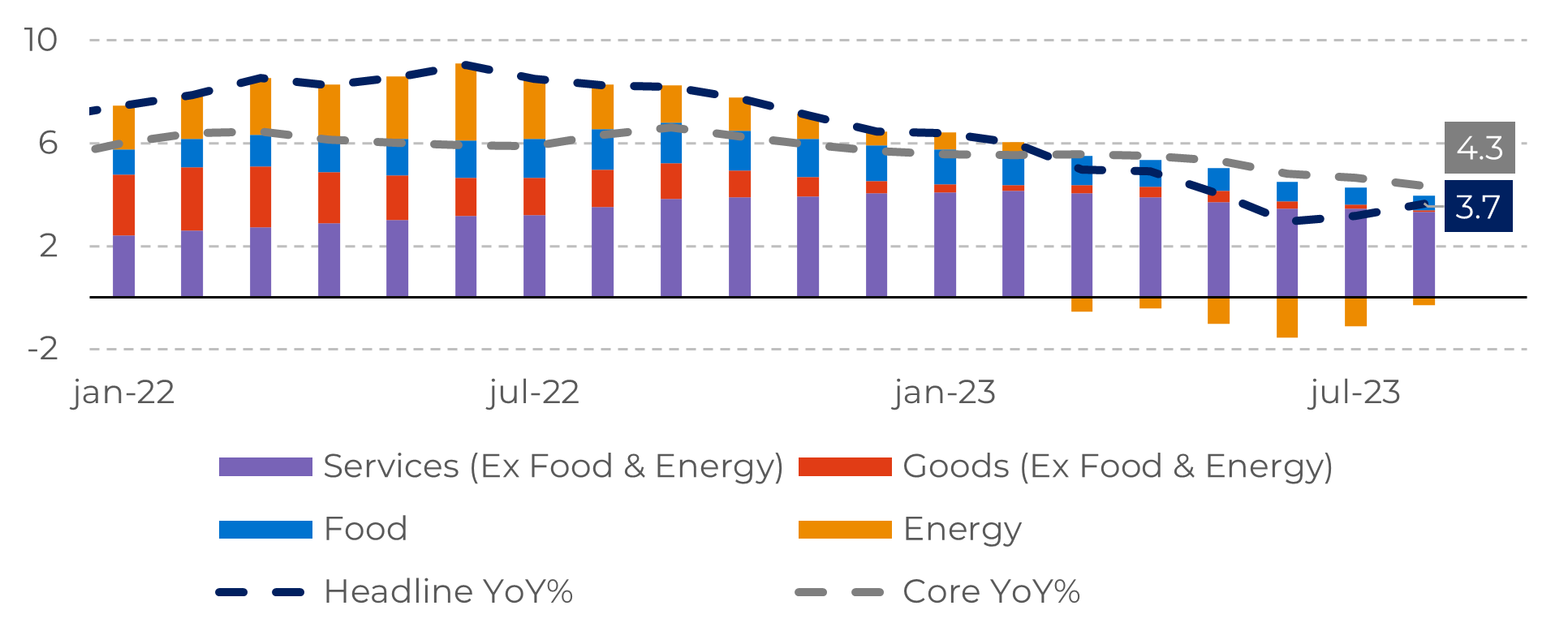

Despite the good work done by the Fed so far, achieving the 2% inflation target will be a bit more challenging than it seems. The headline inflation raised to 3.7% in August on a 12-month basis, largely influenced by increases in fuel costs. On the other hand, the Core CPI, which excludes volatile food and energy, continues to decelerate, reaching 4.3% last month. Based on this result, it is unlikely that the Fed will raise interest rates in the meeting on September 19-20th; however, a potential hike in November remains an open decision.

Services and housing inflation have displayed resilience up to this point. However, as indicated in a paper from the Federal Reserve of San Francisco, shelter inflation is falling sharply in 2023 and are projected to turn negative by late 2024. This deflationary trend in shelter costs could significantly contribute to achieving the 2% inflation target, given that housing is one of the most significant components in the CPI.

Image 3: U.S. CPI (Top-Line Contributors)

Source:

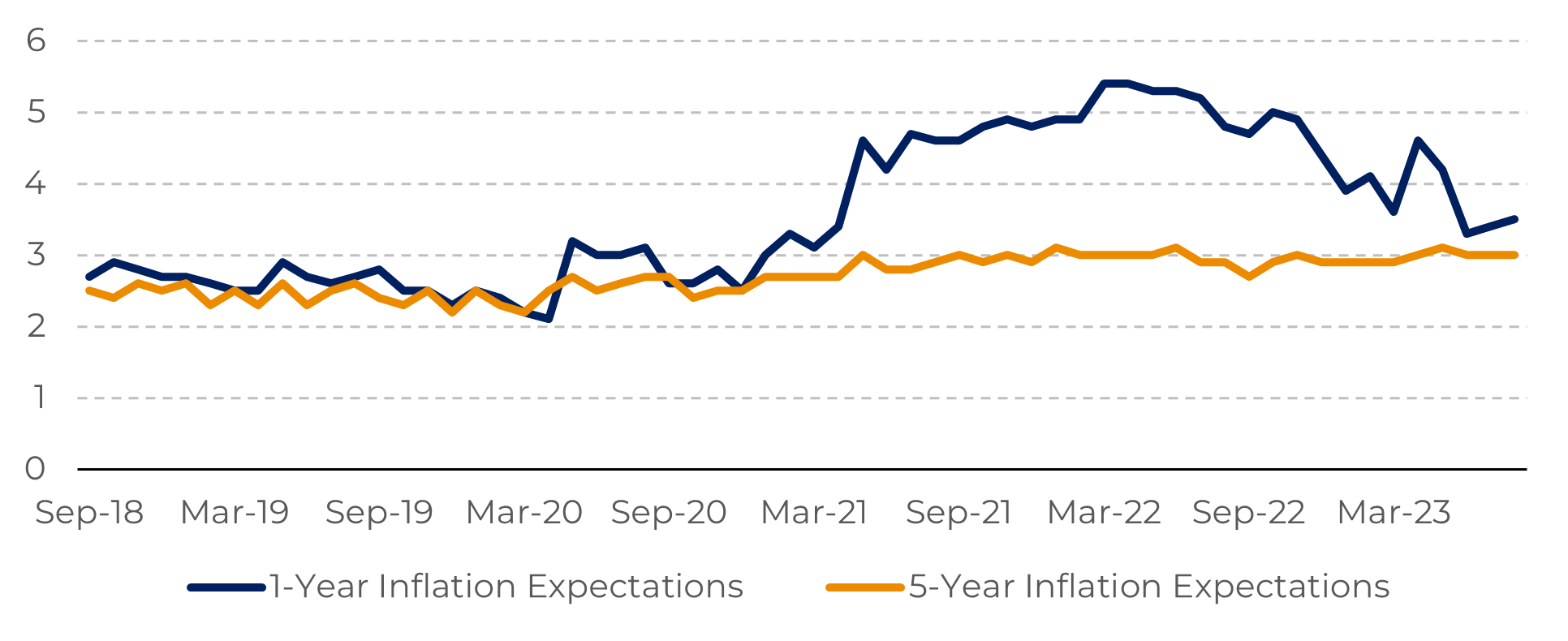

Inflation expectations are a risk when they become unanchored, as they have the potential to lift up inflation. This can lead consumers to act in ways that continue exerting upward pressure on prices, beyond the desired levels. Recently, the median inflation expectation from the University of Michigan (Chart #4) reflect this concerning trend.

However, a slowdown in salaries was recorded last month, with average hourly wages experiencing a 4.3% growth on a year-over-year basis but only a 0.2% increase on a monthly basis. This marks the smallest jump this year. This indicates that the Fed is headed in the right direction, though there might be some uncertainty regarding the pace.

Key sectors, such as services, remain robust, as reported by the Institute for Supply Management (ISM), with its non-manufacturing PMI increasing to 54.5 in August. A reading above the 50-mark indicates growth in the services industry, which constitutes more than two-thirds of the economy. Given the absence of clear indications of a job market slowdown, investors should exercise caution regarding the risks in the current high-price environment and the potential for further interest rate adjustments.

However, a slowdown in salaries was recorded last month, with average hourly wages experiencing a 4.3% growth on a year-over-year basis but only a 0.2% increase on a monthly basis. This marks the smallest jump this year. This indicates that the Fed is headed in the right direction, though there might be some uncertainty regarding the pace.

Image 4: Consumer Inflation Expectations (Median)

Source: University of Michingan

US treasury yields climb ahead Fed meeting

The concerns regarding inflation expectations are indeed manifesting in the US Treasury Bonds Market, as rates have shown a steady increase in recent weeks. Economic resilience, combined with the relatively slow progress in reaching the 2% inflation target, is contributing to the rise in Treasury bond yields. Consequently, this situation implies that interest rates are likely to remain elevated for an extended duration.

The high Treasury bond yields are affecting more volatile assets such as stocks and commodities. Expectations regarding the upcoming Fed meeting and mixed economic data are dampening investors' risk appetite, resulting in a cautious week.

Image 5: U.S. Treasuries Bond Yields

Source:Refinitiv

In Summary

When analyzing headline inflation, one of the most significant improvements has been observed in energy costs. The impact of high-interest rates on major oil benchmark prices has played a pivotal role in reducing overall prices in the economy.

Nevertheless, OPEC+ measures are pushing oil prices to higher levels and introducing increased volatility to inflation scenario as evident in the last CPI. Despite this, core inflation continues to show a decelerating trend, suggesting that the Fed board is likely to maintain borrowing costs unchanged this week.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.