Dec 4

/

Victor Arduin

Macroeconomics Weekly Report - 2023 12 04

Back to main blog page

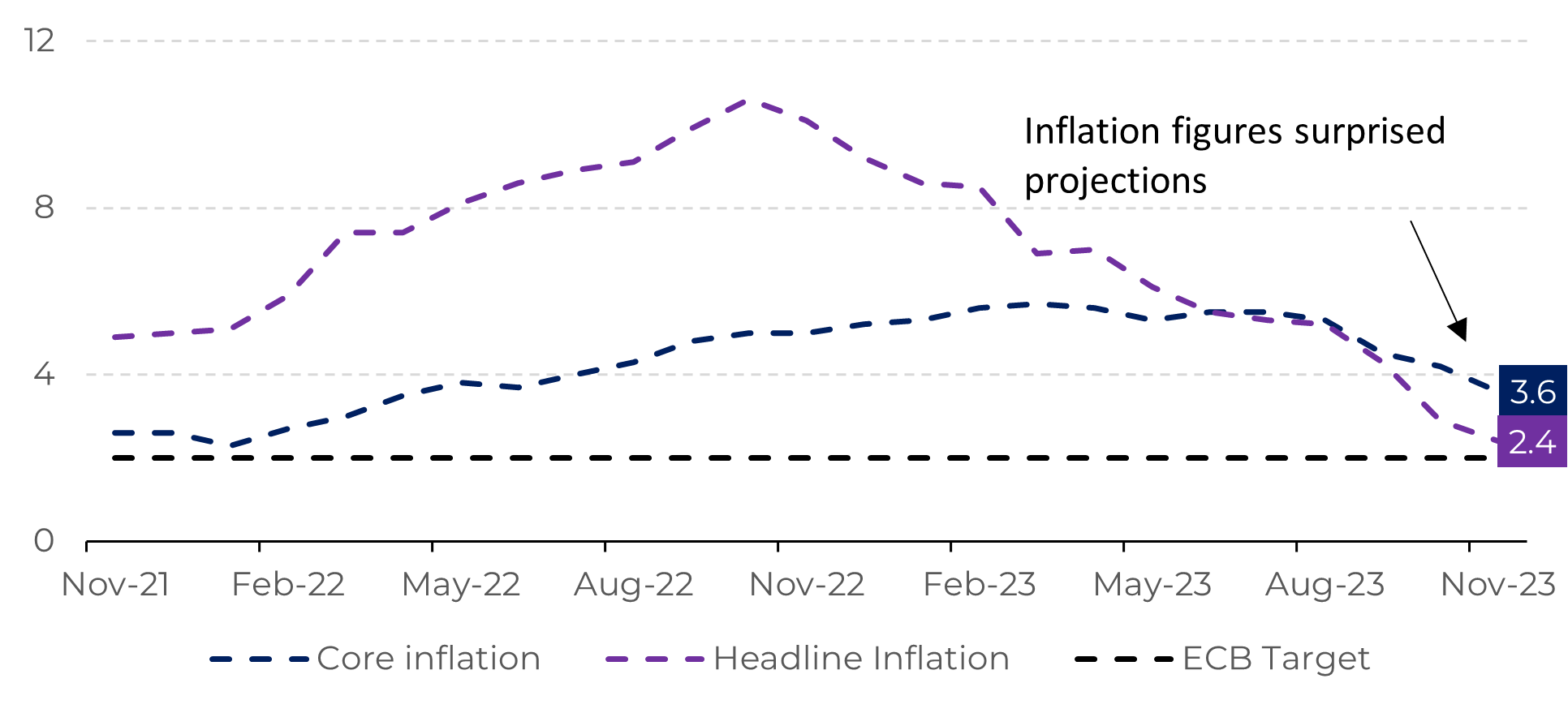

"Europe has good news to celebrate. Inflation in the region is nearing the European Central Bank's (ECB) 2% target as showed by Eurostat. Inflation fell to 2.4% in December, below analysts' expectations of 2.7%."

Inflation surprises in Europe, but the continent faces challenges

- A big surprise, inflation data for the eurozone showed significant improvement in November, falling to 2.4%. Additionally, the core inflation rate, a key indicator for ECB decision-making, also fell below expectations, to 3.6%.

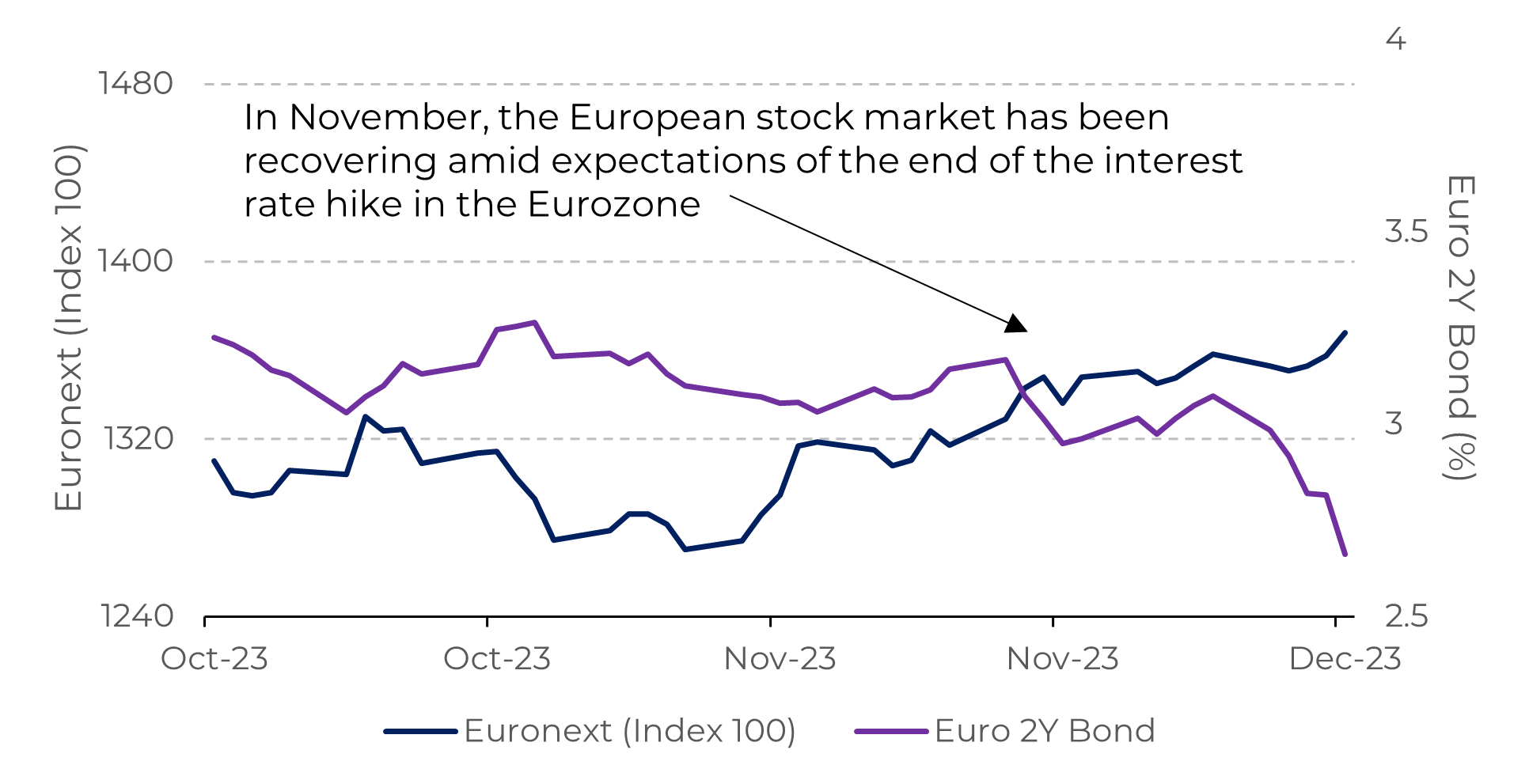

- The markets are quickly pricing in a scenario of interest rate cuts on the horizon, with European bonds falling and stock indexes reflecting greater confidence.

- However, victory over inflation is not yet guaranteed, and monetary authorities have been cautious, not ruling out further increases if necessary.

Introduction

Europe has good news to celebrate. Inflation in the region is nearing the European Central Bank's (ECB) 2% target as showed by Eurostat. Inflation fell to 2.4% in December, below analysts' expectations of 2.7%. A key driver of inflation, energy, continues to experience significant year-on-year declines, reaching -11.5%.

With prices on a more moderate track, speculation about when the central bank will start to cut interest rates is increasing. The continent's economy is struggling to avoid a recession.

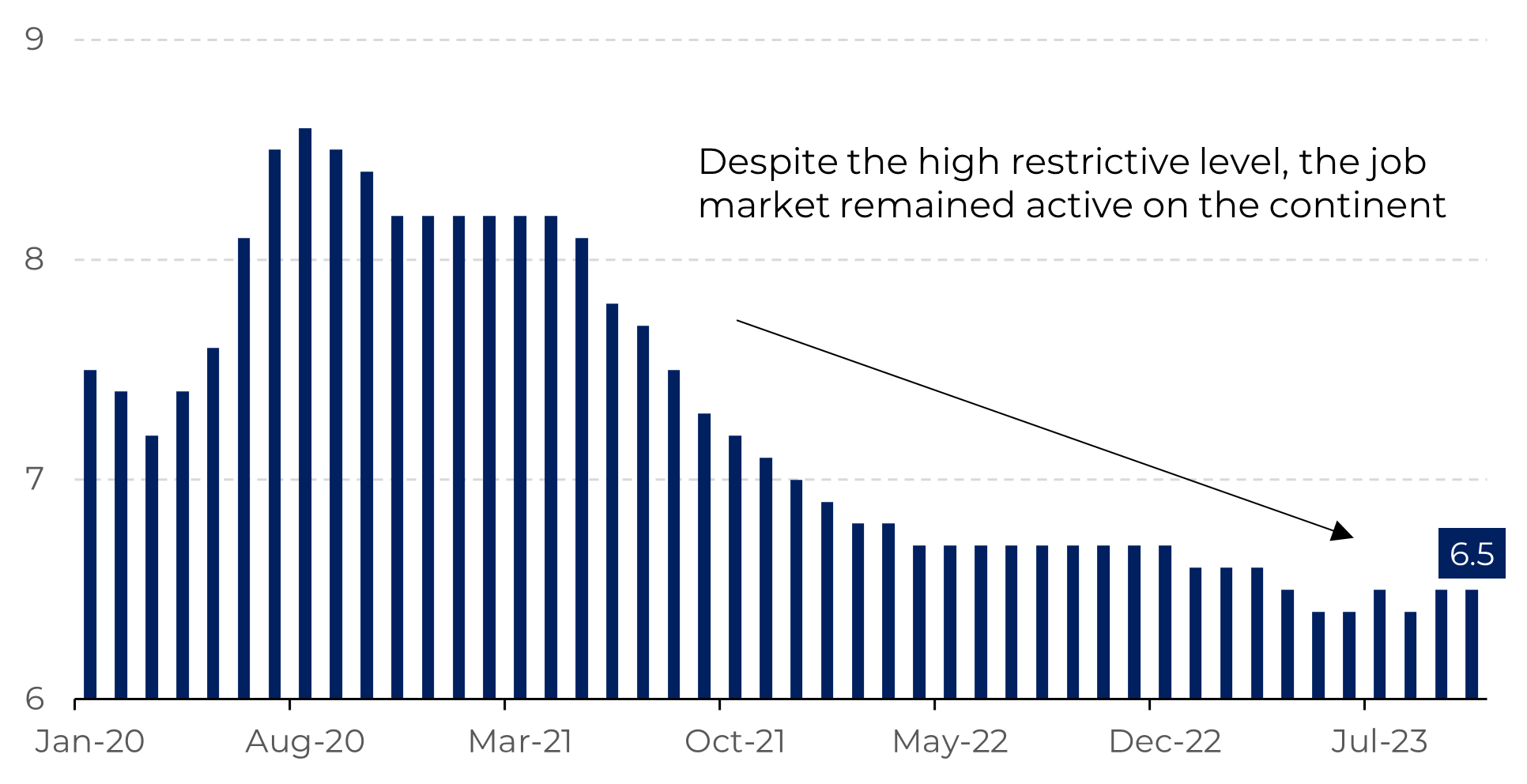

However, there are still inflationary risks to be considered. The labor market in the continent remains resilient, while an escalation in energy prices could pressure inflation in the continent.

Image 1: Inflation - Europe (%)

Source: IBGE

Image 2: Euronext Index vs Euro 2Y bond (%)

Source: Refinitiv

The outlook for 2024 remains challenging, but its improving

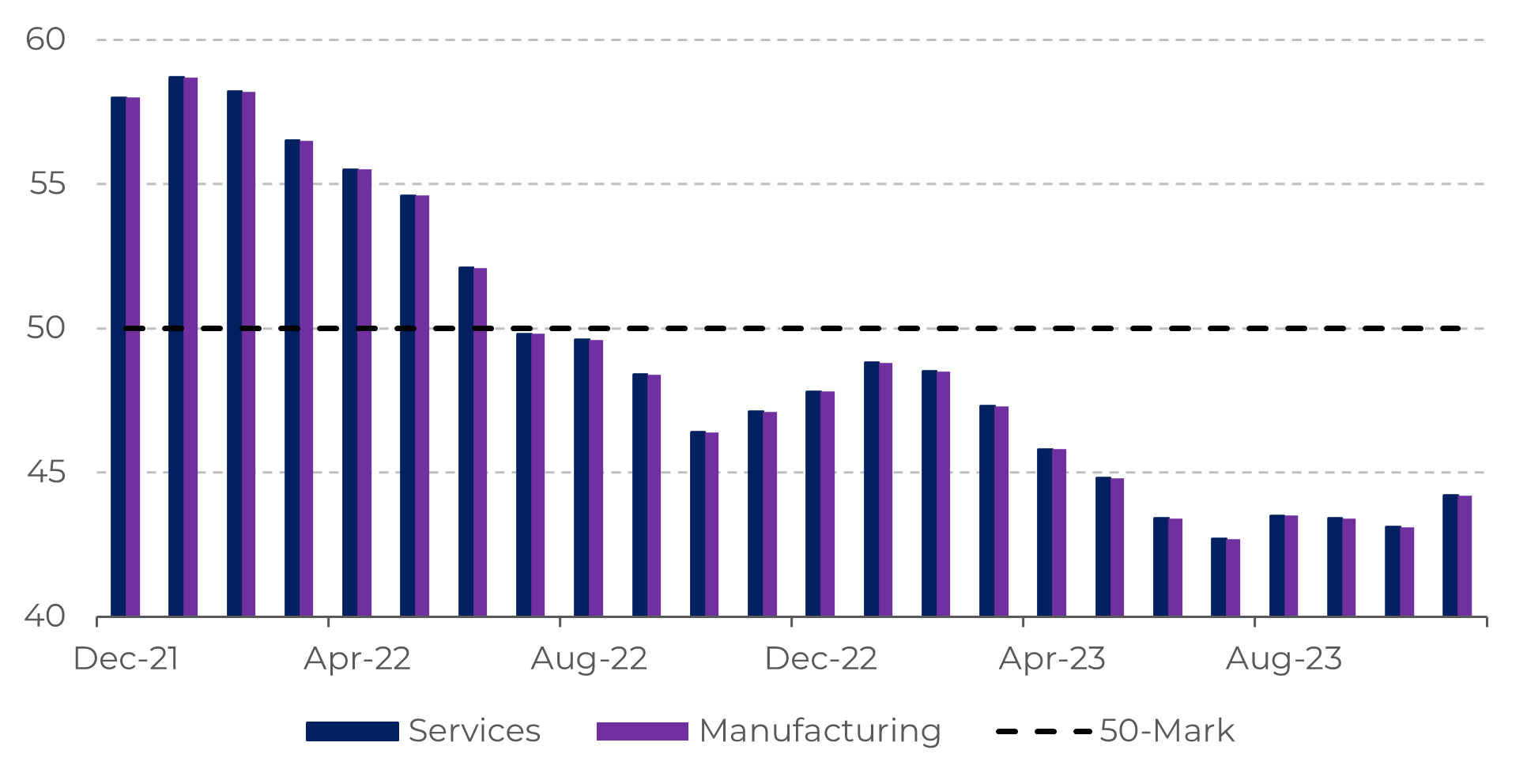

The Eurozone risks entering a recession later this year, accordingly to Eurostat data showing a slight decline in third-quarter output. This follows a meager 0.1% growth over the past year. Despite a slight improvement last month, the continent's PMIs remain in contractionary territory, further exacerbating concerns.

Part of the problems that hinder a more accelerated recovery of the eurozone is structural. An aging population, low productivity gains, and high bureaucracy compared to other developed economies are some examples. Therefore, it is not only the high interest rates that are hampering the economy, despite being the main vector of expectations at the moment.

Image 3: Unemployment Rate – Europe (%)

Source: Refinitiv

However, it is important to also observe the positive data that is emerging. Inflation improved substantially in the latest reading, above expectations, while the labor market remains resilient. This should help to improve demand in the continent, primarily by improving real wage gains and confidence. All of this considering highly restrictive interest rates for developed countries.

The continent is one of the regions that depends the most on externally-sourced energy. Supply disruptions of energy commodities such as natural gas, crude oil, and refined products always pose a risk to the continent's economy.

Furthermore, the energy landscape in Europe is significantly better compared to one year ago, following Russia's invasion of Ukraine. The EU achieved its 90% gas storage target on August 16th this year, 11 weeks ahead of the EU-mandated deadline of November 1st.

The continent is one of the regions that depends the most on externally-sourced energy. Supply disruptions of energy commodities such as natural gas, crude oil, and refined products always pose a risk to the continent's economy.

Image 4: Europe PMIs

Source: Refinitiv

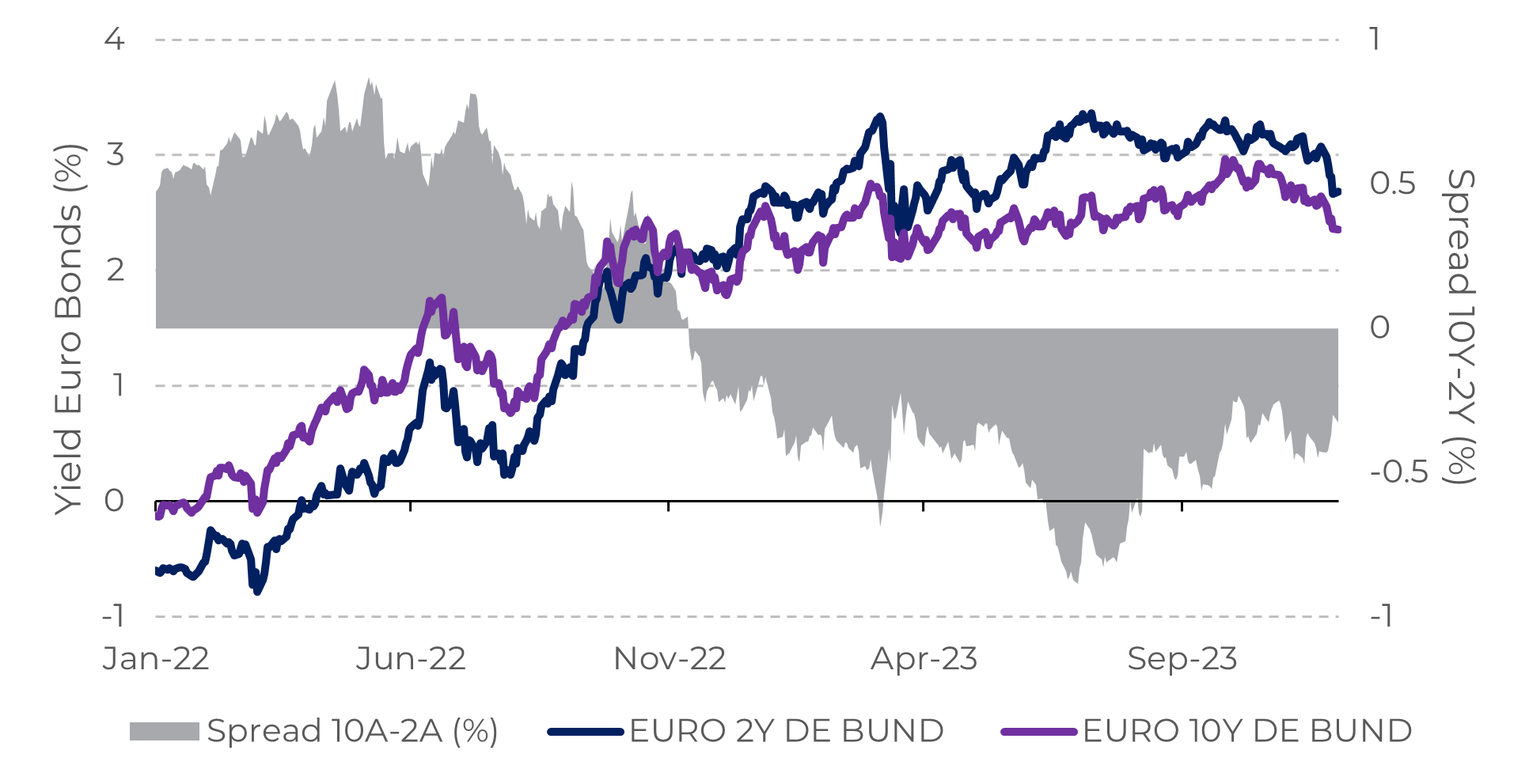

Bonds turn around with a better inflation landscape

The European bond market reacted positively to the improved inflation outlook, with yields on two-year and ten-year bonds dropping by 13.37% and 10.70%, respectively, last week. This reduction in the spread between different maturities is a positive sign for the European economy, which can boost confidence among investors.

Despite still facing considerable risks, expectations that the ECB has reached terminal rates and may potentially cut interest rates next year are positive signs.

Despite still facing considerable risks, expectations that the ECB has reached terminal rates and may potentially cut interest rates next year are positive signs.

Image 5: Euro Bonds (%) and Spread 2Y-10Y Bonds

Source: Refinitiv

In Summary

Currently, oil prices are at much lower levels than observed weeks ago. However, events that cause disruptions to supply are a risk to be considered, such as the conflict between Israel and Hamas, which could escalate.

In general, looking at labor market data and growing confidence in the continent, as reflected in the stock market, it is possible that Europe will avoid a severe recession next year.

Even so, the continent faces a major challenge of reforms to be made to gain more competitiveness and productivity. Without these reforms, it is unlikely to have higher growth in the coming years.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.