Macroeconomics Weekly Report - 2023 10 02

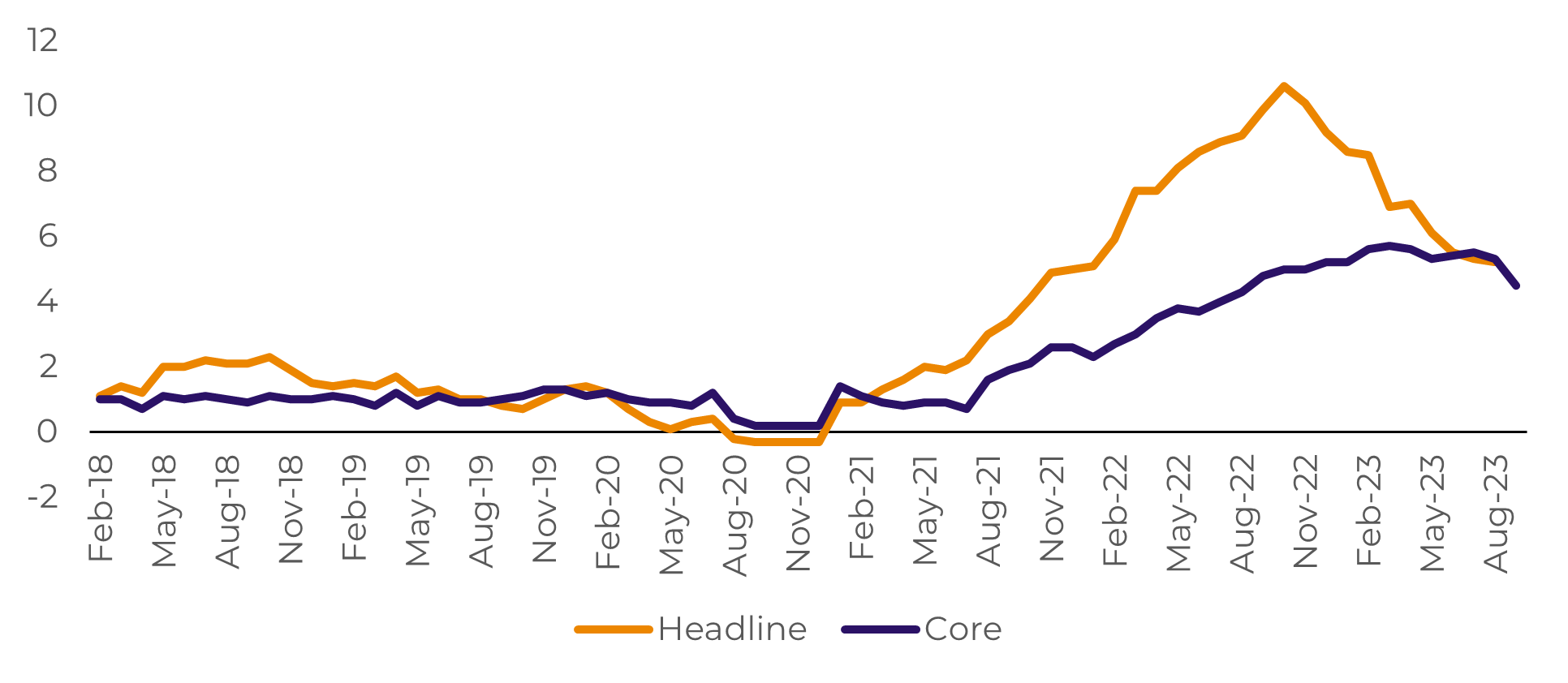

Lower inflation backs ECB last hike hint

- Following its latest interest rate increase, the European Central Bank suggested that it could potentially be the final move in this cycle of monetary tightening. The significant decline in inflation in September has probably strengthened the Governing Council's conviction that additional tightening measures are not required.

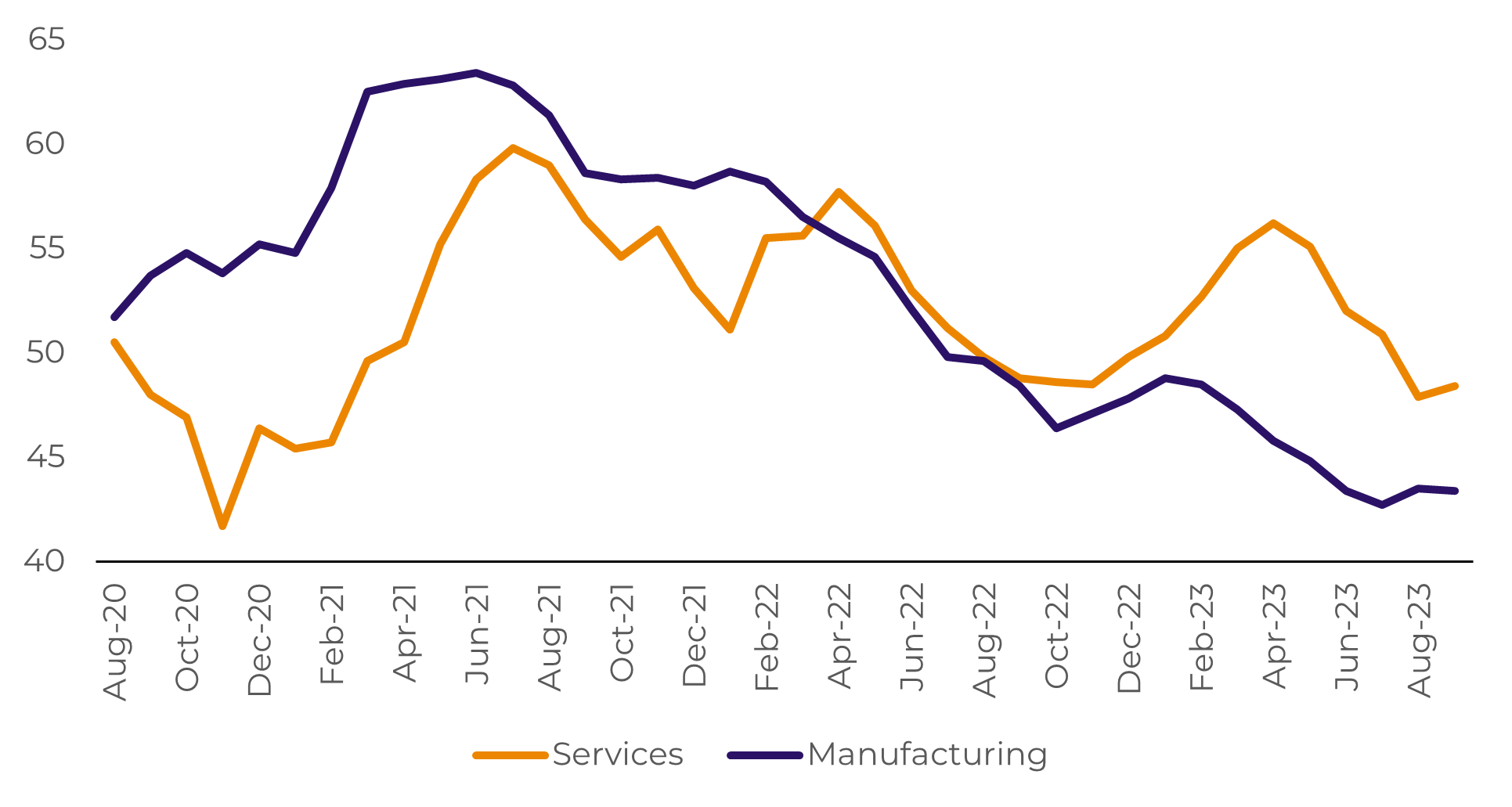

- Concerning business surveys indicating a notable decline in economic activity, and credit extension at levels reminiscent of the euro crisis era contribute to this view.

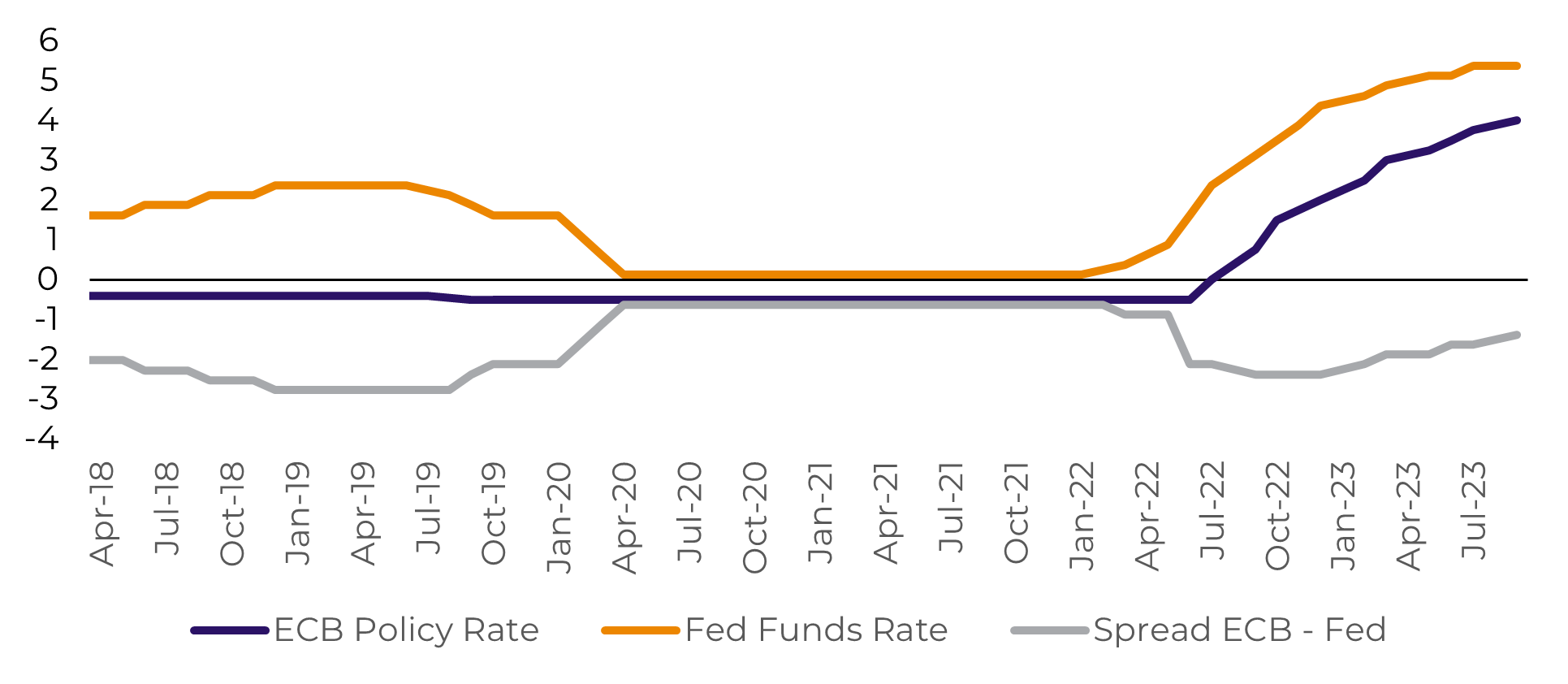

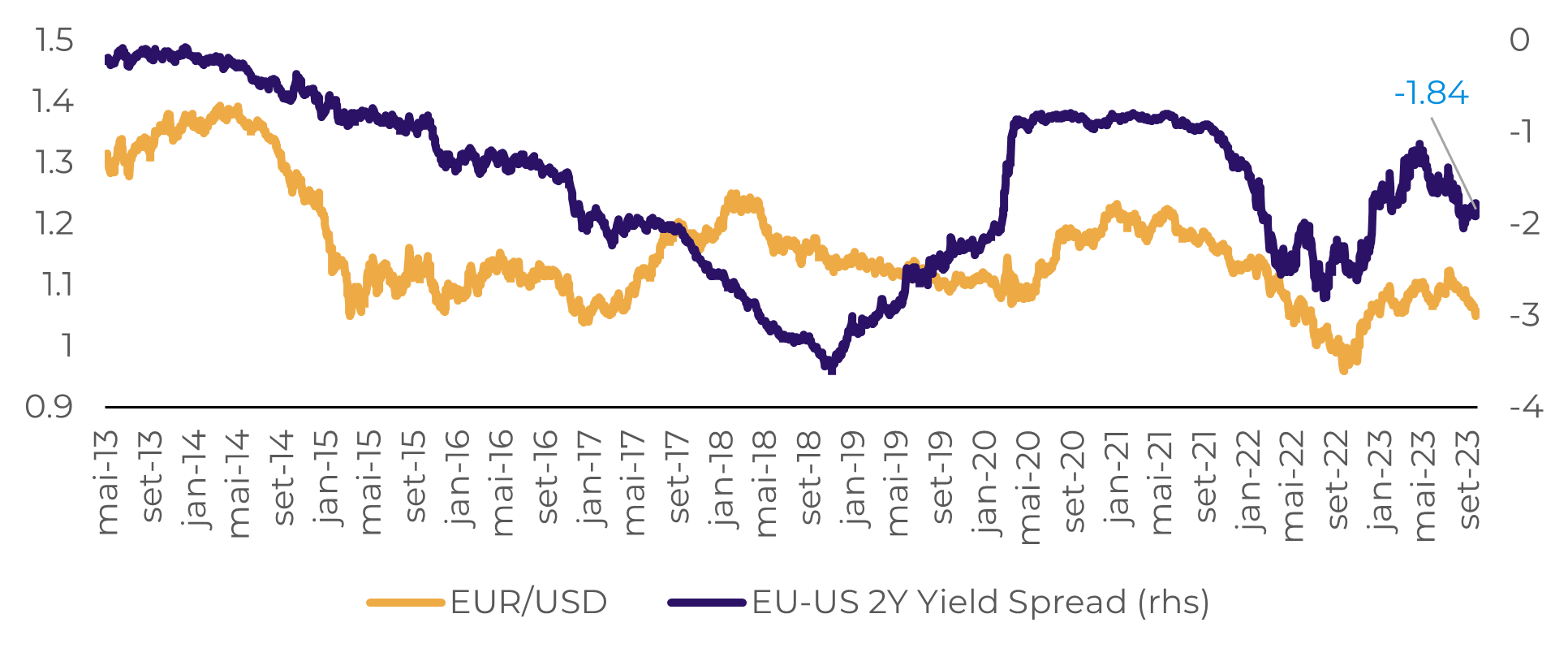

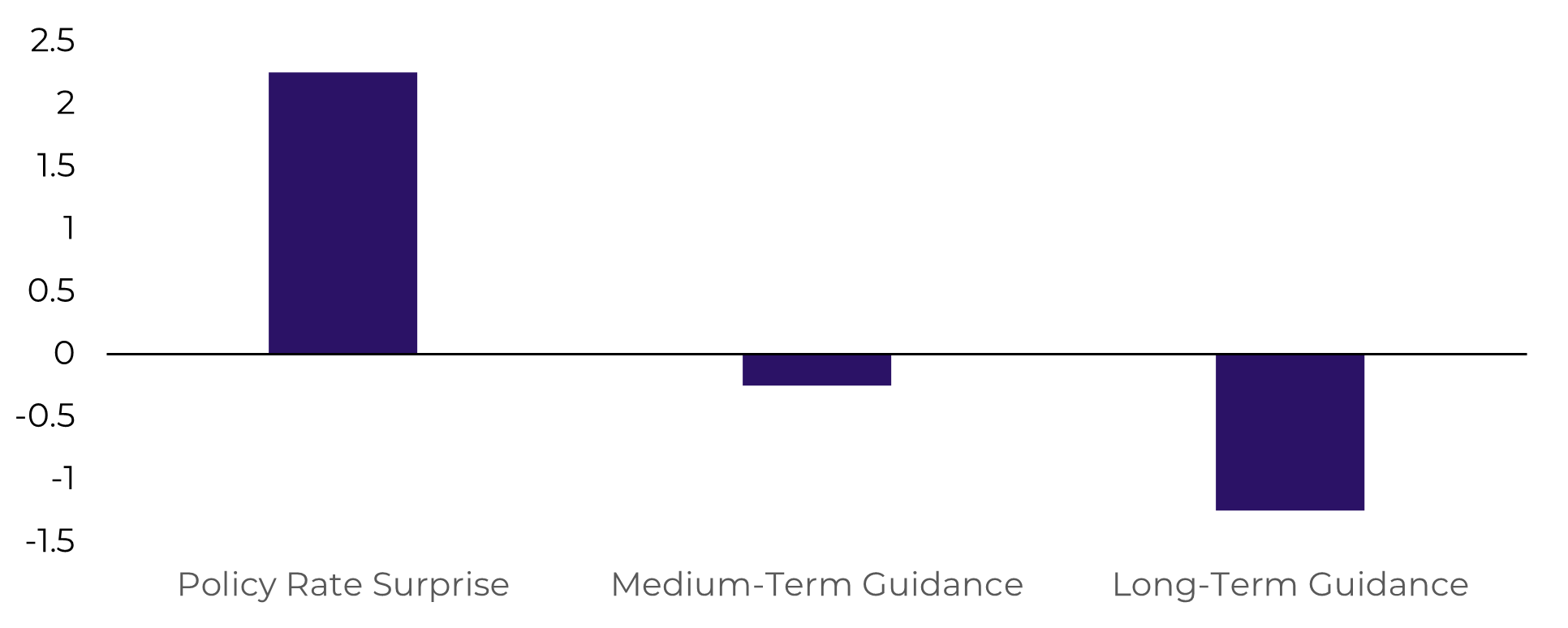

- Now, there isn’t many fundamentals pointing towards a “gap-closing” between US and EU yields. In the last ECB meeting, the changes in bonds markets show that for the medium and long term, traders received the decision and Lagarde’s speech as dovish. In summary, there isn’t much room for a strengthening of the Euro in the coming months.

Introduction

Inflation cooled faster than market expected

Image 1: Headline and Core inflation - EU

Source: Source: Refinitiv

Image 2: Policy Interest Rates – ECB and Fed

Source: Refinitiv

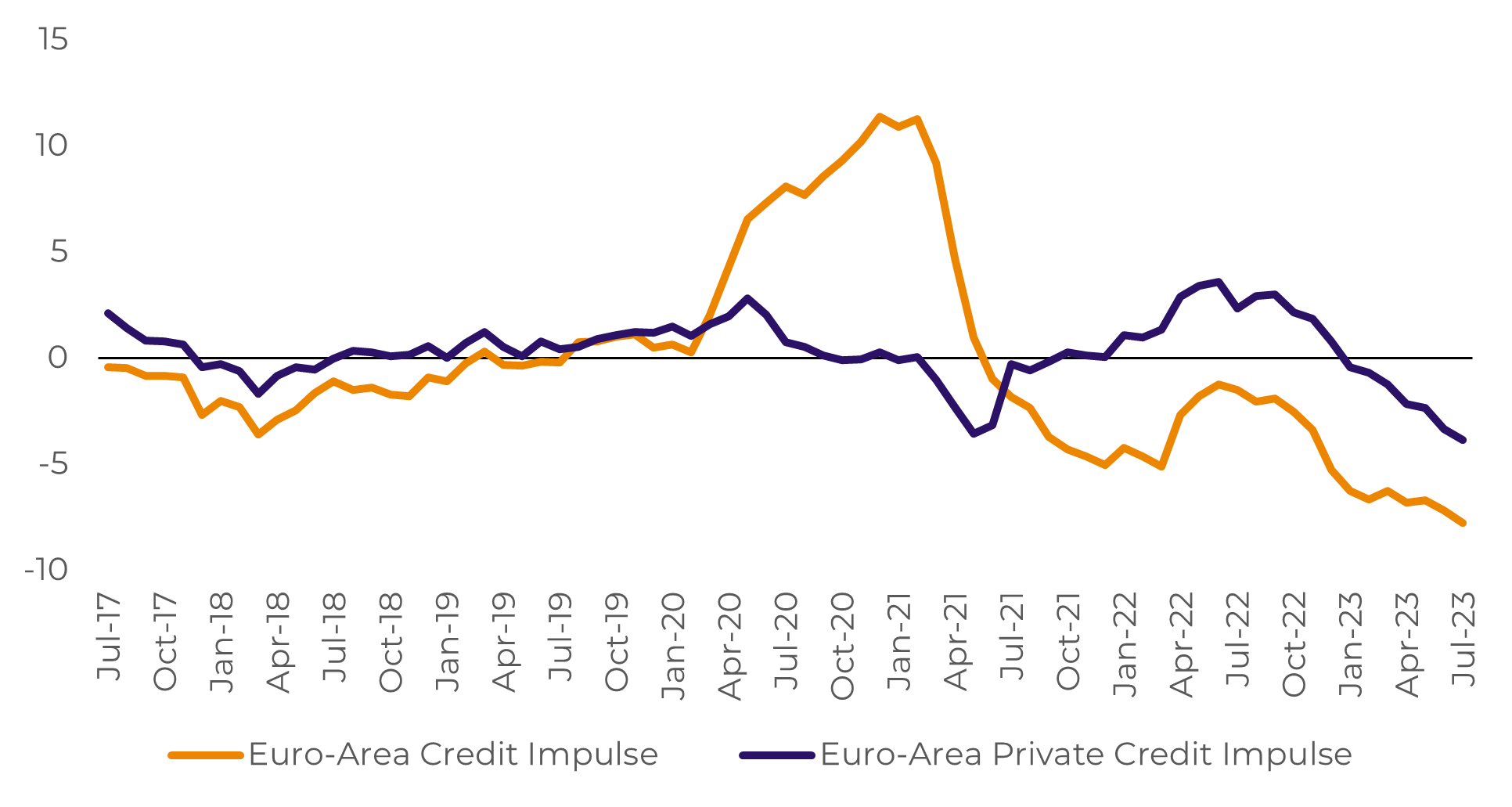

Image 3: EU Credit Impulse (%, YoY)

Source: Bloomberg

Credit Impulse Points to Slump in Demand

The latest European Central Bank's monthly credit data reveals that the drag on spending caused by reduced credit provision is now considerably more pronounced than it was during the depths of the Euro crisis. As a result, the risk of economic contraction in the latter half of the year is on the rise.

The credit impulse for households and non-financial corporations within the Eurozone declined to -5.2% of GDP in August, down from -3.7% in July. This shift lowered the three-month average to -3.9% from -2.9%. M3 money supply growth fell below the consensus forecast, declining to -1.3% year over year from the previous month's -0.4%. These figures contrast with the median estimate of -1.0%.

Image 4: EU PMIs

Source: Refinitiv

PMI’s Rise Is Unlikely to Alter ECB Rate Outlook

Source: Bloomberg

In Summary

Image 1: 2-Y yield spread (EU vs US)

Source: Refinitiv

Image 2: ECB’s decision impact on policy rates expectations (b.p.)

Source: Bloomberg

Weekly Report — Macro

alef.dias@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.