Macroeconomics Weekly Report - 2023 10 30

Terminal rates arrived in Europe, but cuts are still far away

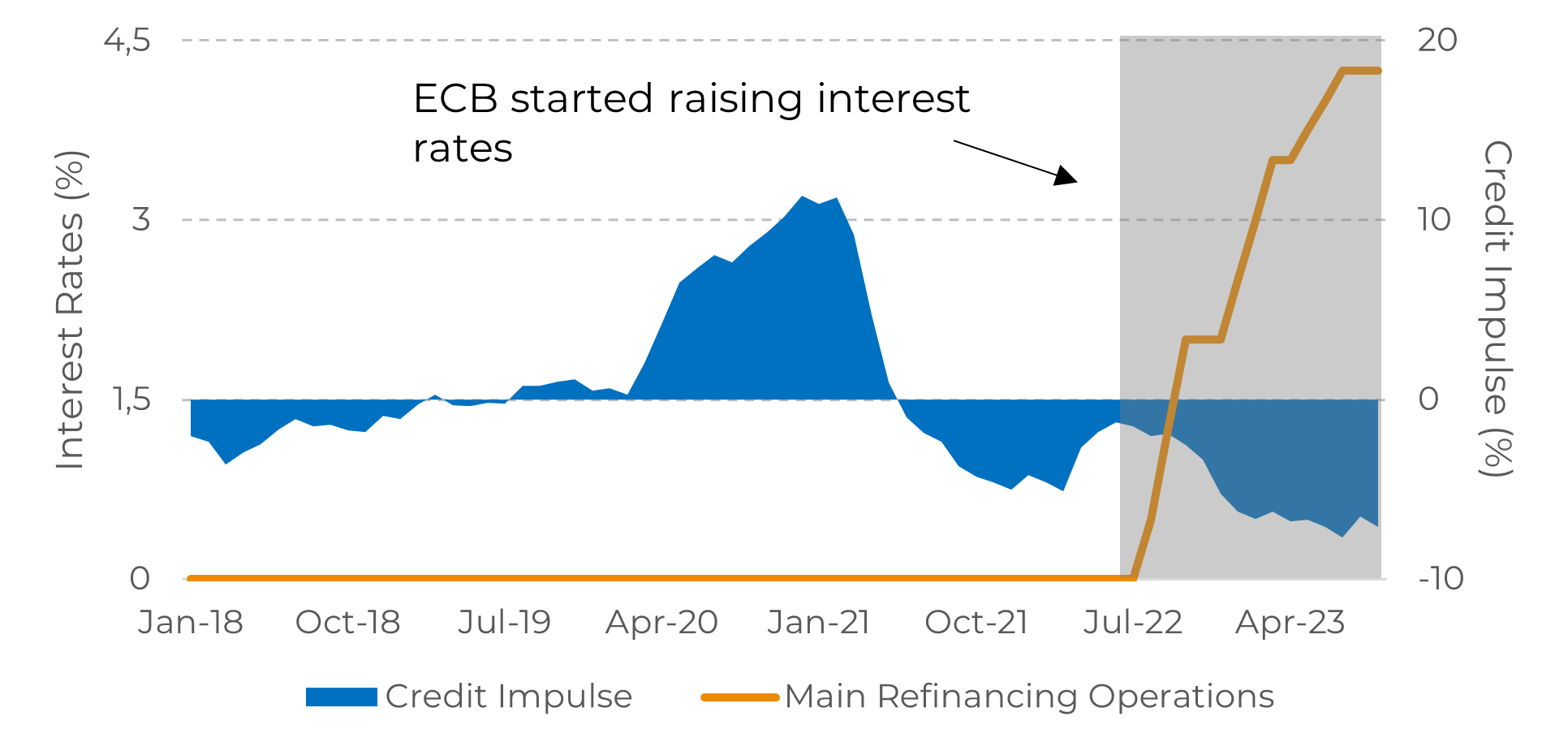

- The ECB kept interest rates unchanged in its last meeting. The improvement in inflation and the deterioration in economic activity suport maintaining borrowing costs at their current level.

- Credit impulse on the continent is still retreating, a signal that a tight monetary policy is helping to bring prices under control. However, the risk of an escalation of the conflict in the Middle East is a concern for monetary authorities.

- Additionally, another European country is in focus: the Bank of England is expected to announce another rate pause, keeping interest rates at a 15-year high of 5.25%.

Introduction

Since the COVID-19, Europe has encountered many economic challenges. Disruptions in the supply chain, coupled with the reopening of the economy, have exerted upward pressure on the prices of a wide range of goods and services. Furthermore, the conflict in Ukraine has contributed to elevate energy costs.

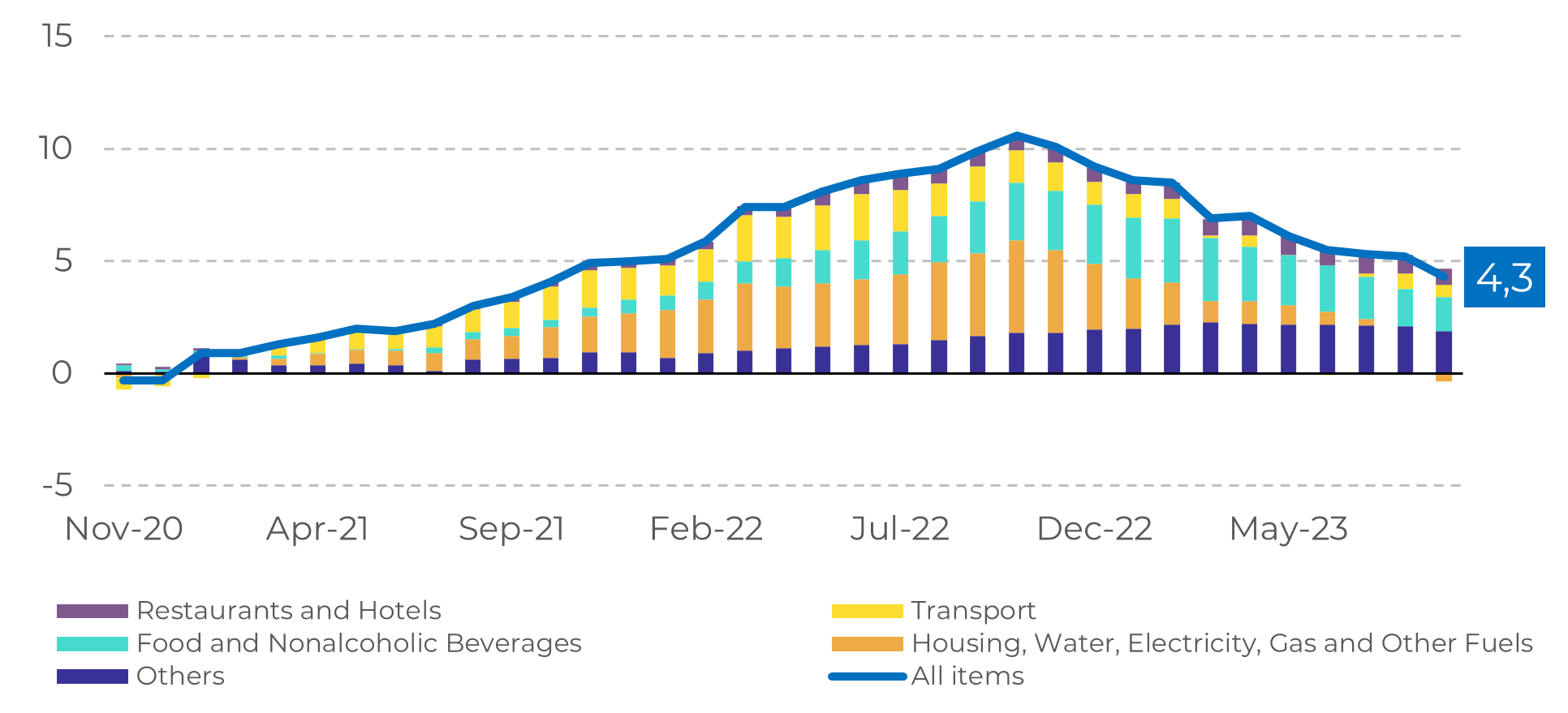

The European Central Bank (ECB) rose interest rates by 4.5% since July 2022, making the fastest hike of interest rate in its history. Currently inflation it at the lowest level since October 2021, with annual figures declining to 4.3% in September. However, inflation still remains significantly above the ECB's target of 2%.

Furthermore, inflation dynamics vary across member states, with Germany at 4.5%, France at 5.7%, Slovakia at 8.2%, and Slovenia at 6.86%. While the ECB's rate hikes are expected to bring inflation down over time, it is likely to remain high in some countries for longer than others.

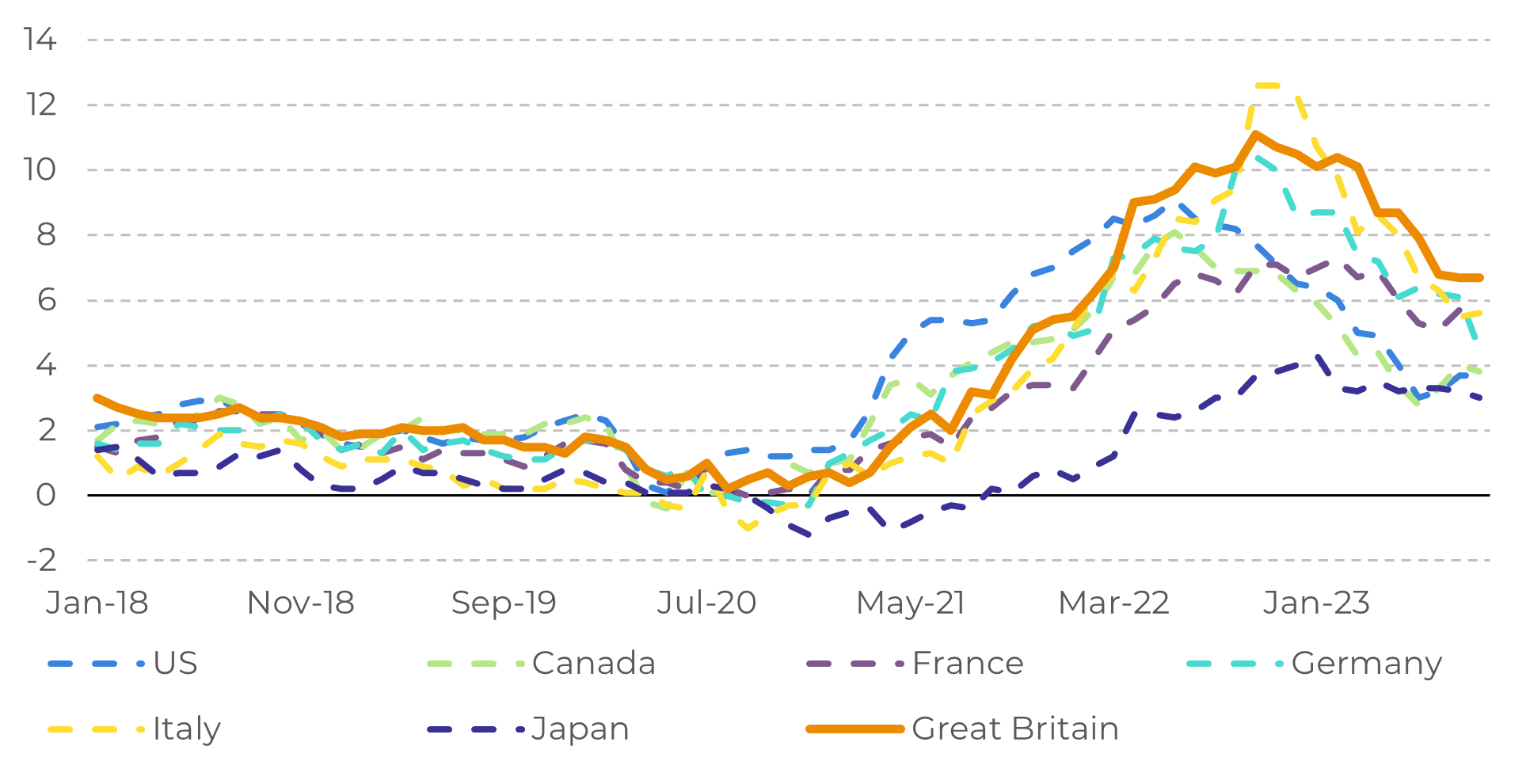

This week will be crucial for Great Britain, as the Bank of England (BOE) is scheduled to release its interest rate decision and macroeconomic projections. The country has the highest inflation in the G7 and is facing economic growth challenges.

Image 1: Major Components of Eurozone Inflation (%)

Source: Bloomberg

ECB maintain interest rates, but energy prices concerns

Image 2: Euro-Area Credit Impulse and Interest Rates (%)

Source: Bloomberg, Eurostat

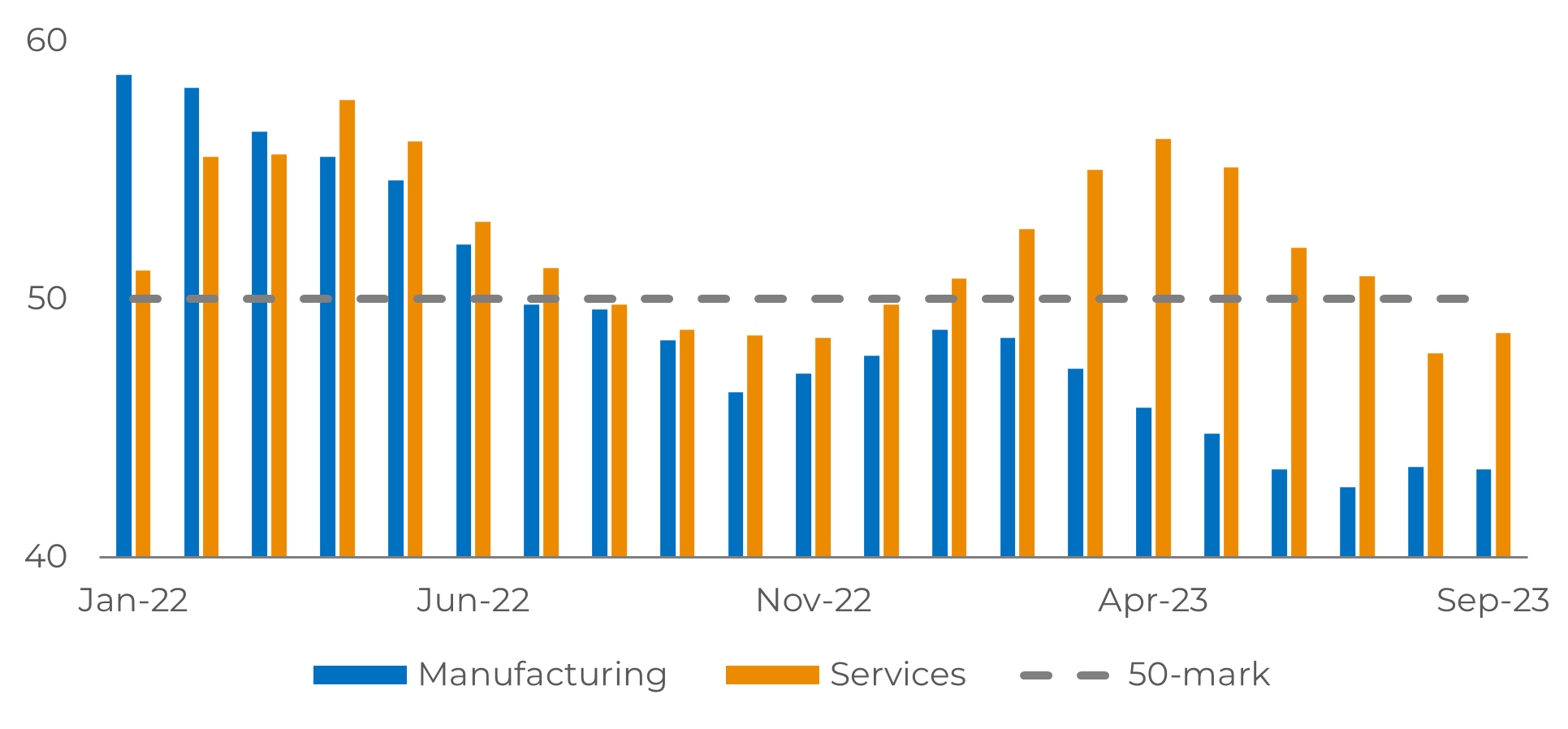

Eurozone countries are mostly net energy importers, relying on external sources to meet their energy needs. Data shows that the main energy product imports in 2021 were petroleum products (including crude oil), followed by natural gas and solid fuels.

Hence, in the event of a substantial increase in energy costs, there is a potential for a decline in consumer disposable income and reduced competitiveness for businesses. This impact has already been witnessed in the manufacturing sector of the Eurozone (as shown in Chart #3) since last year, following Russia's invasion of Ukraine.

Image 3: Eurozone PMI by Sector

Source: Refinitiv

Crucial week for another European country

Image 3: G7 Inflation Rates (%)

Source: Refinitiv

In Summary

Weekly Report — Macro

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com