Dec 26

/

Alef Dias

Macroeconomics Weekly Report - 2023 12 26

Back to main blog page

Argentina: Market excited with reforms, but challenges remain

- Over the last two weeks, Argentina has been in the macroeconomics headlines with the first economic measures of the new government. The direction of economic policies has so far been in line with what the market sees as necessary to adjust the severe imbalances present in the Argentine economy at the moment.

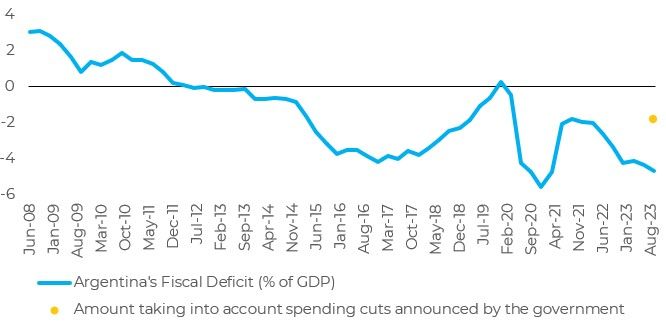

- The fiscal deficit - the main problem to be solved - has already been addressed, and now the implementation of the fiscal adjustment must be followed closely.

- The exchange rate distortion was also tackled, with caution due to the shortage of foreign exchange reserves in the country. In the monetary sphere, the change in the policy rate could result in additional inflationary pressure, although it is recognized as an important operational adjustment.

- Now, the market's focus should be on the speed with which the reforms proposed by the current government will be implemented and the resistance that may arise in relation to these policies. This scenario should play a significant role in the pricing of Argentinian assets in the coming months.

Introduction

Over the last two weeks, Argentina has been in the macro and grains headlines with the first economic measures of Javier Milei - the new president who took office on December 10th. This report will analyze these measures, with a focus on understanding how they should impact the commodities markets in the medium and long term.

First wave of adjustments: spending cuts and currency devaluation

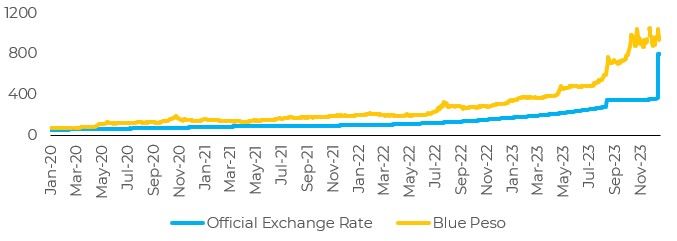

The new government's first measures, announced on the 12th, focused on currency and fiscal issues. The newly inaugurated administration weakened the official exchange rate to 800 pesos per dollar. Before the change, it was 366.5 pesos per dollar, which means a devaluation of 54%. From now on, the central bank will aim for a monthly devaluation of 2%.

On the fiscal side, the government plans to cut spending equivalent to 2.9% of GDP. Cuts in energy subsidies will save 0.5% of GDP, while reductions in transportation subsidies will save 0.2%, according to government estimates. The government also expects reductions in social security and pensions to save a further 0.4% of GDP. The government also plans to end the indexation of pension payments.

On the revenue side, the government plans to increase its income by 2.2% next year. One of the main tools for achieving this result should be taxing the import and export of products. This should further discourage imports and transfer part of exporters' gains from a weaker exchange rate to the public coffers.

In the weeks before the devaluation, exporters had been converting their profits at a different exchange rate - the average between the official and parallel rates, so the impact of the devaluation shouldn't be as dramatic for them as it is for importers.

Image 1: USD/ARS - Official exchange rate and Blue Peso

Source: Refinitiv

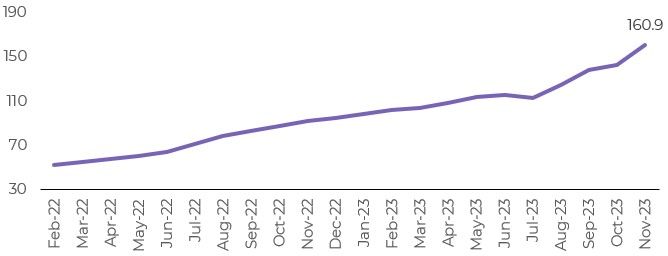

Image 2: US Dollar Index (DXY)

Source: Bloomberg

Monetary policy: confidence in fiscal and exchange rate adjustments allows operational change

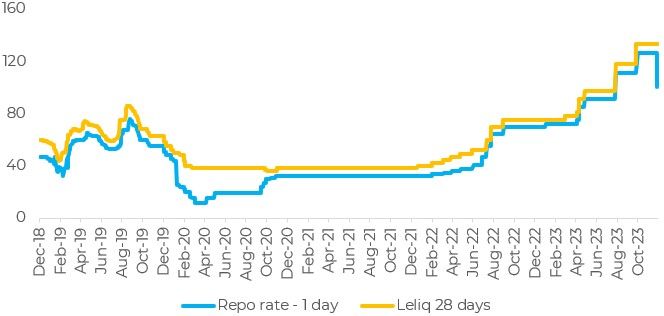

On the 19th, the Central Bank of Argentina (BCRA) announced a change in its reference rate for monetary policy. The BCRA now uses the one-day repurchase rate as its policy reference and announced that it will no longer auction the 28-day Leliq bonds it had been using to absorb market liquidity. The Leliq rate - the official policy rate until then - is 133%; the one-day repurchase rate was reduced from 126% to 100% on December 13.

The central bank also cut the minimum rate that banks must pay customers on 30-day deposits to 110%, from 133%. This compares with annual inflation of 160.9% in November and a median forecast of 226.7% over the next 12 months, which implies negative real returns for depositors.

The measure appears to be another step towards encouraging banks to direct their depositors' funds into government-issued bonds, rather than leaving them with the central bank. This would improve the BCRA's balance sheet - by reducing liabilities - and the government's chances of financing its deficit on the market, rather than by issuing currency.

There are risks in this strategy. It depends fundamentally on the market's confidence in the government's ability to fulfill its fiscal plan. If banks are suspicious of the public sector's creditworthiness, they may continue to place clients' funds in one-day repurchase agreements. Negative real rates for depositors could also fuel a run on the dollar - which could weaken the parallel rate - unless investors are convinced that the currency is likely to strengthen substantially over time. They could also further accelerate inflation.

Image 3: Change in monetary policy rate – Argentina (%)

Source: Refinitiv

Liberalizing reforms and resistance to them

In addition to the changes in economic policy, Milei announced last Wednesday an initial list of 30 policies - which are part of a larger list of more than 300 measures - whose main focus is to reduce the role of the state in Argentina's economy.

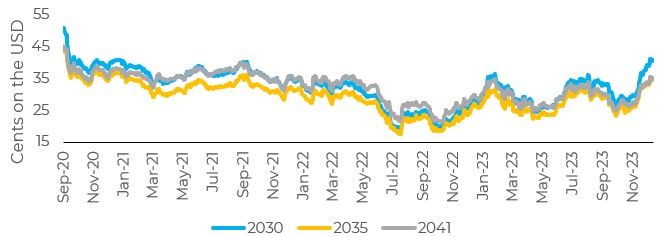

Wall Street applauded the first batch of reforms, with big banks encouraging their clients to buy the country's sovereign bonds. Despite the optimism about these reforms, it is necessary to monitor their implementation and how far he can go in implementing his plan by emergency decree.

Wall Street applauded the first batch of reforms, with big banks encouraging their clients to buy the country's sovereign bonds. Despite the optimism about these reforms, it is necessary to monitor their implementation and how far he can go in implementing his plan by emergency decree.

What is certain is that he will face opposition in Congress, where he does not have a majority, even with the combined votes of the pro-business coalition that is likely to support him. In addition, some of the measures and the decision to legislate by decree are likely to be challenged in the courts, and the opposition has already begun organizing demonstrations against his policies.

Image 4: Argentine Debt Bonds - Different Maturities

Source: Bloomberg

In Summary

The direction of the economic policies of Javier Milei's government is so far in line with what the market sees as necessary to adjust the severe imbalances present in the Argentine economy at the moment. The fiscal deficit - the main problem to be solved - has already been addressed, and now the implementation of the fiscal adjustment must be closely monitored.

The exchange rate imbalance was also addressed, and with the necessary parsimony given the lack of foreign exchange reserves afflicting the country. On the monetary side, the change in the reference rate could bring additional inflationary pressure, even though it is an important operational adjustment.

Now, the main focus of the market should be on the pace of implementation of the current government's reforms and resistance to them. This should greatly dictate the pricing of assets in the country over the coming months. In the short term, greater exchange rate competitiveness should boost Argentina's grain exports, even if the increase in taxes on these exports takes away some of this competitiveness.

The exchange rate imbalance was also addressed, and with the necessary parsimony given the lack of foreign exchange reserves afflicting the country. On the monetary side, the change in the reference rate could bring additional inflationary pressure, even though it is an important operational adjustment.

Now, the main focus of the market should be on the pace of implementation of the current government's reforms and resistance to them. This should greatly dictate the pricing of assets in the country over the coming months. In the short term, greater exchange rate competitiveness should boost Argentina's grain exports, even if the increase in taxes on these exports takes away some of this competitiveness.

Image 5: Argentine inflation (%)

Source: Bloomberg

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Pedro Schicchi

alef.diaspedro.schicchi@hedgepointglobal.com

alef.diaspedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.