Macroeconomics Weekly Report - 2023 11 27

Economic growth remains strong in Mexico

- Last week, the final figures for Mexico's GDP in the third quarter were released. In line with expectations, the data confirmed the continuation of a very positive scenario for the Mexican economy.

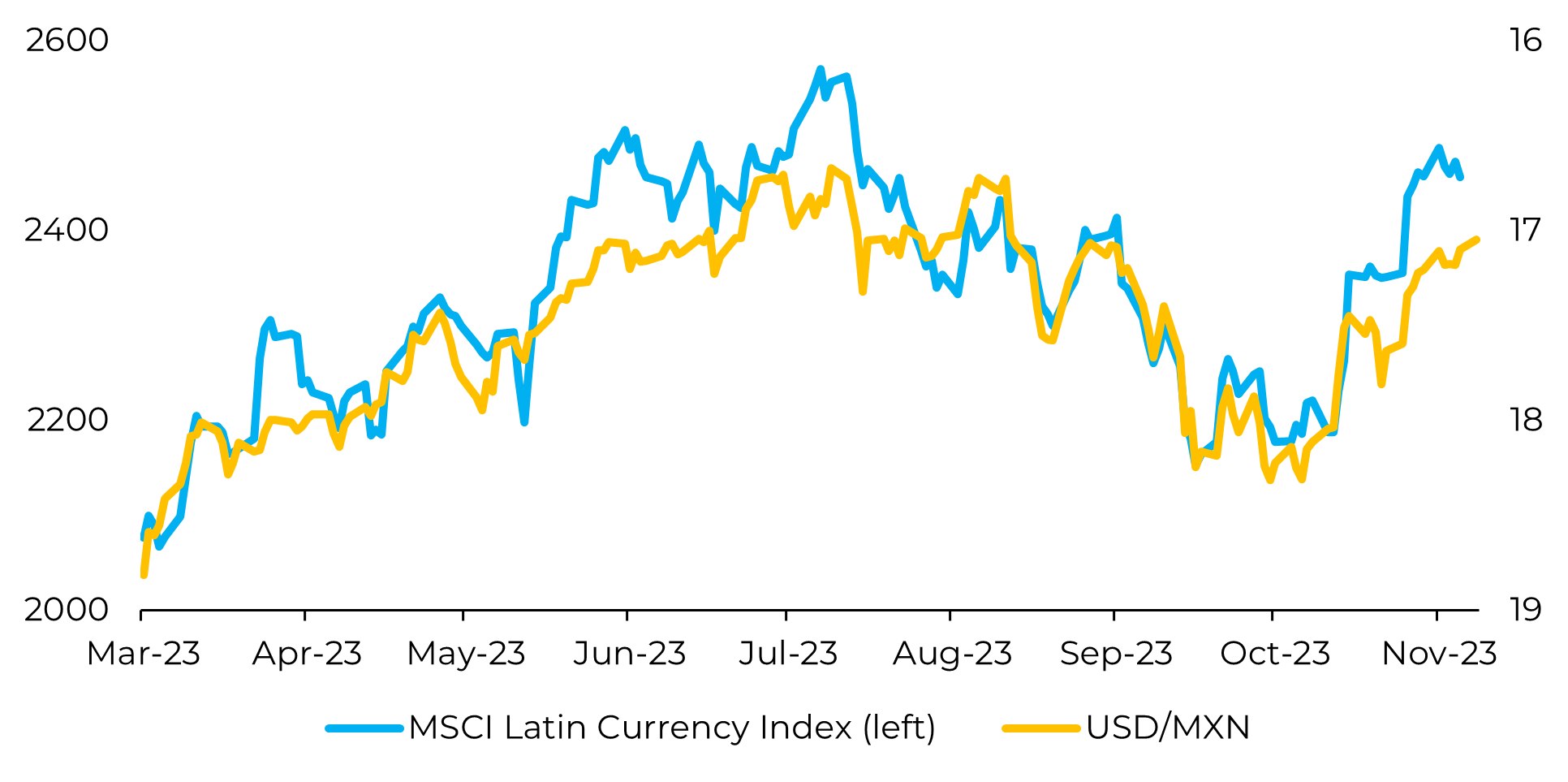

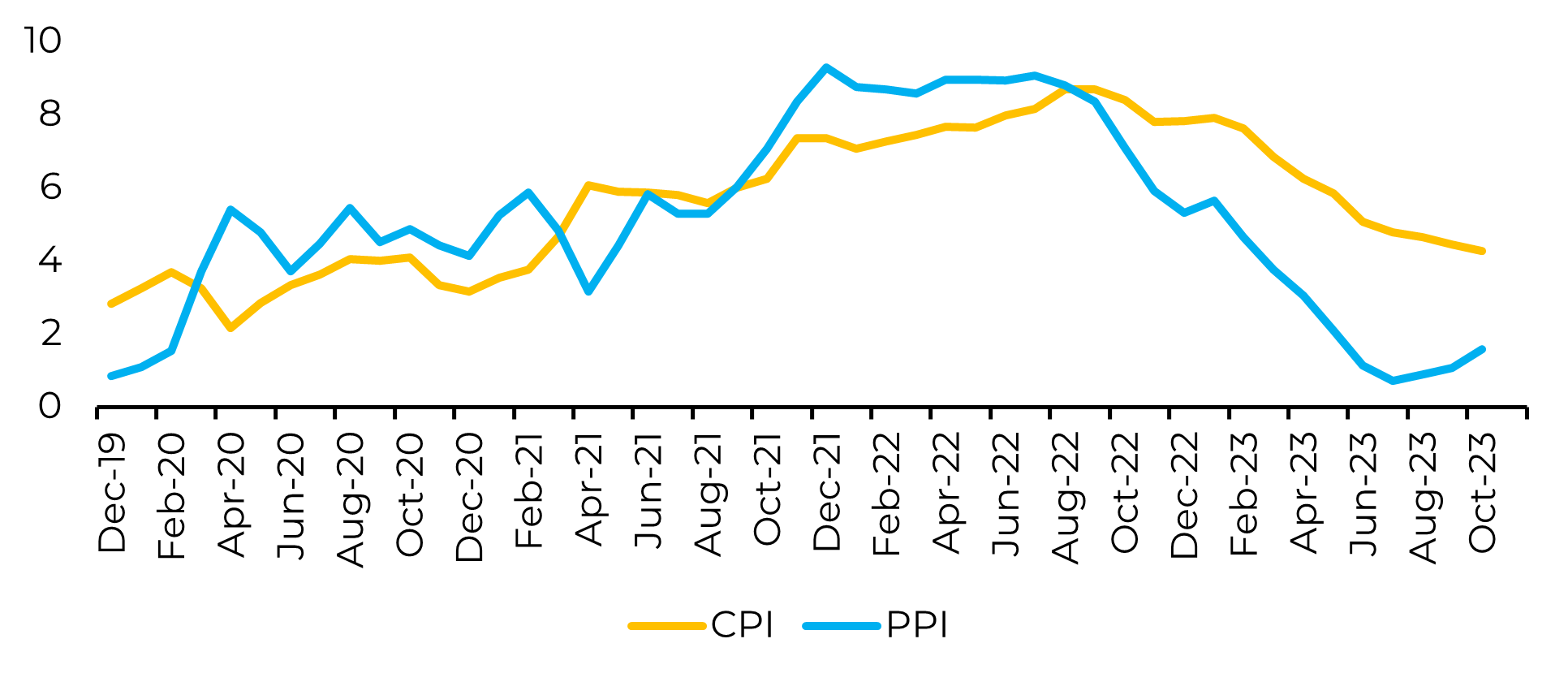

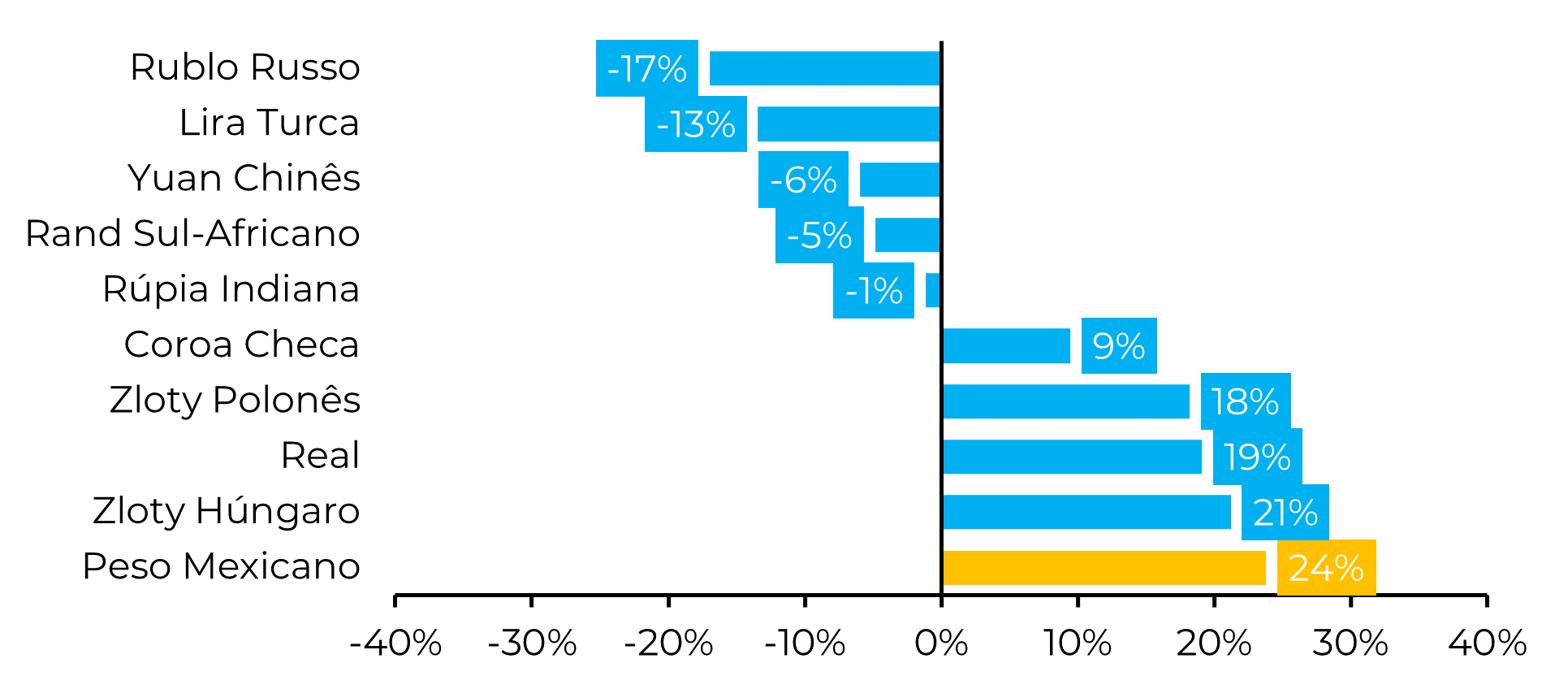

- The Mexican economy has a virtually unique combination in a context of global economic slowdown that should continue to strengthen its currency: the country has shown resilient growth amid high interest rates and slowing inflation. This scenario leads to a combination of a strengthening economy and an extremely positive interest rate differential against the US.

- However, the continued strength of the Mexican Peso also depends on the external scenario - that is, whether the main economies avoid some kind of deep recession and/or whether US yields continue to fall or at least stabilize.

Introduction

Image 1: MXN and Latam Currencies

Source: Refinitiv

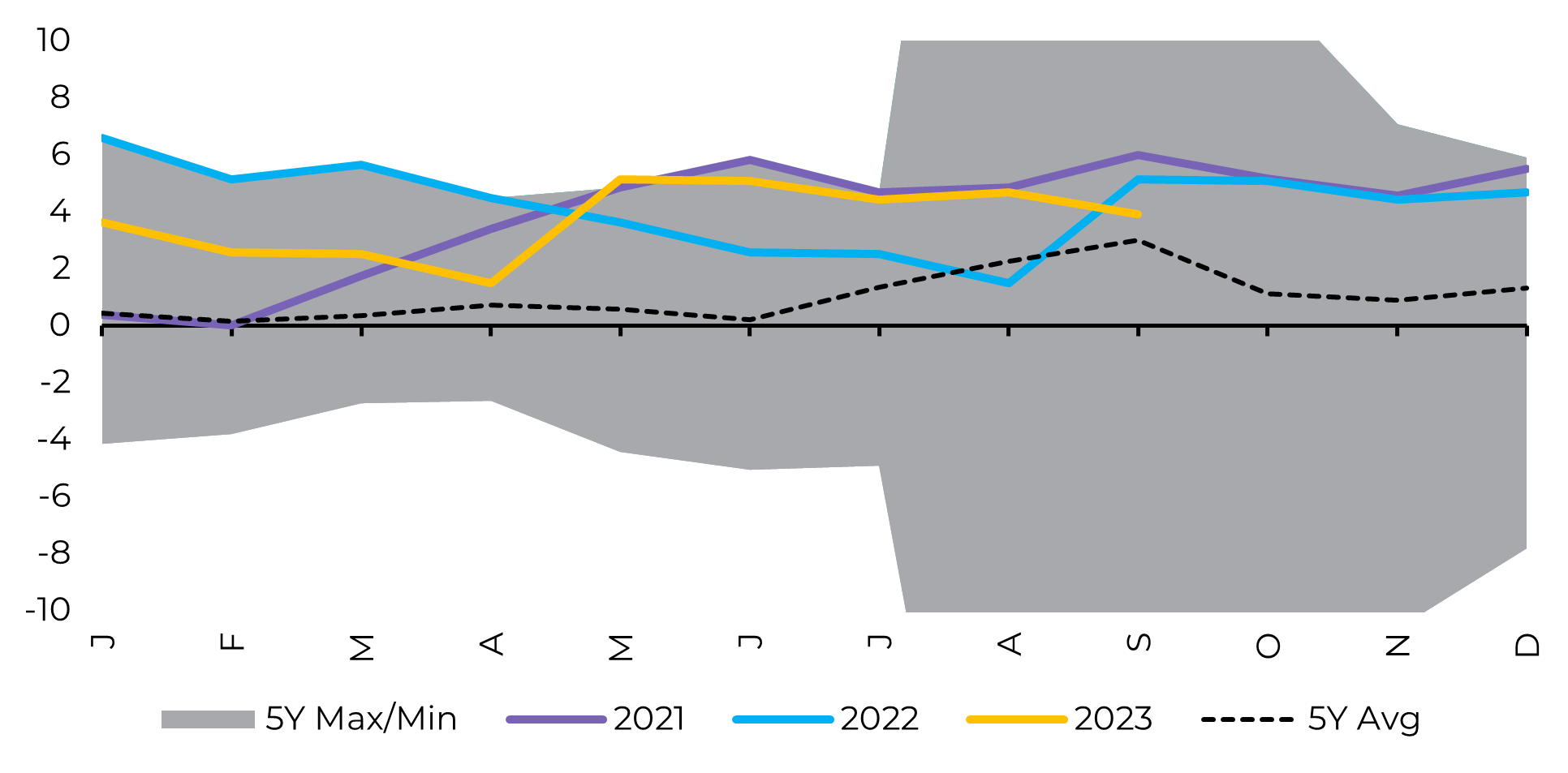

Image 2: GDP Mexico (YoY)

Source: Bloomberg

A quarter of strong growth

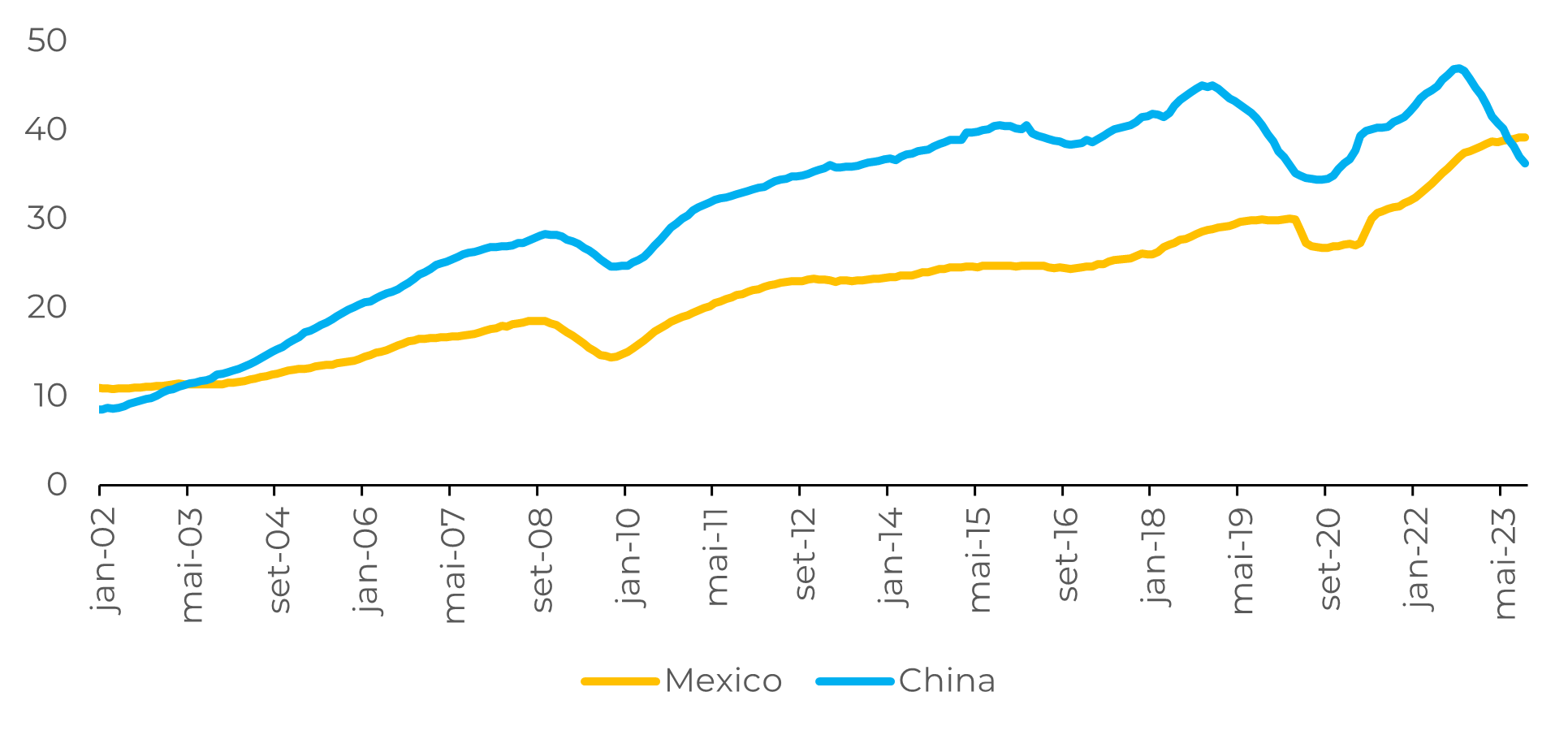

Image 3: Industrial Production (YoY)

Source: Bloomberg

The Mexican economy's performance in 2023 is admirable, especially considering the global scenario of high interest rates and economic slowdown. Domestic demand remains robust, even in the face of restrictive fiscal and monetary conditions, as well as negative market sentiment towards some government policies.

The economy has benefited from increased employment, rising wages, high remittances and positive consumer confidence. Investment is benefiting as Mexico attracts more capital inflows: the country has been one of the biggest beneficiaries of the relocation of global supply chains, given its proximity to the US. In July, for the first time in more than 20 years, Mexico overtook China as the main exporter to the US.

Image 4: Monthly exports to the US (Average 12 months - bi USD)

Source: Bloomberg

In Summary

Image 1: 2-Y Inflation Indices Mexico (YoY)

Source: Bloomberg

Image 2: Carry Trade Return Index

Source: Bloomberg

Weekly Report — Macro

alef.dias@hedgepointglobal.com

victor.arduin@hedgepointglobal.com