Macroeconomics Weekly Report - 2023 11 06

Higher for longer thesis reviewed

- The recent communication from the Federal Reserve, alongside the job market and economic activity indicators released last week, increase the chances of an early start to interest rate cuts, compared to the expectations that prevailed in previous weeks. This has resulted in a notable drops in US' bond yields.

- However, for this downward pressure in yields to persist, it is essential to monitor how effective the impact of the economic slowdown will be on inflation. Concerns about the US fiscal deficit and public debt, as well as increases in risk aversion, have the potential to reverse this downward trend in yields.

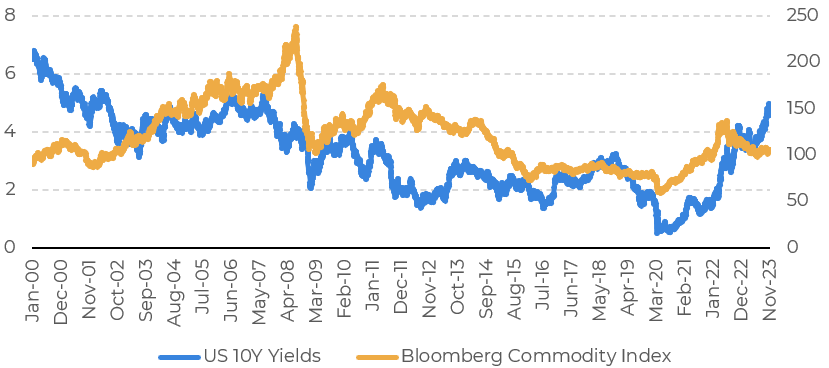

- If the bearishness in yields is maintained, it opens up the possibility of a more favorable scenario for commodities that are not strongly linked to economic growth.

Introduction

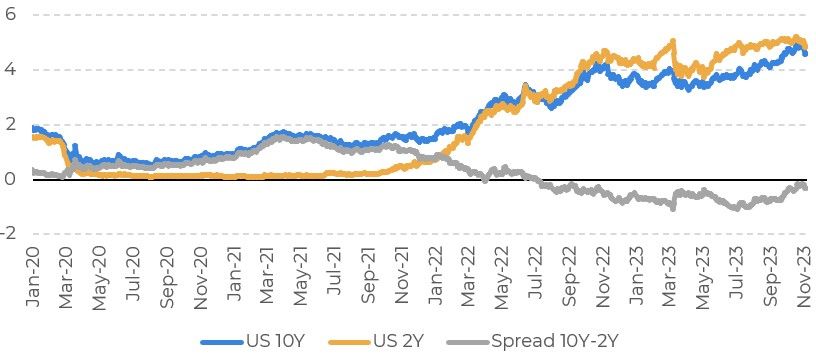

The rise in US bond yields had been one of the main topics in macroeconomic news in recent weeks, as 10-year rates reached their highest level in 16 years.

These rises were mainly anchored in resilient US economic activity and labor market data and more "persistent" inflation - which hasn't slowed down since June – implying an expectation that the Fed would keep interest rates high for longer.

However, the last week has brought several elements pointing in the opposite direction, causing a significant drop in US bond yields. Could this be the end of the "higher rates for longer" narrative?

Image 1: US Yields (%)

Source: Refinitiv

Surprisingly, Powell and the FOMC adopted dovish speeches

Last Wednesday, the Fed decided to keep the Fed Funds Rate at 5.25%-5.5% for the second meeting in a row. This decision was already widely expected by the market, so the post-decision communications would be the focus of economic agents.

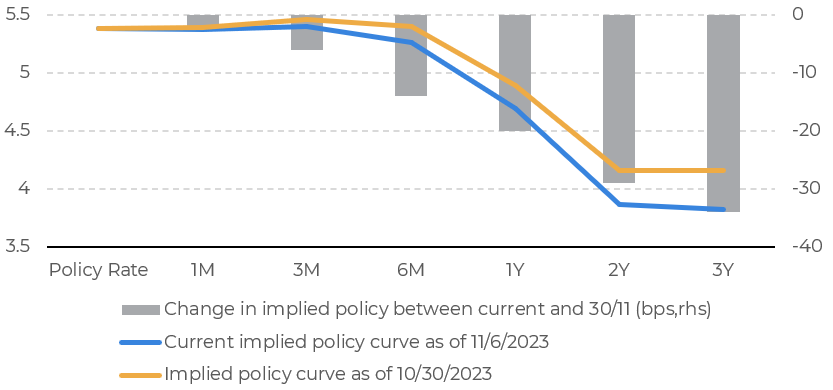

In the view of most analysts, both Fed Chairman Jerome Powell and the post-decision statement by the FOMC (Federal Open Market Committee) sounded dovish in general. The committee's statement subtly hinted that it didn't take much account of the strong third quarter data or the September jobs report, while Powell signaled that the September dot plot may already be out of date, meaning that further rate hikes may not be necessary.

The FOMC statement acknowledged the recent strength in economic activity, but noted that this occurred in the third quarter. The quote is retrospective and does not imply any belief that the strength will continue.

Mentions of the labor market also sounded slightly dovish. Instead of highlighting September's explosive non-farm payroll gains, the committee chose to emphasize that employment gains "have moderated since the beginning of the year".

Powell tried to strike a hawkish tone in his post-meeting press conference, but ended up being interpreted as dovish by the market. On the hawkish side, Powell said that the FOMC is "not yet confident" that rates will be restrictive enough to control inflation. However, in the rest of the press conference, he repeatedly refuted the idea that strong data means the need for further rate hikes.

In particular, despite the surprisingly strong Employment Cost Index (ECI) and other inflation surprises, he said that September's dot plot - which indicated the need for another hike this year - may already be obsolete due to tightening financial conditions.

Image 2: US Yield Curve

Source: Bloomberg

Trend reversal in the job market

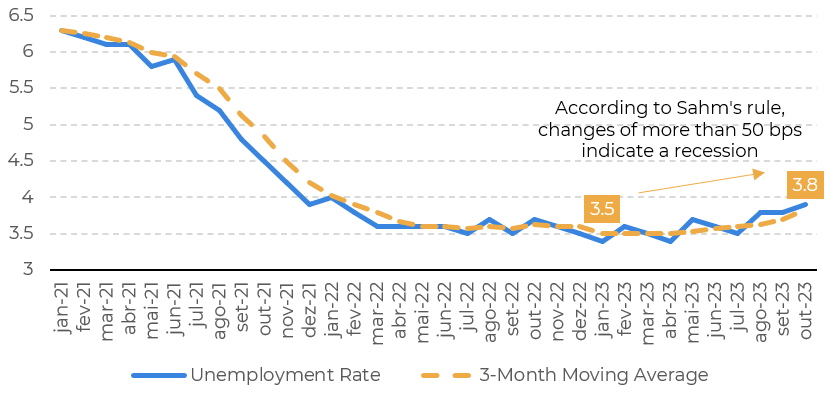

The October jobs report was uniformly discouraging for job seekers, but encouraging for the Federal Reserve, which is seeking to bring inflation down to its 2% target.

The biggest sign of the report was the increase in the unemployment rate - which outweighs the significant slowdown in non-farm payrolls and the large negative revisions. Nonfarm payrolls rose by 150,000 in October (compared to a downwardly revised gain of 297,000 in September) below the consensus estimate of 180,000. The two-month net revision was -101 thousand.

The U-3 unemployment rate rose to 3.9% (compared to 3.8% previously). The labor force in October decreased by 201 thousand, while the number of unemployed workers increased by 146 thousand.

The three-month moving average of the U-3 unemployment rate rose 0.42 p.p. above last year's low. This figure matches all 11 recessions since 1950 on a three-month average from their start, with a false positive rate of just 1%. In order to trigger the Sahm Rule - which proposes a slightly larger change of 0.50 p.p. as the threshold for recession and historically has no false positives - the unemployment rate needs to rise above 4.0%.

Image 3: US Unemployment Rate (%)

Source: Refinitiv

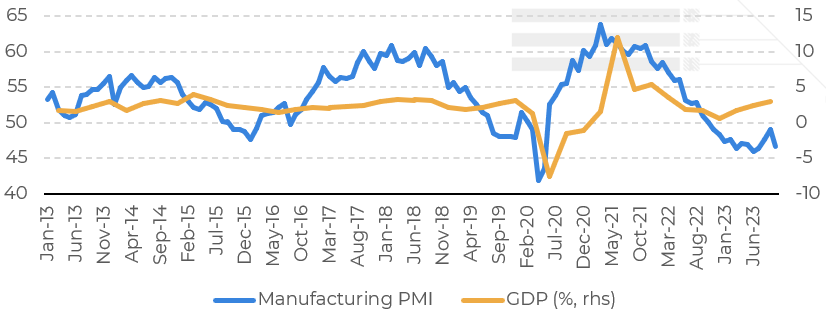

In addition, the ISM manufacturing PMI surprised with a drop to 46.7 in October. The employment and new orders components also contracted. The interviewees noted a slowing economy, with some already seeing it "clearly in a mild recession", creating an "urgent need to reduce the workforce".

Image 4: ISM PMI and GDP - US

Source: Refinitiv

Conclusion

Image 5: Yields and Commodities

Source: Refinitiv

Weekly Report — Macro

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.