Macroeconomics Weekly Report - 2023 10 16

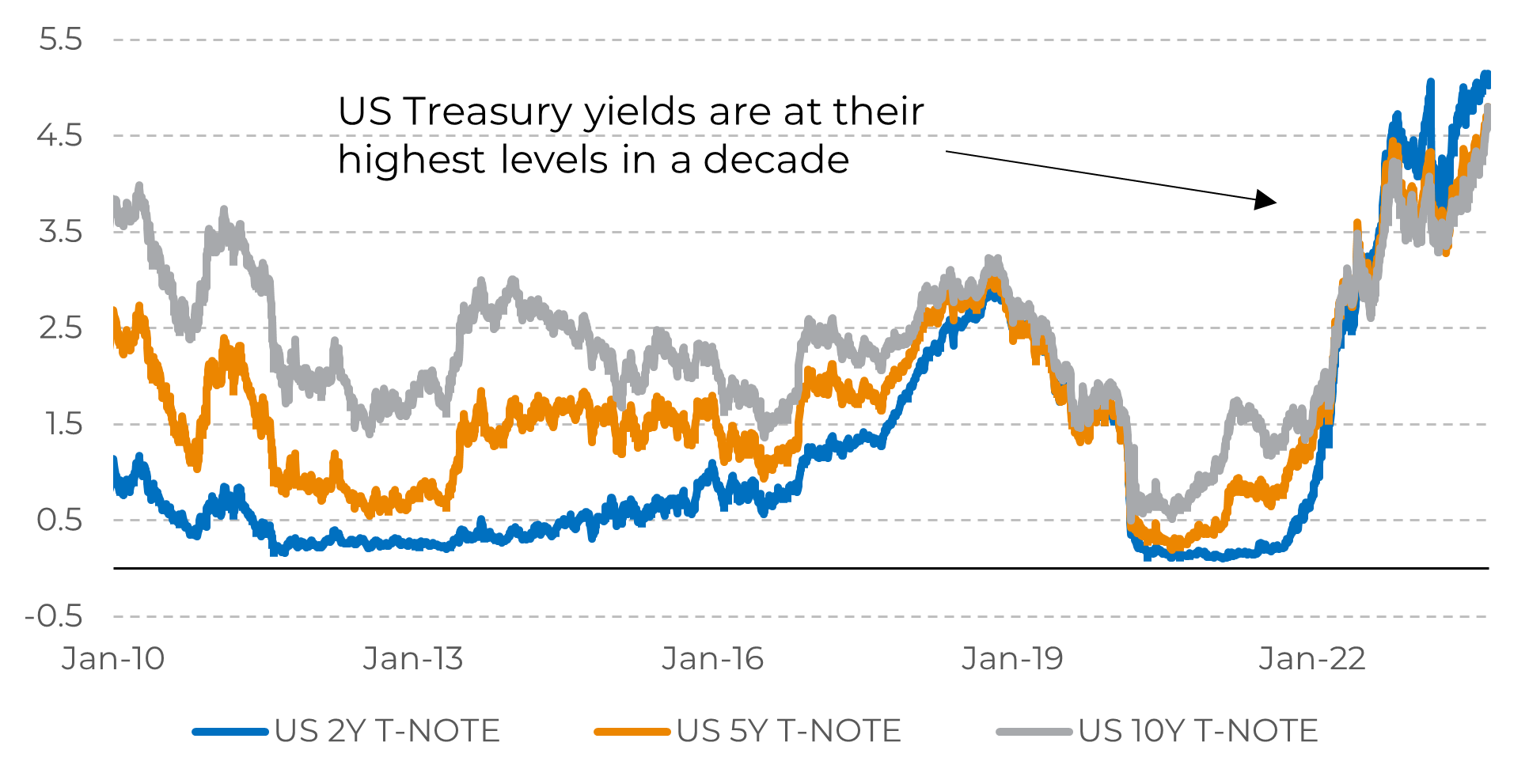

The yield on US Treasury bonds reaches ten-year highs

- US Treasury yields continue to rise to the highest levels in a decade, supported by strong labor market data and higher revisions to past numbers.

- Higher interest rates are pressuring the US stock market and commodities. Investors are flocking to US Treasury bonds, which are becoming increasingly attractive in the face of a still complex inflationary environment.

- Meanwhile, the US House of Representatives passed a bill extending government funding for 45 days, allowing the Fed to have access to economic data until its next meeting on November 1.

Introduction

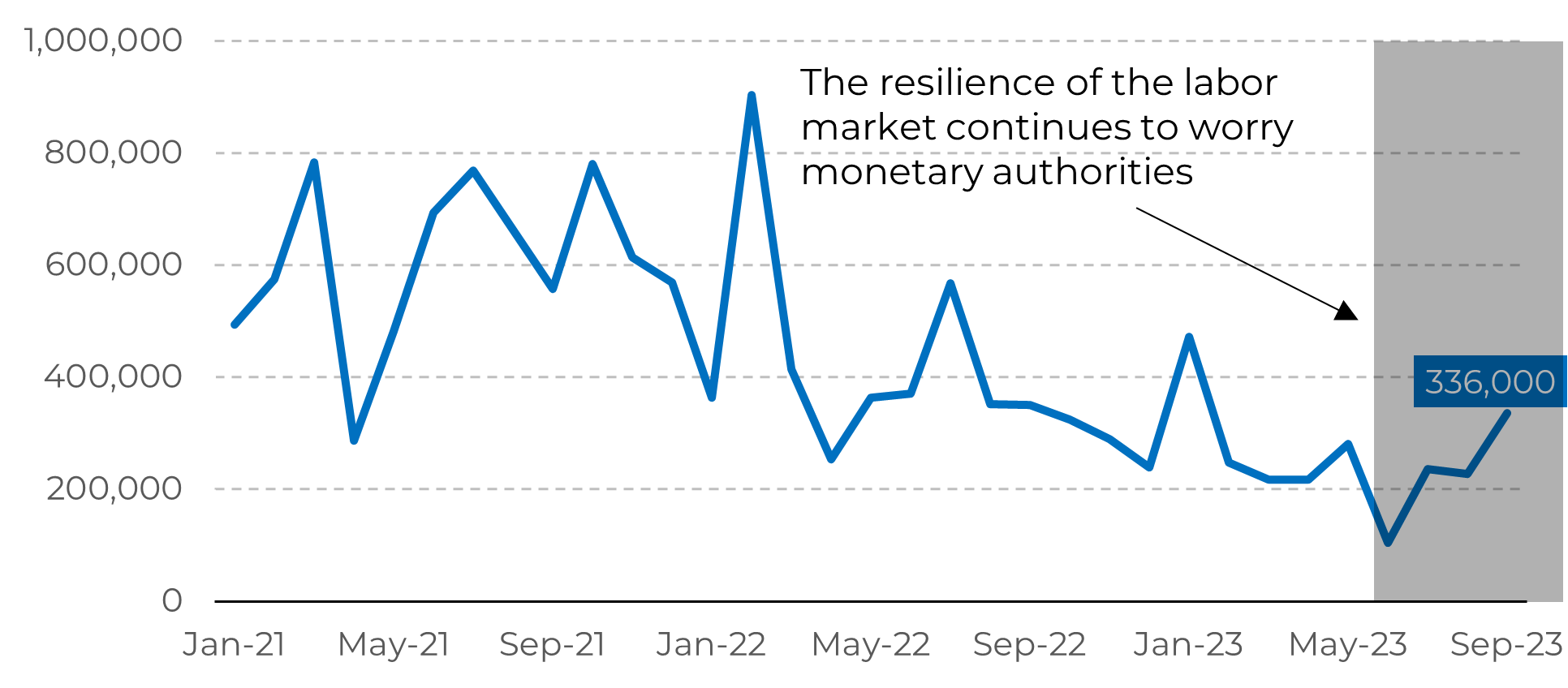

The

labor market in the US remains strong, raising concerns about the pace of

improvement in the country's inflationary environment, as the total inflation

index rose again in its latest reading, also driven by higher energy costs.

The

labor market in the United States continued to grow in September, with the

creation of 336,000 jobs, almost double market expectations. Despite this, the

good news is that wage growth is stabilizing, with an average increase of 0.2%

per hour of work (4.2% increase on a year-on-year basis).

Those numbers are especially important for defining the path of interest

rates in the US, as they are used in conjunction with other indicators, such as

the consumer price index (CPI), to measure economic activity and inflation. A

very strong labor market indicates an expansion of consumer demand, which can

lead to higher prices.

Although

there is some disagreement among monetary authorities about a new interest rate

hike by the end of the year, there seems to be a consensus that interest rates

need to remain elevated for “longer than desired”.

Therefore, the market is paying attention to economic indicators to predict the Fed's decision on November 1, and the latest US jobs report has increased the chances of a new increase in the interest rate.

Image 1: Non-Farm Payrolls in the US

Source: United States Bureau of Labor Statistics

US Treasury bonds continue to rise

Image 2: Yield on US Treasury Bonds (%)

Source: Bloomberg

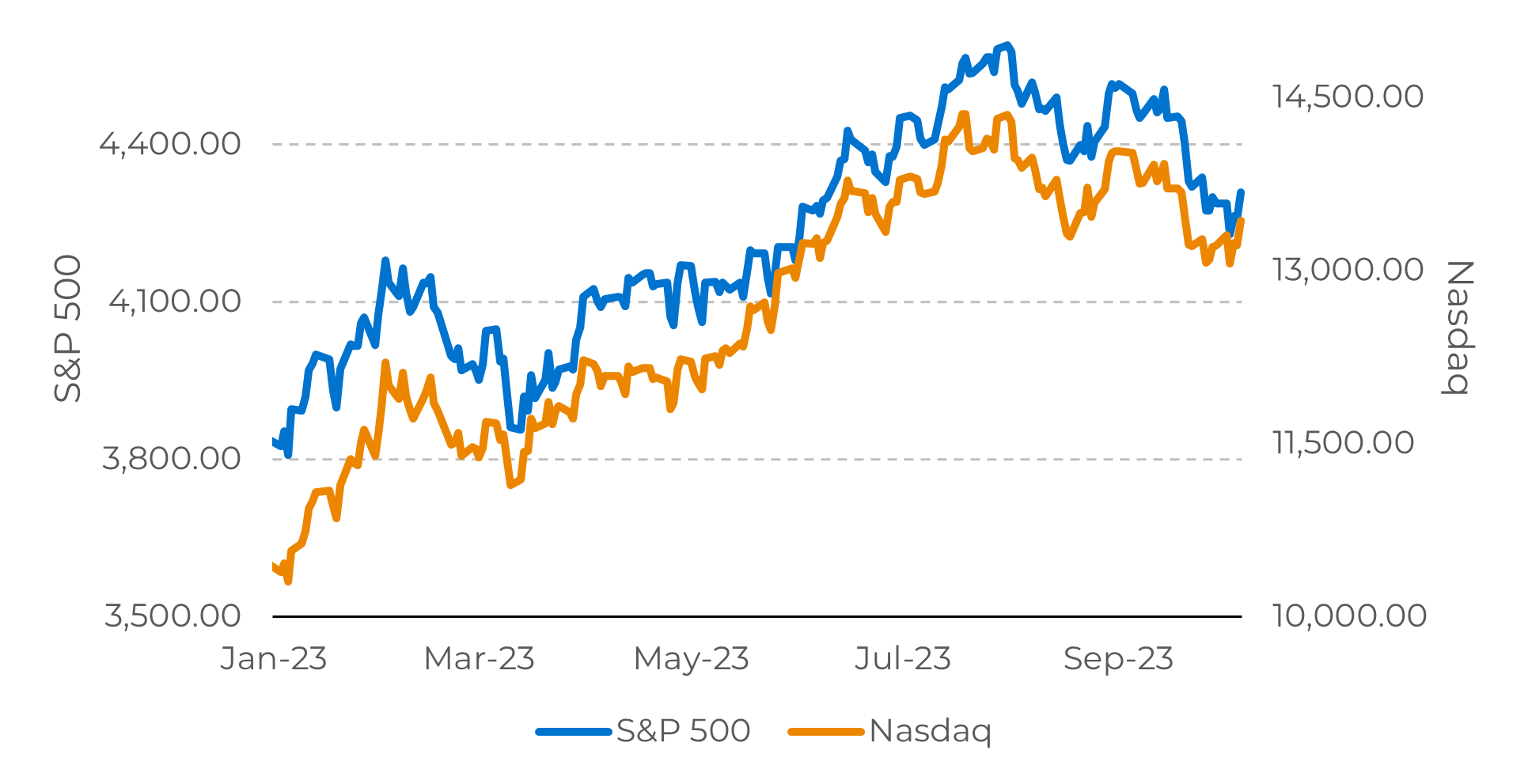

The latest European Central Bank's monthly credit data reveals that the drag on spending caused by reduced credit provision is now considerably more pronounced than it was during the depths of the Euro crisis. As a result, the risk of economic contraction in the latter half of the year is on the rise.

The credit impulse for households and non-financial corporations within the Eurozone declined to -5.2% of GDP in August, down from -3.7% in July. This shift lowered the three-month average to -3.9% from -2.9%. M3 money supply growth fell below the consensus forecast, declining to -1.3% year over year from the previous month's -0.4%. These figures contrast with the median estimate of -1.0%.

Image 3: EU PMIs

Source: Refinitiv

In Summary

Weekly Report — Macro

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.