Macroeconomics Weekly Report - 2023 10 23

Surprise in the first round raises uncertainty in Argentina

- Once again, the Argentine elections brought surprises as the candidate of the situation, Sergio Massa, pulled off a surprising victory, in the first round, beating Javier Milei - that was ahead in most polls.

- Massa's partial victory could delay the revision of the official Argentine peso rate. Rising inflation has undermined the currency's competitiveness, making it almost 10% stronger than before the primaries. Although an increase in interest rates is likely, in order to impact the parallel market and inflation, it must be substantial enough to offset the increased political risk.

- Regardless of the outcome of the second round on November 19, Argentina faces the need to implement significant reforms to its fiscal policy in order to overcome the current economic crisis. The absence of a solid and transparent fiscal plan could worsen the crisis if there are abrupt changes to exchange control policies.

Introduction

Another surprise at the polls in Argentina will prolong the already high political uncertainty for another four weeks. The result of the first round - with Economy Minister Sergio Massa in first place and libertarian Javier Milei in second - is possibly the worst-case scenario for the markets.

Most polls showed Milei - who surprised with a victory in the August 13 primaries - in the lead. One of the main conclusions of the primaries - that support for the government was waning - is now weaker.

First round developments

It is not expected that either candidate will provide detailed details about their political plans before the second round on November 19. In the meantime, Massa could reinforce his populist approach of an artificially strong peso, interventionism and high fiscal cost measures.

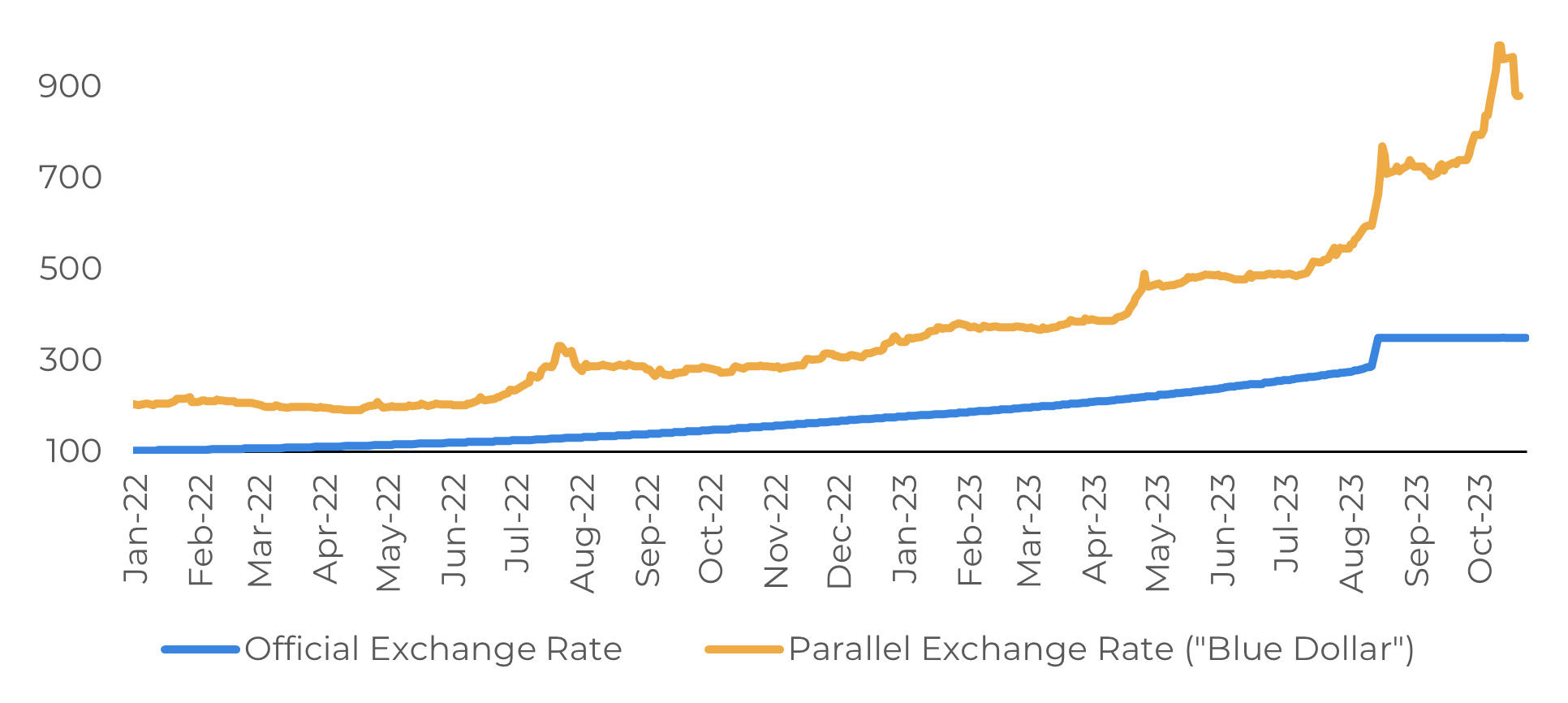

Massa's lead in the first round gives him the incentive to postpone the realignment of the official peso rate. After a devaluation of almost 20% following the August primaries, the official peso was frozen at 350 per dollar. High inflation has eroded its competitiveness, and the currency is now almost 10% stronger than before the primaries, in real effective terms.

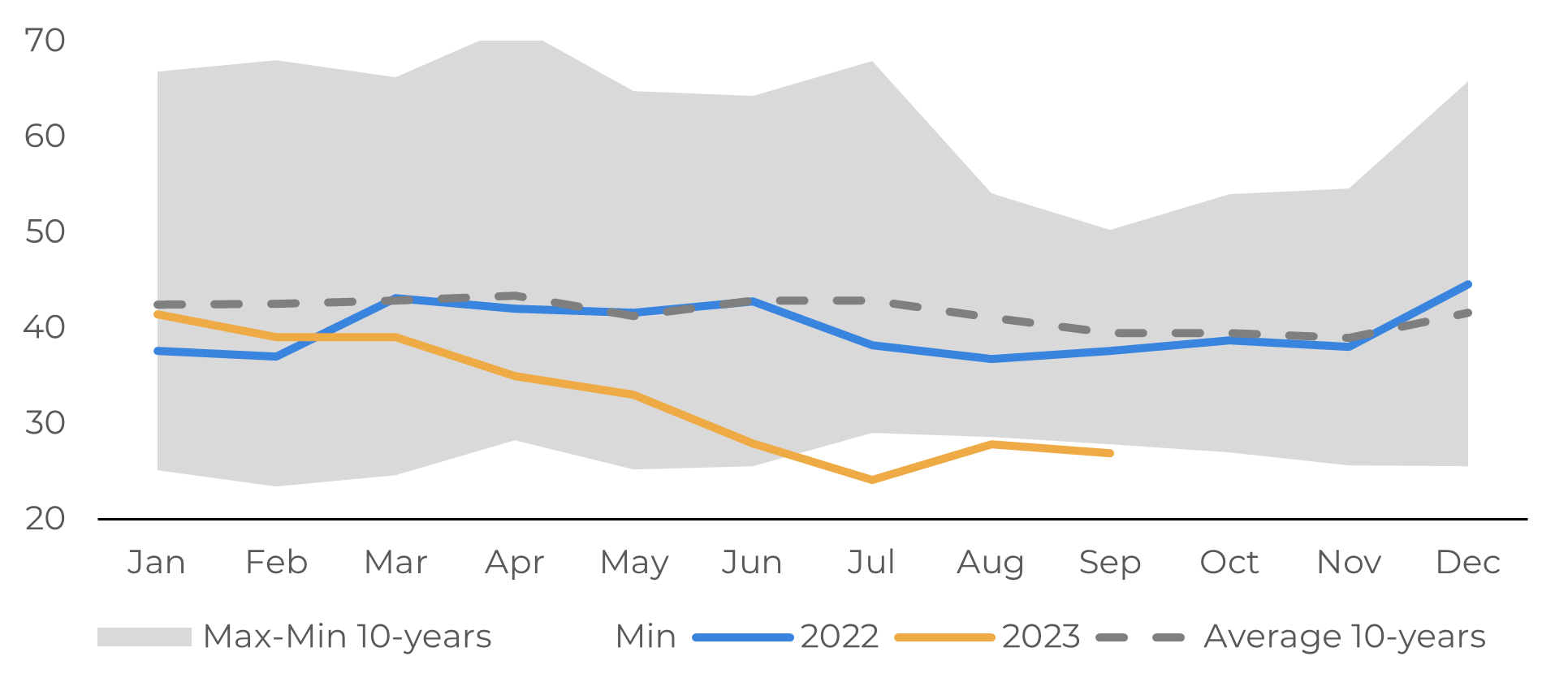

A further increase in the interest rate is a possibility - with few dollars in the reserve coffers, the government may want to increase financing costs to reduce demand for dollars and relieve pressure on the parallel markets.

The reaction of the parallel peso markets will depend on whether the combination of a frozen official exchange rate and potentially higher interest rates drives a carry trade that overcomes the high electoral uncertainty and additional monetary issuance - especially if Massa accelerates his spending policy ahead of the next vote.

Image 1: Official and Parallel Argentina Exchange Rate (USD/ARS)

Source: Refinitiv

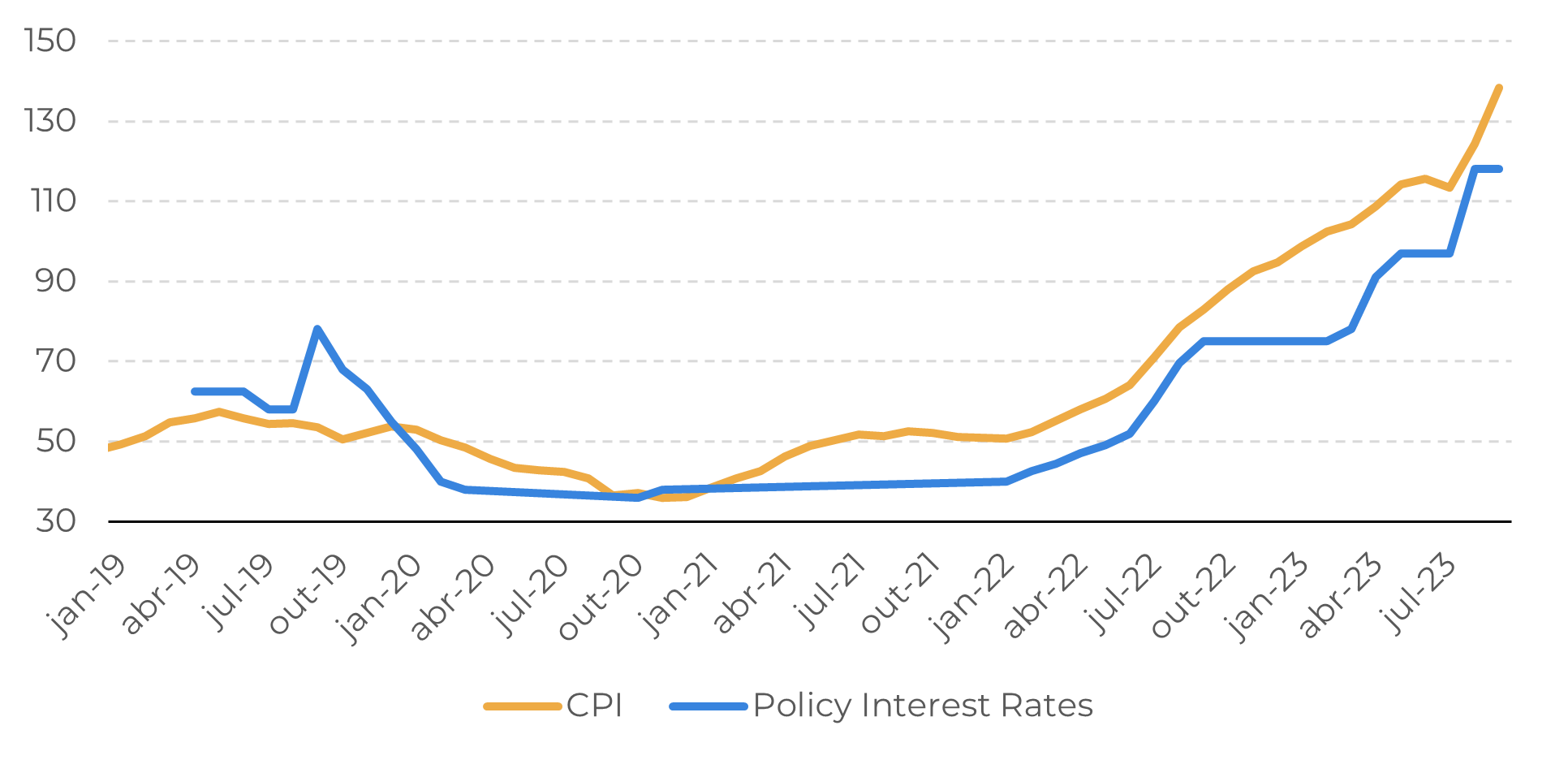

A further weakening of the peso in the parallel markets could push inflation even higher in the October and November readings - with monthly figures possibly in the double digits for four consecutive months - and make policymakers' task of controlling rising prices much more difficult. Annual inflation rose to 138.3% in September, and the consensus forecast in the central bank's latest survey of analysts is for it to close the year at 180.7%.

Fiscal policy is the new administration's main issue

Image 2: Inflation and Policy Interest Rates (%)

Source: Refinitiv

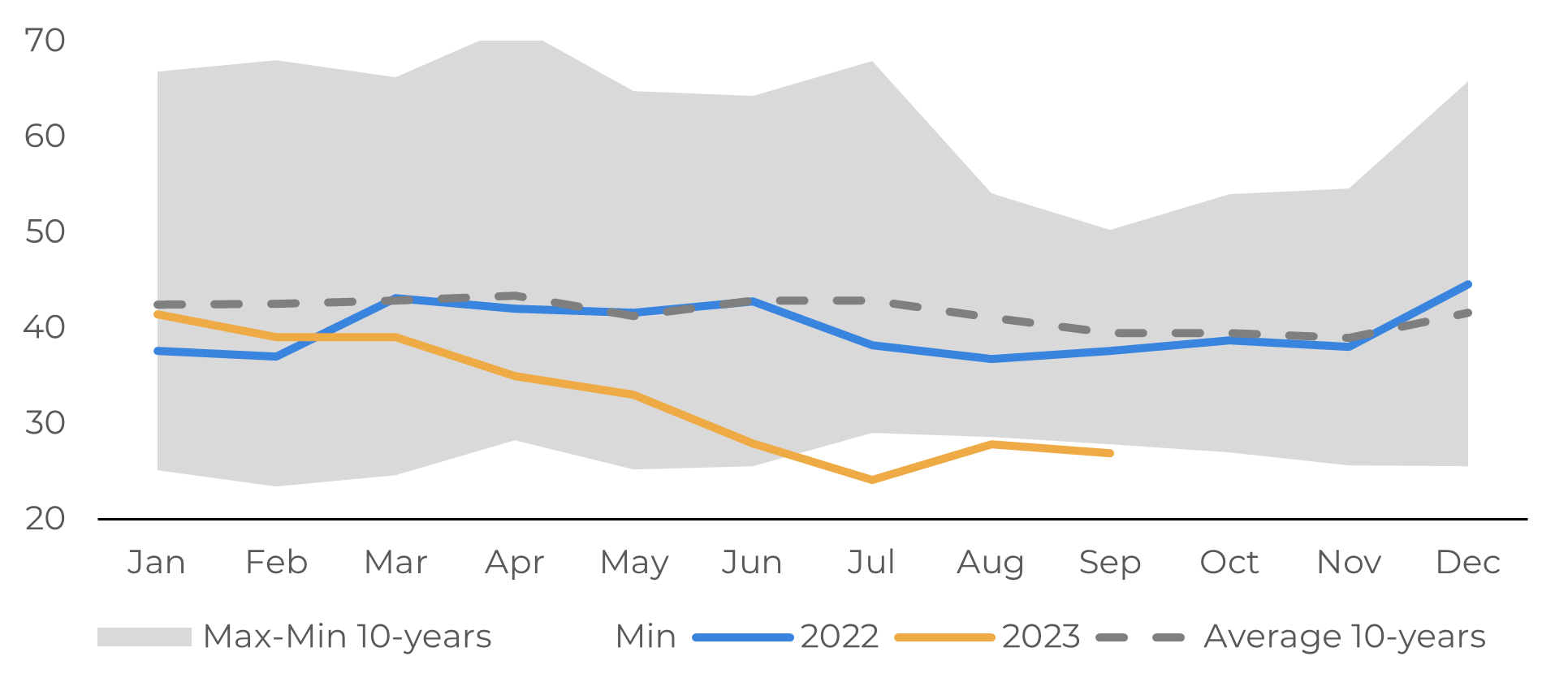

Argentina's budget has been in the red for more than 10 years. The government's latest measures, which include tax cuts and higher public spending, will take the primary deficit to over 3% of GDP. This puts the next government in a difficult situation, and it will have to act quickly.

A balanced budget for 2024 is needed to curb the reliance on currency issuance to finance the deficit - one of the main factors behind Argentina's triple-digit inflation. A large primary surplus is needed to stabilize public debt, especially if the new government stops maintaining an artificially strong currency and the central bank keeps real interest rates well above zero.

Any fiscal plan must be credible in order to create confidence in the next Argentine government, stimulate savings and investment in pesos and attract capital flows. The new government will also have to clarify how it intends to refinance the country's short-term debt, mainly domestic, and deal with the primary deficit in the meantime.

Image 3: FX Reserves (bi USD)

Source: Refinitiv

A weaker peso and the realignment of regulated prices - fundamental to any fiscal plan - will probably keep inflation very high at first. The Central Bank of Argentina (BCRA) will tend to raise interest rates to control inflationary pressures, reduce the demand for dollars and attract investors to finance the public debt. The extent of monetary tightening will depend on how much the fiscal plan and monetary measures reduce inflation expectations.

Exchange rate policy depends on fiscal credibility

Conclusion

Massa's lead in the first round could postpone the realignment of the official Argentine peso rate. High inflation has eroded its competitiveness, and the currency is now almost 10% stronger than before the primaries. A further increase in the interest rate is a possibility, but to have an effect on the parallel exchange rate and inflation it must be high enough to compensate for the greater political risk.

Image 4: Budget Balance Argentina (% GDP)

Source: Bloomberg

Weekly Report — Macro

alef.dias@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.