Macroeconomics Weekly Report - 2023 11 13

Depreciated exchange rate masks China's trade growth

- The Chinese economy has faced significant challenges throughout the year, but there is ample room for stimulus if Beijing chooses to intervene.

- A series of unfavorable economic indicators have emerged, creating considerable obstacles to building confidence in both consumption and investments.

- Nevertheless, its international trade remains resilient with a depreciated exchange rate, resulting in greater competitiveness for its products.

Introduction

The

reopening of China post-COVID-19 has been quite challenging. High youth

unemployment, economic slowdown, and high public debt are some of the issues

faced by the world's second-largest economy.

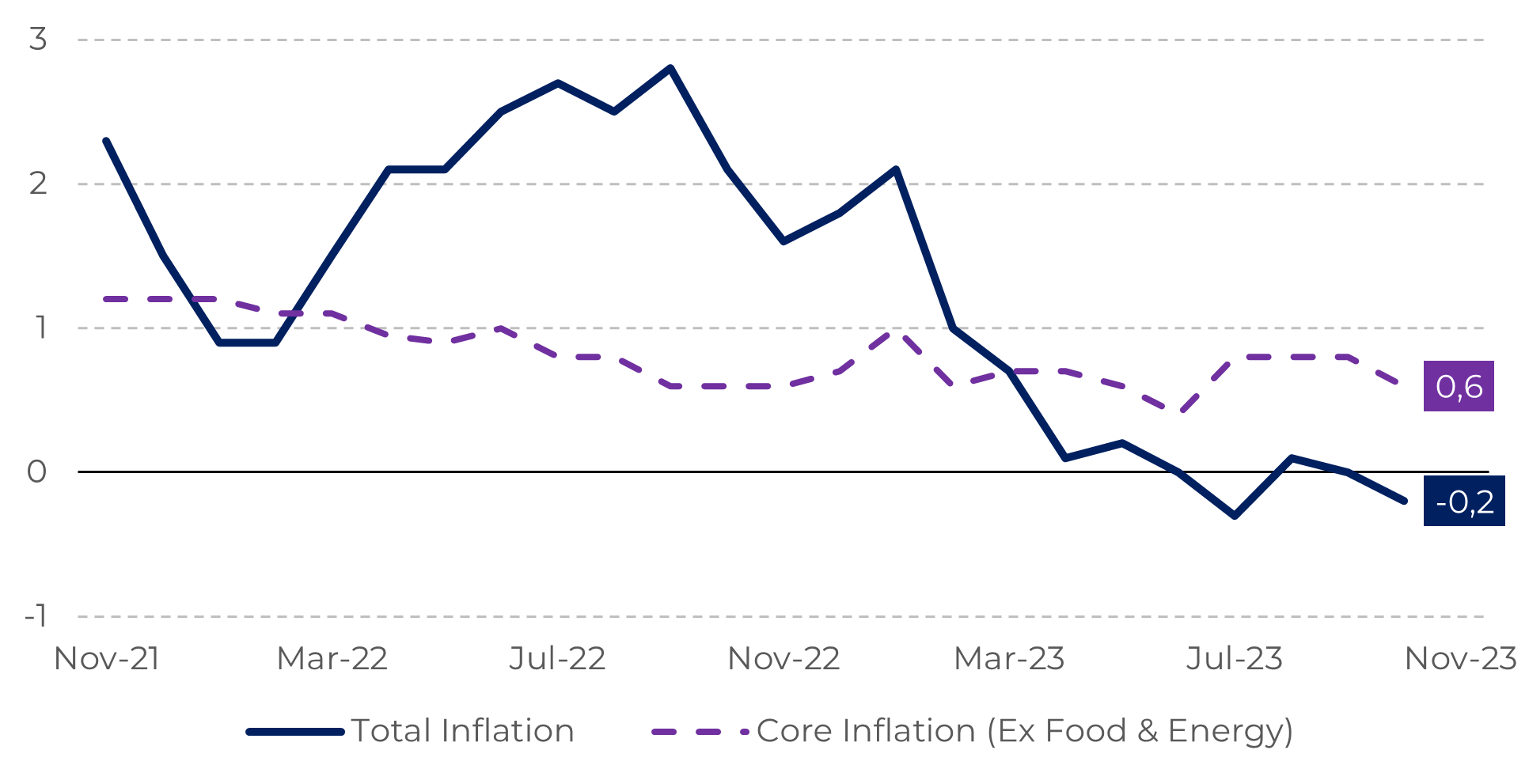

Another

challenge that China is grappling with is the pace of price increases, which

persist in the disinflationary zone. This reflects the difficulty in

stimulating consumption and investment in the country.

On the other hand, this could lead to a more flexible fiscal and monetary policy over time. Beijing has been avoiding the use of more aggressive economic stimuli at the moment, but that does not mean it cannot use them in the future.

Image 1: Inflation - China (%)

Source: National Bureau of Statistics of China

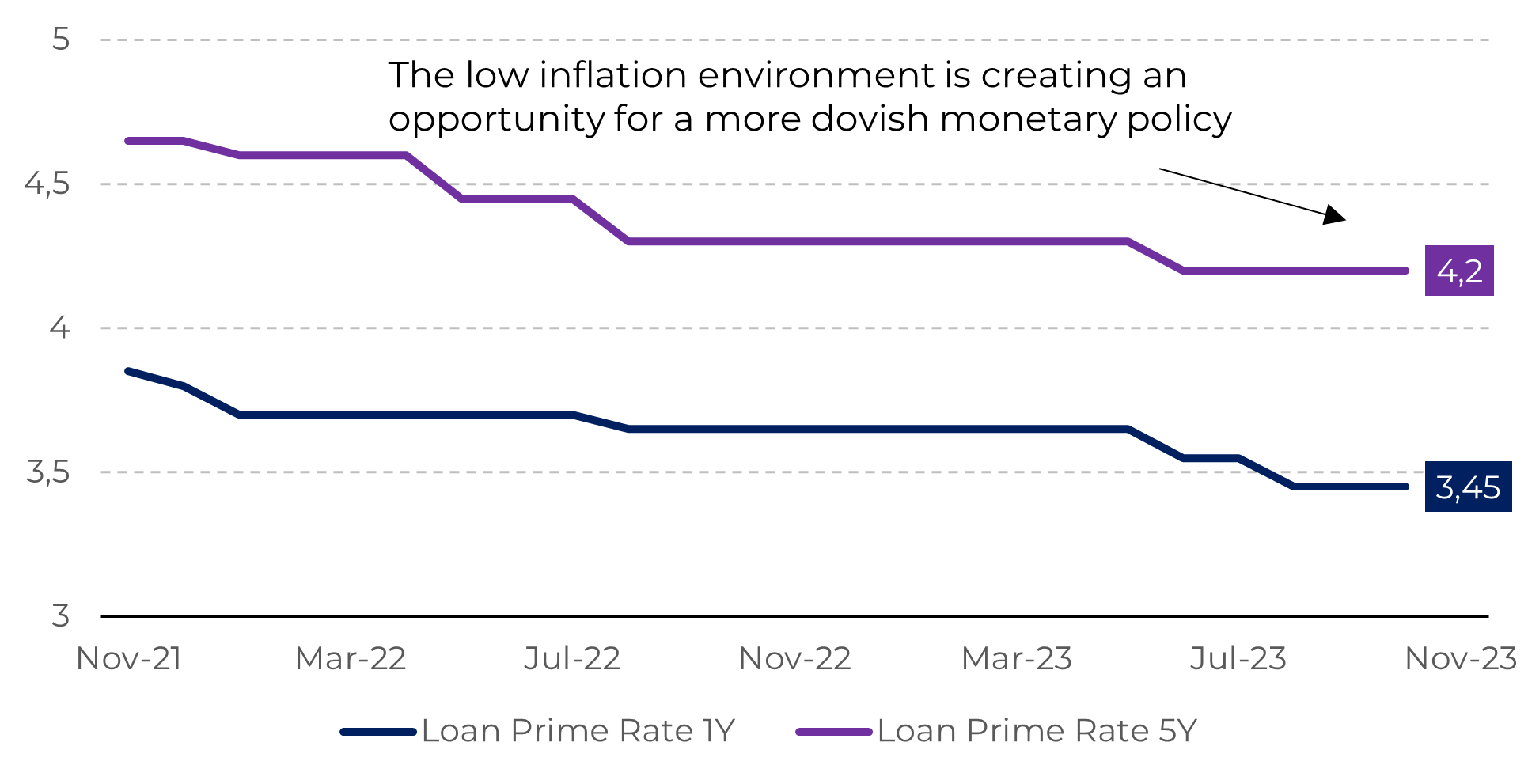

Image 2: Interest Rates - China (%)

Source: People's Republic of China

Trade is changing in the Asian country

Economic

data from China in 2023 has elicited a mix of sentiments in the market. On one

hand, the country's economic slowdown, driven by challenges in the real estate

sector, is a warning sign. On the other hand, its trade balance has been

resilient, even considering the global scenario of high interest rates.

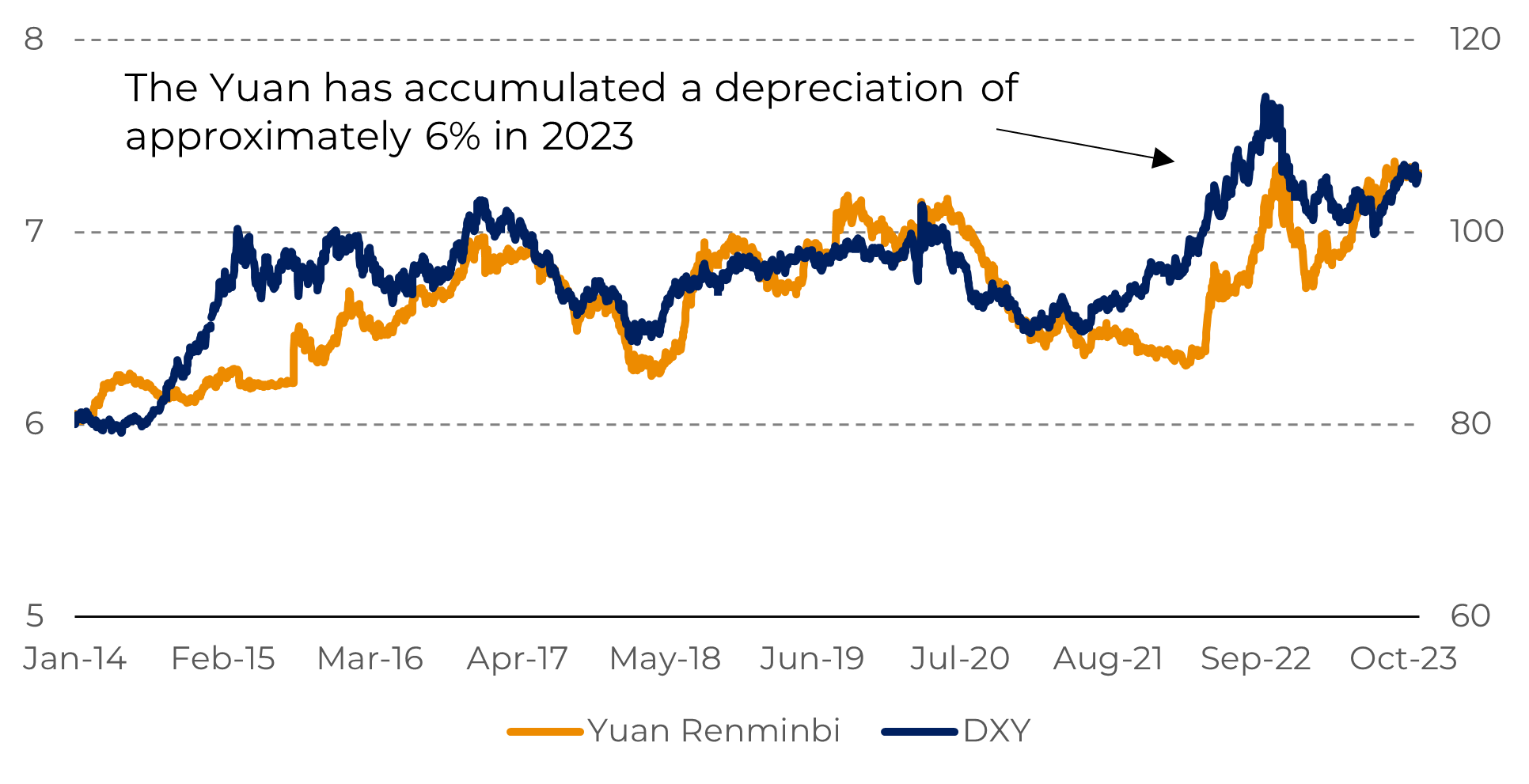

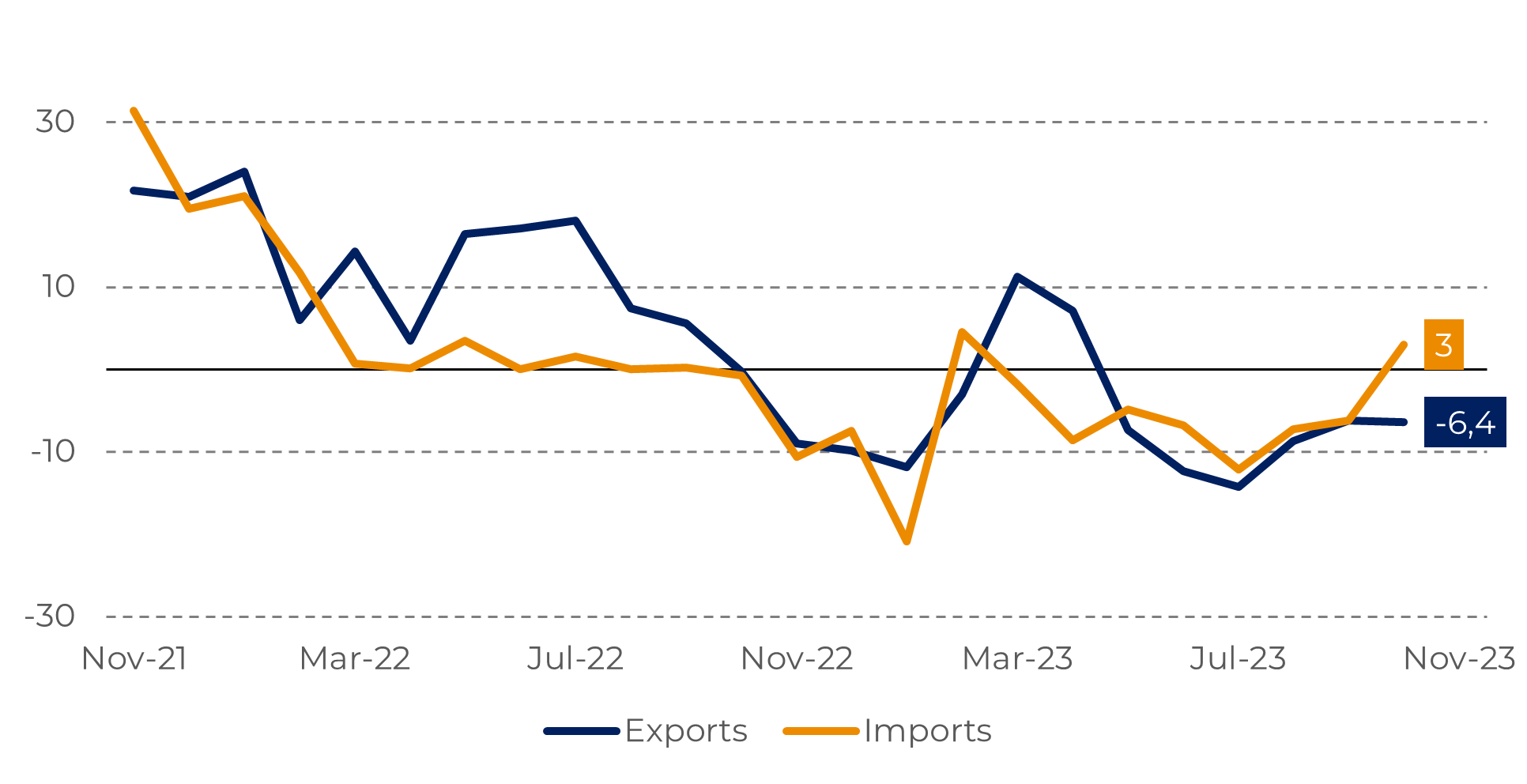

When measured in dollars, China's exports fell by 6.4% in October 2023, while imports increased by 3%. However, this decline can be explained by the significant devaluation of the yuan against the dollar. The monetary tightening carried out by the United States and other major world economies has created a more challenging environment for the appreciation of currencies in emerging markets, such as China.

Image 3: Comparing the Chinese Currency with the DXY Index

Source: Refinitiv

The devaluation of the yuan against the dollar has created a certain “distortion” in the comparison of China's imports and exports with the previous year when the yuan was more appreciated. In part, this explains why, when measured in dollars, the data seems milder.

China's exports grew by 0.4% compared to the previous year, reaching 19.55 trillion yuan for the cumulative period of 2023, while imports decreased by 0.5% compared to the previous year, totaling 14.77 trillion yuan, according to data from the General Administration of Customs.

However, it is important to note that the profile of China's international trade is changing. Trade with Western countries is decreasing, with a 1.6% decline with the European Union and a 7.6% decline with the United States compared to the previous year. In contrast, trade with Central Asian countries is growing, with an increase of 34.8%.

Image 4: Variation in Dollar-denominated Exports and Imports YoY (%)

Source: Refinitiv

In Summary

China is undergoing a series of long-term structural reforms that, if left unaddressed, could compromise its economic growth. These challenges include high local government debt, difficulties in stimulating population consumption, and the aging of its inhabitants.

However, it is essential to note that, despite these challenges, China still exhibits strong economic dynamism. Its international trade continues to grow, even though the dollar value has decreased due to the depreciation of the Chinese currency.

Therefore, the world's second-largest economy is expected to remain a focal point for global commodities, as it has been in recent years. In 2023, the country recorded the highest oil imports since the beginning of the pandemic, indicating a positive outlook for agricultural commodities as well.

Weekly Report — Macro

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com