Dec 18

/

Victor Arduin

Macroeconomics Weekly Report - 2023 12 18

Back to main blog page

"It wasn't easy, but after a campaign initiated in March 2022 with 11 interest rate hikes, the monetary authorities of the United States finally begin to signal victory over inflation."

Fed's communication indicates an anticipation of monetary policy easing

- The inflation in the US has been falling more or less steadily since peaking in June of 2022 when it reached 9.1%. With prices at more comfortable levels, the discussion for interest rate cuts in the world's largest economy is increasingly advancing.

- One of the main consequences of a less restrictive interest rate environment is the decline in yields of American Treasuries. However, the country's financing needs for 2024 may provide support for yields, even with the decline in interest rates.

- Energy, one of the most volatile inflationary components, is increasingly posing less risk to price increases. Therefore, inflation is expected to continue improving in the coming months.

Introduction

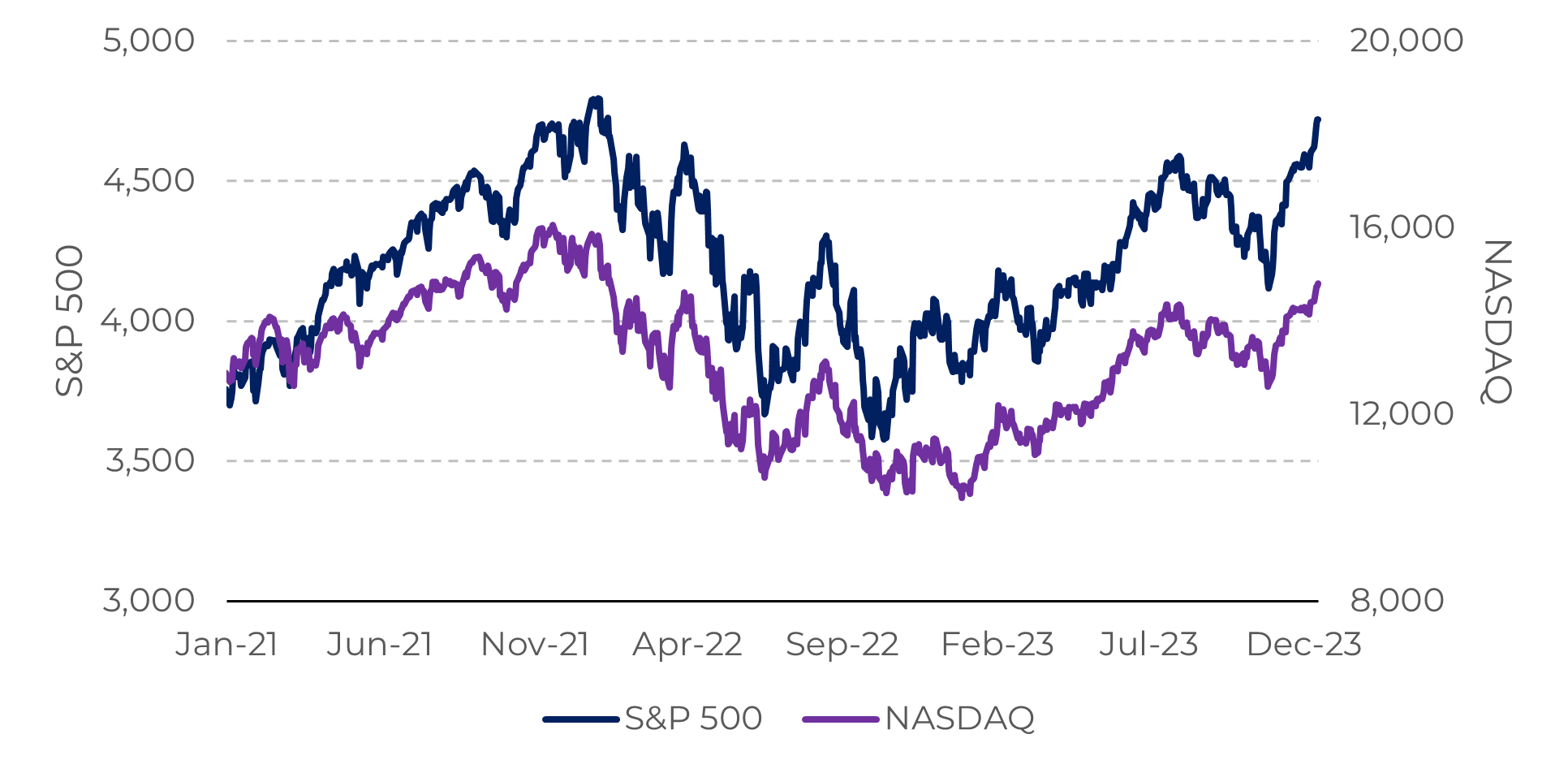

It wasn't easy, but after a campaign initiated in March 2022 with 11 interest rate hikes, the monetary authorities of the United States finally begin to signal victory over inflation. Jerome Powell's , the Fed's chairman, made a much more dovish speech, and brought a bullish sentiment to risky markets, with the S&P rising 2.49% last week, while the DXY fell 1.4%.

However, the consequences of restrictive interest rates may still come from the world's largest economy. The market's greatest fear is whether the American economy will be able to avoid a recession or not, which, even if mild, would have bearish repercussions, especially in the commodities markets.

Image 1: Major US Stock Indexes

Source: Refinitiv

Image 2: US Dollar Index (DXY)

Source: Refinitiv

With controlled prices, the focus is on interest rate cuts in 2024

Once

again, the Fed announced that it is holding interest rates steady, maintaining

the federal funds rate between 5.25 and 5.5 percent. With the probability of

further hikes nearly non-existent, Jerome Powell's dovish speech suggests that US’s monetary policy is rapidly moving towards

an interest rate-cutting cycle in the first semester of 2024.

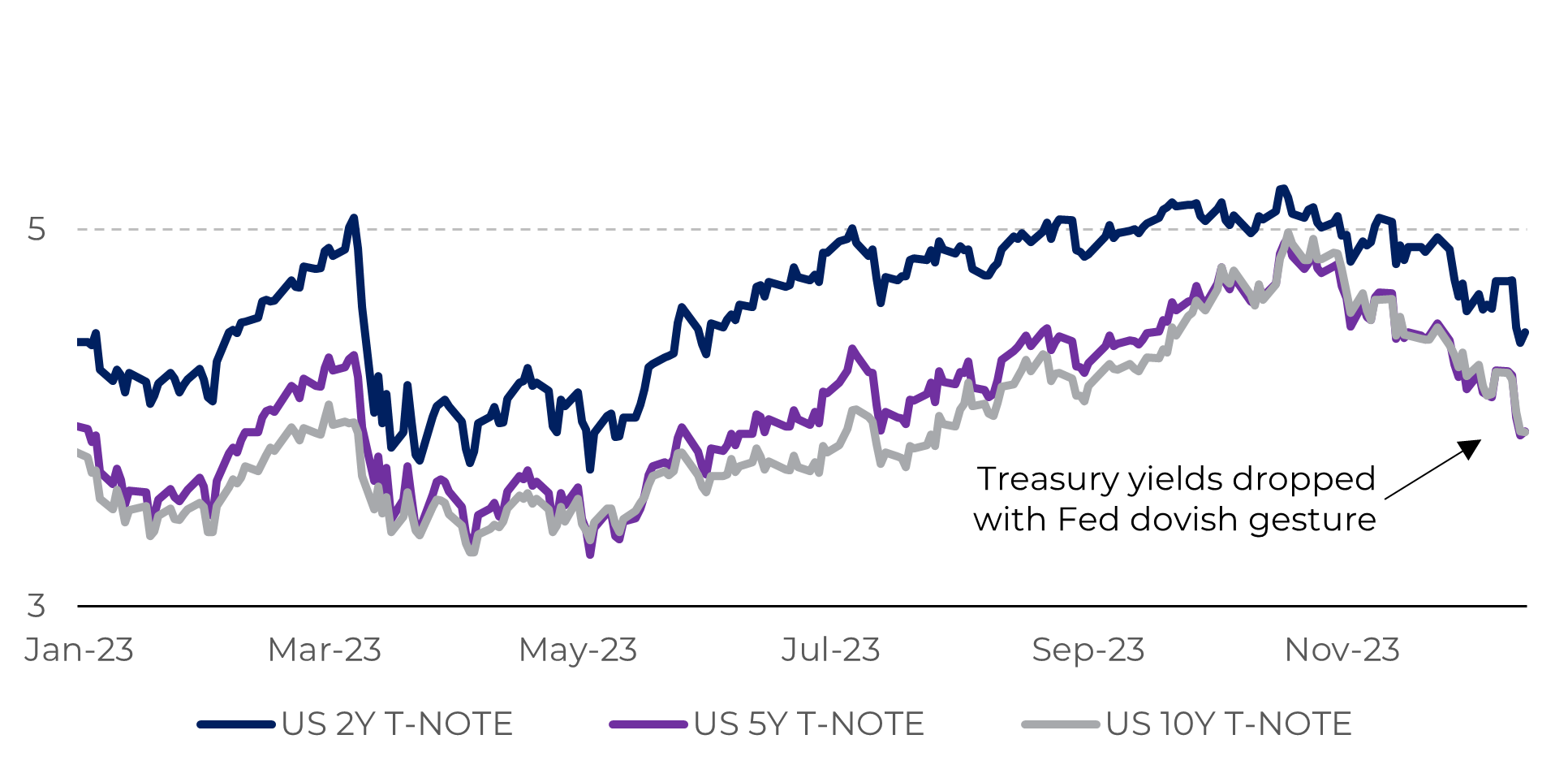

An interest rate-cut scenario unfolding sooner than anticipated is creating a more risk-on environment, impacting major stock exchanges worldwide. Additionally, the two-year Treasury yields have declined by 25 basis points, settling around 4.5%. However, is the optimism seen thus far perhaps a bit exaggerated?

An interest rate-cut scenario unfolding sooner than anticipated is creating a more risk-on environment, impacting major stock exchanges worldwide. Additionally, the two-year Treasury yields have declined by 25 basis points, settling around 4.5%. However, is the optimism seen thus far perhaps a bit exaggerated?

Image 3: Treasuries Bond Yields - US (%)

Source: Refinitiv

Some

signs from the American economy show that it is still necessary to be cautious

if interest rates are at a sufficiently restrictive level to bring inflation to

the target of 2%. An example is that the labor market in the US remains quite heated, with job growth

accelerating in November and the unemployment rate falling to 3.7%. While, on

one hand, it dispels the fear of a recession on the horizon, on the other hand,

it could indicate that inflation will persist longer than wished.

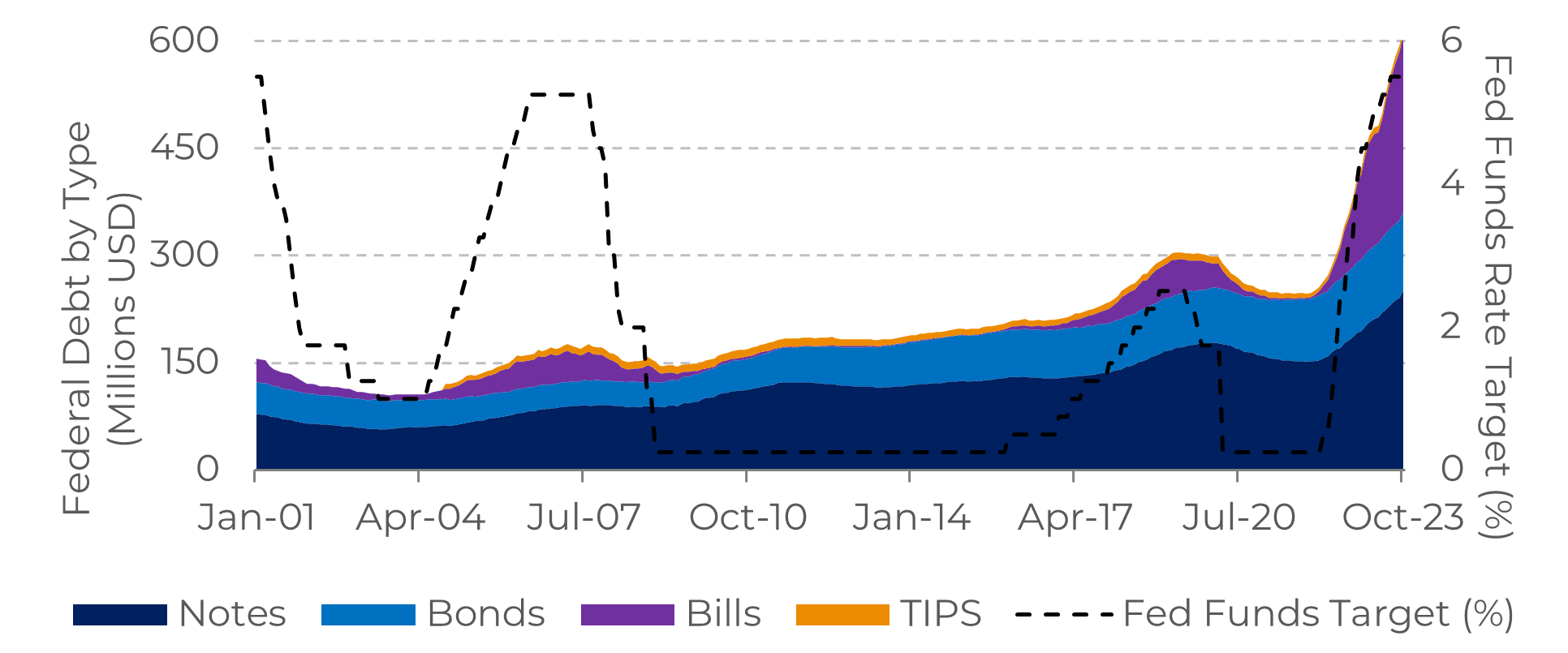

Furthermore, other risks present challenges for the commodities markets. The American federal budget forecasts a $1.7 trillion deficit for 2024. These high fiscal deficits will require more issuance of short-term Treasury bonds (T-Bills), increasing the already substantial American debt of around $34 trillion. As a result, the yields paid for Treasuries could be higher than expected in a scenario of interest rate cuts, as the US Treasury will seek to allure investors with a more attractive premium for their securities, leading to a valuation of the dollar.

Furthermore, other risks present challenges for the commodities markets. The American federal budget forecasts a $1.7 trillion deficit for 2024. These high fiscal deficits will require more issuance of short-term Treasury bonds (T-Bills), increasing the already substantial American debt of around $34 trillion. As a result, the yields paid for Treasuries could be higher than expected in a scenario of interest rate cuts, as the US Treasury will seek to allure investors with a more attractive premium for their securities, leading to a valuation of the dollar.

Image 4: Federal Debt by Type in the United States

Source: Bloomberg

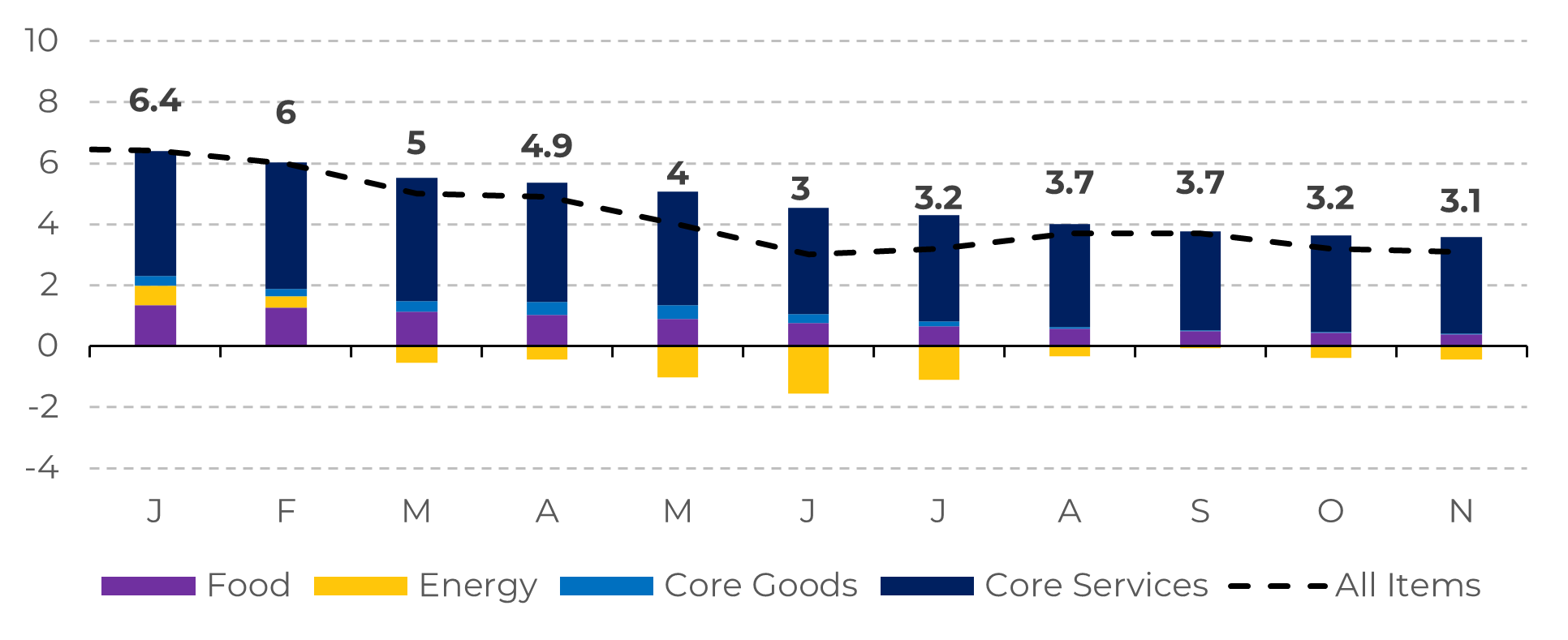

Energy costs are no longer a threat

Inflation is heading towards the Fed's 2% target. Energy costs, which were responsible for a significant inflationary shock in 2022, have become a concern for authorities from August to October, a consequence of OPEC+ cuts that have put pressure on the price per barrel of oil.

However, for now, they seem to not pose risks, given the significant losses observed in the energy complex in recent weeks. The deficit of oil in the market appears to be much smaller than anticipated. Therefore, it is expected that inflation will continue to improve in the world's largest economy.

Image 5: Contributions to U.S. CPI YoY (%)

Source: Bloomberg

In Summary

It

cannot be denied that there is a substantial improvement in the prices in the

American economy. The worst inflation in the last 30 years continues to

converge towards its target, and each new FOMC meeting that reinforces this

optimistic view of inflation is opening up more space for discussion about interest

rate cuts, something eagerly awaited by the market.

However, there are still some important macroeconomic risks to be observed, as the American debt continues to grow, requiring an increasing issuance of Treasuries to finance the expenses of the US’s government. Even if the long-awaited interest rate cut arrives next year, yields may not fall with as much intensity, which will still provide some support for American Treasuries.

Furthermore, it is always important to exercise caution. While improvements in inflation are visible in the economy, the US job market remains resilient, posing a potential risk to inflation at any time. Despite it not being the most likely scenario, the possibility of inflation rising again, is something to pay attention.

However, there are still some important macroeconomic risks to be observed, as the American debt continues to grow, requiring an increasing issuance of Treasuries to finance the expenses of the US’s government. Even if the long-awaited interest rate cut arrives next year, yields may not fall with as much intensity, which will still provide some support for American Treasuries.

Furthermore, it is always important to exercise caution. While improvements in inflation are visible in the economy, the US job market remains resilient, posing a potential risk to inflation at any time. Despite it not being the most likely scenario, the possibility of inflation rising again, is something to pay attention.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.